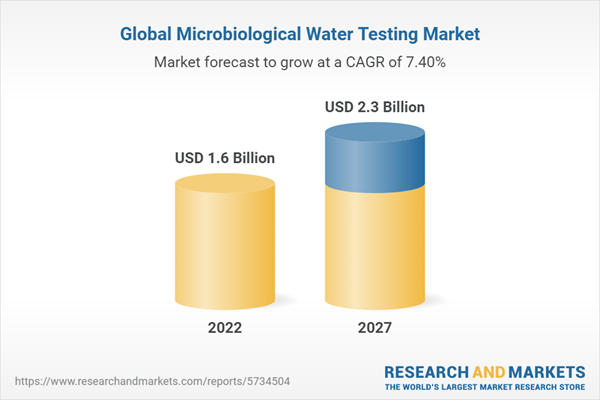

The Microbiological testing of water is estimated at USD 1.6 Billion in 2022. It is projected to grow at a CAGR of 7.4% to reach USD 2.3 Billion by 2027. The increasing incidences of waterborne diseases are one of the major factors driving growth in the microbiological testing of water market. Most deaths globally are caused by water-borne illnesses, particularly in developing and underdeveloped countries. It is possible to prevent many of these diseases with one simple action, by testing the water and ensuring its quality and suitability for human consumption. The analysis of harmful biological organisms, elements, and compounds in the water is aided by the microbiological testing of water.

Industrial water, by water type, is projected to observe the fastest growth in the Microbiological testing of water market throughout the forecasted period

Due to the high-water usage in the industrial sector and the presence of adequate regulations to support such testing, the industrial water segment dominated the global market for microbiological testing of water.

The Pharmaceutical segment by industry is estimated to account for the largest market share in the global Microbiological testing of water market

The growth of the pharmaceutical industry is also expected to fuel the development of the global microbiological testing of water market. Purified water and water for injections (WFI) are the two primary types of water that are used by the pharmaceutical industry. Both types of water need to be assessed for bioburden, and WFI also must be tested for bacterial endotoxins.

North America is expected to account for the largest market share in the Microbiological testing of water market

North America is the largest regional market for the microbiological testing of water and is expected to grow steadily due to the stringent food norms and strict legislation for the industrial usage of water. With the increasing number of FDA regulations governing the safety & quality of drinking water, there is a surge in the demand for microbial water testing solutions

Break-up of Primaries

- By Company Type: Tier 1: 30%, Tier 2: 45%, Tier 3: 25%

- By Designation: CXOs: 20%, Managers: 50%, and Executives: 30%

- By Region: North America: 42%, Europe: 27%, Asia Pacific: 18%, South America: 9%, RoW: 4%

Leading players profiled in this report

- 3M (US)

- Thermo Fisher Scientific Inc. (US)

- Danaher Corporation (US)

- Döhler Group (Germany)

- Agilent Technologies, Inc. (US)

- Shimadzu Corporation (Japan)

- Merck (Germany)

- PerkinElmer, Inc. (US)

- Bio-Rad Laboratories, Inc. (US)

- IDEXX Laboratories, Inc. (US)

- Avantor Inc. (US)

- Hardy Diagnostics (US)

Research Coverage:

This report segments the Microbiological testing of water market based on pathogen type, water type, type, industry, and region. In terms of insights, this research report focuses on various levels of analyses - competitive landscape, end-use analysis, and company profiles - which together comprise and discuss the basic views on the emerging & high-growth segments of the Microbiological testing of water market, the high-growth regions, countries, government initiatives, market disruption, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

- To get a comprehensive overview of the Microbiological testing of water market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights into the major countries/regions where the Microbiological testing of water market is flourishing.

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

Figure 1 Microbiological Testing of Water Market Snapshot

1.3.2 Regional Segmentation

Figure 2 Microbiological Testing of Water Market, by Region

1.4 Inclusions & Exclusions

1.5 Years Considered

1.6 Currency Considered

Table 1 Us Dollar Exchange Rates Considered, 2018-2021

1.7 Stakeholders

1.8 Summary of Changes

2 Research Methodology

2.1 Research Data

Figure 3 Microbiological Testing of Water Market: Research Design

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.2.3 Supply-Side Approach

2.2.4 Demand-Side Approach

2.3 Data Triangulation

Figure 4 Data Triangulation Methodology

2.4 Assumptions

2.5 Limitations and Risk Assessment

3 Executive Summary

Table 2 Microbiological Testing of Water Market Snapshot, 2022 Vs. 2027

Figure 5 Microbiological Testing of Water Market, by Industry, 2022 Vs. 2027 (USD Million)

Figure 6 Microbiological Testing of Water Market, by Type, 2022 Vs. 2027 (USD Million)

Figure 7 Microbiological Testing of Water Market, by Water Type, 2022 Vs. 2027 (USD Million)

Figure 8 Microbiological Testing of Water Market Share, by Region, 2021

4 Premium Insights

4.1 Attractive Opportunities for Key Players in Market

Figure 9 Introduction of Innovative Rapid Technologies to Drive Market

4.2 Microbiological Testing of Water Market: Major Regional Submarkets

Figure 10 China to Grow at Highest CAGR During Forecast Period

4.3 Asia-Pacific: Microbiological Testing of Water Market, by Key Type & Country

Figure 11 China Accounted for Largest Share in Asia-Pacific and Instruments Segment Dominated, on Basis of Types, in 2021

4.4 Microbiological Testing of Water Market, by Industry & Region

Figure 12 Asia-Pacific Dominates Market Across Food Industry

4.5 Microbiological Testing of Water Market, by Water Type & Region

Figure 13 North America to Dominate Microbiological Testing of Industrial and Drinking & Bottled Water in 2022

4.6 Microbiological Testing of Water Market, by Type & Region

Figure 14 North America Dominated Instruments and Reagents & Test Kits Segments in Market in 2021

5 Market Overview

5.1 Introduction

5.2 Macroeconomic Indicators

5.2.1 Growing Industrialization and Urbanization to Fuel Demand for Microbial Water Testing

Figure 15 Population Living in Urban Areas (%), 2015, 2020, and 2050

Figure 16 Global Annual Growth Rate of Industries, 2017-2021

5.2.2 Increase in Global Outbreaks of Waterborne Illnesses

Figure 17 Number of Deaths, by Risk Factor Globally, 2019

Figure 18 Year-Wise Performance of Major Contributing States in India for Water Borne Disease (Diarrhea)

5.3 Market Dynamics

Figure 19 Microbial Water Testing Market: Drivers, Restraints, Opportunities, and Challenges

5.3.1 Drivers

5.3.1.1 Increasing Need for Microbial Water Quality Analysis

Figure 20 Number of People Without Access to Safe Drinking Water Global

5.3.1.1.1 Increasing Microbial Contamination in Water Reservoirs due to Increased Urban Waste

5.3.1.1.2 Increased Microbial Contamination in Water Reservoirs due to Climatic Conditions

5.3.1.1.3 Increasing Disease Outbreaks due to Microbially Contaminated Water

Table 3 Pathogens Found in Untreated Wastewater and Diseases Caused by Them

5.3.1.2 Stringent Regulatory Environment

Table 4 Water Regulations, by Country

5.3.1.2.1 Epa Regulations on Drinking Water

Table 5 Epa Regulations on Drinking Water

5.3.1.3 Shift from Culture-Based Tests to Rapid Tests for Cost & Time Effectiveness

5.3.1.4 Active Involvement of Government Authorities

Table 6 Regulatory Bodies Actively Participating in Water Protection and Monitoring

5.3.1.4.1 Government Funding for Technological Developments

Figure 21 Main Funding Sources of Water and Wastewater Services in Europe

5.3.1.4.2 Increasing Government and Private Funding for Tackling Water-Borne Diseases

5.3.2 Restraints

5.3.2.1 High Capital Investment

5.3.3 Opportunities

5.3.3.1 Growing Market in Emerging Economies

5.3.3.2 Introduction of Innovative Rapid Technologies

5.3.4 Challenges

5.3.4.1 Lack of Basic Supporting Infrastructure

6 Industry Trends

6.1 Introduction

6.2 Value Chain Analysis

Figure 22 Value Chain: Microbiological Testing of Water Market

6.3 Technology Analysis

6.3.1 Upcoming Technologies in Microbiological Testing of Water Market

6.3.2 Advanced Instruments for Water Testing

6.3.2.1 Turbidimeter

6.3.2.2 Colorimeter

6.3.2.3 Electronic Burette

6.4 Pricing Analysis

6.4.1 Selling Price, by Key Player and Product Type

Figure 23 Microbiological Testing of Water: Selling Price by Key Player and Product Type

Table 7 Selling Price, by Key Player and Product Type

Figure 24 Average Selling Price in Key Regions, by Product Type, 2019-2021 (Usd/Unit)

Table 8 Instruments: Average Selling Price, by Region, 2018-2021 (Usd/Unit)

Table 9 Reagents & Test Kits: Average Selling Price, by Region, 2018-2021 (Usd/Unit)

6.5 Patent Analysis

Figure 25 Patents Granted for Microbiological Testing of Water Market, 2011-2021

Figure 26 Regional Analysis of Patents Granted for Microbiological Testing of Water Market, 2011-2021

Table 10 Key Patents Pertaining to Microbiological Testing of Water Market, 2022

6.6 Market Map

6.6.1 Demand Side

6.6.2 Supply Side

Figure 27 Microbiological Testing of Water: Market Map

Table 11 Microbiological Testing of Water Market: Ecosystem

6.7 Porter's Five Forces Analysis

Table 12 Microbiological Testing of Water Market: Porter's Five Forces Analysis

6.7.1 Degree of Competition

6.7.2 Bargaining Power of Suppliers

6.7.3 Bargaining Power of Buyers

6.7.4 Threat of Substitutes

6.7.5 Threat of New Entrants

6.8 Key Stakeholders and Buying Criteria

6.8.1 Key Stakeholders in Buying Process

Figure 28 Influence of Stakeholders on Buying Process for Top End-users

Table 13 Influence of Stakeholders on Buying Process for Top End-users

6.8.2 Buying Criteria

Figure 29 Key Criteria for Selecting Supplier/Vendor

Table 14 Key Criteria for Selecting Supplier/Vendor

6.9 Key Conferences and Events in 2022-2023

Table 15 Microbiological Testing of Water Market: Detailed List of Conferences and Events, 2022-2023

6.10 Tariff and Regulatory Landscape

6.10.1 Regulatory Bodies, Government Agencies, and Other Organizations

Table 16 North America: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 17 Europe: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 18 Asia-Pacific: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 19 Rest of the World: List of Regulatory Bodies, Government Agencies, and Other Organizations

6.10.2 Regulatory Framework

6.10.2.1 North America

6.10.2.1.1 US

6.10.2.1.2 Canada

6.10.2.2 Europe

Table 20 Regulations and Standards by European Commission for Water Treatment Equipment

Table 21 Parameters as Per Directive 98/83/Ec

Table 22 Regulatory Model in European Countries in Water Industry

6.10.2.3 Asia-Pacific

6.10.2.3.1 Japan

6.10.2.3.2 India

6.10.2.3.3 China

Table 23 International and Country Standards for Drinking Water Quality

6.10.2.4 South America

6.10.2.4.1 Brazil

6.10.2.5 Middle East

Table 24 Microbiological Parameters

6.10.2.6 Africa

6.11 Trends/Disruptions Impacting Customer Businesses

Figure 30 Revenue Shift for Microbiological Testing of Water Market

6.12 Case Study Analysis

6.12.1 Zurich Water Works (Wvz): Batch-Processing of Drinking Water Samples for Microbial Testing

6.12.2 Luminultra: Rapid Microbial Assessment Following Legionellosis in Nursing Home

7 Microbiological Testing of Water Market, by Pathogen Type

7.1 Introduction

7.2 Legionella

7.3 Coliform

7.4 Salmonella

Figure 31 US: Salmonella Cases, by Year

7.5 Vibrio

Figure 32 US: Vibriosis Cases, by Year

7.6 Clostridium

7.7 Others

Table 25 Waterborne Bacterial Diseases

Table 26 Waterborne Protozoan Diseases

Table 27 Waterborne Viral Diseases

8 Microbiological Testing of Water Market, by Water Type

8.1 Introduction

Figure 33 Microbiological Testing of Water Market, by Water Type, 2022 and 2027

Table 28 Microbiological Testing of Water Market, by Water Type, 2017-2021 (USD Million)

Table 29 Microbiological Testing of Water Market, by Water Type, 2022-2027 (USD Million)

8.2 Drinking & Bottled Water

8.2.1 Government Regulations on Drinking Water to Drive Market

Table 30 Drinking & Bottled Water: Microbiological Testing of Water Market, by Region, 2017-2021 (USD Million)

Table 31 Drinking & Bottled Water: Microbiological Testing of Water Market, by Region, 2022-2027 (USD Million)

8.3 Industrial Water

8.3.1 Raising Environmental Concerns and Awareness to Drive Market

Table 32 Industrial Water: Microbiological Testing of Water Market, by Region, 2017-2021 (USD Million)

Table 33 Industrial Water: Microbiological Testing of Water Market, by Region, 2022-2027 (USD Million)

9 Microbiological Testing of Water Market, by Industry

9.1 Introduction

Figure 34 Microbiological Testing of Water Market, by Industry, 2022-2027

Table 34 Microbiological Testing of Water Market, by Industry, 2017-2021 (USD Million)

Table 35 Microbiological Testing of Water Market, by Industry, 2022-2027 (USD Million)

Table 36 Microbiological Testing of Drinking and Bottled Water Market, by Industry, 2017-2021 (USD Million)

Table 37 Microbiological Testing of Drinking and Bottled Water Market, by Industry, 2022-2027 (USD Million)

Table 38 Microbiological Testing of Industrial Water Market, by Industry, 2017-2021 (USD Million)

Table 39 Microbiological Testing of Industrial Water Market, by Industry, 2022-2027 (USD Million)

9.2 Pharmaceuticals

9.2.1 Microbiological Water Quality Monitoring to be Crucial due to Use of Sterile Water Across Pharmaceutical Production

Table 40 Pharmaceuticals: Microbiological Testing of Industrial Water Market, by Region, 2017-2021 (USD Million)

Table 41 Pharmaceuticals: Microbiological Testing of Industrial Water Market, by Region, 2022-2027 (USD Million)

9.3 Clinical

9.3.1 Government Schemes to Ensure Adequate Water Quality for Clinics

Table 42 Clinical: Microbiological Testing of Industrial Water Market, by Region, 2017-2021 (USD Million)

Table 43 Clinical: Microbiological Testing of Industrial Water Market, by Region, 2022-2027 (USD Million)

9.4 Food

9.4.1 Stringent Quality Regulations by Fda in Food & Beverages Industry to Drive Market

Table 44 Food: Microbiological Testing of Industrial Water Market, by Region, 2017-2021 (USD Million)

Table 45 Food: Microbiological Testing of Industrial Water Market, by Region, 2022-2027 (USD Million)

Table 46 Food: Microbiological Testing of Drinking & Bottled Water Market, by Region, 2017-2021 (USD Million)

Table 47 Food: Microbiological Testing of Drinking & Bottled Water Market, by Region, 2022-2027 (USD Million)

9.5 Energy

9.5.1 Effect of Microbial Contamination on Underwater Pipelines in Power Plants to Drive Market

Table 48 Energy: Microbiological Testing of Industrial Water Market, by Region, 2017-2021 (USD Million)

Table 49 Energy: Microbiological Testing of Industrial Water Market, by Region, 2022-2027 (USD Million)

9.6 Chemical & Material

9.6.1 Strict Fda Approved Safety Laws in Production of Cosmetics to Drive Market

Table 50 Chemical & Material: Microbiological Testing of Industrial Water Market, by Region, 2017-2021 (USD Million)

Table 51 Chemical & Material: Microbiological Testing of Industrial Water Market, by Region, 2022-2027 (USD Million)

9.7 Environmental

9.7.1 Increased Use of Microbiological Water Testing in Bioterrorism Surveillance to Drive Market

Table 52 Environmental: Microbiological Testing of Industrial Water Market, by Region, 2017-2021 (USD Million)

Table 53 Environmental: Microbiological Testing of Industrial Water Market, by Region, 2022-2027 (USD Million)

10 Microbiological Testing of Water Market, by Type

10.1 Introduction

Figure 35 Microbiological Testing of Water Market, by Type, 2022 Vs. 2027 (USD Million)

Table 54 Microbiological Testing of Water Market, by Type, 2017-2021 (USD Million)

Table 55 Microbiological Testing of Water Market, by Type, 2022-2027 (USD Million)

10.2 Instruments

10.2.1 Fast and Accurate Results Promote Use of Pcr in Microbiological Water Testing

Table 56 Instruments: Microbiological Testing of Water Market, by Region, 2017-2021 (USD Million)

Table 57 Instruments: Microbiological Testing of Water Market, by Region, 2022-2027 (USD Million)

10.3 Reagents & Test Kits

10.3.1 Development of Low-Cost Microbiology Water Testing Kits Drives Market

Table 58 Reagents & Test Kits: Microbiological Testing of Water Market, by Region, 2017-2021 (USD Million)

Table 59 Reagents & Test Kits: Microbiological Testing of Water Market, by Region, 2022-2027 (USD Million)

11 Microbiological Testing of Water Market, by Technology

11.1 Introduction

Figure 36 Microbiological Testing of Water Market, by Technology, 2022 Vs. 2027 (USD Million)

Table 60 Microbiological Testing of Water Market, by Technology, 2017-2021 (USD Million)

Table 61 Microbiological Testing of Water Market, by Technology, 2022-2027 (USD Million)

11.2 Traditional

11.2.1 Continuous Product Refinement Innovations to Improve Efficiency of Traditional Technology

Table 62 Traditional: Microbiological Testing of Water Market, by Region, 2017-2021 (USD Million)

Table 63 Traditional: Microbiological Testing of Water Market, by Region, 2022-2027 (USD Million)

11.3 Rapid

11.3.1 Automation Capabilities of Rapid Technology Promote Its Use in Microbiological Testing of Water

Table 64 Rapid: Microbiological Testing of Water Market, by Region, 2017-2021 (USD Million)

Table 65 Rapid: Microbiological Testing of Water Market, by Region, 2022-2027 (USD Million)

12 Microbiological Testing of Water Market, by Region

12.1 Introduction

Figure 37 China and Mexico to be Fastest-Growing Countries in Microbiological Testing of Drinking & Bottled Water by 2027

Table 66 Microbiological Testing of Water Market, by Region, 2017-2021 (USD Million)

Table 67 Microbiological Testing of Water Market, by Region, 2022-2027 (USD Million)

12.2 North America

Figure 38 Us to Witness Highest Growth Rate in North American Market from 2022 to 2027

Table 68 North America: Microbiological Testing of Water Market, by Country, 2017-2021 (USD Million)

Table 69 North America: Microbiological Testing of Water Market, by Country, 2022-2027 (USD Million)

Table 70 North America: Microbiological Testing of Water Market, by Water Type, 2017-2021 (USD Million)

Table 71 North America: Microbiological Testing of Water Market, by Water Type, 2022-2027 (USD Million)

Table 72 North America: Microbiological Testing of Water Market, by Type, 2017-2021 (USD Million)

Table 73 North America: Microbiological Testing of Water Market, by Type, 2022-2027 (USD Million)

Table 74 North America: Microbiological Testing of Water Market, by Industry, 2017-2021 (USD Million)

Table 75 North America: Microbiological Testing of Water Market, by Industry, 2022-2027 (USD Million)

12.2.1 US

12.2.1.1 New Technologies and Advanced Equipment to Increase Opportunities for Microbial Water Testing Solutions

Table 76 US: Microbiological Testing of Water Market, by Type, 2017-2021 (USD Million)

Table 77 US: Microbiological Testing of Water Market, by Type, 2022-2027 (USD Million)

Table 78 US: Microbiological Testing of Water Market, by Water Type, 2017-2021 (USD Million)

Table 79 US: Microbiological Testing of Water Market, by Water Type, 2022-2027 (USD Million)

Table 80 US: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2017-2021 (USD Million)

Table 81 US: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2022-2027 (USD Million)

Table 82 US: Microbiological Testing of Industrial Water Market, by Type, 2017-2021 (USD Million)

Table 83 US: Microbiological Testing of Industrial Water Market, by Type, 2022-2027 (USD Million)

12.2.2 Canada

12.2.2.1 Regulated Guidelines for Drinking Water to Monitor Microbiological Contaminants

Table 84 Microbiological Parameter Guidelines by Health Canada

Table 85 Canada: Microbiological Testing of Water Market, by Type, 2017-2021 (USD Million)

Table 86 Canada: Microbiological Testing of Water Market, by Type, 2022-2027 (USD Million)

Table 87 Canada: Microbiological Testing of Water Market, by Water Type, 2017-2021 (USD Million)

Table 88 Canada: Microbiological Testing of Water Market, by Water Type, 2022-2027 (USD Million)

Table 89 Canada: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2017-2021 (USD Million)

Table 90 Canada: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2022-2027 (USD Million)

Table 91 Canada: Microbiological Testing of Industrial Water Market, by Type, 2017-2021 (USD Million)

Table 92 Canada: Microbiological Testing of Industrial Water Market, by Type, 2022-2027 (USD Million)

12.2.3 Mexico

12.2.3.1 Microbiological Contamination in Groundwater to Drive Market

Table 93 Mexico: Microbiological Testing of Water Market, by Type, 2017-2021 (USD Million)

Table 94 Mexico: Microbiological Testing of Water Market, by Type, 2022-2027 (USD Million)

Table 95 Mexico: Microbiological Testing of Water Market, by Water Type, 2017-2021 (USD Million)

Table 96 Mexico: Microbiological Testing of Water Market, by Water Type, 2022-2027 (USD Million)

Table 97 Mexico: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2017-2021 (USD Million)

Table 98 Mexico: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2022-2027 (USD Million)

Table 99 Mexico: Microbiological Testing of Industrial Water Market, by Type, 2017-2021 (USD Million)

Table 100 Mexico: Microbiological Testing of Industrial Water Market, by Type, 2022-2027 (USD Million)

12.3 Europe

Table 101 Europe: Microbiological Testing of Water Market, by Country, 2017-2021 (USD Million)

Table 102 Europe: Microbiological Testing of Water Market, by Country, 2022-2027 (USD Million)

Table 103 Europe: Microbiological Testing of Water Market, by Water Type, 2017-2021 (USD Million)

Table 104 Europe: Microbiological Testing of Water Market, by Water Type, 2022-2027 (USD Million)

Table 105 Europe: Microbiological Testing of Drinking & Bottled Water Market, by Country, 2017-2021 (USD Million)

Table 106 Europe: Microbiological Testing of Drinking & Bottled Water Market, by Country, 2022-2027 (USD Million)

Table 107 Europe: Microbiological Testing of Industrial Water Market, by Country, 2017-2021 (USD Million)

Table 108 Europe: Microbiological Testing of Industrial Water Market, by Country, 2022-2027 (USD Million)

Table 109 Europe: Microbiological Testing of Water Market, by Type, 2017-2021 (USD Million)

Table 110 Europe: Microbiological Testing of Water Market, by Type, 2022-2027 (USD Million)

Table 111 Europe: Microbiological Testing of Water Market, by Industry, 2017-2021 (USD Million)

Table 112 Europe: Microbiological Testing of Water Market, by Industry, 2022-2027 (USD Million)

12.3.1 Germany

12.3.1.1 Stringent Policies by Health Safety Protection Agencies Fuel Market Growth for German Microbial Water Testing

Table 113 Germany: Microbiological Testing of Water Market, by Type, 2017-2021 (USD Million)

Table 114 Germany: Microbiological Testing of Water Market, by Type, 2022-2027 (USD Million)

Table 115 Germany: Microbiological Testing of Water Market, by Water Type, 2017-2021 (USD Million)

Table 116 Germany: Microbiological Testing of Water Market, by Water Type, 2022-2027 (USD Million)

Table 117 Germany: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2017-2021 (USD Million)

Table 118 Germany: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2022-2027 (USD Million)

Table 119 Germany: Microbiological Testing of Industrial Water Market, by Type, 2017-2021 (USD Million)

Table 120 Germany: Microbiological Testing of Industrial Water Market, by Type, 2022-2027 (USD Million)

12.3.2 UK

12.3.2.1 Drinking Water Standards & Guidelines Positively Affect Market

Table 121 UK: Microbiological Guidelines and Standards for Drinking Water

Table 122 Microbiological Guidelines and Standards for Bathing Water

Table 123 UK: Microbiological Testing of Water Market, by Type, 2017-2021 (USD Million)

Table 124 UK: Microbiological Testing of Water Market, by Type, 2022-2027 (USD Million)

Table 125 UK: Microbiological Testing of Water Market, by Water Type, 2017-2021 (USD Million)

Table 126 UK: Microbiological Testing of Water Market, by Water Type, 2022-2027 (USD Million)

Table 127 UK: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2017-2021 (USD Million)

Table 128 UK: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2022-2027 (USD Million)

Table 129 UK: Microbiological Testing of Industrial Water Market, by Type, 2017-2021 (USD Million)

Table 130 UK: Microbiological Testing of Industrial Water Market, by Type, 2022-2027 (USD Million)

12.3.3 France

12.3.3.1 Growing Industrial Activities to Drive Market

Table 131 France: Microbiological Testing of Water Market, by Type, 2017-2021 (USD Million)

Table 132 France: Microbiological Testing of Water Market, by Type, 2022-2027 (USD Million)

Table 133 France: Microbiological Testing of Water Market, by Water Type, 2017-2021 (USD Million)

Table 134 France: Microbiological Testing of Water Market, by Water Type, 2022-2027 (USD Million)

Table 135 France: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2017-2021 (USD Million)

Table 136 France: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2022-2027 (USD Million)

Table 137 France: Microbiological Testing of Industrial Water Market, by Type, 2017-2021 (USD Million)

Table 138 France: Microbiological Testing of Industrial Water Market, by Type, 2022-2027 (USD Million)

12.3.4 Italy

12.3.4.1 Increased Need for Clean and Wholesome Drinking Water

Table 139 Italy: Microbiological Testing of Water Market, by Type, 2017-2021 (USD Million)

Table 140 Italy: Microbiological Testing of Water Market, by Type, 2022-2027 (USD Million)

Table 141 Italy: Microbiological Testing of Water Market, by Water Type, 2017-2021 (USD Million)

Table 142 Italy: Microbiological Testing of Water Market, by Water Type, 2022-2027 (USD Million)

Table 143 Italy: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2017-2021 (USD Million)

Table 144 Italy: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2022-2027 (USD Million)

Table 145 Italy: Microbiological Testing of Industrial Water Market, by Type, 2017-2021 (USD Million)

Table 146 Italy: Microbiological Testing of Industrial Water Market, by Type, 2022-2027 (USD Million)

12.3.5 Spain

12.3.5.1 Economic Regulations to Manage Water Quality and Quantity Risks

Table 147 Spain: Microbiological Testing of Water Market, by Type, 2017-2021 (USD Million)

Table 148 Spain: Microbiological Testing of Water Market, by Type, 2022-2027 (USD Million)

Table 149 Spain: Microbiological Testing of Water Market, by Water Type, 2017-2021 (USD Million)

Table 150 Spain: Microbiological Testing of Water Market, by Water Type, 2022-2027 (USD Million)

Table 151 Spain: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2017-2021 (USD Million)

Table 152 Spain: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2022-2027 (USD Million)

Table 153 Spain: Microbiological Testing of Industrial Water Market, by Type, 2017-2021 (USD Million)

Table 154 Spain: Microbiological Testing of Industrial Water Market, by Type, 2022-2027 (USD Million)

12.3.6 Rest of Europe

Table 155 Rest of Europe: Microbiological Testing of Water Market, by Type, 2017-2021 (USD Million)

Table 156 Rest of Europe: Microbiological Testing of Water Market, by Type, 2022-2027 (USD Million)

Table 157 Rest of Europe: Microbiological Testing of Water Market, by Water Type, 2017-2021 (USD Million)

Table 158 Rest of Europe: Microbiological Testing of Water Market, by Water Type, 2022-2027 (USD Million)

Table 159 Rest of Europe: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2017-2021 (USD Million)

Table 160 Rest of Europe: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2022-2027 (USD Million)

Table 161 Rest of Europe: Microbiological Testing of Industrial Water Market, by Type, 2017-2021 (USD Million)

Table 162 Rest of Europe: Microbiological Testing of Industrial Water Market, by Type, 2022-2027 (USD Million)

12.4 Asia-Pacific

Figure 39 China to Witness Fastest Growth in Asia-Pacific from 2022 to 2027 (USD Million)

Table 163 Asia-Pacific: Microbiological Testing of Water Market, by Country, 2017-2021 (USD Million)

Table 164 Asia-Pacific: Microbiological Testing of Water Market, by Country, 2022-2027 (USD Million)

Table 165 Asia-Pacific: Microbiological Testing of Water Market, by Water Type, 2017-2021 (USD Million)

Table 166 Asia-Pacific: Microbiological Testing of Water Market, by Water Type, 2022-2027 (USD Million)

Table 167 Asia-Pacific: Microbiological Testing of Drinking & Bottled Water Market, by Country, 2017-2021 (USD Million)

Table 168 Asia-Pacific: Microbiological Testing of Drinking & Bottled Water Market, by Country, 2022-2027 (USD Million)

Table 169 Asia-Pacific: Microbiological Testing of Industrial Water Market, by Country, 2017-2021 (USD Million)

Table 170 Asia-Pacific: Microbiological Testing of Industrial Water Market, by Country, 2022-2027 (USD Million)

Table 171 Asia-Pacific: Microbiological Testing of Water Market, by Type, 2017-2021 (USD Million)

Table 172 Asia-Pacific: Microbiological Testing of Water Market, by Type, 2022-2027 (USD Million)

Table 173 Asia-Pacific: Microbiological Testing of Water Market, by Industry, 2017-2021 (USD Million)

Table 174 Asia-Pacific: Microbiological Testing of Water Market, by Industry, 2022-2027 (USD Million)

12.4.1 China

12.4.1.1 Strict Government Regulations and Increased Adoption of Water Monitoring Systems

Table 175 China: Microbiological Testing of Water Market, by Type, 2017-2021 (USD Million)

Table 176 China: Microbiological Testing of Water Market, by Type, 2022-2027 (USD Million)

Table 177 China: Microbiological Testing of Water Market, by Water Type, 2017-2021 (USD Million)

Table 178 China: Microbiological Testing of Water Market, by Water Type, 2022-2027 (USD Million)

Table 179 China: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2017-2021 (USD Million)

Table 180 China: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2022-2027 (USD Million)

Table 181 China: Microbiological Testing of Industrial Water Market, by Type, 2017-2021 (USD Million)

Table 182 China: Microbiological Testing of Industrial Water Market, by Type, 2022-2027 (USD Million)

12.4.2 Japan

12.4.2.1 High Risk of Water Contamination due to Heavy Rain and Flooding

Table 183 Japan: Microbiological Testing of Water Market, by Type, 2017-2021 (USD Million)

Table 184 Japan: Microbiological Testing of Water Market, by Type, 2022-2027 (USD Million)

Table 185 Japan: Microbiological Testing of Water Market, by Water Type, 2017-2021 (USD Million)

Table 186 Japan: Microbiological Testing of Water Market, by Water Type, 2022-2027 (USD Million)

Table 187 Japan: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2017-2021 (USD Million)

Table 188 Japan: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2022-2027 (USD Million)

Table 189 Japan: Microbiological Testing of Industrial Water Market, by Type, 2017-2021 (USD Million)

Table 190 Japan: Microbiological Testing of Industrial Water Market, by Type, 2022-2027 (USD Million)

12.4.3 Australia & New Zealand

12.4.3.1 Increased Innovation to Fuel Market Growth

Table 191 Australia & New Zealand: Microbiological Testing of Water Market, by Type, 2017-2021 (USD Million)

Table 192 Australia & New Zealand: Microbiological Testing of Water Market, by Type, 2022-2027 (USD Million)

Table 193 Australia & New Zealand: Microbiological Testing of Water Market, by Water Type, 2017-2021 (USD Million)

Table 194 Australia & New Zealand: Microbiological Testing of Water Market, by Water Type, 2022-2027 (USD Million)

Table 195 Australia & New Zealand: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2017-2021 (USD Million)

Table 196 Australia & New Zealand: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2022-2027 (USD Million)

Table 197 Australia & New Zealand: Microbiological Testing of Industrial Water Market, by Type, 2017-2021 (USD Million)

Table 198 Australia & New Zealand: Microbiological Testing of Industrial Water Market, by Type, 2022-2027 (USD Million)

12.4.4 India

12.4.4.1 Government Initiatives to Create Awareness About Water Quality Monitoring & Surveillance

Table 199 India: Microbiological Testing of Water Market, by Type, 2017-2021 (USD Million)

Table 200 India: Microbiological Testing of Water Market, by Type, 2022-2027 (USD Million)

Table 201 India: Microbiological Testing of Water Market, by Water Type, 2017-2021 (USD Million)

Table 202 India: Microbiological Testing of Water Market, by Water Type, 2022-2027 (USD Million)

Table 203 India: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2017-2021 (USD Million)

Table 204 India: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2022-2027 (USD Million)

Table 205 India: Microbiological Testing of Industrial Water Market, by Type, 2017-2021 (USD Million)

Table 206 India: Microbiological Testing of Industrial Water Market, by Type, 2022-2027 (USD Million)

12.4.5 Rest of Asia-Pacific

Table 207 Rest of Asia-Pacific: Microbiological Testing of Water Market, by Type, 2017-2021 (USD Million)

Table 208 Rest of Asia-Pacific: Microbiological Testing of Water Market, by Type, 2022-2027 (USD Million)

Table 209 Rest of Asia-Pacific: Microbiological Testing of Water Market, by Water Type, 2017-2021 (USD Million)

Table 210 Rest of Asia-Pacific: Microbiological Testing of Water Market, by Water Type, 2022-2027 (USD Million)

Table 211 Rest of Asia-Pacific: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2017-2021 (USD Million)

Table 212 Rest of Asia-Pacific: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2022-2027 (USD Million)

Table 213 Rest of Asia-Pacific: Microbiological Testing of Industrial Water Market, by Type, 2017-2021 (USD Million)

Table 214 Rest of Asia-Pacific: Microbiological Testing of Industrial Water Market, by Type, 2022-2027 (USD Million)

12.5 South America

Table 215 South America: Microbiological Testing of Water Market, by Country, 2017-2021 (USD Million)

Table 216 South America: Microbiological Testing of Water Market, by Country, 2022-2027 (USD Million)

Table 217 South America: Microbiological Testing of Water Market, by Water Type, 2017-2021 (USD Million)

Table 218 South America: Microbiological Testing of Water Market, by Water Type, 2022-2027 (USD Million)

Table 219 South America: Microbiological Testing of Drinking & Bottled Water Market, by Country, 2017-2021 (USD Million)

Table 220 South America: Microbiological Testing of Drinking & Bottled Water Market, by Country, 2022-2027 (USD Million)

Table 221 South America: Microbiological Testing of Industrial Water Market, by Country, 2017-2021 (USD Million)

Table 222 South America: Microbiological Testing of Industrial Water Market, by Country, 2022-2027 (USD Million)

Table 223 South America: Microbiological Testing of Water Market, by Type, 2017-2021 (USD Million)

Table 224 South America: Microbiological Testing of Water Market, by Type, 2022-2027 (USD Million)

Table 225 South America: Microbiological Testing of Water Market, by Industry, 2017-2021 (USD Million)

Table 226 South America: Microbiological Testing of Water Market, by Industry, 2022-2027 (USD Million)

12.5.1 Argentina

12.5.1.1 Increasing Investments by Government to Improve Water and Sanitation Services in Metropolitan Areas

Table 227 Argentina: Microbiological Testing of Water Market, by Type, 2017-2021 (USD Million)

