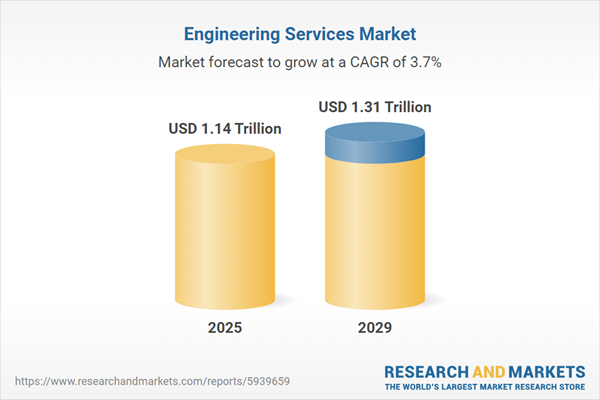

The engineering services market size is expected to see steady growth in the next few years. It will grow to $1.31 trillion in 2029 at a compound annual growth rate (CAGR) of 3.7%. The growth in the forecast period can be attributed to increasing digitalization, rising demand for IoT (internet of things) solutions for smart manufacturing, rising prominence of robots in the construction industry, government investments in the aviation industry, continuous development of smart cities and a rapid adoption of advanced technologies. Major trends in the forecast period include focus on partnerships and collaborations, adoption of artificial intelligence, use of blockchain, investment in development of smart cities, investment in low-code development, focus on environment-friendly buildings services and use of industry 4.0.

The forecast of 3.7% growth over the next five years reflects a modest reduction of 0.2% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. Tariff escalations are likely to challenge U.S. infrastructure projects by increasing expenses for structural analysis platforms and computer-aided design or computer-aided manufacturing systems developed in Sweden and South Korea, potentially extending project timelines and raising design service costs. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The increasing adoption of artificial intelligence is anticipated to drive the expansion of the engineering services market in the future. Engineering services encompass any service or creative work that necessitates engineering education, training, and expertise in applying specialized knowledge of mathematical, physical, and engineering sciences. The integration of artificial intelligence can enhance the efficiency, productivity, and profitability of engineering services, leading to the creation of new job roles and opportunities. For instance, Stanford University's AI Index Report 2023 reveals that the proportion of companies adopting AI doubled between 2016 and 2022, plateauing in recent years at 50% to 60%. This growing adoption of artificial intelligence is a key driver for the engineering services market.

The engineering services market is poised to benefit from consistent economic growth in both developed and developing countries. For instance, in April 2024, the International Monetary Fund (IMF), a US-based financial agency, projected that the global economy would grow at a rate of 3.2 percent in both 2024 and 2025, maintaining the same growth rate as in 2023. Advanced economies are expected to experience a modest growth increase, from 1.6 percent in 2023 to 1.7 percent in 2024, and reaching 1.8 percent in 2025. Thus, the ongoing economic growth in developed and developing nations is driving the expansion of the engineering services market.

Leading companies in the engineering services market are introducing innovative products to address industry challenges. An example is Ricoh USA Inc., a US-based software company, which launched RICOH Remote Patient Monitoring (RPM) Enablement in October 2023. This end-to-end managed services offering for health systems aims to streamline remote patient monitoring workflows, addressing healthcare staffing challenges amid a significant industry burnout crisis. The service supports the integration of remote patient monitoring devices into existing virtual care programs, covering inventory tracking, logistics, and device returns. This launch coincides with the healthcare industry's shift to virtual care delivery and a shortage of healthcare workers.

The latest trend in the engineering services market is the widespread adoption of the Internet of Things (IoT) globally. IoT is a system of interconnected devices that facilitate data transmission across various networks. It enables continuous innovation in real-time data analytics, product design, and development, fostering faster business growth. Engineering service providers are increasingly leveraging industrial IoT to optimize production processes by improving energy usage, resource allocation, and asset management. As an example, PureSoftware, an engineering service company, has successfully integrated IoT into its services, creating a robust IoT platform to enhance the speed and accuracy of data retrieval.

In June 2023, UES, a US-based engineering and consulting company, acquired Riner Engineering for an undisclosed amount, aiming to expand its geotechnical expertise. The acquisition was expected to bolster UES's capabilities in geotechnical engineering, construction materials testing, and environmental consulting. Additionally, it provided Riner Engineering with access to UES's resources and expertise, enabling the firm to extend its services and geographic reach. Riner Engineering, a US-based geotechnical engineering and construction materials testing firm, was the subject of this strategic acquisition.

Major companies operating in the engineering services market include AECOM, WorleyParsons Limited, Babcock International, Fluor Corporation, Bechtel Corporation, Kiewit Corporation, WSP Global Inc, John Wood Group PLC, NV5 Global Inc, Arup Group, DNV, SGS S.A, ICS Engineering Services, Engineers India Limited, Laserbond, Cyient, Wipro, Samsung Engineering, Porsche Engineering (Shanghai) Co Ltd, Hyundai Engineering (HEC), UGL, Cybage Software Pvt. Ltd, China Overseas Engineering Group, China Engineering Consultants, Inc. (CECI), China International Engineering Consulting Corporation, SMEC, ALTEN Group, JLL engineering services, Dyson UK, