Rapid diagnostics play an important role in disease testing by rendering quick and effective results. The growing prevalence of infectious diseases like sepsis and respiratory diseases, such as tuberculosis and influenza, is expected to drive the market during the forecast period. According to WHO, tuberculosis is among the top 10 causes of death globally; about 10.0 million new cases of tuberculosis were recorded in 2021, accounting for approximately 1.4 million deaths.

Moreover, as per World Health Organization (WHO), around 50.0 million people are estimated to be affected by sepsis every year. Furthermore, the rise in drug-resistant infections is another impact-rendering driver of market growth. Therefore, the rising burden of such diseases is increasing the demand for diagnostics and fueling the rapid tests market.

The space is witnessing rapid technological advancements to obtain low-cost, improved accuracy, and highly portable products. Companies such as Roche Diagnostics and Abbott Laboratories have introduced portable products that are user-friendly and therefore can be easily adopted by patients. Moreover, innovative product launches in the market are also due to the rising number of R&D and partnership programs by industry players.

For instance, in April 2021, Chembio Diagnostics, Inc. introduced a rapid point-of-care COVID-19/Flu A&B test in the U.S. market. This product is approved for laboratory use along with a CLIA-waived license, which is suitable for differentiating between influenza and COVID-19 in a shorter turnaround time in traditional & decentralized settings.

Key market players are strategically taking initiatives such as launching novel products, facility expansions, and mergers and acquisitions, which are further driving the rapid diagnostics space growth. For instance, in July 2022, Cytovale announced 510(k) pending for its rapid sepsis risk stratification test, IntelliSep, which can produce results in 10 minutes. Moreover, in April 2022, bioMérieux announced the acquisition of Specific Diagnostics. Through this acquisition, bioMérieux is expected to gain the advantage of Specific Diagnostics’ rapid Antimicrobial Susceptibility Test (AST) system.

Rapid Tests Market Report Highlights

- By product, the consumables segment dominated the market in 2022, with a revenue share of 68.08%. Growing demand for the testing of upper respiratory diseases and commercialization of a number of PoC assays are some of the key factors driving the segment

- In 2022, immunoassay dominated the space with a 52.45% share in the technology segment. Immunoassays typically have high product penetration as they offer higher testing efficacy and accuracy. However, the molecular diagnostics segment is expected to witness the fastest growth during the forecast period

- In 2022, by application, the upper respiratory tract infections segment dominated the space, due to the increase in product approvals and high incidences of infectious diseases that affect the lungs. However, the antibiotic-resistant infections segment is expected to exhibit the fastest growth during the forecast period

- Based on end-use, hospitals and clinics are well-established segments that have contributed significantly to revenue in 2022. However, the at-home setting is a lucrative segment owing to the cost-effectiveness and comfort level of POCT provided to patients at home

- By region, North America had the highest revenue share in the global rapid tests market in 2022. However, Asia Pacific is expected to be the fastest-growing region during the forecast period

Table of Contents

Chapter 1 Methodology And Scope1.1 Market Segmentation And Scope

1.1.1 Segment Scope

1.1.2 Regional Scope

1.1.3 Estimates And Forecast Timeline

1.2 Research Methodology

1.3 Information Procurement

1.3.1 Purchased Database:

1.3.2 Internal Database

1.3.3 Secondary Sources

1.3.4 Primary Research

1.3.5 Details Of Primary Research

1.4 Information Or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Validation

1.6 Model Details

1.6.1 Commodity Flow Analysis

1.6.1.1 Approach: Commodity Flow Approach

1.7 Research Assumptions

1.8 List Of Secondary Sources

1.9 List Of Abbreviations

1.10 Objectives

1.10.1 Objective 1

1.10.2 Objective 2

1.10.3 Objective 3

1.10.4 Objective 4

Chapter 2 Executive Summary

2.1 Market Outlook

Chapter 3 Rapid Tests Diagnostics Market Variables, Trends, And Scope

3.1 Market Lineage Outlook

3.1.1 Parent Market Outlook

3.2 Penetration And Growth Prospect Mapping

3.3 Regulatory And Reimbursement Framework

3.4 Market Driver Analysis

3.4.1 Increasing Adoption Of Self - Testing & Point - Of - Care Products, And Introduction Of CLIA Waived Tests

3.4.2 Growing Geriatric Population Base

3.4.3 Introduction Of Advance Technology Enabled Products

3.4.4 Growing Prevalence Of Target Diseases

3.5 Market Restraint Analysis

3.5.1 Presence Of Ambiguous Regulatory And Reimbursement Framework For Primary Care Setting

3.5.2 Rapid Tests Sensitivity And Accuracy

3.6 Industry Analysis - Porter’s

3.7 Barriers To Entry

3.8 PESTLE Analysis, By Factor (Political & Legal, Economic, And Technological)

3.9 Market Entry Strategies

Chapter 4 Rapid Tests Market: Segment Analysis, By Product, 2018 - 2030 (USD Million)

4.1 Rapid Tests Market: Product Movement Analysis

4.2 Instruments

4.2.1 Instruments Market, 2018 - 2030 (USD Million)

4.3 Consumables

4.3.1 Consumables Market, 2018 - 2030 (USD Million)

4.4 Others

4.4.1 Others Market, 2018 - 2030 (USD Million)

Chapter 5 Rapid Tests Market: Segment Analysis, By Technology, 2018 - 2030 (USD Million)

5.1 Rapid Tests Market: Technology Movement Analysis

5.2 Molecular Diagnostics

5.2.1 Molecular Diagnostics Market, 2018 - 2030 (USD Million)

5.3 Immunoassay

5.3.1 Immunoassay Market, 2018 - 2030 (USD Million)

5.4 Others

5.4.1 Others Market, 2018 - 2030 (USD Million)

Chapter 6 Rapid Tests Market: Segment Analysis, By Application Type, 2018 - 2030 (USD Million)

6.1 Rapid Tests Market: Application Type Movement Analysis

6.2 Upper Respiratory Tract Infections

6.2.1 Upper Respiratory Tract Infections Market, 2018 - 2030 (USD Million)

6.2.2 Influenza And Parainfluenza Virus

6.2.2.1 Influenza And Parainfluenza Virus Market, 2018 - 2030 (USD Million)

6.2.3 Respiratory Syncytial Virus

6.2.3.1 Respiratory Syncytial Virus Market, 2018 - 2030 (USD Million)

6.2.4 Streptococcus

6.2.4.1 Streptococcus Market, 2018 - 2030 (USD Million)

6.3 Antibiotic - Resistant Infections (MRSA, Streptococcus Pneumonia, And Others)

6.3.1 Antibiotic - Resistant Infections (MRSA, Streptococcus Pneumoniae, And Others) Market, 2018 - 2030 (USD Million)

6.4 Sepsis

6.4.1 Sepsis Market, 2018 - 2030 (USD Million)

6.4.1.1 Bacterial Sepsis

6.4.1.1.1 Bacterial Sepsis Market, 2018 - 2030 (USD Million)

6.4.1.2 Fungal Sepsis

6.4.1.2.1 Fungal Sepsis Market, 2018 - 2030 (USD Million)

6.4.1.3 Others

6.4.1.3.1 Others Market, 2018 - 2030 (USD Million)

Chapter 7 Rapid Tests Market: Segment Analysis, By End - Use, 2018 - 2030 (USD Million)

7.1 Rapid Tests Market: End - Use Movement Analysis

7.2 Hospitals & Clinics

7.2.1 Hospitals & Clinics Market, 2018 - 2030 (USD Million)

7.3 Laboratories

7.3.1 Laboratories Market, 2018 - 2030 (USD Million)

7.4 At - Home Testing And Others

7.4.1 At - Home Testing And Others Market, 2018 - 2030 (USD Million)

Chapter 8 Rapid Tests Market: Segment Analysis, By Region, 2018 - 2030 (USD Million)

8.1 Regional Market Share Analysis, 2022 & 2030

8.2 Regional Market Snapshot

8.3 Market Size, & Forecasts, Revenue And Trend Analysis, 2022 To 2030

8.4 North America

8.4.1 North America Market Estimates And Forecast, 2018 - 2030 (USD Million)

8.4.2 U.S.

8.4.2.1 U.S. Market Estimates And Forecast, 2018 - 2030 (USD Million)

8.4.3 Canada

8.4.3.1 Canada Market Estimates And Forecast, 2018 - 2030 (USD Million)

8.5 Europe

8.5.1 Europe Market Estimates And Forecast, 2018 - 2030 (USD Million)

8.5.2 Uk

8.5.2.1 Uk Market Estimates And Forecast, 2018 - 2030 (USD Million)

8.5.3. Germany

8.5.3.1 Germany Market Estimates And Forecast, 2018 - 2030 (USD Million)

8.5.4 Spain

8.5.4.1 Spain Market Estimates And Forecast, 2018 - 2030 (USD Million)

8.5.5 France

8.5.5.1 France Market Estimates And Forecast, 2018 - 2030 (USD Million)

8.5.6 Italy

8.5.6.1 Italy Market Estimates And Forecast, 2018 - 2030 (USD Million)

8.5.7 Denmark

8.5.7.1 Denmark Market Estimates And Forecast, 2018 - 2030 (USD Million)

8.5.8 Sweden

8.5.8.1 Sweden Market Estimates And Forecast, 2018 - 2030 (USD Million)

8.5.9 Norway

8.5.9.1 Norway Market Estimates And Forecast, 2018 - 2030 (USD Million)

8.6 Asia Pacific

8.6.1 Asia Pacific Market Estimates And Forecast, 2018 - 2030 (USD Million)

8.6.2 Japan

8.6.2.1 Japan Market Estimates And Forecast, 2018 - 2030 (USD Million)

8.6.3 China

8.6.3.1 China Market Estimates And Forecast, 2018 - 2030 (USD Million)

8.6.4 India

8.6.4.1 India Market Estimates And Forecast, 2018 - 2030

8.6.5 Australia

8.6.5.1 Australia Market Estimates And Forecast, 2018 - 2030

8.6.6 South Korea

8.6.6.1 South Korea Market Estimates And Forecast, 2018 - 2030

8.6.7 Thailand

8.6.7.1 Thailand Market Estimates And Forecast, 2018 - 2030

8.7 Latin America

8.7.1 Latin America Market Estimates And Forecast, 2018 - 2030 (USD Million)

8.7.2 Brazil

8.7.2.1 Brazil Market Estimates And Forecast, 2018 - 2030 (USD Million)

8.7.3 Mexico

8.7.3.1 Mexico Market Estimates And Forecast, 2018 - 2030 (USD Million)

8.7.4 Argentina

8.7.4.1 Argentina Market Estimates And Forecast, 2018 - 2030 (USD Million)

8.8 Middle East & Africa (Mea)

8.8.1 Middle East & Africa Market Estimates And Forecast, 2018 - 2030 (USD Million)

8.8.2 South Africa

8.8.2.1 South Africa market estimates and forecast, 2018 - 2030 (USD Million)

8.8.3 Saudi Arabia

8.8.6.1 Saudi Arabia market estimates and forecast, 2018 - 2030 (USD Million)

8.8.4 UAE

8.8.4.1 UAE market estimates and forecast, 2018 - 2030 (USD Million)

8.8.5 Kuwait

8.8.5.1 Kuwait market estimates and forecast, 2018 - 2030 (USD Million)

Chapter 9 Rapid tests market: Competitive Analysis

9.1 Recent Developments and Impact Analysis, by Key Market Participants

9.1.1 New Product Launches

9.1.2 Mergers and Acquisitions

9.1.3 Partnerships and Strategic Collaborations

9.1.4 Conferences and Campaigns

9.2 Company Categorization

9.2.1 Innovators

9.2.2 Market Leaders

9.3 Vendor Landscape

9.3.1 List of key distributors and channel partners

9.3.2 Key company market share analysis, 2022

9.4 Private Companies

9.4.1 List of key emerging companies

9.5 Public Companies

9.5.1 Company market position analysis

9.5.2 Competitive dashboard analysis

9.6 Company Profiles

9.6.1 Abbott

9.6.1.1 Company overview

9.6.1.2 Financial performance

9.6.1.3 Product benchmarking

9.6.1.4 Strategic initiatives

9.6.2 BD (Becton, Dickinson and Company)

9.6.2.1 Company overview

9.6.2.2 Financial performance

9.6.2.3 Product benchmarking

9.6.2.4 Strategic initiatives

9.6.3 bioMérieux SA

9.6.3.1 Company overview

9.6.3.2 Financial performance

9.6.3.3 Product benchmarking

9.6.3.4 Strategic initiatives

9.6.4 DiaSorin S.p.A.

9.6.4.1 Company overview

9.6.4.2 Financial performance

9.6.4.3 Product benchmarking

9.6.4.4 Strategic initiatives

9.6.5 Danaher Corporation

9.6.5.1 Company overview

9.6.5.2 Financial performance

9.6.5.3 Product benchmarking

9.6.5.4 Strategic initiatives

9.6.6 Thermo Fisher Scientific, Inc.

9.6.6.1 Company overview

9.6.6.2 Financial performance

9.6.6.3 Product benchmarking

9.6.6.4 Strategic initiatives

9.6.7 F. Hoffmann - La Roche Ltd

9.6.7.1 Company overview

9.6.7.2 Financial performance

9.6.7.3 Product benchmarking

9.6.7.4 Strategic initiatives

List of Tables

Table 1 List of Secondary Sources

Table 2 List of Abbreviation

Table 3 List of Parameters

Table 4 List of Distributors

Table 5 Global Rapid tests market, By Region, 2018 - 2030 (USD Million)

Table 6 Global Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 7 Global Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 8 Global Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 9 Global Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 10 North America Rapid tests market, By Country, 2018 - 2030 (USD Million)

Table 11 North America Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 12 North America Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 13 North America Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 14 North America Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 15 U.S. Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 16 U.S. Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 17 U.S. Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 18 U.S. Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 19 Canada Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 20 Canada Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 21 Canada Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 22 Canada Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 23 Europe Rapid tests market, By Country, 2018 - 2030 (USD Million)

Table 24 Europe Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 25 Europe Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 26 Europe Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 27 Europe Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 28 Germany Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 29 Germany Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 30 Germany Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 31 Germany Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 32 UK Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 33 UK Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 34 UK Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 35 UK Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 36 France Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 37 France Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 38 France Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 39 France Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 40 Italy Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 41 Italy Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 42 Italy Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 43 Italy Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 44 Spain Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 45 Spain Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 46 Spain Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 47 Spain Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 48 Denmark Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 49 Denmark Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 50 Denmark Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 51 Denmark Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 52 Sweden Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 53 Sweden Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 54 Sweden Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 55 Sweden Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 56 Norway Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 57 Norway Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 58 Norway Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 59 Norway Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 60 Asia Pacific Rapid tests market, By Country, 2018 - 2030 (USD Million)

Table 61 Asia Pacific Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 62 Asia Pacific Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 63 Asia Pacific Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 64 Asia Pacific Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 65 Japan Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 66 Japan Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 67 Japan Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 68 Japan Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 69 China Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 70 China Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 71 China Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 72 China Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 73 India Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 74 India Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 75 India Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 76 India Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 77 South Korea Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 78 South Korea Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 79 South Korea Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 80 South Korea Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 81 Australia Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 82 Australia Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 83 Australia Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 84 Australia Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 85 Thailand Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 86 Thailand Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 87 Thailand Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 88 Thailand Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 89 Latin America Rapid tests market, By Country, 2018 - 2030 (USD Million)

Table 90 Latin America Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 91 Latin America Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 92 Latin America Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 93 Latin America Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 94 Brazil Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 95 Brazil Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 96 Brazil Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 97 Brazil Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 98 Mexico Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 99 Mexico Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 100 Mexico Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 101 Mexico Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 102 Argentina Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 103 Argentina Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 104 Argentina Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 105 Argentina Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 106 Middle East & Africa Rapid tests market, By Country, 2018 - 2030 (USD Million)

Table 107 Middle East & Africa Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 108 Middle East & Africa Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 109 Middle East & Africa Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 110 Middle East & Africa Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 111 Saudi Arabia Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 112 Saudi Arabia Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 113 Saudi Arabia Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 114 Saudi Arabia Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 115 South Africa Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 116 South Africa Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 117 South Africa Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 118 South Africa Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 119 UAE Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 120 UAE Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 121 UAE Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 122 UAE Rapid tests market, By End-use, 2018 - 2030 (USD Million)

Table 123 Kuwait Rapid tests market, By Product, 2018 - 2030 (USD Million)

Table 124 Kuwait Rapid tests market, By Technology, 2018 - 2030 (USD Million)

Table 125 Kuwait Rapid tests market, By Application, 2018 - 2030 (USD Million)

Table 126 Kuwait Rapid tests market, By End-use, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Rapid tests market segmentation

Fig. 2 Market research process

Fig. 3 Information procurement

Fig. 4 Primary research pattern

Fig. 5 Market research approaches

Fig. 6 Value - chain - based sizing & forecasting

Fig. 7 QFD modeling for market share assessment

Fig. 8 Market formulation & validation

Fig. 9 Market outlook (2022)

Fig. 10 Penetration and growth prospect mapping

Fig. 11 Market driver impact

Fig. 12 Shift in POC molecular diagnostic trends

Fig. 13 Market restraint impact

Fig. 14 Porter’s Five Forces Analysis

Fig. 15 KoL split, by geography

Fig. 16 Rapid tests product outlook: Key takeaways

Fig. 17 Rapid tests market: Product movement analysis (USD Million)

Fig. 18 Instruments market, 2018 - 2030 (USD Million)

Fig. 19 Consumables market, 2018 - 2030 (USD Million)

Fig. 20 Others market, 2018 - 2030 (USD Million)

Fig. 21 Rapid tests technology outlook: Key takeaways

Fig. 22 Rapid tests market: Technology movement analysis (USD Million)

Fig. 23 Molecular diagnostics market, 2018 - 2030 (USD Million)

Fig. 24 Immunoassay market, 2018 - 2030 (USD Million)

Fig. 25 Others market, 2018 - 2030 (USD Million)

Fig. 26 Rapid tests application outlook: Key takeaways

Fig. 27 Rapid tests market: Application type movement analysis (USD Million)

Fig. 28Upper respiratory tract infections market, 2018 - 2030 (USD Million)

Fig. 29 Influenza and parainfluenza virus market, 2018 - 2030 (USD Million)

Fig. 30 Respiratory syncytial virus market, 2018 - 2030 (USD Million)

Fig. 31 Streptococcus market, 2018 - 2030 (USD Million)

Fig. 32 Antibiotic - resistant infections (MRSA, Streptococcus pneumonia, and others) market, 2018 - 2030 (USD Million)

Fig. 33 Sepsis market, 2018 - 2030 (USD Million)

Fig. 34 Bacterial Sepsis market, 2018 - 2030 (USD Million)

Fig. 35 Fungal sepsis market, 2018 - 2030 (USD Million)

Fig. 36 Others market, 2018 - 2030 (USD Million)

Fig. 37 Rapid tests end - use outlook: Key takeaways

Fig. 38 Rapid tests market: End - use movement analysis (USD Million)

Fig. 39 Hospitals & clinics market, 2018 - 2030 (USD Million)

Fig. 40 Laboratories market, 2018 - 2030 (USD Million)

Fig. 41 At - home testing and others market, 2018 - 2030 (USD Million)

Fig. 42 Regional outlook, 2021 & 2030

Fig. 43 Regional marketplace: Key takeaways

Fig. 44 North America

Fig. 45 North America Rapid tests market Estimates & Forecasts, 2018 - 2030

Fig. 46 U.S.

Fig. 47 U.S. Rapid tests market Estimates & Forecasts, 2018 - 2030

Fig. 48Canada

Fig. 49 Canada Rapid tests market Estimates & Forecasts, 2018 - 2030

Fig. 50 Europe

Fig. 51 Europe Rapid tests market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 52 UK

Fig. 53 UK Rapid tests market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 54 Germany

Fig. 55 Germany Rapid tests market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 56 Spain

Fig. 57 Spain Rapid tests market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 58 France

Fig. 59 France Rapid tests market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 60 Italy

Fig. 61 Italy Rapid tests market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 62 Spain

Fig. 63 Spain Rapid tests market Estimates & Forecasts, 2018 - 2030

Fig. 64 Denmark

Fig. 65 Denmark Rapid tests market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 66 Sweden

Fig. 67 Sweden Rapid tests market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 68 Norway

Fig. 69 Norway Rapid tests market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 70 Rest of Europe

Fig. 71 Rest of Europe Rapid tests market Estimates & Forecasts, 2018 - 2030 (USD Million

Fig. 72 Asia Pacific

Fig. 73 Asia Pacific Rapid tests market Estimates & Forecasts, 2018 - 2030

Fig. 74 Japan

Fig. 75 Japan Rapid tests market Estimates & Forecasts, 2018 - 2030

Fig. 76 China

Fig. 77 China Rapid tests market Estimates & Forecasts, 2018 - 2030

Fig. 78 India

Fig. 79 India Rapid tests market Estimates & Forecasts, 2018 - 2030

Fig. 80 South Korea

Fig. 81 South Korea Rapid tests market Estimates & Forecasts, 2018 - 2030

Fig. 82 Australia

Fig. 83 Australia Rapid tests market Estimates & Forecasts, 2018 - 2030

Fig. 84 Thailand

Fig. 85 Thailand Rapid tests market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 86 Rest of APAC

Fig. 87 Rest of APAC Rapid tests market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 88 Latin America

Fig. 89 Latin America Rapid tests market Estimates & Forecasts, 2018 - 2030

Fig. 90Brazil

Fig. 91 Brazil Rapid tests market Estimates & Forecasts, 2018 - 2030

Fig. 92 Mexico

Fig. 93 Mexico Rapid tests market Estimates & Forecasts, 2018 - 2030

Fig. 94 Argentina

Fig. 95 Argentina Rapid tests market Estimates & Forecasts, 2018 - 2030

Fig. 96 Rest of LATAM

Fig. 97 Rest of LATAM Rapid tests market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 98 Middle East & Africa

Fig. 99 Middle East and Africa Rapid tests market Estimates & Forecasts, 2018 - 2030

Fig. 100 South Africa

Fig. 101 South Africa Rapid tests market Estimates & Forecasts, 2018 - 2030

Fig. 102 Saudi Arabia

Fig. 103 Saudi Arabia Rapid tests market Estimates & Forecasts, 2018 - 2030

Fig. 104 UAE

Fig. 105 UAE Rapid tests market Estimates & Forecasts, 2018 - 2030

Fig. 106 Kuwait

Fig. 107 Kuwait Rapid tests market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 108 Rest of MEA

Fig. 109 Rest of MEA Rapid tests market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 110Company market share analysis - Rapid diagnostic market, 2022

Fig. 111 Company market position analysis,2022

Fig. 112 Company market position analysis

Fig. 113 Competitive Dashboard analysis

Fig. 114 Regional network map

Companies Mentioned

- Abbott

- BD (Becton, Dickinson and Company)

- bioMérieux SA

- DiaSorin S.p.A.

- Danaher Corporation

- Thermo Fisher Scientific, Inc.

- F. Hoffmann - La Roche Ltd

Table Information

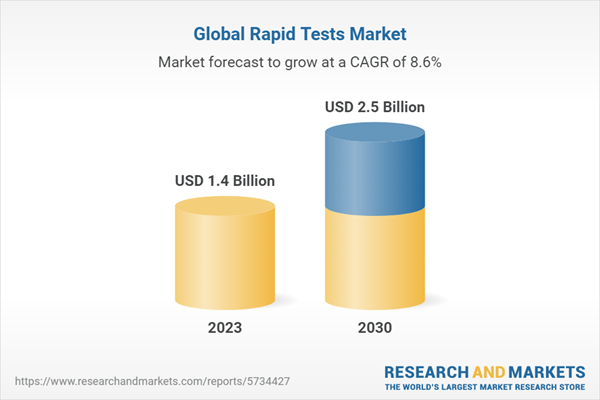

| Report Attribute | Details |

|---|---|

| No. of Pages | 110 |

| Published | January 2023 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 1.4 Billion |

| Forecasted Market Value ( USD | $ 2.5 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 7 |