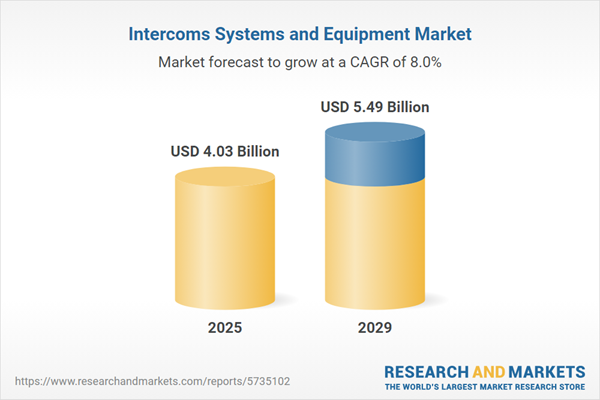

The intercoms systems and equipment market size is expected to see strong growth in the next few years. It will grow to $5.49 billion in 2029 at a compound annual growth rate (CAGR) of 8%. The growth in the forecast period can be attributed to smart building trends, health and safety compliance, remote working and virtual communication, education sector growth, hospitality industry requirements. Major trends in the forecast period include voice recognition technology, increased focus on cybersecurity, remote work solutions, AI and automation integration, customization and personalization.

The growing residential sector is expected to drive the expansion of the intercom systems and equipment market in the coming years. The residential sector encompasses various types of properties, including single-family homes, multi-family dwellings, mobile homes, and both rented and owned residences, excluding institutional housing such as barracks or schools. This growth is fueled by factors such as rapid urbanization, population increase, and heightened demand for housing in metropolitan areas. Intercom systems and equipment are essential in the residential sector for enhancing security, facilitating communication between residents and visitors, providing controlled access, and integrating with smart home features for added convenience and safety. For example, in December 2022, Stats NZ Tauranga Aotearoa, a New Zealand government data agency, reported a 3.8% increase in overall building activity, with residential building activity rising by 3.1% in 2022. Additionally, in April 2023, Statistics Canada, a national agency responsible for producing statistics, indicated that investment in Canada’s building construction grew by 1%, reaching $20.6 billion in February 2023, with the residential sector alone increasing by 1.1% to $15 billion. Thus, the growth of the residential sector is significantly contributing to the expansion of the intercom systems and equipment market.

The upward trend in smart homes is expected to drive the growth of intercom systems and equipment. Smart homes are residential properties equipped with an array of devices and systems that can be remotely monitored, controlled, and automated. Intercom systems and equipment within smart homes are accessible through smartphones, tablets, or other devices, enabling residents to communicate with each other, screen visitors at the front door, and manage access control. In August 2023, RubyHome, a US-based real estate company, reported that 63.43 million homes in the US utilize smart home devices, with approximately 7 in 10 homebuyers expressing willingness to invest in a smart home. Consequently, the increasing popularity of smart homes is a key driver behind the growth of the intercom systems and equipment market.

Major companies in the intercom systems and equipment market are focusing on technological advancements, including lightweight full-duplex communication systems. These systems enable simultaneous two-way communication without requiring push-to-talk functionality, allowing users to speak and listen at the same time, similar to a regular phone call. This feature enhances communication efficiency and usability. For example, in September 2024, Hollyland Technology, a China-based company, introduced the Solidcom SE Wireless Intercom System. This system is a lightweight full-duplex communication solution designed to improve communication for small production teams and various collaborative settings. The Solidcom SE offers several advanced features tailored to professionals in industries such as video production and outdoor events. It can connect up to five headsets, making it adaptable for different team sizes and communication requirements, which is particularly advantageous for small to medium-sized productions.

Key players in the intercom systems and equipment market are committed to product innovation, exemplified by offerings such as IMPW, aimed at delivering reliable services across various scenarios. IMPW stands out as a wireless intercom system and equipment specifically engineered for critical missions, catering to both civilian and combat contexts. In September 2023, Savox Communications Ltd., a prominent communication solutions provider based in the US, introduced IMPW to the market. The IMPW intercom system comprises the Savox IMP system, the Savox WIM (Wireless Interface Module), and a designated number of Savox WPCU's (Wireless Personal Communication Units). This system boasts wireless capabilities, low-power operation, robust encryption, and natural audio features within vehicles or vessels. It ensures seamless collaboration between teams and supporting vehicles in diverse and challenging situations.

In October 2022, ASSA ABLOY AB, a Sweden-based manufacturing company specializing in locks, doors, gates, and entrance automation, acquired DoorBird for an undisclosed amount. This acquisition is intended to enhance ASSA ABLOY's portfolio in smart home and building security by integrating innovative intercom technology, thereby strengthening its position in the connected access solutions market. DoorBird is a Germany-based company that specializes in intercom systems and equipment.

Major companies operating in the intercoms systems and equipment market include Samsung Electronics Co. Ltd., Panasonic Corporation, Commax Co. Ltd., Honeywell International Inc., ABB Ltd., Hangzhou Hikvision Digital Technology Co. Ltd., Legrand Legrand SA, Dahua Technology Co. Ltd., TKH Group NV, Godrej Industries Limited, Elvox SpA, Axis Communications AB, Alpha Communications Inc., Fermax Electronica S.A.U., Gira Giersiepen GmbH & Co. KG, Aiphone Co. Ltd., 2N TELEKOMUNIKACE a.s., Zenitel NV, TekTone Sound & Signal Systems Inc., Comelit Group S.p.A., Commend International GmbH, Cornell Communications Inc., ButterflyMX Inc., Zicom Electronics Security Systems Limited, Ring Communications Inc., Nidac Security Pty Ltd., Siedle & Söhne OHG.

The Asia-Pacific was the largest region in the intercoms systems and equipment market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global intercoms systems and equipment market analysis report during the forecast period. The regions covered in the intercoms systems and equipment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the intercoms systems and equipment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

An intercom system serves as a closed-circuit voice communication device facilitating two-way interactions between individuals.

Intercom systems primarily come in two product types such as audio and video. Audio pertains to sound-related functions involving transmission, reception, reproduction, or specific frequency modulation. These systems leverage either IP-based or analog technology. They find extensive utility across government, residential, and commercial sectors, catering to diverse applications.

The intercoms systems and equipment market research report is one of a series of new reports that provides intercoms systems and equipment market statistics, including intercoms systems and equipment market global market size, regional shares, competitors with a intercoms systems and equipment market share, detailed intercoms systems and equipment market segments, market trends and opportunities, and any further data you may need to thrive in the intercoms systems and equipment industry. This intercoms systems and equipment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The intercoms systems and equipment market consist of sales of intercom system devices for usage in an electronic communications system that contains circuitry to transmit and receive audio and/or video transmissions. The intercom system services can be through wireless, wired, video, apartment based, and two ways radios for communication. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Intercoms Systems and Equipment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on intercoms systems and equipment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for intercoms systems and equipment? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The intercoms systems and equipment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Audio; Video2) By Technology: IP Based, Analog Based

3) By End-User: Government; Residential; Commercial

Subsegments:

1) By Audio: Wired Audio Intercoms; Wireless Audio Intercoms; Intercom Stations and Panels2) By Video: Wired Video Intercoms; Wireless Video Intercoms; Video Door Phones; Multi-Tenant Video Intercom Systems

Key Companies Mentioned: Samsung Electronics Co. Ltd.; Panasonic Corporation; Commax Co. Ltd.; Honeywell International Inc.; ABB Ltd.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Samsung Electronics Co. Ltd.

- Panasonic Corporation

- Commax Co. Ltd.

- Honeywell International Inc.

- ABB Ltd.

- Hangzhou Hikvision Digital Technology Co. Ltd.

- Legrand Legrand SA

- Dahua Technology Co. Ltd.

- TKH Group NV

- Godrej Industries Limited

- Elvox SpA

- Axis Communications AB

- Alpha Communications Inc.

- Fermax Electronica S.A.U.

- Gira Giersiepen GmbH & Co. KG

- Aiphone Co. Ltd.

- 2N TELEKOMUNIKACE a.s.

- Zenitel NV

- TekTone Sound & Signal Systems Inc.

- Comelit Group S.p.A.

- Commend International GmbH

- Cornell Communications Inc.

- ButterflyMX Inc.

- Zicom Electronics Security Systems Limited

- Ring Communications Inc.

- Nidac Security Pty Ltd.

- Siedle & Söhne OHG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 4.03 Billion |

| Forecasted Market Value ( USD | $ 5.49 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |