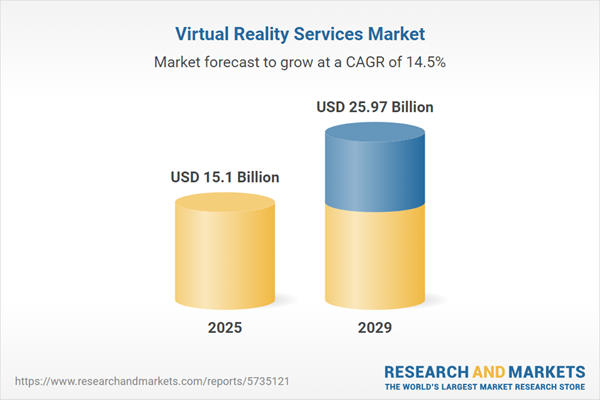

The virtual reality services market size has grown rapidly in recent years. It will grow from $13.32 billion in 2024 to $15.1 billion in 2025 at a compound annual growth rate (CAGR) of 13.4%. The growth in the historic period can be attributed to increasing demand in gaming and entertainment, corporate adoption and training, reduced costs and accessibility, content creation and industry investment, cinematic and media experiences.

The virtual reality services market size is expected to see rapid growth in the next few years. It will grow to $25.97 billion in 2029 at a compound annual growth rate (CAGR) of 14.5%. The growth in the forecast period can be attributed to 5g technology integration, enterprise and industrial applications, healthcare and therapeutic use, immersive social experiences, augmented reality integration. Major trends in the forecast period include vr in e-commerce and retail, location-based entertainment, travel and tourism experiences, cross-industry collaboration, virtual social spaces.

The utilization of virtual reality services in telehealth plays a crucial role in propelling the growth of the virtual reality services market. With the need to train and equip healthcare professionals to deal with the challenges posed by COVID-19 patients, virtual reality-powered tools have become essential. These tools offer a simulated environment that can efficiently prepare doctors and nurses to handle an anticipated surge in COVID-19 cases. Virtual reality training services, specifically tailored for scenarios related to COVID-19 pathology, provide a highly realistic and beneficial training experience. They enable medical students, doctors, and nurses to swiftly apply their learned principles and procedures in real-world situations. For example, applications like XRHealth facilitate the treatment and monitoring of COVID-19 patients in hospital quarantine as well as after their return home. Thus, the increasing demand for virtual reality services in telehealth is a significant driver of the virtual reality services market's growth.

The growth of the gaming industry is expected to be a significant driver of the virtual reality services market in the future. The gaming industry encompasses the development, distribution, and consumption of video games across various platforms, including consoles, personal computers, mobile devices, and online platforms. Gamers are increasingly seeking immersive experiences, and virtual reality (VR) technology offers a solution to meet this demand. VR gaming content, social interactions in virtual environments, and the emergence of VR eSports are expanding rapidly, attracting gamers to VR services. The competitive nature of the gaming industry encourages ongoing innovation in VR, both in terms of hardware and accessories. For instance, in February 2024, according to the Entertainment Software Association, a US-based video game trade association, US consumers spent $57.2 billion on video games in 2023. Therefore, the growing gaming industry is driving the expansion of the virtual reality services market.

Remote shopping using virtual reality has emerged as a significant trend in the virtual reality services market. With the global COVID-19 pandemic leading to isolation and quarantine measures, many people have shifted away from in-person shopping. However, this shift doesn't mean that e-commerce companies have to discontinue their engagement with customers and clients. Instead, virtual reality offers a valuable alternative, allowing businesses to provide potential customers with novel and immersive shopping experiences without limitations on outreach. E-commerce companies now have the opportunity to redefine the customer experience and transform their shopping journeys by leveraging VR services. For example, the US-based brand GAP has developed a virtual Dressing Room app that enables users to virtually try on clothing items before making a purchase decision. This innovative approach helps customers make informed choices, ultimately reducing the number of product returns and alleviating financial pressures on retailers.

Leading companies in the virtual reality services market are actively creating innovative solutions tailored to virtual reality-based education to maintain a competitive advantage in the industry. Virtual reality-based learning leverages three-dimensional, computer-generated environments to enable learners to interact with educational content, thereby enhancing their comprehension and knowledge retention. As an example, in April 2023, Coursera Inc., a US-based online learning company, introduced a range of new VR course experiences and AR (Augmented Reality) content developed in partnership with Meta Inc. These VR courses, offered in collaboration with renowned universities, provide immersive learning opportunities across various subjects, including human physiology, Chinese language, and public speaking. Additionally, Coursera launched the advanced Meta AR Developer Professional Certificate, encompassing AR applications in social media, web browsers, and mobile apps, as well as a beginner-friendly Spark Creator AR Certification Prep Specialization.

Major companies operating in the virtual reality services market include Skywell Software LLC, LittlStar's, Creative Solutions, Gramercy Tech LLC, HQSoftware LLC, Program-Ace LLC, Groove Jones LLC, Xicom Technologies Ltd., Zco Corporation, The Intellify, Quy Technology Pvt. Ltd., Fluper Ltd., JPLoft Solution, Credencys Solutions Inc., HorizonCore Infosoft Pvt. Ltd., Quytech Company, Hedgehog lab Ltd., IndiaNIC Infotech Limited, Chetu Inc., Vakoms LLC, Delta Reality, Dyfuzja Software Development Co., Cortex Inc., Chocolate Milk & Donuts LLC, NARSUN Studios, Setapp Inc., Oodles Technologies Pvt. Ltd., Infotrum LLC, Sumeru Inc., NewGenApps, HTC Corporation, Sony Group Corporation, Oculus VR LLC, Google LLC, Samsung Electronics Co. Ltd., Lenovo Group Ltd., Meta Platforms Inc., NVIDIA Corporation, Apple Inc., Amazon Inc., Unity Technologies Inc., Unreal Engine 3D, Autodesk Inc., Eon Reality Inc., 3D Systems Corporation, Dassault Systèmes SE, Pico Interactive Inc., StarVR Corporation, FOVE Inc.

Virtual reality (VR) refers to a computer-generated artificial environment that is presented to the user in a manner that simulates a real environment, leading the user to perceive and interact with it as though it were genuine.

The primary categories of virtual reality services encompass hardware and software. These services are delivered based on various service components, including consulting, training, implementation, integration, operation, and maintenance. VR services find applications across a wide range of industries, such as healthcare, education, real estate, advertising, travel, gaming, entertainment, and more. Consulting, in this context, refers to offering expertise on a particular subject to a third party in exchange for a fee. Advisory and implementation services are often included as part of the service offerings.

The virtual reality services market research report is one of a series of new reports that provides virtual reality services market statistics, including virtual reality services industry global market size, regional shares, competitors with a virtual reality services market share, detailed virtual reality services market segments, market trends and opportunities, and any further data you may need to thrive in the virtual reality services industry. This virtual reality services market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Asia-Pacific was the largest region in the virtual reality services market in 2024. North America was the second largest region in the virtual reality services market. The regions covered in the virtual reality services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the virtual reality services market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The virtual reality services market includes revenues earned by entities by providing virtual reality services that are used in different sectors such as aerospace, defense, gaming, entertainment, tourism, diagnostics and surgeries. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Virtual Reality Services Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on virtual reality services market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for virtual reality services ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The virtual reality services market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Hardware; Software2) By Basis of Service: Consulting; Training; Implementation; Integration; Operation; Maintenance

3) By Application: Healthcare; Education; Real Estate; Advertising; Travel; Gaming; Entertainment; Other Applications

Subsegments:

1) By Hardware: VR Headsets; VR Controllers; VR Tracking Devices; VR Gloves; Haptic Feedback Devices; Motion Platforms; VR Cameras2) By Software: VR Content Creation Software; VR Gaming Software; VR Simulation Software; VR Training and Education Software; VR Design and Architecture Software; VR Entertainment and Media Applications; Augmented Reality (AR) Integration Software

Key Companies Mentioned: Skywell Software LLC; LittlStar's; Creative Solutions; Gramercy Tech LLC; HQSoftware LLC

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Virtual Reality Services market report include:- Skywell Software LLC

- LittlStar's

- Creative Solutions

- Gramercy Tech LLC

- HQSoftware LLC

- Program-Ace LLC

- Groove Jones LLC

- Xicom Technologies Ltd.

- Zco Corporation

- The Intellify

- Quy Technology Pvt. Ltd.

- Fluper Ltd.

- JPLoft Solution

- Credencys Solutions Inc.

- HorizonCore Infosoft Pvt. Ltd.

- Quytech Company

- Hedgehog lab Ltd.

- IndiaNIC Infotech Limited

- Chetu Inc.

- Vakoms LLC

- Delta Reality

- Dyfuzja Software Development Co.

- Cortex Inc.

- Chocolate Milk & Donuts LLC

- NARSUN Studios

- Setapp Inc.

- Oodles Technologies Pvt. Ltd.

- Infotrum LLC

- Sumeru Inc.

- NewGenApps

- HTC Corporation

- Sony Group Corporation

- Oculus VR LLC

- Google LLC

- Samsung Electronics Co. Ltd.

- Lenovo Group Ltd.

- Meta Platforms Inc.

- NVIDIA Corporation

- Apple Inc.

- Amazon Inc.

- Unity Technologies Inc.

- Unreal Engine 3D

- Autodesk Inc.

- Eon Reality Inc.

- 3D Systems Corporation

- Dassault Systèmes SE

- Pico Interactive Inc.

- StarVR Corporation

- FOVE Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 15.1 Billion |

| Forecasted Market Value ( USD | $ 25.97 Billion |

| Compound Annual Growth Rate | 14.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 50 |