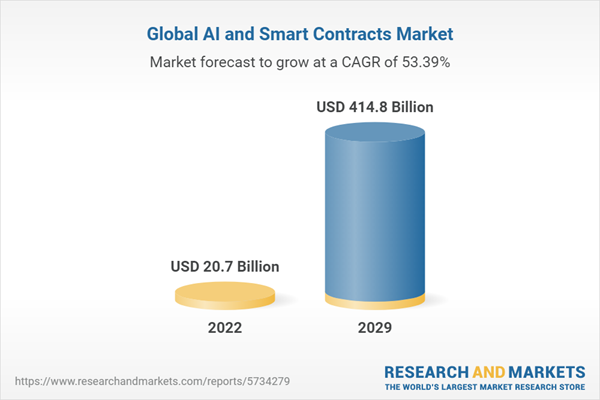

Identities and contracts, physical and digital, are at the heart of a globalized world. In parallel, AI technology and eGovernment are revolutionizing the way we authenticate ourselves and negotiate action through smart contracts, making all manner of automation, including central bank digital currency CBDC possible. The global AI & smart contract blockchain market is projected to grow at a CAGR of 53.39% during the forecast period, 2022-2029.

AI and smart contracts, useful in government, farming, healthcare, banking, insurance, business, and for central bank digital currencies (CBDC) will revolutionize processes. These processes implemented with AI through smart contracts are more efficient. Smart contracts support faster and cheaper cross-border payments. The settlements process moves from two days to several seconds, creating a less costly, more efficient settlements process.

The pace of global warming, Chinese investment in the military, and big tech R&D spending are driving unprecedented adoption of AI for the military, agriculture, electric vehicles, and digital currency, which is creating the ability to implement more efficient business practices. Smart contracts fulfill the need to implement AI efficiently.

AI will bring the same digital revolution that PCs, smartphones, and the Internet have already brought, but quicker and with a greater impact. Smart contracts make AI work. All these shifts to AI bring strong growth of the US and World GDP. They create an economic push for CBDCs and smart contracts. AI is already here, making change immediate.

Electric vehicle implementation is anticipated to add $114 trillion to the global economy by 2029 over and above what is part of the world economy now. Microsoft is said to be investing another $10 billion into CHATgpt and adding the AI functionality to Excel and Word immediately. AI functionality is driving another $100 trillion into the global economy.

Teachers, professors, and users are already noticing the effects of CHATgbt. All groups, including law firms, leading, large, medium, and small need this study. They need to understand the smart contracts, how smart contracts will be used, and how the market will play out, to start allying with the companies that are installing smart contract technology.

Table of Contents

1. SMART CONTRACT MARKET DEFINITION AND MARKET DYNAMICS

1.1 Business Built on Trust

1.1.1 Smart Contracts Disruptive Technology

1.2 AI and Smart Contracts Leverage Digital Currency for Transaction Settlements

1.3 Using Smart Contracts to Improve Data Management

1.4 Blockchain as an Electronic List of Connected Records

1.5 Immutability: Preventing Change to Smart Contracts

1.6 Self-Enforcing Contracts

1.7 Signing Smart Contracts: Legal Considerations

1.8 Obstacles to Smart Contracts

1.9 Security And Privacy

2 SMART CONTRACTS MARKET SHARES, MARKET FORECASTS

2.1 Smart Contracts Market Driving Forces

2.2 Smart Contract Blockchain Market Shares

2.3 Smart Contract Market Forecasts

2.3.1 Improvements In Payment Systems

3 CBDCS AND SMART CONTRACTS

3.1 Central Bank Monetary Policy

3.2 Digital Money

3.3 US Central Bank Money: Most Trusted

3.4 Cryptocurrency Value Decline

3.5 Token-Based CBDCs

3.6 Sonoco and IBM Applications of Smart Contracts

3.7 Everscale Consensus Mechanism

3.8 Variability in Value of Private and Crypto Currencies

3.9 Private Digital Money

3.9.1 Private Platforms Can Be Risky

3.9.2 Fedcoin Features

3.10 Barclays CBDC Analysis

3.10.1 Barklays Working with Central Banks

4 SMART CONTRACTS REGIONAL ANALYSIS

4.1 Countries Move to Control Blockchain, Reducing Tax Evasion, Money Laundering, and Fraud

4.2 US

4.2.1 US Central Bank Digital Currency (CBDC) Executive Order: Research a Matter of Urgency

4.2.2 Federal Reserve Bank of Boston and the Massachusetts Institute of Technology Digital Currency Initiative

4.3 China

4.3.1 CBDC for China

4.4 India

4.4.1 IBM Blockchain Platform for Supply Chain Financing and Security in India

4.5 Japan

4.6 UK

4.7 Switzerland

4.8 Bahamas and Cambodia

4.9 Central Bank of Bahrain and JPMorgan to Work on Digital Currency Settlement Pilot

4.10 Bank for International Settlements (BIS) - Australia, Malaysia, Singapore, South Africa

4.10.1 Bank for International Settlements (BIS) Core CBDC Technology Options

4.11 AI Smart Contract Software

5 COMPANY PROFILES

5.1 AIWORK

5.2 Accenture Smart Contracts

5.2.1 Accenture Blockchain for Contracts

5.3 AWS Smart Contracts

5.4 OpenAI / ChatGPT

5.4.1 Microsoft Set to Invest Billions in ChatGPT

5.5 Ethereum

5.6 Everscale

5.6.1 Everscale GameFi and Metaverse SDK

5.6.2 Everscale API

5.6.3 Everscale Low Transaction Fees Enable CBDCs

5.6.4 Everscale CBDC

5.7 Goldman Sacks Smart Contracts

5.7.1 Goldman Sachs Blockchain Redefines the Way Transactions Occur

5.8 Huawei Smart Contracts

5.8.1 Huawei Smart Contract Systems Vision For 2030 Intelligent World

5.9 IBM

5.9.1 IBM Smart Contracts

5.9.2 IBM Smart Contracts Safeguarding the Efficacy of Medications

5.9.3 IBM Supply Chain Transparency

5.9.4 Blockchain for Trade Finance

5.9.5 Blockchain for Food Supply

5.10 JP Morgan Chase

5.11 L4S / TapestryX

5.11.1 L4S Tapestry Distributed Ledger

5.11.2 L4S / TapestryX

5.12 Microsoft Smart Contracts

5.12.1 Microsoft Implementing Enterprise Smart Contracts

5.12.2 Microsoft Azure - The Enabler

5.12.3 Microsoft Enterprise Smart Contracts - Framework

5.12.4 Microsoft Smart Contracts Summary

5.13 Near

5.14 Oracle

5.14.1 Oracle Smart Contract Benefits

5.14.2 Oracle Blockchain for Smart Contracts: Use Cases - Banking, Government, Insurance, Business

5.15 Partior Smart Contracts

5.16 R3 / Corda

5.16.1 Smart Contracts - R3 Documentation

5.17 Solana

5.18 Swift

5.18.1 SWIFT Experiments with Accenture

5.19 Tata Consultancy Services (TCS)

5.20 Wipro

5.20.1 Wipro and R3 Target Thailand

5.20.2 Wipro Revenue

5.21 Selected Smart Contract Market Participants and Legal Firms

List of Figures

Figure 1. Basic Rules of Smart Contract Contractual Agreements

Figure 2. Smart Contract Efficiency That Accrues from The Automation Of Contract Terms

Figure 3. AI and Smart Contract Blockchain and Distributed Ledger Market Shares, Dollars, 2022

Figure 4. Smart Contracts

Figure 5. Benefits of Blockchain Electronic Ledger

Figure 6. Smart Contract Interruption Events

Figure 7. Smart Contracts Business Market Driving Forces

Figure 8. AI and Smart Contract Blockchain and Distributed Ledger Market Shares, Dollars, 2022

Figure 9. AI and Smart Contracts Blockchain and Distributed Ledger Market Shares, Dollars, Worldwide, 2022

Figure 10. AI and Smart Contracts Blockchain and Distributed Ledger Market Shares, Dollars, Worldwide, 2022

Figure 11. Smart Contracts Blockchain and Digital Ledger Market Forecasts, Dollars Shipped, Worldwide, 2023-2029

Figure 12. CBDC Implementation: Large Bank Interbank Settlement and Cross Border Payments Savings Market Forecasts, Dollars, Worldwide, 2022-2028

Figure 13. IBM Blockchain Transparent Supply

Figure 14. Benefits of Smart Contracts

Figure 15. Sears Roebuck and Co. Had its Own Currency Years Ago

Figure 16. Private money before crypto: Chesapeake and Ohio Canal Company note (1841)

Figure 17. Threats Cryptocurrencies Pose to Financial System Stability

Figure 18. The US Federal Reserve

Figure 19. The US Federal Reserve Key Functions

Figure 20. The US Federal Reserve Activities

Figure 21. IBM Security Command Center in Bengaluru, India

Figure 22. The Rise of Decentralized Finance

Figure 23. Core CBDC Technology Options

Figure 24. CBDC Access Implementation

Figure 25. CBDC Commercial Deployment and Operation

Figure 26. Benefits of Smart Contract Software

Figure 27. AWS Blockchain Smart Contract Templates

Figure 28. Everscale Value to Developers

Figure 29. Everscale Scalable Network Benefits

Figure 30. Everscale SDK Features

Figure 31. Goldman Sacks Smart Contracts Functions

Figure 32. Goldman Sachs Blockchain Positioning

Figure 33. Goldman Sachs Blockchain Transaction Management

Figure 34. Goldman Sachs Blockchain Redefines the Way Transactions Occur

Figure 35. Huawei Envisions An Era Of Intelligent Smart Contracts Powering A 4th Industrial Revolution, Intelligent Vehicles

Figure 36. IBM Smart Contracts

Figure 37. IBM Provides Home Depo Increased Visibility Into The Supply Chain,

Figure 38. IBM We Trade

Figure 39. IBM Benefits of Smart Contracts

Figure 40. Sonoco + IBM: Safeguarding the Efficacy of Lifesaving Medications with Blockchain

Figure 41. JPMC Cross Border Transactional Cash Management Metrics

Figure 42. Global Payments Infrastructure

Figure 43. Twitter November 2, 2022 Token Digital Asset Transfer by Bank

Figure 44. L4S DLT Supply Chain Benefits

Figure 45. L4S Tapestry Distributed Ledger

Figure 46. L4S DL/Blockchain Features

Figure 47. TapestryX Fundamental DTL Requirements vs Blockchain Capabilities

Figure 48. Microsoft Smart Contracts

Figure 49. Microsoft Enterprise Smart Contract Components

Figure 50. Microsoft Blockchain and Cloud

Figure 51. Microsoft Azure Smart Contracts Composition

Figure 52. Microsoft Smart Contracts Axure Platform Building Blocks

Figure 53. Microsoft Smart Contracts Message Based API

Figure 54. Microsoft Smart Contracts Message Based API Functions

Figure 55. Using Microsoft Azure Enterprise Smart Contracts

Figure 56. NEAR Apps Functions

Figure 57. NEAR-api-js Features

Figure 58. NEAR-api-js: Functions

Figure 59. Developer Choices for Compiling a NEAR Smart Contract:

Figure 60. Oracle Smart Contract Benefits

Figure 61. Partior Services:

Figure 62. Partior Countries Served

Figure 63. R3 / Corda DLT Production Ecosystem

Figure 64. Solana Smart Contract Technology Features

Figure 65. Wipro Revenue 2001-2021

Figure 66. Project Inthanon: Wipro and R3 Launch Interbank Settlement Blockchain with Digital Currency

Figure 67. Project Inthanon Functions

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accenture

- AIWORK

- AWS

- Corda

- Ethereum

- Goldman Sacks

- Huawei

- IBM

- JP Morgan Chase

- L4S

- Microsoft

- Near

- OpenAI (ChatGPT)

- Oracle

- Partior

- R3

- Solana

- Swift

- TapestryX

- Tata Consultancy Services (TCS)

- Wipro

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 134 |

| Published | January 2023 |

| Forecast Period | 2022 - 2029 |

| Estimated Market Value ( USD | $ 20.7 Billion |

| Forecasted Market Value ( USD | $ 414.8 Billion |

| Compound Annual Growth Rate | 53.4% |

| Regions Covered | Global |