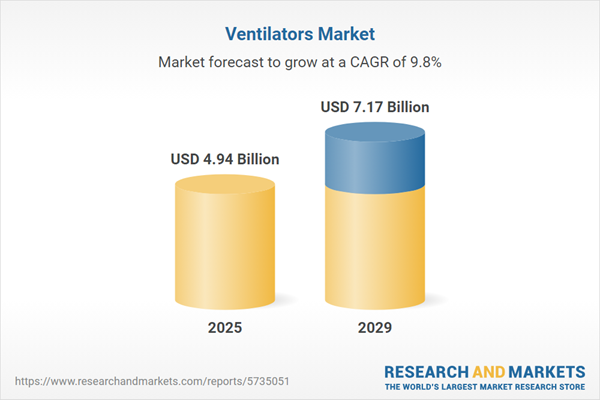

The ventilators market size has grown strongly in recent years. It will grow from $4.5 billion in 2024 to $4.94 billion in 2025 at a compound annual growth rate (CAGR) of 9.6%. The growth in the historic period can be attributed to respiratory conditions prevalence, surgical procedures, intensive care units (icus), technological advancements, aging population.

The ventilators market size is expected to see strong growth in the next few years. It will grow to $7.17 billion in 2029 at a compound annual growth rate (CAGR) of 9.8%. The growth in the forecast period can be attributed to telemedicine and remote monitoring, personalized medicine, technological innovations, hospital infrastructure investment. Major trends in the forecast period include portable and transport ventilators, advanced ventilation modes, digital health and telehealth integration, innovation in ventilation technologies.

The ventilators market is experiencing growth due to the increasing prevalence of respiratory diseases. Chronic respiratory conditions like asthma, bronchitis, pneumonia, and others, arising from various causes including bacterial and viral infections, are contributing to the growing demand for ventilators. Ventilators are respiratory devices designed to provide vital respiratory support to patients with chronic respiratory illnesses. For instance, in 2023, data from the Australian Institute of Health and Welfare reveals that nearly 30% of Australians reported long-term respiratory conditions. Among the statistics, 5.1 million Australians (20% of the total population) suffered from allergic rhinitis, commonly known as 'hay fever,' 2.7 million (11%) had asthma, and 2 million (8%) were diagnosed with chronic sinusitis, out of an expected 7.5 million people with these ailments (ABS 2022). Furthermore, the COVID-19 pandemic has resulted in a surge of respiratory infections, including pneumonia, affecting individuals' breathing. The emergence of such infectious diseases with pandemic potential is a significant driver of growth in the ventilator market.

The growing number of surgical procedures is expected to drive the growth of the ventilators market. Surgical procedures, also referred to as surgeries or surgical interventions, involve invasive techniques performed by healthcare professionals to diagnose, treat, or alleviate a medical condition, injury, or disease. Ventilators, also known as mechanical ventilators or breathing machines, are essential in many surgical procedures, especially during general anesthesia and specific types of surgeries. For example, in February 2024, the American Academy of Facial Plastic and Reconstructive Surgery, a U.S.-based non-profit organization, reported that around 83% of all medical procedures performed in 2023 were minimally invasive, with the remaining 17% being standard surgical procedures. Additionally, the American Society of Plastic Surgeons, a U.S.-based specialty organization, stated that the total number of cosmetic minimally invasive procedures grew from 23.7 million in 2022 to 25.4 million in 2023. As a result, the increasing number of surgical procedures is driving the ventilators market.

In response to the surge in demand caused by the COVID-19 pandemic, companies in the ventilator market have been rapidly expanding their production capabilities. COVID-19, a respiratory illness caused by the COVID-19, primarily affects the lungs and can lead to severe pneumonia and respiratory complications. Many patients afflicted with the virus require ventilator support for breathing. For example, Medtronic, a prominent medical device manufacturer, boosted its ventilator production by 40%. Likewise, Philips aimed to increase its ventilator production capacity fourfold to address the growing need.

Prominent companies in the vehicle engine and engine parts industry are striving to gain a competitive advantage by developing innovative products like the F&P Visairo. The F&P Visairo is a respiratory humidification system specifically designed to offer optimal humidification for patients undergoing mechanical ventilation within a hospital environment. For instance, in November 2021, Fisher & Paykel Healthcare, a healthcare company based in New Zealand, introduced the F&P Visairo, a non-invasive ventilation hospital under-nose mask. This innovative medical mask, the F&P Visairo, incorporates dynamic support technology to deliver optimal performance. It enables bridge-free non-invasive ventilation, ensuring stability and performance while eliminating pressure on the nose bridge, providing an unobstructed field of view. Fisher & Paykel Healthcare is a leading manufacturer of systems and products catering to acute and long-term respiratory care, surgical applications, and the management of obstructive sleep apnea.

In February 2022, Zehnder Group, a Swiss-based ventilation company, successfully acquired Airia Brand Inc. for an undisclosed sum. This strategic acquisition is set to broaden Zehnder Group's product offerings and enhance its presence in the North American market. Airia Brand Inc. specializes in the production of various residential and commercial ventilation products, which include heat recovery ventilators and energy recovery ventilators.

Ventilators are mechanical devices designed to function as bellows, facilitating the inhalation and exhalation of air into and out of the lungs. These devices are programmed by respiratory therapists and doctors to control the volume and frequency of air delivered to the patient's lungs.

The primary types of ventilator devices include those used in intensive care units or critical care settings, transportable or portable units for ambulatory care, and specialized neonatal ventilators intended for newborns and young infants during the first month after birth. Ventilator interfaces can be categorized as either invasive or non-invasive, depending on how they are connected to the patient. These ventilators find use across various end-users, including hospitals, clinics, home care, ambulatory care centers, and other healthcare settings.

The ventilator devices market research report is one of a series of new reports that provides ventilator devices market statistics, including ventilator devices industry global market size, regional shares, competitors with a ventilator devices market share, detailed ventilator devices market segments, market trends and opportunities, and any further data you may need to thrive in the ventilator devices industry. This ventilator devices market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Major companies operating in the ventilators market include Philips Healthcare, ResMed Inc., Medtronic PLC, Becton Dickinson and Company, GE Healthcare, Hamilton Medical AG, Drägerwerk AG & Co. KGaA, Getinge AB, Smiths Group PLC, Fisher & Paykel Healthcare Corporation Limited, Air Liquide S.A., Allied Healthcare Products Inc., Teleflex Incorporated, Mindray Medical International Limited, Vyaire Medical Inc., SCHILLER Healthcare India Private Limited, ZOLL Medical Corporation, Asahi Kasei Corporation, Biovo Technologies Ltd., Breas Medical AB, Enexor BioEnergy LLC, Sechrist Industries Inc., Spiritus Medical LLC, Ventis Medical Inc., Airon Corporation, Beijing Aeonmed Co. Ltd., Demax Medical Technology Co. Ltd., FW Equipment Co. Ltd., Hamilton Medical Inc., Heyer Medical AG.

Asia-Pacific was the largest region in the ventilator devices market in 2024. Western Europe was the second-largest region in the ventilator device market. The regions covered in the ventilators market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the ventilators market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The ventilator device market consists of sales of face mask ventilators, mechanical ventilators, manual resuscitator bags and tracheostomy ventilators. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Ventilators Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on ventilators market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for ventilators ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The ventilators market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Intensive Care Unit or Critical Care; Transport or Portable or Ambulatory; Neonatal2) By Interface: Invasive; Non-Invasive

3) By End-User: Hospitals and Clinics; Home care; Ambulatory Care Centers; Other End Users

Subsegments:

1) By Intensive Care Unit (ICU) Or Critical Care Ventilators: Invasive Ventilators; Non-invasive Ventilators2) By Transport or Portable or Ambulatory Ventilators: Battery-operated Portable Ventilators; Lightweight Transport Ventilators

2) By Neonatal: High-frequency Oscillatory Ventilators; Conventional Neonatal Ventilators

Key Companies Mentioned: Philips Healthcare; ResMed Inc.; Medtronic plc; Becton Dickinson and Company; GE Healthcare

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Ventilators market report include:- Philips Healthcare

- ResMed Inc.

- Medtronic plc

- Becton Dickinson and Company

- GE Healthcare

- Hamilton Medical AG

- Drägerwerk AG & Co. KGaA

- Getinge AB

- Smiths Group plc

- Fisher & Paykel Healthcare Corporation Limited

- Air Liquide S.A.

- Allied Healthcare Products Inc.

- Teleflex Incorporated

- Mindray Medical International Limited

- Vyaire Medical Inc.

- SCHILLER Healthcare India Private Limited

- ZOLL Medical Corporation

- Asahi Kasei Corporation

- Biovo Technologies Ltd.

- Breas Medical AB

- Enexor BioEnergy LLC

- Sechrist Industries Inc.

- Spiritus Medical LLC

- Ventis Medical Inc.

- Airon Corporation

- Beijing Aeonmed Co. Ltd.

- Demax Medical Technology Co. Ltd.

- FW Equipment Co. Ltd.

- Hamilton Medical Inc.

- Heyer Medical AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 4.94 Billion |

| Forecasted Market Value ( USD | $ 7.17 Billion |

| Compound Annual Growth Rate | 9.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |