According to the International Trade Administration, the mining industry in Mexico witnessed a growth of approximately 23% in 2021 and was valued at USD 1.81 billion in the same year. The increase in the production output of the oil & gas and mining industries is expected to surge the wastewater generation in the country, thereby fueling the demand for water treatment chemicals in Mexico in the coming years.

The increasing population in Mexico and climate changes caused by global warming have led to the exhaustion of finite natural resources in the country that are predicted to result in a surged water scarcity in Mexico in the coming years. It is estimated that more than 65 million people in Mexico will face the problem of water scarcity in the coming years which is expected to intensify during April, the driest month in Mexico.

Approximately 1 out of 4 people in the country are expected to be affected by water scarcity by 2050. Moreover, the quality of water in natural water bodies in the country is also deteriorating owing to increased industrial effluent discharge, along with the ill effects of agricultural, human, and mining activities on these natural water sources. All these factors contribute to the increasing demand for water treatment chemicals in the country.

The formulation of stringent regulations by the Government of Mexico for the proper disposal of effluents and wastewater generated by industries also acts as a growth opportunity for the water treatment chemicals market in the country. Industries must comply with the Mexican Official Standards that have set forth the maximum permissible levels of pollutants to be discharged into water bodies under federal jurisdiction or with the specific discharge conditions mentioned for receiving wastewater discharge permits.

Mexico Water Treatment Chemicals Market Report Highlights

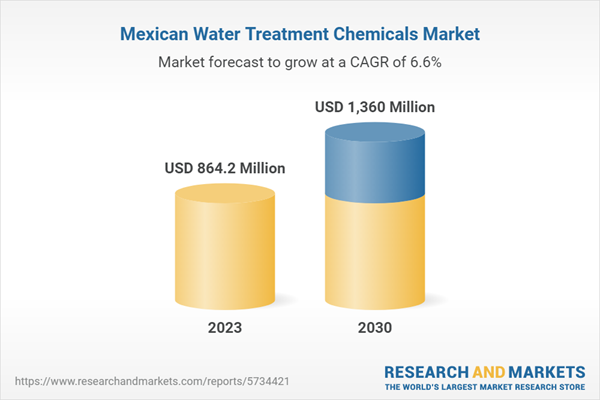

- The global market is estimated to advance with a CAGR of 6.6% from 2023 to 2030. This is attributed to the increasing demand for water treatment chemicals from various end users such as power, petrochemical manufacturing, construction, and chemical manufacturing among others is expected to trigger the market growth

- Coagulants & flocculants dominated the product segment with a revenue share of over 44.9% in 2022. This growth is attributed to its increased usage in the oil & gas, mining, and chemical industries. Companies such as Veolia offer a wide range of flocculants and coagulants under the name KlarAid coagulants, PolyFloc flocculants, Novus flocculants, and others

- Raw water treatment in the application segment dominated the market in 2022 as it helps avoid corrosion, scaling, and fouling by removing suspended and dissolved solids, bacteria, and other types of impurities present in water before it is used for industrial processes or human consumption

- Municipal dominated the end-use segment with a revenue share of over 41.6% in 2022. This growth is attributed to the depleting natural water resources in the country thus, creating the need for recycling and reusing the water

- According to Borgen, a non-profit organization, in 2020, over 50% of the population of Mexico faced water scarcity. Municipalities' increasing burden on waste treatment has provided the impetus for industrialists to establish or improve wastewater treatment and reuse facilities. Thus, increasing the demand for water treatment chemicals

Table of Contents

Chapter 1 Methodology and Scope1.1 Market Segmentation & Scope

1.2 Market Definitions

1.3 Information Procurement

1.3.1 Information Analysis

1.3.2 Market Formulation & Data Visualization

1.3.3 Data Validation & Publishing

1.4 Research Scope And Assumptions

1.4.1 List Of Data Sources

Chapter 2 Executive Summary

2.1 Market Outlook

2.2 Segmental Snapshot

2.3 Competitive Landscape Snapshot

Chapter 3 Market Variables, Trends & Scope

3.1 Market Lineage Outlook

3.1.1 Global Water Treatment Chemicals Market Outlook

3.2 Penetration & Growth Prospect Mapping, 2018 - 2030

3.3 Industry Value Chain Analysis

3.3.1 Raw Material Trend Analysis

3.3.2 Manufacturing Trend Analysis

3.3.3 Sales Channel Analysis

3.4 Price Trend Analysis, 2018-2030

3.4.1 Factors Influencing Prices

3.5 Regulatory Framework

3.6 Impact of the COVID-19 Pandemic

3.7 Target Addressable Market Analysis

3.8 Analysis of Process Chemicals for Water Treatment in the Oil & Gas Industry

3.9 Market Dynamics

3.9.1 Market Driver Impact Analysis

3.9.1.1 Ongoing Industrial Development in Mexico

3.9.1.2 Growing demand for clean water in Mexico

3.9.2 Market Restraint Impact Analysis

3.9.2.1 Surging adoption of chemical-free water treatment systems in Mexico

3.9.3 Market Opportunity Analysis

3.9.4 Industry Challenges Analysis

3.10 Industry Analysis Tools

3.10.1 Porter's Five Forces Analysis

3.10.1 Macroeconomic Analysis

Chapter 4 Mexico Water Treatment Chemicals Market: Suppliers Portfolio Analysis

4.1 List of Raw Material Suppliers

4.2 Raw Material Trends

4.3 Portfolio Analysis/Kraljic Matrix

4.4 Engagement Model

4.5 Negotiation Strategies

4.6 Sourcing Best Practices

Chapter 5 Mexico Water Treatment Chemicals Market: Product Estimates & Trend Analysis

5.1 Product Movement Analysis & Market Share, 2022 & 2030 (Kilotons) (USD Million)

5.2 Mexico Water Treatment Chemicals Market Size & Forecasts and Trend Analysis, By Product, 2018 - 2030 (Kilotons) (USD Million)

5.2.1 Coagulants & Flocculants

5.2.2 Biocide & Disinfectant

5.2.3 Defoamer & Defoaming Agent

5.2.4 pH & Adjuster & Softener

5.2.5 Scale & Corrosion Inhibitor

5.2.6 Other products

Chapter 6 Mexico Water Treatment Chemicals Market: Application By End-Use Estimates & Trend Analysis

6.1 Application By End-Use Movement Analysis & Market Share, 2022 & 2030 (Kilotons) (USD Million)

6.2 Mexico Water Treatment Chemicals Market Size & Forecasts and Trend Analysis, By Application By End-Use, 2018 - 2030 (Kilotons) (USD Million)

6.2.1 Raw Water Treatment

6.2.1.1 Power

6.2.1.2 Oil & Gas

6.2.1.2.1 Upstream

6.2.1.2.1.1 Well Development

6.2.1.2.1.2 Hydraulic Equipment

6.2.1.2.1.3 Others

6.2.1.2.2 Midstream

6.2.1.2.2.1 Tank Cleaning

6.2.1.2.2.2 Others

6.2.1.2.3 Downstream

6.2.1.2.3.1 Refineries

6.2.1.2.3.2 Others

6.2.1.3 Chemical Manufacturing

6.2.1.4 Mining & Mineral Processing

6.2.1.5 Municipal

6.2.1.6 Food & Beverage

6.2.1.7 Pulp & Paper

6.2.1.8 Construction

6.2.1.9 Others

6.2.2 Water Desalination

6.2.2.1 Power

6.2.2.2 Oil & Gas

6.2.2.2.1 Upstream

6.2.2.2.1.1 Well Development

6.2.2.2.1.2 Hydraulic Equipment

6.2.2.2.1.3 Others

6.2.2.2.2 Midstream

6.2.2.2.2.1 Tank Cleaning

6.2.2.2.2.2 Others

6.2.2.2.3 Downstream

6.2.2.2.3.1 Refineries

6.2.2.2.3.2 Others

6.2.2.3 Chemical Manufacturing

6.2.2.4 Mining & Mineral Processing

6.2.2.5 Municipal

6.2.2.6 Food & Beverage

6.2.2.7 Pulp & Paper

6.2.2.8 Construction

6.2.2.9 Others

6.2.3 Boiling & Cooling

6.2.3.1 Power

6.2.3.2 Oil & Gas

6.2.3.2.1 Upstream

6.2.3.2.1.1 Well Development

6.2.3.2.1.2 Hydraulic Equipment

6.2.3.2.1.3 Others

6.2.3.2.2 Midstream

6.2.3.2.2.1 Tank Cleaning

6.2.3.2.2.2 Others

6.2.3.2.3 Downstream

6.2.3.2.3.1 Refineries

6.2.3.2.3.2 Others

6.2.3.3 Chemical Manufacturing

6.2.3.4 Mining & Mineral Processing

6.2.3.5 Municipal

6.2.3.6 Food & Beverage

6.2.3.7 Pulp & Paper

6.2.3.8 Construction

6.2.3.9 Others

6.2.4 Water Desalination

6.2.4.1 Power

6.2.4.2 Oil & Gas

6.2.4.2.1 Upstream

6.2.4.2.1.1 Well Development

6.2.4.2.1.2 Hydraulic Equipment

6.2.4.2.1.3 Others

6.2.4.2.2 Midstream

6.2.4.2.2.1 Tank Cleaning

6.2.4.2.2.2 Others

6.2.4.2.3 Downstream

6.2.4.2.3.1 Refineries

6.2.4.2.3.2 Others

6.2.4.3 Chemical Manufacturing

6.2.4.4 Mining & Mineral Processing

6.2.4.5 Municipal

6.2.4.6 Food & Beverage

6.2.4.7 Pulp & Paper

6.2.4.8 Construction

6.2.4.9 Others

6.2.5 Effluent Water Treatment

6.2.5.1 Power

6.2.5.2 Oil & Gas

6.2.5.2.1 Upstream

6.2.5.2.1.1 Well Development

6.2.5.2.1.2 Hydraulic Equipment

6.2.5.2.1.3 Others

6.2.5.2.2 Midstream

6.2.5.2.2.1 Tank Cleaning

6.2.5.2.2.2 Others

6.2.5.2.3 Downstream

6.2.5.2.3.1 Refineries

6.2.5.2.3.2 Others

6.2.5.3 Chemical Manufacturing

6.2.5.4 Mining & Mineral Processing

6.2.5.5 Municipal

6.2.5.6 Food & Beverage

6.2.5.7 Pulp & Paper

6.2.5.8 Construction

6.2.5.9 Others

6.2.6 Other Applications

Chapter 7 Mexico Water Treatment Chemicals Market: End-Use Estimates & Trend Analysis

7.1 End-Use Movement Analysis & Market Share, 2022 & 2030 (Kilotons) (USD Million)

7.2 Mexico Water Treatment Chemicals Market Size & Forecasts and Trend Analysis, By End-Use, 2018 - 2030 (Kilotons) (USD Million)

