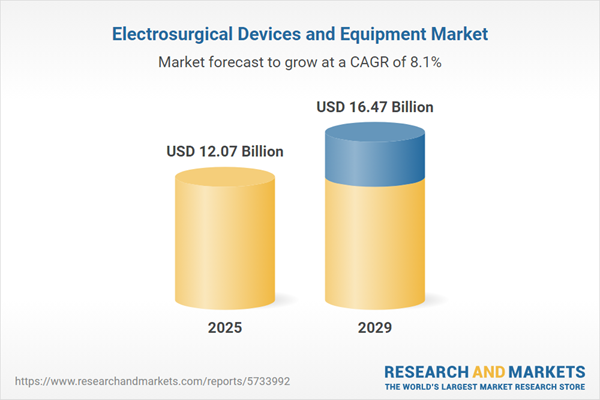

The electrosurgical devices and equipment market size has grown rapidly in recent years. It will grow from $10.94 billion in 2024 to $12.07 billion in 2025 at a compound annual growth rate (CAGR) of 10.4%. The growth in the historic period can be attributed to aging population, minimally invasive surgery (mis), surgical procedure volumes, telemedicine and remote surgery.

The electrosurgical devices and equipment market size is expected to see strong growth in the next few years. It will grow to $16.47 billion in 2029 at a compound annual growth rate (CAGR) of 8.1%. The growth in the forecast period can be attributed to emerging markets growth, robotics and automation, personalized medicine, value-based healthcare. Major trends in the forecast period include energy-efficient devices, integration of imaging technologies, smart and connected devices, enhanced safety features.

The notable expansion of the electrosurgical devices and equipment market is largely attributed to the rising prevalence of chronic diseases. Electrosurgical devices play a crucial role in the treatment of various life-threatening conditions, including skin cancer, small basal cell carcinomas, squamous cell carcinoma, wound surgery, skin surgery, non-cancerous moles, dentistry, and other medical procedures. The global incidence of skin diseases, for example, has been on the rise. For example, in April 2024, Allergy UK, a UK-based national charity, reported that more than 21 million people in the UK are affected by allergies, which became the most commonly reported chronic health condition in 2022. Projections suggest that by 2026, half of Europe's population will experience at least one allergy. As a result, the rising prevalence of chronic diseases is driving the growth of the electrosurgical devices and equipment market.

The growth of the electrosurgical devices and equipment market is anticipated to be propelled by the escalating number of surgical procedures. Surgical procedures encompass a wide range of medical treatments that involve making incisions, are typically carried out in an operating room, and often require anesthesia or pain management. Electrosurgical devices and equipment play a pivotal role in enhancing the precision, efficiency, and overall outcomes of surgical procedures conducted across various medical specialties. This enhancement benefits both healthcare providers and patients alike. For instance, as of October 2023, data from the Organization for Economic Co-operation and Development, an intergovernmental organization based in France, reported an 8.4% increase in cataract surgical procedures in the Czech Republic. The total number of procedures rose to 142,670 in 2022, up from 131,612 in 2021. This surge in surgical procedures underscores the driving force behind the growth of the electrosurgical devices and equipment market, as these tools play a crucial role in supporting and improving the delivery of surgical care.

The electrosurgical equipment industry is grappling with rising costs in product development and supply to healthcare organizations due to evolving regulatory changes, particularly in the realm of customer data protection. Notably, the European Union's General Data Protection Regulation (GDPR) and alterations in equipment approval procedures are key drivers of this cost escalation. The GDPR, a comprehensive EU law governing data protection and privacy for individuals within the European Union and the European Economic Area (EEA), also exerts influence over the export of personal data outside these regions. Compliance with GDPR has proven to be a costly endeavor, with a report from Ernst and Young revealing that Fortune 500 companies have collectively spent $7.8 billion to meet GDPR requirements. In the United States, electrosurgical devices are subject to regulation by the U.S. Department of Health and Human Services and the Center for Devices and Radiological Health, operating under the U.S. FDA. Manufacturers pursuing approval have two primary pathways. One route involves conducting clinical studies and submitting a premarket approval (PMA) application, offering evidence that the device is safe and effective. The alternative approach entails submitting a 510(k) notification to demonstrate that the device is substantially equivalent to an existing device on the market, known as a predicate device, and thus not requiring a PMA. The FDA's increasing request for clinical data to support claims has significantly extended the processing time for 510(k) submissions, with delays surpassing 55% over the past decade. These delays in product releases, coupled with the additional costs incurred as a result of stringent approval processes, create challenges for investments in electrosurgical equipment and new product development. Consequently, this may lead to potential revenue loss for manufacturers in the industry.

Electrosurgery involves the application of high-frequency electric current to biological tissue for various medical purposes. Recent technological advancements have given rise to modern Electrosurgical Units (ESUs) that provide precise control and monitoring of key parameters, enabling the delivery of medically beneficial thermal effects. These advanced systems have the capability to continuously monitor both current and voltage, allowing for the calculation of parameters such as power and tissue resistance, which can be further analyzed. Depending on the specific treatment goals, these devices can maintain consistent operating parameters or make targeted adjustments through control and regulation. Therefore, Electrosurgical equipment manufacturers should consider investing in these advanced ESUs as a strategic move to enhance their market share within the industry.

Prominent companies in the electrosurgical devices and equipment market are placing a strong emphasis on the development of cutting-edge technology, particularly electrosurgical generators, as a strategic approach to bolster their market position. Electrosurgical generators are essential devices utilized in medical procedures for tasks like cutting, coagulation, and tissue manipulation through the application of high-frequency electrical currents. For instance, in June 2023, Olympus Corporation, a Japan-based manufacturer specializing in reprography and optics products, introduced the ESG-410 Electrosurgical Generator. This advanced system is equipped with PLASMA+ Technology, representing a significant leap in surgical treatment capabilities. It offers advantages such as quicker ignition, improved plasma stability, and versatile applicability with various loops, including large, medium, and band loops, along with an oval button, all achieved without direct tissue contact. The ESG-410 is a high-frequency bipolar electrosurgical generator designed for endoscopic procedures, providing a reliable and precise technology for resection and surgical tissue management. This innovation underscores the commitment of major players in the industry to remain at the forefront of technological advancements in the field of electrosurgical equipment.

Electrosurgical devices and equipment play a pivotal role in surgical procedures by enabling the cutting, sealing, and coagulation of tissue, both in open and laparoscopic surgeries.

The primary products within the electrosurgical devices category encompass electrosurgery generators, electrosurgery instruments, and associated accessories, as well as argon and smoke management systems. Electrosurgery generators are critical in the field of therapeutic endoscopy, as they provide the necessary high-frequency electrical current to operate endoscopic accessories effectively. These devices find applications across a range of surgical disciplines, including general surgery, gynecology surgery, urologic surgery, orthopedic surgery, cardiovascular surgery, cosmetic surgery, and neurosurgery. The end-users of these electrosurgical devices and equipment are diverse and include hospitals, specialized clinics, and ambulatory surgery centers, all of which rely on these technologies to enhance the precision and effectiveness of their surgical procedures.

The electrosurgical devices market research report is one of a series of new reports that provides electrosurgical devices market statistics, including electrosurgical devices industry global market size, regional shares, competitors with an electrosurgical devices market share, detailed electrosurgical devices market segments, market trends and opportunities, and any further data you may need to thrive in the electrosurgical devices industry. This electrosurgical devices market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Major companies operating in the electrosurgical devices and equipment market include Bovie Medical Corporation, Johnson & Johnson Private Limited, B. Braun Melsungen AG, Medtronic plc, Smith and Nephew plc, Boston Scientific Corporation, Stryker Corporation, ATMOS Inc., Heal Force Bio-meditech Holdings Limited, Erbe Elektromedizin GmbH, Bowa-Electronic Gmbh & Co.KG, Conmed Corporation, Ethicon Inc., Olympus Corporation, Megadyne Medical Products Inc., COVIDien plc, Applied Medical Resources Corporation, KLC Martin Group, Utah Medical Products Inc., Kirwan Surgical Products LLC, Parkell Inc., XcelLance Medical Technologies Pvt. Ltd., Prima Medical Ltd., Abbott Laboratories, Philips, GE Healthcare, Encision Inc., Symmetry Surgical Inc., Meyer-Haake GmbH Medical Innovations, AtriCure Inc.

North America was the largest region in the global electrosurgical devices market in 2024. Western Europe was the second-largest region in the electrosurgical devices market. The regions covered in the electrosurgical devices and equipment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa. The countries covered in the electrosurgical devices and equipment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

The electrosurgical devices and equipment market consists of sales of surgical generators (radiofrequency, ultrasonic, electrocautery, and argon plasma equipment) and electrosurgical instruments (monopolar, bipolar, and ultrasonic instruments). Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Executive Summary

Electrosurgical Devices and Equipment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on electrosurgical devices and equipment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 50 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for electrosurgical devices and equipment ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The electrosurgical devices and equipment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Electrosurgery Generators; Electrosurgery Instruments and Accessories; Argon and Smoke Management Systems2) By Application: General Surgery; Gynecology Surgery; Urologic Surgery; Orthopedic Surgery; Cardiovascular Surgery; Cosmetic Surgery; Neurosurgery

3) By End User: Hospitals; Specialized Clinics; Ambulatory Surgery Centers

Subsegments:

1) By Electrosurgery Generators: Monopolar Electrosurgery Generators; Bipolar Electrosurgery Generators; Hybrid Electrosurgery Generators2) By Electrosurgery Instruments and Accessories: Electrosurgical Pencils; Electrodes; Forceps; Electrosurgical Cords and Cables; Disposables (Electrodes, Pads)

3) By Argon and Smoke Management Systems: Argon Plasma Coagulation (APC) Systems; Smoke Evacuation Systems; Smoke Filtration Systems

Key Companies Mentioned: Bovie Medical Corporation; Johnson & Johnson Private Limited; B. Braun Melsungen AG; Medtronic plc; Smith and Nephew plc

Countries: Australia; China; India; Indonesia; Japan; South Korea; Bangladesh; Thailand; Vietnam; Malaysia; Singapore; Philippines; Hong Kong; New Zealand; USA; Canada; Mexico; Brazil; Chile; Argentina; Colombia; Peru; France; Germany; UK; Austria; Belgium; Denmark; Finland; Ireland; Italy; Netherlands; Norway; Portugal; Spain; Sweden; Switzerland; Russia; Czech Republic; Poland; Romania; Ukraine; Saudi Arabia; Israel; Iran; Turkey; UAE; Egypt; Nigeria; South Africa

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Electrosurgical Devices and Equipment market report include:- Bovie Medical Corporation

- Johnson & Johnson Private Limited

- B. Braun Melsungen AG

- Medtronic plc

- Smith and Nephew plc

- Boston Scientific Corporation

- Stryker Corporation

- ATMOS Inc.

- Heal Force Bio-meditech Holdings Limited

- Erbe Elektromedizin GmbH

- Bowa-Electronic Gmbh & Co.KG

- Conmed Corporation

- Ethicon Inc.

- Olympus Corporation

- Megadyne Medical Products Inc.

- COVIDien plc

- Applied Medical Resources Corporation

- KLC Martin Group

- Utah Medical Products Inc.

- Kirwan Surgical Products LLC

- Parkell Inc.

- XcelLance Medical Technologies Pvt. Ltd.

- Prima Medical Ltd.

- Abbott Laboratories

- Philips

- GE Healthcare

- Encision Inc.

- Symmetry Surgical Inc.

- Meyer-Haake GmbH Medical Innovations

- AtriCure Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 12.07 Billion |

| Forecasted Market Value ( USD | $ 16.47 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |