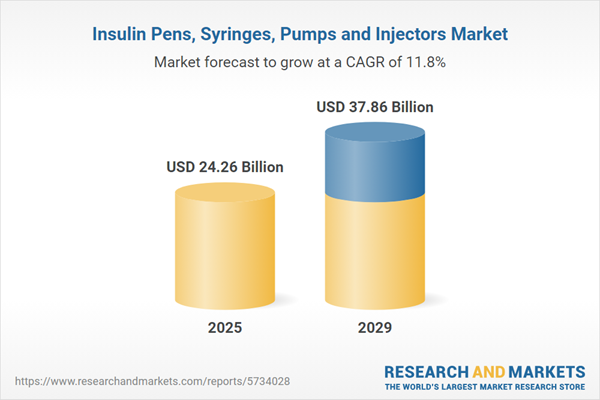

The insulin pens, syringes, pumps and injectors market size has grown rapidly in recent years. It will grow from $21.6 billion in 2024 to $24.26 billion in 2025 at a compound annual growth rate (CAGR) of 12.3%. The growth in the historic period can be attributed to urbanization and infrastructure development, electrification of rural areas, industrialization, renewable energy integration.

The insulin pens, syringes, pumps and injectors market size is expected to see rapid growth in the next few years. It will grow to $37.86 billion in 2029 at a compound annual growth rate (CAGR) of 11.8%. The growth in the forecast period can be attributed to energy transition, electrification of transportation, smart grids and iot integration, 5g expansion, aging infrastructure replacement. Major trends in the forecast period include high-voltage direct current (hvdc) cables, fire-resistant insulation, fiber optic integration, environmentally friendly materials, customization and specialization.

The global increase in diabetes prevalence is fueling the growth of the insulin pens, syringes, pumps, and injectors market. Factors such as the rising number of people affected by obesity, unhealthy dietary habits, lack of physical activity, and a growing elderly population are contributing to the worldwide surge in diabetes cases. For instance, according to a report published by the International Diabetes Federation, a Belgium-based umbrella organization of over 240 national diabetes associations, approximately 537 million adults globally were living with diabetes in 2021, and this number is projected to rise to 783 million by 2045. Therefore, the increasing prevalence of diabetes worldwide is driving the growth of the insulin pens, syringes, pumps, and injectors market.

The expanding elderly population is expected to be a significant driver for the insulin pens, syringes, pumps, and injectors market in the future. The geriatric population consists of older individuals, typically aged 65 and above. The rising incidence of diabetes among this age group has created a demand for specialized insulin delivery solutions that enhance adherence, reduce complications, and improve the overall quality of life for older adults with diabetes. For instance, a report from the World Health Organization (WHO) in October 2022 highlighted that by 2030, one in six people worldwide is expected to be 60 or older, and by 2050, there will be 2.1 billion people aged 60 and above. The number of individuals aged 80 or older is projected to increase by 426 million between 2020 and 2050 compared to the current population. Therefore, the growing elderly population is a significant factor driving the insulin pens, syringes, pumps, and injectors market's growth.

Many companies operating in the insulin pens, syringes, pumps, and injectors market are focusing on technological advancements in insulin delivery systems to ensure effective and safe insulin administration. Insulin delivery systems are tools designed to provide insulin to diabetic patients, including devices such as pens, syringes, pumps, and injectors, ensuring precise and efficient blood sugar management. For instance, in June 2024, Insulet Corporation, a US-based medical equipment manufacturing company, launched the Omnipod 5, a tubeless automated insulin delivery system for individuals with type 1 diabetes aged two and older. It is the first system to integrate with both Dexcom G6 and Abbott FreeStyle Libre 2 Plus continuous glucose monitors, offering unique compatibility with these leading CGM brands for enhanced diabetes management.

Strategic partnerships are a prominent trend in the insulin pens, syringes, pumps, and injectors market. Major companies in this sector offer a wide range of products and technologies to cater to the needs of individuals with diabetes. In December 2022, Eli Lilly and Company, a US-based pharmaceutical firm, joined forces with Eva Pharma, an Egypt-based pharmaceutical company, with the aim of enhancing sustainable access to affordable insulin in low- and middle-income countries, particularly in Africa, making insulin more accessible and affordable to those in need.

In September 2023, Abbott Laboratories, a US-based medical device company, completed the acquisition of Bigfoot Biomedical Inc. for an undisclosed sum. This acquisition is part of Abbott's strategy to expand its presence in diabetes care and strengthen its portfolio of connected diabetes solutions. Bigfoot Biomedical Inc. is a US medical technology company specializing in the development and manufacturing of diabetes management systems, including insulin pens and syringes.

Insulin pens, syringes, pumps, and injectors play a crucial role in regulating the blood glucose levels of diabetic individuals. These tools can be either reusable or disposable and are employed for the purpose of delivering the required insulin dosage into the bloodstream of diabetic patients.

The primary categories of insulin delivery devices and equipment encompass pens, injectors, pumps, and syringes. A syringe serves as an instrument for introducing or extracting fluids. Both reusable and disposable pens are utilized for insulin administration. Pumps are available in two forms, including tube pumps and tubeless pumps. These devices find applications in a variety of settings, such as hospitals, home care, and others.

The insulin pens, syringes, pumps, and injectors devices and equipment market research report is one of a series of new reports that provides insulin pens, syringes, pumps, and injectors devices and equipment market statistics, including insulin pens, syringes, pumps, and injectors devices and equipment industry global market size, regional shares, competitors with an insulin pens, syringes, pumps, and injectors devices and equipment market share, detailed insulin pens, syringes, pumps, and injectors devices and equipment market segments, market trends and opportunities, and any further data you may need to thrive in the insulin pens, syringes, pumps, and injectors devices and equipment industry. This insulin pens, syringes, pumps, and injectors devices and equipment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Major companies operating in the insulin pens, syringes, pumps and injectors market include Novo Nordisk A/S, Eli Lilly and Company, Medtronic PLC, Abbott Laboratories, Insulet Corporation, Sanofi Aventis, F. Hoffmann-La Roche Ltd., Becton Dickinson and Company, Animas Corporation, Ypsomed Holding AG, Dickinson and Company, Valeritas Inc., MannKind Corporation, Tandem Diabetes Care Inc., Biocon Ltd., B. Braun Melsungen AG, Terumo Corporation, Teleflex Incorporated, Nipro Corporation, Smiths Medical Inc., Owen Mumford, UltiMed Inc., Ypsomed Holding, Ascensia Diabetes Care, Trividia Health, ARKRAY Inc., AgaMatrix Inc., Medline Industries LP, Gerresheimer AG, West Pharmaceutical Services Inc., SHL Medical AG, Zhejiang POCTech Medical Co.Ltd., Jiangsu Wanhai Medical Instruments Co. Ltd.

North America was the largest region in the global insulin pens, syringes, pumps, and injectors devices and equipment market in 2024. Asia-Pacific was the second-largest region in insulin pens, syringes, pumps, and injectors devices and equipment market. The regions covered in the insulin pens, syringes, pumps and injectors market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa. The countries covered in the insulin pens, syringes, pumps and injectors market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

The insulin pens, syringes, pumps, and injectors market consist of sales of reusable pens, disposable pens, tubed pumps, and tubeless pumps that are used for injecting insulin. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Insulin Pens, Syringes, Pumps and Injectors Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on insulin pens, syringes, pumps and injectors market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 50 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for insulin pens, syringes, pumps and injectors ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The insulin pens, syringes, pumps and injectors market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Pens; Injectors and Pumps; Syringes2) By Pens: Reusable; Disposable

3) By Pumps: Tubed Pumps; Tubeless Pumps

4) By End Users: Hospitals; Homecare; Other End Users

Subsegments:

1) By Pens: Disposable Insulin Pens; Reusable Insulin Pens2) By Injectors and Pumps: Insulin Injectors; Insulin Pumps; Traditional Insulin Pumps; Patch Insulin Pumps

3) By Syringes: Disposable Syringes; Reusable Syringes

Key Companies Mentioned: Novo Nordisk a/S; Eli Lilly and Company; Medtronic plc; Abbott Laboratories; Insulet Corporation

Countries: Australia; China; India; Indonesia; Japan; South Korea; Bangladesh; Thailand; Vietnam; Malaysia; Singapore; Philippines; Hong Kong; New Zealand; USA; Canada; Mexico; Brazil; Chile; Argentina; Colombia; Peru; France; Germany; UK; Austria; Belgium; Denmark; Finland; Ireland; Italy; Netherlands; Norway; Portugal; Spain; Sweden; Switzerland; Russia; Czech Republic; Poland; Romania; Ukraine; Saudi Arabia; Israel; Iran; Turkey; UAE; Egypt; Nigeria; South Africa

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Insulin Pens, Syringes, Pumps and Injectors market report include:- Novo Nordisk A/S

- Eli Lilly and Company

- Medtronic plc

- Abbott Laboratories

- Insulet Corporation

- Sanofi Aventis

- F. Hoffmann-La Roche Ltd

- Becton Dickinson and Company

- Animas Corporation

- Ypsomed Holding AG

- Dickinson and Company

- Valeritas Inc.

- MannKind Corporation

- Tandem Diabetes Care Inc.

- Biocon Ltd.

- B. Braun Melsungen AG

- Terumo Corporation

- Teleflex Incorporated

- Nipro Corporation

- Smiths Medical Inc.

- Owen Mumford

- UltiMed Inc.

- Ypsomed Holding

- Ascensia Diabetes Care

- Trividia Health

- ARKRAY Inc.

- AgaMatrix Inc.

- Medline Industries LP

- Gerresheimer AG

- West Pharmaceutical Services Inc.

- SHL Medical AG

- Zhejiang POCTech Medical Co.Ltd.

- Jiangsu Wanhai Medical Instruments Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 24.26 Billion |

| Forecasted Market Value ( USD | $ 37.86 Billion |

| Compound Annual Growth Rate | 11.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 33 |