7.2.1. Power

7.2.2. Oil & Gas

7.2.3. Chemical Manufacturing

7.2.4. Mining & Mineral Processing

7.2.5. Municipal

7.2.6. Food & Beverage

7.2.7. Pulp & Paper

7.2.8. Construction

7.2.9. Others

Chapter 8 Mexico Water Treatment Chemicals Market - Competitive Analysis

8.1 Heat Map Analysis, By Key Manufacturers

8.2 Recent Developments & Impact Analysis, By Key Market Participants

8.3 Company/Competition Categorization (Key innovators, Market leaders, Emerging Players)

8.4 Vendor Landscape

8.4.1 List of Global Key Manufacturers

8.4.2 List of Local/Domestic Manufacturers

8.4.3 List of Key Distributors/Suppliers

8.4.4 List of Potential End-Users

8.5 Strategic Framework

Chapter 9 Company Profiles

9.1 IDE Water Technologies

9.1.1 Company Overview

9.1.2 Financial Performance

9.1.3 Product Benchmarking

9.1.4 Strategic Initiatives

9.2 Baker Hughes Company

9.2.1 Company Overview

9.2.2 Financial Performance

9.2.3 Product Benchmarking

9.3 BASF SE

9.3.1 Company Overview

9.3.2 Financial Performance

9.3.3 Product Benchmarking

9.3.4 Strategic Initiatives

9.4 Buckman

9.4.1 Company Overview

9.4.2 Financial Performance

9.4.3 Product Benchmarking

9.4.4 Strategic Initiatives

9.5 Cortec Corporation

9.5.1 Company Overview

9.5.2 Financial Performance

9.5.3 Product Benchmarking

9.6 Ecolab Inc

9.6.1 Company Overview

9.6.2 Financial Performance

9.6.3 Product Benchmarking

9.6.4 Strategic Initiatives

9.7 Kemira

9.7.1 Company Overview

9.7.2 Financial Performance

9.7.3 Product Benchmarking

9.8 Nouryon

9.8.1 Company Overview

9.8.2 Financial Performance

9.8.3 Product Benchmarking

9.9 SNF Group

9.9.1 Company Overview

9.9.2 Financial Performance

9.9.3 Product Benchmarking

9.10 Solenis LLC

9.10.1 Company Overview

9.10.2 Financial Performance

9.10.3 Product Benchmarking

9.10.4 Strategic Initiatives

9.11 Solvay

9.11.1 Company Overview

9.11.2 Financial Performance

9.11.3 Product Benchmarking

9.12 Dow

9.12.1 Company Overview

9.12.2 Financial Performance

9.12.3 Product Benchmarking

9.13 Veolia

9.13.1 Company Overview

9.13.2 Financial Performance

9.13.3 Product Benchmarking

9.14 Apollo Chemicals

9.14.1 Company Overview

9.14.2 Financial Performance

9.14.3 Product Benchmarking

List of Tables

Table 1 Commonly Used Process Chemicals in the Oil & Gas Industry

Table 2 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, Product, 2018 - 2030 (Kilo Tons)

Table 3 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, Product, 2018 - 2030 (USD Million)

Table 4 Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, By Application By End-Use, 2018 - 2030 (Kilotons)

Table 5 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, By Application By End-Use, 2018 - 2030 (USD Million)

Table 6 Global Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, By End-Use, 2018 - 2030 (Kilotons)

Table 7 Global Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, By End-Use, 2018 - 2030 (USD Million)

Table 8 Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, By Raw Water Treatment, 2018 - 2030 (Kilotons)

Table 9 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, By Raw Water Treatment, 2018 - 2030 (USD Million)

Table 10 Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, By By Oil & Gas, 2018 - 2030 (Kilotons)

Table 11 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, By By Oil & Gas, 2018 - 2030 (USD Million)

Table 12 Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, Upstream, 2018 - 2030 (Kilotons)

Table 13 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, Upstream, 2018 - 2030 (USD Million)

Table 14. Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, By Midstream, 2018 - 2030 (Kilotons)

Table 15 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, By Midstream, 2018 - 2030 (USD Million)

Table 16 Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, Downstream, 2018 - 2030 (Kilotons)

Table 17 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, Downstream, 2018 - 2030 (USD Million)

Table 18 Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, By Water Desalination, 2018 - 2030 (Kilotons)

Table 19 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, By Water Desalination, 2018 - 2030 (USD Million)

Table 20 Mexico Water Treatment Chemicals Volume Estimates & Forecasts, Oil & Gas, 2018 - 2030 (Kilotons)

Table 21 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, Oil & Gas, 2018 - 2030 (USD Million)

Table 22 Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, By Upstream, 2018 - 2030 (Kilotons)

Table 23 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, By Upstream, 2018 - 2030 (USD Million)

Table 24 Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, Midstream, 2018 - 2030 (Kilotons)

Table 25 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, Midstream, 2018 - 2030 (USD Million)

Table 26 Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, By Downstream, 2018 - 2030 (Kilotons)

Table 27 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, By Downstream, 2018 - 2030 (USD Million)

Table 28 Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, Boiling & Cooling, 2018 - 2030 (Kilotons)

Table 29 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, Boiling & Cooling, 2018 - 2030 (USD Million)

Table 30 Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, By Oil & Gas, 2018 - 2030 (Kilotons)

Table 31 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, By Oil & Gas, 2018 - 2030 (USD Million)

Table 32 Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, Upstream, 2018 - 2030 (Kilotons)

Table 33 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, Upstream, 2018 - 2030 (USD Million)

Table 34 Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, By Midstream, 2018 - 2030 (Kilotons)

Table 35 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, By Midstream, 2018 - 2030 (USD Million)

Table 36 Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, Downstream, 2018 - 2030 (Kilotons)

Table 37 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, Downstream, 2018 - 2030 (USD Million)

Table 38 Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, By Effluent Water Treatment, 2018 - 2030 (Kilotons)

Table 39 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, By Effluent Water Treatment, 2018 - 2030 (USD Million)

Table 40 Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, Oil & Gas, 2018 - 2030 (Kilotons)

Table 41 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, Oil & Gas, 2018 - 2030 (USD Million)

Table 42 Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, By Upstream, 2018 - 2030 (Kilotons)

Table 43 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, By Upstream, 2018 - 2030 (USD Million)

Table 44 Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, Midstream, 2018 - 2030 (Kilotons)

Table 45 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, Midstream, 2018 - 2030 (USD Million)

Table 46 Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, By Downstream, 2018 - 2030 (Kilotons)

Table 47 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, By Downstream, 2018 - 2030 (USD Million)

Table 48 Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, End-Use, 2018 - 2030 (Kilotons)

Table 49 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, End-Use, 2018 - 2030 (USD Million)

Table 50 Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, By Oil & Gas, 2018 - 2030 (Kilotons)

Table 51 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, By Oil & Gas, 2018 - 2030 (USD Million)

Table 52 Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, Upstream, 2018 - 2030 (Kilotons)

Table 53 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, Upstream, 2018 - 2030 (USD Million)

Table 54 Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, By Midstream, 2018 - 2030 (Kilotons)

Table 55 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, By Midstream, 2018 - 2030 (USD Million)

Table 56 Mexico Water Treatment Chemicals Market Volume Estimates & Forecasts, Downstream, 2018 - 2030 (Kilotons)

Table 57 Mexico Water Treatment Chemicals Market Revenue Estimates & Forecasts, Downstream, 2018 - 2030 (USD Million)

Table 58 Heat Map Analysis, By Key Manufacturers

Table 59 Recent Developments & Impact Analysis, By Key Market Participants

Table 60 Company/Competition Categorization (Key innovators, Market leaders, Emerging Players)

Table 61 List of Global Key Manufacturers

Table 62 List of Local/Domestic Manufacturers

Table 63 List of Key Distributors/Suppliers

Table 64 List of Potential End-users

List of Figures

Fig. 1 Mexico Water Treatment Chemicals Market Segmentation & Scope

Fig. 2 Information Procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation And Validation

Fig. 5 Data Validating & Publishing

Fig. 6 Market Snapshot

Fig. 7 Segment Snapshot

Fig. 8 Competitive Landscape Snapshot

Fig. 9 Mexico Water Treatment Chemicals Market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 10 Mexico Water Treatment Chemicals Market: Value Chain Analysis

Fig. 11 Mexico Water Treatment Chemicals Prices, 2017 - 2030 (USD/Kg)

Fig. 12 Mexico Water Treatment Chemicals Market Dynamics

Fig. 13 Market Driver Analysis

Fig. 14 Market Restraint Analysis

Fig. 15 Mexico Water Treatment Chemicals Market: Porter’s Analysis

Fig. 16 Mexico Water Treatment Chemicals Market: PESTEL Analysis

Fig. 17 Mexico Water Treatment Chemicals Market Revenue Share, By Product, 2022 & 2030 (%)

Fig. 18 Mexico Water Treatment Chemicals Market Revenue Share, By Application By End-Use, 2022 & 2030 (%)

Fig. 19 Mexico Water Treatment Chemicals Market Revenue Share, By End-Use, 2022 & 2030 (%)

Companies Mentioned

- IDE Water Technologies

- Baker Hughes Company

- BASF SE

- Buckman

- Cortec Corporation

- Ecolab Inc

- Kemira

- Nouryon

- SNF Group

- Solenis LLC

- Solvay

- Dow

- Veolia

- Apollo Chemicals

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 131 |

| Published | January 2023 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 864.2 Million |

| Forecasted Market Value ( USD | $ 1360 Million |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Mexico |

| No. of Companies Mentioned | 14 |