Table 228 Argentina: Microbiological Testing of Water Market, by Type, 2022-2027 (USD Million)

Table 229 Argentina: Microbiological Testing of Water Market, by Water Type, 2017-2021 (USD Million)

Table 230 Argentina: Microbiological Testing of Water Market, by Water Type, 2022-2027 (USD Million)

Table 231 Argentina: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2017-2021 (USD Million)

Table 232 Argentina: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2022-2027 (USD Million)

Table 233 Argentina: Microbiological Testing of Industrial Water Market, by Type, 2017-2021 (USD Million)

Table 234 Argentina: Microbiological Testing of Industrial Water Market, by Type, 2022-2027 (USD Million)

12.5.2 Brazil

12.5.2.1 Prevalence of Microbial Contaminants in Groundwater

Table 235 Brazil: Microbiological Testing of Water Market, by Type, 2017-2021 (USD Million)

Table 236 Brazil: Microbiological Testing of Water Market, by Type, 2022-2027 (USD Million)

Table 237 Brazil: Microbiological Testing of Water Market, by Water Type, 2017-2021 (USD Million)

Table 238 Brazil: Microbiological Testing of Water Market, by Water Type, 2022-2027 (USD Million)

Table 239 Brazil: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2017-2021 (USD Million)

Table 240 Brazil: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2022-2027 (USD Million)

Table 241 Brazil: Microbiological Testing of Industrial Water Market, by Type, 2017-2021 (USD Million)

Table 242 Brazil: Microbiological Testing of Industrial Water Market, by Type, 2022-2027 (USD Million)

12.5.3 Rest of South America

Table 243 Rest of South America: Microbiological Testing of Water Market, by Type, 2017-2021 (USD Million)

Table 244 Rest of South America: Microbiological Testing of Water Market, by Type, 2022-2027 (USD Million)

Table 245 Rest of South America: Microbiological Testing of Water Market, by Water Type, 2017-2021 (USD Million)

Table 246 Rest of South America: Microbiological Testing of Water Market, by Water Type, 2022-2027 (USD Million)

Table 247 Rest of South America: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2017-2021 (USD Million)

Table 248 Rest of South America: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2022-2027 (USD Million)

Table 249 Rest of South America: Microbiological Testing of Industrial Water Market, by Type, 2017-2021 (USD Million)

Table 250 Rest of South America: Microbiological Testing of Industrial Water Market, by Type, 2022-2027 (USD Million)

12.6 Rest of the World

Table 251 RoW: Microbiological Testing of Water Market, by Country, 2017-2021 (USD Million)

Table 252 RoW: Microbiological Testing of Water Market, by Country, 2022-2027 (USD Million)

Table 253 RoW: Microbiological Testing of Water Market, by Water Type, 2017-2021 (USD Million)

Table 254 RoW: Microbiological Testing of Water Market, by Water Type, 2022-2027 (USD Million)

Table 255 RoW: Microbiological Testing of Drinking & Bottled Water Market, by Country, 2017-2021 (USD Million)

Table 256 RoW: Microbiological Testing of Drinking & Bottled Water Market, by Country, 2022-2027 (USD Million)

Table 257 RoW: Microbiological Testing of Industrial Water Market, by Country, 2017-2021 (USD Million)

Table 258 RoW: Microbiological Testing of Industrial Water Market, by Country, 2022-2027 (USD Million)

Table 259 RoW: Microbiological Testing of Water Market, by Type, 2017-2021 (USD Million)

Table 260 RoW: Microbiological Testing of Water Market, by Type, 2022-2027 (USD Million)

Table 261 RoW: Microbiological Testing of Water Market, by Industry, 2017-2021 (USD Million)

Table 262 RoW: Microbiological Testing of Water Market, by Industry, 2022-2027 (USD Million)

12.6.1 Africa

12.6.1.1 Increased Mortality in Infants due to Water-Borne Diseases

Table 263 Africa: Microbiological Testing of Water Market, by Type, 2017-2021 (USD Million)

Table 264 Africa: Microbiological Testing of Water Market, by Type, 2022-2027 (USD Million)

Table 265 Africa: Microbiological Testing of Water Market, by Water Type, 2017-2021 (USD Million)

Table 266 Africa: Microbiological Testing of Water Market, by Water Type, 2022-2027 (USD Million)

Table 267 Africa: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2017-2021 (USD Million)

Table 268 Africa: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2022-2027 (USD Million)

Table 269 Africa: Microbiological Testing of Industrial Water Market, by Type, 2017-2021 (USD Million)

Table 270 Africa: Microbiological Testing of Industrial Water Market, by Type, 2022-2027 (USD Million)

12.6.2 Middle East

12.6.2.1 Reuse of Wastewater due to Water Scarcity

Table 271 Middle East: Microbiological Testing of Water Market, by Type, 2017-2021 (USD Million)

Table 272 Middle East: Microbiological Testing of Water Market, by Type, 2022-2027 (USD Million)

Table 273 Middle East: Microbiological Testing of Water Market, by Water Type, 2017-2021 (USD Million)

Table 274 Middle East: Microbiological Testing of Water Market, by Water Type, 2022-2027 (USD Million)

Table 275 Middle East: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2017-2021 (USD Million)

Table 276 Middle East: Microbiological Testing of Drinking & Bottled Water Market, by Type, 2022-2027 (USD Million)

Table 277 Middle East: Microbiological Testing of Industrial Water Market, by Type, 2017-2021 (USD Million)

Table 278 Middle East: Microbiological Testing of Industrial Water Market, by Type, 2022-2027 (USD Million)

13 Competitive Landscape

13.1 Overview

13.2 Segmental Revenue Analysis of Key Players

Figure 40 Segmental Revenue Analysis of Key Players in Market, 2017-2021 (USD Million)

13.3 Key Player Strategies

13.4 Market Share Analysis, 2021

Table 279 Microbiological Testing of Water Market: Degree of Competition (Competitive)

13.5 Company Evaluation Quadrant (Key Players)

13.5.1 Stars

13.5.2 Emerging Leaders

13.5.3 Pervasive Players

13.5.4 Participants

Figure 41 Microbiological Testing of Water Market: Company Evaluation Quadrant, 2021 (Key Players)

