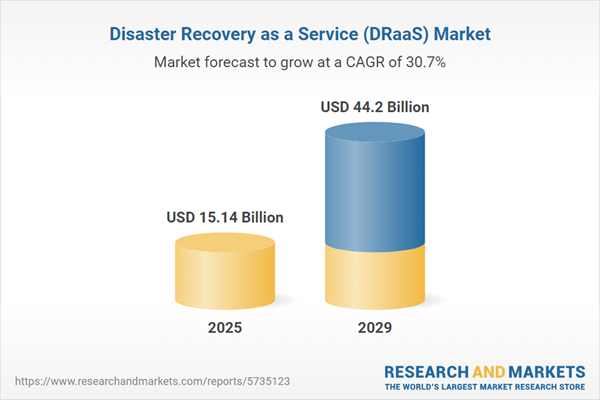

The disaster recovery as a service (DRaaS) market size is expected to see exponential growth in the next few years. It will grow to $44.2 billion in 2029 at a compound annual growth rate (CAGR) of 30.7%. The growth in the forecast period can be attributed to AI and machine learning integration, continuous data protection (CDP), edge computing resilience, ransomware mitigation solutions, multi-cloud and interoperability. Major trends in the forecast period include cost optimization and scalability, resilience against natural disasters, automation and orchestration, real-time recovery expectations, shift to remote work.

The surge in demand for safeguarding both public and private data is fueling the expansion of the Disaster Recovery as a Service (DRaaS) market. With a staggering 2.5 quintillion bytes of data generated daily, unplanned system downtime emerges as a significant contributor to data loss, leading to the shutdown of various companies. The potential losses and damages resulting from system downtimes are substantial, necessitating the provision of backup services. These services play a crucial role in assuring companies against unforeseen disasters, consequently propelling the growth of the DRaaS market. For instance, as per a study by invenio IT, fewer than 10% of companies survive a disaster without a comprehensive recovery plan. This statistic includes not only small market players but also major corporations such as FedEx and Nissan, underscoring the universal need for backup services.

The growing risks of cyber-attacks are anticipated to drive the expansion of the disaster recovery as a service (DRAAS) market in the future. A cyber-attack is defined as any attempt to infiltrate a computer, computing system, or network with the intention of causing damage. DRAAS assists in mitigating the effects of cyberattacks by facilitating data recovery from secure offsite backups and ensuring rapid, automated system failover, thus maintaining business operations while reducing downtime. For instance, in November 2023, the Australian Signals Directorate's Australian Cyber Security Centre, a government agency in Australia, reported that it dealt with 143 cybersecurity incidents related to critical infrastructure during the 2022-23 period. Consequently, the rising risks of cyberattacks are propelling the growth of the disaster recovery as a service (DRAAS) market.

Companies have embraced the integration of AI and Machine Learning into their Disaster Recovery as a Service (DRaaS) solutions to proactively identify and address potential risks due to the increasing prevalence of cyber threats. Predictive learning algorithms are being developed to discern between genuine and false disaster recovery scenarios. These algorithms have the capability to autonomously execute proactive recovery measures, preventing outages before they become apparent. For instance, Unitrends, a US-based company, incorporates artificial intelligence (AI) in its services, actively running during every backup operation to detect backups affected by ransomware. Upon identifying data threats, the company promptly notifies stakeholders, leveraging AI and advanced technologies to enhance data security.

Leading enterprises in the disaster recovery as a service (DRaaS) market are innovating technological solutions, exemplified by the introduction of Verinext DRaaS Managed Service, to strengthen their global footprint. The Verinext DRaaS Managed Service provides secure, compliant, and flexible DRaaS managed services, catering to customers seeking ransomware resistance, continuous data protection, and availability with minimal data loss or downtime. For instance, in July 2023, Verinext Corporation, a US-based IT service management company, launched a disaster recovery-as-a-service (DRaaS) solution on HPE GreenLake. Deployed in dedicated Verinext data centers, this solution incorporates disaster recovery software from Zerto, a Hewlett Packard Enterprise company, capitalizing on the agility of the HPE GreenLake platform for swift customer onboarding and scalability.

In August 2023, First Onsite Property Restoration, a US-based company specializing in disaster recovery and restoration services for commercial businesses, disclosed its acquisition of Case Restoration for an undisclosed sum. This acquisition aligns with First Onsite's strategic goal of enhancing customer experiences through an expanded range of crucial services and swift responsiveness. Case Restoration, also based in the US, offers commercial services in mitigation, general contracting, fire and water restoration, demolition, and roofing.

Major companies operating in the disaster recovery as a service (DRaaS) market include Amazon.com Inc., Microsoft Corporation, Verizon Communications Inc., NTT Communications Corporation, Dell Inc., The International Business Machines Corporation, Cisco Systems Inc., The Hewlett Packard Enterprise Company, VMWare Inc., Geminare Incorporated, Windstream Holdings II LLC, Sun Gard Availability Services, Commvault, Datto Inc., TierPoint LLC, Acronis International GmbH, 11:11 Systems Inc., Node Africa, Evolve IP LLC, Axcient, Infrascale Inc., Recovery Point Systems Inc., Treo Information Technologies, Disaster Recovery South Africa PTY. Ltd., Bluelock, Quorum Business Solutions Inc.

The Asia-Pacific was the largest region in the disaster recovery as a service (DRaaS) industry in 2024. Asia-Pacific is expected to be the fastest-growing region in the global disaster recovery as a service (draas) market analysis report during the forecast period. The regions covered in the disaster recovery as a service (draas) market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the disaster recovery as a service (draas) market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Disaster Recovery as a Service (DRaaS) represents a cloud computing service model that allows organizations to safeguard their data and IT infrastructure by backing them up in a third-party cloud environment. Through a Software as a Service (SaaS) solution, DRaaS facilitates the orchestration of all disaster recovery processes, ensuring the restoration of access and functionality to the IT infrastructure post a disaster.

The primary service categories within disaster recovery as a service (DRaaS) encompass backup and recovery, real-time replication, and data protection. Real-time replication involves the continuous synchronization of data between a source and a destination database whenever a change occurs in the data source. The clouds utilized in DRaaS include public, private, and hybrid options, adhering to deployment models such as premises-to-cloud and cloud-to-cloud. Enterprises of various sizes, including large enterprises and small & medium enterprises, can benefit from DRaaS. Application areas span across banking, financial services and insurance (BFSI), government, IT and telecom, media and entertainment, manufacturing and logistics, as well as education.

The disaster recovery as a service (DRaaS) market research report is one of a series of new reports that provides disaster recovery as a service (DRaaS) market statistics, including disaster recovery as a service (DRaaS) industry global market size, regional shares, competitors with a disaster recovery as a service (DRaaS) market share, detailed disaster recovery as a service (DRaaS) market segments, market trends and opportunities, and any further data you may need to thrive in the disaster recovery as a service (DRaaS) industry. This disaster recovery as a service (DRaaS) market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The disaster recovery as a service (DRaaS) market includes revenues earned by entities by providing cloud-based disaster recovery as a service for protecting applications and data from the disruption caused due to disaster. DRaaS helps in business continuity in any event of system failure. Some features of these solutions are hybrid cloud availability monitoring, cross-cloud infrastructure management, and cross-platform health monitoring. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Disaster Recovery as a service (DRaaS) Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on disaster recovery as a service (draas) market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for disaster recovery as a service (draas)? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The disaster recovery as a service (draas) market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Service Type: Backup and Recovery; Real-Time Replication; Data Protection2) By Size of Enterprise: Large Enterprises; Small and Medium Enterprises

3) By Application: Banking; Financial Services and insurance (BFSI); Government; IT and Telecom; Media and Entertainment; Manufacturing and Logistics; Education

Subsegments:

1) By Backup and Recovery: Cloud Backup Services; on-Premises Backup Solutions2) By Real-Time Replication: Continuous Data Protection; Synchronous Replication; Asynchronous Replication

2) By Data Protection: Data Security Solutions; Compliance and Governance Services

Key Companies Mentioned: Amazon.com Inc.; Microsoft Corporation; Verizon Communications Inc.; NTT Communications Corporation; Dell Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Amazon.com Inc.

- Microsoft Corporation

- Verizon Communications Inc.

- NTT Communications Corporation

- Dell Inc.

- The International Business Machines Corporation

- Cisco Systems Inc.

- The Hewlett Packard Enterprise Company

- VMWare Inc.

- Geminare Incorporated

- Windstream Holdings II LLC

- Sun Gard Availability Services

- Commvault

- Datto Inc.

- TierPoint LLC

- Acronis International GmbH

- 11:11 Systems Inc.

- Node Africa

- Evolve IP LLC

- Axcient

- Infrascale Inc.

- Recovery Point Systems Inc.

- Treo Information Technologies

- Disaster Recovery South Africa PTY. Ltd.

- Bluelock

- Quorum Business Solutions Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 15.14 Billion |

| Forecasted Market Value ( USD | $ 44.2 Billion |

| Compound Annual Growth Rate | 30.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |