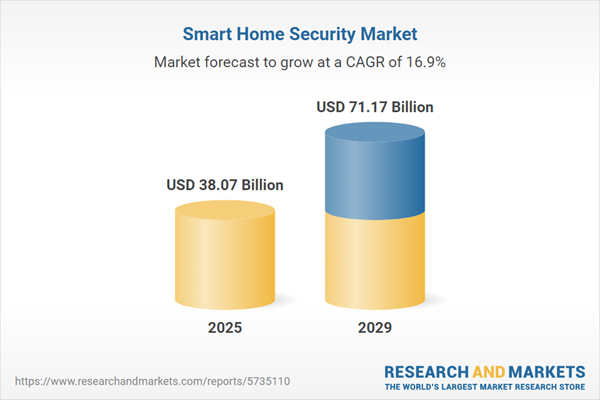

The smart home security market size is expected to see rapid growth in the next few years. It will grow to $71.17 billion in 2029 at a compound annual growth rate (CAGR) of 16.9%. The growth in the forecast period can be attributed to artificial intelligence and machine learning integration, privacy and data security concerns, customization and personalization, rise of DIY installations, smart city initiatives and collaboration. Major trends in the forecast period include behavioral analytics for threat detection, cybersecurity training and education, integration with smart home ecosystems, rise of DIY (do-it-yourself) security solutions, collaboration with law enforcement.

The growth of the smart home security market is driven by rising crime rates worldwide. As crime rates increase, consumers are placing a greater emphasis on safety and security systems, particularly in residential areas. Households are increasingly opting for smart devices such as smart alarms, smart cameras, and smart lockers to enhance their safety and security. For instance, in October 2023, the United States Department of Justice, a government agency, reported that hate crime incidents rose by 794 in 2022, totaling 11,634 cases, up from 10,840 in 2021. Therefore, the escalating crime rates globally are fueling the growth of the smart home security market.

An increasing number of internet users is expected to drive the growth of the smart home security market in the future. Internet users are individuals who access and use the Internet, a vast network of interconnected computers and digital services. Their presence enables remote monitoring and control of smart home security systems, allowing for real-time alerts and the integration of devices for improved security and convenience. For instance, in July 2023, the Canadian Internet Use Survey 2022 conducted by Statistics Canada, a national statistics agency, revealed that internet usage among Canadians aged 15 and older rose from 92% in 2020 to 95% in 2022. Notably, Canadians aged 75 and older experienced the most significant increase, from 62% in 2020 to 72% in 2022. Thus, the growing number of internet users is contributing to the expansion of the smart home security market.

The high installation costs of smart home security devices act as a constraint on market growth. As a relatively new technology, the setup costs and associated expenses for smart home security, including utilities, maintenance, and repairs, are considerable. The cost varies based on the installation plan and property size, with alarm systems and security camera installations being more expensive. A basic smart home security system, including a burglar alarm, thermostat, outdoor lighting, and a backdoor lock controlled remotely, may cost $2,500. Advanced security and home automation systems can cost up to $1.8 million. Monitoring costs typically range from $5 to $65 per month, averaging $32 per month, according to Safewise. Installation costs range from $0 to $200, and basic equipment costs range from $350 to $400 per individual device.

Manufacturers of smart home security systems are increasingly incorporating AI (Artificial Intelligence) technologies with visual recognition capabilities into their security devices. AI is advancing to a stage where security confirmation and authentication processes are conducted through facial and visual recognition. Home security systems, including consumer video cameras, are integrating AI technology with a novel security validation framework, enhancing safety and security through features such as facial recognition, fingerprints, and voice recognition. AI is also proposed for use in smart alarms, creating databases of incoming alerts to predict and analyze false alarms. For example, in June 2022, Infineon Technologies AG, a Germany-based semiconductor manufacturer, introduced its battery-operated Smart Alarm System (SAS). This technology platform employs sensor fusion based on artificial intelligence/machine learning (AI/ML) for high precision and extremely low-power operation. When used with low-power wake-on acoustic event detection, this technique achieves outstanding performance, offering battery life equal to or greater than less sophisticated solutions. It surpasses the detection accuracy of acoustic-only alarm systems used in smart homes, buildings, and other IoT applications.

Major players in the smart home security market are intensifying their focus on introducing convenient and efficient home security solutions to maintain a competitive advantage. These solutions emphasize ease of use, time-saving features, and effective protection for homeowners and their properties. In September 2023, Yale, a US-based door company, launched a new line of home security products tailored for the European market. This product line includes a video doorbell, the next generation of its smart alarm system, and the Smart Indoor Camera. The Smart Indoor Camera offers 1080p footage, a 110-degree field of view with night vision, motion-triggered event recording, customizable coverage zones, AI-powered human detection, motion scheduling, and a privacy mode that deactivates recording when the door is unlocked. The Smart Alarm system secures both the inside and outside of the home, integrating with the Yale Home app for remote arm/disarm functionality and real-time notifications.

In July 2024, LG Electronics Inc., a technology company based in South Korea, acquired Athom B.V. for an undisclosed sum. This acquisition aims to bolster LG Electronics Inc.'s presence in the smart home market by incorporating Athom B.V.'s Homey platform, which facilitates seamless connectivity and automation among a diverse array of devices. This integration enhances LG's capacity to provide comprehensive and customizable smart home security and automation solutions to its global consumer base. Athom B.V. is a company located in the Netherlands that specializes in smart home security.

Major companies operating in the smart home security market include Amazon.com Inc., Google LLC, Comcast Corporation, AT&T Inc., Robert Bosch GmbH, United Technologies Corporation, Hangzhou Hikvision Digital Technology Co. Ltd., Honeywell International Inc., G4S plc, Assa Abloy AB, ADT Inc., Vivint Smart Home Inc., NETGEAR Inc., Alarm.com Holdings Inc., Legrand North America LLC, SimpliSafe Inc., Ring LLC, Samsung Electronics Co. Ltd., Protect America Inc., August Home Inc., SkyBell Technologies Inc., Canary Connect Inc., Frontpoint Security Solutions LLC, LiveWatch Security LLC, Allegion plc, Control4 Corporation, Godrej & Boyce Manufacturing Company Limited, Nortek Security & Control LLC, Johnson Controls International plc, Abode Systems Inc., Zmodo Technology Corporation Ltd.

Smart home security comprises a combination of physical and technological elements designed to enable users to remotely monitor and control their residences in real-time, providing alerts for unusual activities or unauthorized attempts to access doors or windows.

The key components of smart home security include smart alarms, smart cameras and monitoring systems, smart locks and sensors, and smart detectors. A smart alarm utilizes wireless technology, home networks, and mobile phones to seamlessly integrate security measures into daily life. The essential elements of smart home security encompass hardware, software, and services. These applications find relevance in various settings such as independent homes, apartments, and condominiums.

The smart home security market research report is one of a series of new reports that provides smart home security market statistics, including smart home security industry global market size, regional shares, competitors with a smart home security market share, detailed smart home security market segments, market trends and opportunities, and any further data you may need to thrive in the smart home security industry. This smart home security market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The Asia-Pacific was the largest region in the smart home security market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global smart home security market report during the forecast period. The regions covered in the smart home security market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the smart home security market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The smart home security market consists of sales of security devices for household use that can be connected to Wi-Fi and accessed from anywhere using smartphones, smartwatches or voice. The security devices produced include devices such as smart alarms, smart cameras, smart locks, smart detectors, and others. This market does not include the installation of these devices and/or integration with the home set-up. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Smart Home Security Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on smart home security market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for smart home security? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The smart home security market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Smart Alarms; Smart Camera and Monitoring System; Smart Locks and Sensors; Smart Detectors2) By Component: Hardware; Software; Service

3) By Application: Independent Homes; Apartments; Condominiums

Subsegments:

1) By Smart Alarms: Motion Sensors; Door or Window Sensors; Smart Sirens; Smart Alert Systems2) By Smart Camera and Monitoring System: Indoor Security Cameras; Outdoor Security Cameras; Video Doorbells; Smart Surveillance Systems

3) By Smart Locks and Sensors: Smart Deadbolts; Keyless Entry Systems; Smart Door Sensors; Smart Padlocks

4) By Smart Detectors: Smoke Detectors; Carbon Monoxide Detectors; Water Leak Detectors; Glass Break Sensors

Key Companies Mentioned: Amazon.com Inc.; Google LLC; Comcast Corporation; AT&T Inc.; Robert Bosch GmbH

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Amazon.com Inc.

- Google LLC

- Comcast Corporation

- AT&T Inc.

- Robert Bosch GmbH

- United Technologies Corporation

- Hangzhou Hikvision Digital Technology Co. Ltd.

- Honeywell International Inc.

- G4S plc

- Assa Abloy AB

- ADT Inc.

- Vivint Smart Home Inc.

- NETGEAR Inc.

- Alarm.com Holdings Inc.

- Legrand North America LLC

- SimpliSafe Inc.

- Ring LLC

- Samsung Electronics Co. Ltd.

- Protect America Inc.

- August Home Inc.

- SkyBell Technologies Inc.

- Canary Connect Inc.

- Frontpoint Security Solutions LLC

- LiveWatch Security LLC

- Allegion plc

- Control4 Corporation

- Godrej & Boyce Manufacturing Company Limited

- Nortek Security & Control LLC

- Johnson Controls International plc

- Abode Systems Inc.

- Zmodo Technology Corporation Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 38.07 Billion |

| Forecasted Market Value ( USD | $ 71.17 Billion |

| Compound Annual Growth Rate | 16.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |