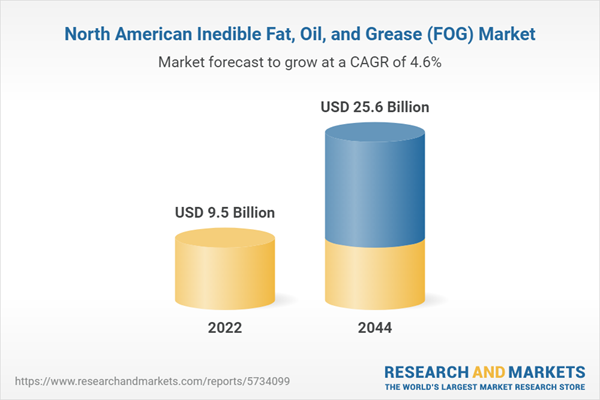

The North America FOG market is projected to grow from USD 9.5 billion in 2022 to USD 25.6 billion by 2044, at a CAGR of 4.6% during the forecast period. Appropriate recycling of brown grease reduces landfilling and landfill-related methane emissions. As a feedstock for the biofuels sector, brown grease helps reduce greenhouse gas emissions and lessen the impact of climate change and offers a less expensive option for biofuel and biodiesel production.

Yellow grease, Restaurants/fast-food restaurants segment has the largest share in North America FOG market in 2021

Yellow grease is produced from used cooking oil as well as other fats and oils gathered from commercial or industrial cooking operations. The yellow grease market will increase due to the growing awareness of sustainable energy resources and environmental conservation. The restaurants and food industry is evolving that directly impacting the overall production of brown grease from used cooking oil.

Brown grease fuel is the fastest segment in the North America FOG market

Brown grease is collected through grease traps installed in commercial, industrial, or municipal sewage treatment plants to separate grease and oil from wastewater. When preheated, brown grease can be utilized as crude bio-boiler fuel in conjunction with diesel fuel to prime and clean the system before and after each usage. According to international convention, CO2 emissions from biofuel combustion are excluded from national greenhouse gas emissions inventories as growing the biomass feedstocks used for biofuel production may offset the CO2 produced when biofuels are burned.

US FOG market is projected to have largest market share during the forecast period

The US FOG market for yellow and brown grease is likely to be driven by the increasing production of biofuels and government initiatives and subsidies on biofuels production. According to the US Energy Information Administration, the US production of biodiesel was 159 million gallons in December 2020. Biodiesel production from the Midwest region accounted for 72% of the US total production. The demand for yellow grease is expected to increase in the region due to the increased corn prices, which is also used as feedstock for biofuel, and the rising demand for cleaner fuel alternatives.

Breakup of Primary Interviews

In-depth interviews were performed with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from several key organizations working in the North America FOG market.

- By Department: Tier 1: 30%, Tier 2: 50%, Tier 3: 20%

- By Designation: Directors: 20%, CXOs: 40%, and Others: 40%

- By Region: US: 60%, Canada: 30%, and Mexico: 10%

The North America FOG market comprises major manufacturers, such as Darling Ingredients, Inc. (US), Restaurant Technologies Inc. (US), Downey Ridge Environmental Company (US), Baker Commodities Inc. (US), Mopac (US), Grease Cycle LLC (US).

Research Coverage

The market study covers the North America FOG market across various segments. It aims at estimating the market size and the growth potential of this market across different segments based on type, generation, application, and region. The study also includes an in-depth competitive analysis of key players in the market, along with their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to enhance their position in the North America FOG market.

Key Benefits of Buying the Report

The report is projected to help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers of the overall North America FOG market and its segments and sub-segments. This report is projected to help stakeholders understand the market’s competitive landscape and gain insights to improve the position of their businesses and plan suitable go-to-market strategies. The report also aims at helping stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities.

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

Figure 1 North America Inedible Fat, Oil, and Grease (FOG) Market Segmentation

1.3.1 Regions Covered

1.4 Years Considered

1.5 Currency Considered

1.6 Research Limitations

1.7 Stakeholders

2 Research Methodology

2.1 Research Data

Figure 2 North America FOG Market: Research Design

2.1.1 Secondary Data

2.1.1.1 Critical Secondary Inputs

2.1.1.2 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Critical Primary Inputs

2.1.2.2 Key Data from Primary Sources

2.1.2.3 Key Industry Insights

2.1.2.4 Breakdown of Primary Interviews

Figure 3 Breakdown of Primary Interviews

2.2 Market Size Estimation Approach

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation: Top-Down Approach

2.3 Data Triangulation

Figure 6 North America FOG Market: Data Triangulation

2.4 Research Assumptions

2.5 Limitations

2.6 Recession Impact

3 Executive Summary

Figure 7 Yellow Grease Accounted for Larger Share in 2021

Figure 8 Fuel Segment Led North America FOG Market in 2021

Figure 9 US Accounted for Largest Share of North America FOG Market in 2021

4 Premium Insights

4.1 Attractive Opportunities in North America FOG Market

Figure 10 Growing Demand from Fuel Application to Drive FOG Market

4.2 North America: FOG Market, by Type and Country (2021)

Figure 11 Yellow Grease Accounted for Larger Share

4.3 FOG Market, by Key Countries

Figure 12 Canada to Register Higher CAGR During Forecast Period

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 13 Drivers, Restraints, Opportunities, and Challenges in North America FOG Market

5.2.1 Drivers

5.2.1.1 Increasing Biodiesel Production in North America

5.2.1.2 Growing Demand for Brown Grease

5.2.2 Restraints

5.2.2.1 Unstable Economic Condition

5.2.3 Opportunities

5.2.3.1 Technological Advancements Leading to Innovation

5.2.4 Challenges

5.2.4.1 Lack of Awareness in Developing Economies

5.3 Porter's Five Forces Analysis

Figure 14 North America FOG Market: Porter's Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Supply Chain Analysis

Figure 15 North America FOG Market: Supply Chain

5.4.1 Raw Material

5.4.2 Grease Collection

5.4.3 Distribution

5.4.4 End-user

5.5 Trends and Disruptions Impacting Customers’ Businesses

Figure 16 North America FOG Market: Changing Revenue Mix

5.6 Connected Market: Ecosystem

Figure 17 North America FOG Market: Ecosystem

5.7 Case Studies

Figure 18 Assessment of Lubricants Industry

Figure 19 Market Size Assessment of Lubricants and Specialties of Lube Oil Refinery

Figure 20 Strategic Assessment of Off-Highway Lubricant Industry

5.8 Industry Outlook

5.8.1 GDP Trends and Forecasts for Major Economies

Table 1 Trends and Forecast of GDP, by Major Economy, 2017-2024 (USD Billion)

5.9 Key Conferences & Events (2022-2023)

Table 2 North America FOG Market: Detailed List of Conferences & Events

5.10 Key Stakeholders & Buying Criteria

5.10.1 Key Stakeholders in Buying Process

Figure 21 Influence of Stakeholders in Buying Process

Table 3 Influence of Stakeholders in Buying Process for Top Two End-use Applications (%)

5.10.2 Buying Criteria

Figure 22 Key Buying Criteria for Fuel and Pet Food Fillers

Table 4 Key Buying Criteria for North America FOG Market in Top 2 End-use Applications

5.11 Regulatory Landscape

5.11.1 Regulations Related to Grease

6 North America FOG Market, by Generation

6.1 Introduction

Table 5 North America: Actual FOG Market Size, by Type, 2020-2044 (Thousand Gallon)

Table 6 North America: Actual FOG Market Size, by Type, 2020-2044 (USD Million)

Table 7 North America: Potential FOG Market Size, by Type, 2020-2044 (Thousand Gallon)

Table 8 North America: Potential FOG Market Size, by Type, 2020-2044 (USD Million)

6.2 Brown Grease

6.2.1 Restaurants/Fast Food Restaurants

6.2.2 Food Processing Facility

6.2.3 Water Treatment Facility

Figure 23 Restaurants/Fast Food Restaurants Segment Dominates Brown Grease Market in 2022

Table 9 Brown Grease Market Size, by Generation, 2020-2044 (Thousand Gallon)

Table 10 Brown Grease Market Size, by Generation, 2020-2044 (USD Million)

6.3 Yellow Grease

6.3.1 Restaurants/Fast Food Restaurants

6.3.2 Food Processing Facility

Figure 24 Restaurants/Fast Food Restaurants Segment Dominates Yellow Grease Market in 2022

Table 11 Yellow Grease Market Size, by Generation, 2020-2044 (Thousand Gallon)

Table 12 Yellow Grease Market Size, by Generation, 2020-2044 (USD Million)

7 North America FOG Market, by Application

7.1 Introduction

7.2 Yellow Grease

7.2.1 Fuel

7.2.2 Pet Food Fillers

7.2.3 Others

Figure 25 Fuel Segment Dominates North America Yellow Grease Market in 2022

Table 13 North America FOG Market: Yellow Grease Market Size, by Application, 2020-2044 (Thousand Gallon)

Table 14 North America FOG Market: Yellow Grease Market Size, by Application, 2020-2044 (USD Million)

7.3 Brown Grease

7.3.1 Fuel

7.3.2 Pet Food Fillers

7.3.3 Others

Figure 26 Fuel Segment Dominates North America Brown Grease Market in 2022

Table 15 North America FOG Market: Brown Grease Market Size, by Application, 2020-2044 (Thousand Gallon)

Table 16 North America FOG Market: Brown Grease Market Size, by Application, 2020-2044 (USD Million)

7.4 Tipping Fee: Primary Inputs

8 North America FOG Market, by Country

8.1 Introduction

Figure 27 Canada to be Fastest-Growing FOG Market

8.2 North America

Table 17 North America: Actual FOG Market Size, by Country, 2020-2044 (Thousand Gallon)

Table 18 North America: Actual FOG Market Size, by Country, 2020-2044 (USD Million)

Table 19 North America: Potential FOG Market Size, by Country, 2020-2044 (Thousand Gallon)

Table 20 North America: Potential FOG Market Size, by Country, 2020-2044 (USD Million)

Figure 28 North America: FOG Market Snapshot

8.2.1 US

8.2.1.1 Growing Government Initiatives in Biofuel Production to Drive Market

Table 21 US Biofuels Supply and Disposition in 2021 (Billion Gallon)

Figure 29 US Monthly Biodiesel Production, 2018-2020

Table 22 US: Actual FOG Market Size, by Type, 2020-2044 (Thousand Gallon)

Table 23 US: Actual FOG Market Size, by Type, 2020-2044 (USD Million)

Table 24 US: Potential FOG Market Size, by Type, 2020-2044 (Thousand Gallon)

Table 25 US: Potential FOG Market Size, by Type, 2020-2044 (USD Million)

Table 26 US: Actual Brown Grease Market Size, by Generation, 2020-2044 (Thousand Gallon)

Table 27 US: Actual Brown Grease Market Size, by Generation, 2020-2044 (USD Million)

Table 28 US: Actual Yellow Grease Market Size, by Generation, 2020-2044 (Thousand Gallon)

Table 29 US: Actual Yellow Grease Market Size, by Generation, 2020-2044 (USD Million)

Table 30 US: Actual Brown Grease Market Size, by Application, 2020-2044 (Thousand Gallon)

Table 31 US: Actual Brown Grease Market Size, by Application, 2020-2044 (USD Million)

Table 32 US: Actual Yellow Grease Market Size, by Application, 2020-2044 (Thousand Gallon)

Table 33 US: Actual Yellow Grease Market Size, by Application, 2020-2044 (USD Million)

8.2.2 Canada

8.2.2.1 Government's Focus to Minimize Greenhouse Gas Emissions to Support Market

Table 34 Canada: Actual FOG Market Size, by Type, 2020-2044 (Thousand Gallon)

Table 35 Canada: Actual FOG Market Size, by Type, 2020-2044 (USD Million)

Table 36 Canada: Potential FOG Market Size, by Type, 2020-2044 (Thousand Gallon)

Table 37 Canada: Potential FOG Market Size, by Type, 2020-2044 (USD Million)

Table 38 Canada: Actual Brown Grease Market Size, by Generation, 2020-2044 (Thousand Gallon)

Table 39 Canada: Actual Brown Grease Market Size, by Generation, 2020-2044 (USD Million)

Table 40 Canada: Actual Yellow Grease Market Size, by Generation, 2020-2044 (Thousand Gallon)

Table 41 Canada: Actual Yellow Grease Market Size, by Generation, 2020-2044 (USD Million)

Table 42 Canada: Actual Brown Grease Market Size, by Application, 2020-2044 (Thousand Gallon)

Table 43 Canada: Actual Brown Grease Market Size, by Application, 2020-2044 (USD Million)

Table 44 Canada: Actual Yellow Grease Market Size, by Application, 2020-2044 (Thousand Gallon)

Table 45 Canada: Actual Yellow Grease Market Size, by Application, 2020-2044 (USD Million)

8.2.3 Mexico

8.2.3.1 Growing Investment in Energy & Infrastructure Sector to Drive Growth

Table 46 Mexico: Potential FOG Market Size, by Type, 2020-2044 (Thousand Gallon)

Table 47 Mexico: Potential FOG Market Size, by Type, 2020-2044 (USD Million)

9 Competitive Landscape

9.1 Introduction

9.2 Strategies Adopted by Key Players

Figure 30 Overview of Strategies Adopted by Key Players in FOG Market

9.2.1 Market Share Analysis of Key Players, 2022

Table 48 FOG Market: Share of Key Players

9.3 Key Players' Strategies

Table 49 Strategic Positioning of Key Players

9.4 Company Evaluation Quadrant

9.4.1 Stars

9.4.2 Pervasive Players

9.4.3 Emerging Leaders

9.4.4 Participants

Figure 31 FOG Market: Company Evaluation Quadrant, 2022

9.5 Startups/Small and Medium-Sized Enterprises (SMEs) Evaluation Quadrant

9.5.1 Responsive Companies

9.5.2 Dynamic Companies

9.5.3 Starting Blocks

9.5.4 Progressive Companies

Figure 32 Start-Ups and Small and Medium-Sized Enterprises (SMEs) Evaluation Matrix, 2022

9.6 Competitive Benchmarking

Table 50 FOG Market: Detailed List of Key Players

Table 51 FOG Market: Competitive Benchmarking of Key Players

9.7 Competitive Situation and Trends

9.7.1 Product Launches

Table 52 FOG Market: Product Launches

9.7.2 Deals

Table 53 FOG Market: Acquisitions

9.7.3 Other Developments

Table 54 FOG Market: Expansions

10 Company Profiles

(Business Overview, Products Offered, Recent Developments, Analyst's View, Key Strategies, Strategic Choices, Weaknesses and Competitive Threats)*

10.1 Darling Ingredients, Inc.

Table 55 Darling Ingredients, Inc.: Company Overview

Figure 33 Darling Ingredients, Inc.: Company Snapshot

Table 56 Darling Ingredients, Inc.: Deals

Table 57 Darling Ingredients, Inc.: Others

10.2 Baker Commodities Inc.

Table 58 Baker Commodities Inc.: Company Overview

Table 59 Baker Commodities Inc.: Product Launches

10.3 Restaurant Technologies, Inc.

Table 60 Restaurant Technologies, Inc.: Company Overview

Table 61 Restaurant Technologies, Inc.: Deals

Table 62 Restaurant Technologies, Inc.: Product Launches

10.4 MOPAC

Table 63 MOPAC: Company Overview

10.5 Downey Ridge Environmental Company

Table 64 Downey Ridge Environmental Company: Company Overview

Table 65 Downey Ridge Environmental Company: Product Launches

Table 66 Downey Ridge Environmental Company: Others

10.6 Other Players

10.6.1 GF Commodities LLC.

Table 67 GF Commodities LLC.: Company Overview

10.6.2 Mahoney Environmental Inc.

Table 68 Mahoney Environmental Inc.: Company Overview

10.6.3 Indaba Renewable Fuels California LLC

Table 69 Indaba Renewable Fuels California LLC: Company Overview

10.6.4 Grand Natural Inc.

Table 70 Grand Natural Inc.: Company Overview

10.6.5 Ace Grease Service Inc.

Table 71 Ace Grease Service Inc.: Company Overview

10.6.6 Sequential

Table 72 Sequential: Company Overview

10.6.7 Genuine Bio-Fuel Inc.

Table 73 Genuine Bio-Fuel Inc.: Company Overview

10.6.8 Rocky Mountain Sustainable Enterprises, LLC

Table 74 Rocky Mountain Sustainable Enterprises, LLC: Company Overview

10.6.9 Green Energy Biofuel

Table 75 Green Energy Biofuel: Company Overview

10.6.10 A&A Grease & Pumping Service

Table 76 A&A Grease & Pumping Service: Company Overview

10.6.11 A&P Grease Trappers

Table 77 A&P Grease Trappers: Company Overview

10.6.12 Smisson-Mathis Energy Solutions

Table 78 Smisson-Mathis Energy Solutions: Company Overview

10.6.13 Southwaste Disposal LLC

Table 79 Southwaste Disposal LLC: Company Overview

10.6.14 Farmers Union Industries LLC

Table 80 Farmers Union Industries LLC: Company Overview

*Details on Business Overview, Products Offered, Recent Developments, Analyst's View, Key Strategies, Strategic Choices, Weaknesses and Competitive Threats Might Not be Captured in Case of Unlisted Companies

11 Appendix

11.1 Discussion Guide

11.2 Knowledgestore: The Subscription Portal

11.3 Customization Options

Companies Mentioned

- A&A Grease & Pumping Service

- A&P Grease Trappers

- Ace Grease Service Inc.

- Baker Commodities Inc.

- Darling Ingredients, Inc.

- Downey Ridge Environmental Company

- Farmers Union Industries LLC

- Genuine Bio-Fuel Inc.

- GF Commodities LLC.

- Grand Natural Inc.

- Green Energy Biofuel

- Indaba Renewable Fuels California LLC

- Mahoney Environmental Inc.

- MOPAC

- Restaurant Technologies, Inc.

- Rocky Mountain Sustainable Enterprises, LLC

- Sequential

- Smisson-Mathis Energy Solutions

- Southwaste Disposal LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 112 |

| Published | January 2023 |

| Forecast Period | 2022 - 2044 |

| Estimated Market Value ( USD | $ 9.5 Billion |

| Forecasted Market Value ( USD | $ 25.6 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | North America |

| No. of Companies Mentioned | 19 |