13.5.5 Product Footprint

Table 280 Company Footprint, by Type

Table 281 Company Footprint, by Application

Table 282 Company Footprint, by Region

Table 283 Overall Company Footprint

13.6 Startups/SMEs Evaluation Quadrant (Other Players)

13.6.1 Progressive Companies

13.6.2 Starting Blocks

13.6.3 Responsive Companies

13.6.4 Dynamic Companies

Figure 42 Microbiological Testing of Water Market: Company Evaluation Quadrant, 2021 (Other Players)

13.6.5 Competitive Benchmarking of Key Startups/SMEs

Table 284 Microbiological Testing of Water Market: Detailed List of Key Startups/SMEs

Table 285 Microbiological Testing of Water Market: Competitive Benchmarking of Key Startups/SMEs

13.7 Competitive Scenario

13.7.1 Product Launches

13.7.2 Deals

13.7.3 Others

14 Company Profiles

14.1 Introduction

14.2 Key Players

(Business Overview, Products/Services/Solutions Offered, Analyst's View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses, and Competitive Threats, Recent Developments)*

14.2.1 3M

Table 286 3M: Business Overview

Figure 43 3M: Company Snapshot

Table 287 3M: Products Offered

14.2.2 Thermo Fisher Scientific Inc.

Table 288 Thermo Fisher Scientific Inc.: Business Overview

Figure 44 Thermo Fisher Scientific Inc.: Company Snapshot

Table 289 Thermo Fisher Scientific Inc.: Products Offered

14.2.3 Danaher Corporation

Table 290 Danaher Corporation: Business Overview

Figure 45 Danaher Corporation: Company Snapshot

Table 291 Danaher Corporation: Products Offered

14.2.4 Merck KGaA

Table 292 Merck KGaA: Business Overview

Figure 46 Merck KGaA: Company Snapshot

Table 293 Merck KGaA: Products Offered

14.2.5 Agilent Technologies, Inc.

Table 294 Agilent Technologies, Inc.: Business Overview

Figure 47 Agilent Technologies, Inc.: Company Snapshot

Table 295 Agilent Technologies, Inc.: Products Offered

14.2.6 Shimadzu Corporation

Table 296 Shimadzu Corporation: Business Overview

Figure 48 Shimadzu Corporation: Company Snapshot

Table 297 Shimadzu Corporation: Products Offered

14.2.7 Döhler Group

Table 298 Döhler Group: Business Overview

Table 299 Döhler Group: Products Offered

14.2.8 Perkinelmer, Inc.

Table 300 Perkinelmer, Inc.: Business Overview

Figure 49 Perkinelmer, Inc.: Company Snapshot

Table 301 Perkinelmer, Inc.: Products Offered

Table 302 Perkinelmer, Inc.: Deals

14.2.9 Bio-Rad Laboratories, Inc.

Table 303 Bio-Rad Laboratories, Inc.: Business Overview

Figure 50 Bio-Rad Laboratories, Inc.: Company Snapshot

Table 304 Bio-Rad Laboratories, Inc.: Products Offered

Table 305 Bio-Rad Laboratories, Inc.: Deals

14.2.10 Idexx Laboratories, Inc.

Table 306 Idexx Laboratories, Inc.: Business Overview

Figure 51 Idexx Laboratories, Inc.: Company Snapshot

Table 307 Idexx Laboratories, Inc.: Products Offered

14.2.11 Avantor, Inc.

Table 308 Avantor, Inc.: Business Overview

Figure 52 Avantor, Inc.: Company Snapshot

Table 309 Avantor, Inc.: Products Offered

14.2.12 Hardy Diagnostics

Table 310 Hardy Diagnostics: Business Overview

Table 311 Hardy Diagnostics: Products Offered

14.2.13 Lamotte Company

Table 312 Lamotte Company: Business Overview

Table 313 Lamotte Company: Products Offered

14.2.14 Accepta Ltd

Table 314 Accepta Ltd: Business Overview

Table 315 Accepta Ltd: Products Offered

14.2.15 General Laboratory Products

Table 316 General Laboratory Products: Business Overview

Table 317 General Laboratory Products: Products Offered

14.3 Other Players (Smes/Start-Ups)

14.3.1 Ibi Scientific

Table 318 Ibi Scientific: Business Overview

Table 319 Ibi Scientific: Products Offered

14.3.2 Micrology Laboratories

Table 320 Micrology Laboratories: Business Overview

Table 321 Micrology Laboratories: Products Offered

14.3.3 Pall Corporation

Table 322 Pall Corporation: Business Overview

Table 323 Pall Corporation: Products Offered

14.3.4 Edvotek Inc.

Table 324 Edvotek Inc.: Business Overview

Table 325 Edvotek Inc.: Products Offered

14.3.5 Mp Biomedicals

Table 326 Mp Biomedicals: Business Overview

Table 327 Mp Biomedicals: Products Offered

*Business Overview, Products/Services/Solutions Offered, Analyst's View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments Might Not be Captured in Case of Unlisted Companies.

14.3.6 Northeast Laboratory Services

14.3.7 Ipm Scientific, Inc.

14.3.8 Oxyrase Inc.

14.3.9 Himedia Laboratories

14.3.10 Salus Scientific Inc.

15 Appendix

15.1 Discussion Guide

15.2 Knowledge store: Subscription Portal

15.3 Customization Options

Companies Mentioned

- 3M

- Accepta Ltd

- Agilent Technologies, Inc.

- Avantor, Inc.

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Döhler Group

- Edvotek Inc.

- General Laboratory Products

- Hardy Diagnostics

- Himedia Laboratories

- IBI Scientific

- Idexx Laboratories, Inc.

- IPM Scientific, Inc.

- Lamotte Company

- Merck KGaA

- Micrology Laboratories

- MP Biomedicals

- Northeast Laboratory Services

- Oxyrase Inc.

- Pall Corporation

- Perkinelmer, Inc.

- Salus Scientific Inc.

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 290 |

| Published | February 2023 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 1.6 Billion |

| Forecasted Market Value ( USD | $ 2.3 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |