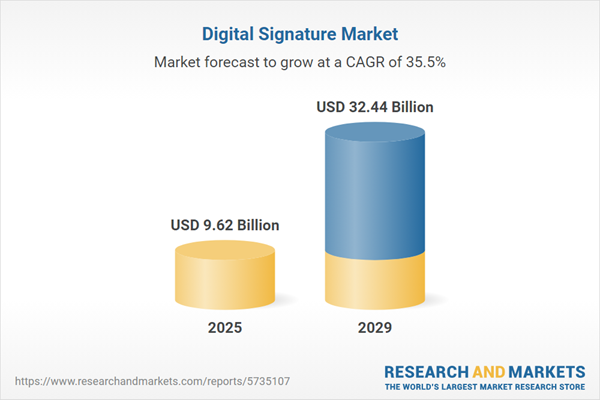

The digital signature market size has grown exponentially in recent years. It will grow from $7.1 billion in 2024 to $9.62 billion in 2025 at a compound annual growth rate (CAGR) of 35.4%. The growth in the historic period can be attributed to legal recognition, security concerns, business efficiency, environmental sustainability, remote work and collaboration.

The digital signature market size is expected to see exponential growth in the next few years. It will grow to $32.44 billion in 2029 at a compound annual growth rate (CAGR) of 35.5%. The growth in the forecast period can be attributed to e-government initiatives, increased cybersecurity measures, healthcare digitization, blockchain integration, iot and smart contracts. Major trends in the forecast period include biometric authentication, mobile signature apps, advanced encryption, integration with collaboration tools, regulatory compliance.

The digital signature market has experienced growth, driven by supportive policies from various governments. One example is the 21st Century Integrated Digital Experience Act (21st Century IDEA Act) in the United States. This act established minimum functionalities and security standards for federal agencies, requiring them to provide digital versions of paper-based citizen services and accept digital signatures. These policies from governments worldwide have boosted the demand for digital signatures.

The increasing adoption of smart contracts is expected to drive the growth of the digital signature market. Smart contracts are self-executing agreements with the terms directly written into code, which automatically execute and enforce the contract’s terms when predefined conditions are met. Digital signatures are essential in smart contracts, providing authentication, security, and cryptographic proof of consent, ensuring the integrity of contract transactions. For example, in June 2022, Alchemy Insights Inc., a U.S.-based software solutions company, reported that around 1.45 million Ethereum smart contracts were generated in the first quarter of 2022, representing a notable 24.7% increase compared to the 1.16 million smart contracts created in the fourth quarter of 2021. As a result, the rising use of smart contracts is anticipated to drive the growth of the digital signature market.

Major companies operating in the digital signature market are prioritizing technological advancements, such as digital signature and stamping products, to enhance security, streamline workflows, and improve user experience. These digital signature and stamping products are electronic solutions that enable secure document signing and the application of authenticated digital marks (or stamps). For example, in July 2024, Protean eGov Technologies, an India-based financial technology company, launched eSignPro, an innovative digital signature and stamping solution designed to streamline business documentation processes. This enterprise-grade solution integrates electronic signing and stamping, offering features such as workflow automation, customizable templates, and maker/checker functionality to boost efficiency. By enabling paperless transactions, eSignPro aims to reduce the costs associated with managing physical documents.

Leading companies in the digital signature market are introducing advanced signing solutions and services, such as Qualified Signing Services (QSS), to gain a competitive edge by offering advanced, compliant signing solutions for a global customer base. QSS is a cloud-based platform that provides qualified electronic signatures and seals compliant with eIDAS regulations for multiple industries. For instance, in February 2023, GMO GlobalSign, a U.S.-based company offering identity and security solutions, launched the Qualified Signing Service (QSS), a cloud-based solution for generating qualified electronic signatures and seals in compliance with the EU's eIDAS regulation. These qualified signatures and seals, supported by qualified digital certificates, are used across industries such as fintech, legal, government, education, insurance, healthcare, and auditing.

In November 2022, PDFTron Systems Inc., a Canadian software company specializing in document processing technology, acquired Eversign GmbH. This strategic acquisition allows PDFTron to enter the no-code sector, using Eversign's expertise to enhance its technology platform and bolster its position in the end-user market. Eversign GmbH, based in Austria, provides cloud-based digital signatures for documents.

A digital signature, an electronic form of signature, holds the same legal weight as a handwritten signature or a stamped seal. It provides an added layer of security and is designed to address issues related to tampering and impersonation.

Digital signature offerings primarily consist of software, hardware, and related services. Digital signature software serves as a tool for businesses, enabling them to securely sign, transmit, and manage documents, streamlining the process of digital document signing. Various deployment modes, including cloud and on-premises options, find application across various sectors, such as banking, financial services, and insurance (BFSI), IT and telecommunications, government, healthcare, life sciences, education, retail, real estate, and other industries.

The digital signature market research report is one of a series of new reports that provides digital signature market statistics, including digital signature industry global market size, regional shares, competitors with a digital signature market share, detailed digital signature market segments, market trends and opportunities, and any further data you may need to thrive in the digital signature industry. This digital signature market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Major companies operating in the digital signature market include Adobe Systems Incorporated, DocuSign Inc., Ascertia Limited, IdenTrust Inc., SIGNiX Inc., Gemalto NV, Entrust Datacard Corporation, Kofax Inc., RPost Communications Limited, Secured Signing Limited, OneSpan Inc., HelloSign Inc., GMO GlobalSign Ltd., MultiCert S.A., RightSignature LLC, Zoho Corporation Pvt. Ltd., VASCO Data Security International Inc., Arthur D. Little Inc., Shachihata Inc., Glykka LLC, eSign Genie Inc., SignaShare Corporation, KeepSolid Inc., GetAccept Inc., Symtrax Holdings Inc., Microsoft Corporation, International Business Solutions LLC, Korea SYSTEM's TECH Inc., Kotrade Inc., Oracle Corporation, SignRequest B.V., SignEasy Inc., SignNow Inc., DocVerify Inc., PandaDoc Inc., Sertifi Inc., SkySignature.

Asia-Pacific was the largest region in the digital signature market in 2024. Asia-Pacific is expected to be the fastest-growing region in the digital signature market report during the forecast period. The regions covered in the digital signature market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the digital signature market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

The digital signature market includes revenues earned by entities by providing digital signature solutions. The digital signature solutions include software and hardware solutions, and related services. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Digital Signature Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on digital signature market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for digital signature ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The digital signature market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Offering: Software; Hardware; Services2) By Deployment: Cloud; on-premises

3) By End User: Banking, Financial services, and Insurance(BFSI); IT and Telecommunications; Government; Health Care and Life Sciences; Education; Retail; Real Estate; Other End-Users

Subsegments:

1) By Software: Digital Signature Software (Standalone); Digital Signature Software (Integrated With Other Applications); Cloud-Based Digital Signature Solutions; Electronic Signature Platforms2) By Hardware: USB Tokens; Smart Cards; Biometric Devices; Hardware Security Modules (HSM)

3) By Services: Digital Signature Verification Services; Authentication Services; Consulting and Integration Services; Training and Support Services

Key Companies Mentioned: Adobe Systems Incorporated; DocuSign Inc.; Ascertia Limited; IdenTrust Inc.; SIGNiX Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Digital Signature market report include:- Adobe Systems Incorporated

- DocuSign Inc.

- Ascertia Limited

- IdenTrust Inc.

- SIGNiX Inc.

- Gemalto NV

- Entrust Datacard Corporation

- Kofax Inc.

- RPost Communications Limited

- Secured Signing Limited

- OneSpan Inc.

- HelloSign Inc.

- GMO GlobalSign Ltd.

- MultiCert S.A.

- RightSignature LLC

- Zoho Corporation Pvt. Ltd.

- VASCO Data Security International Inc.

- Arthur D. Little Inc.

- Shachihata Inc.

- Glykka LLC

- eSign Genie Inc.

- SignaShare Corporation

- KeepSolid Inc.

- GetAccept Inc.

- Symtrax Holdings Inc.

- Microsoft Corporation

- International Business Solutions LLC

- Korea SYSTEM's TECH Inc.

- Kotrade Inc.

- Oracle Corporation

- SignRequest B.V.

- SignEasy Inc.

- SignNow Inc.

- DocVerify Inc.

- PandaDoc Inc.

- Sertifi Inc.

- SkySignature

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 9.62 Billion |

| Forecasted Market Value ( USD | $ 32.44 Billion |

| Compound Annual Growth Rate | 35.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 38 |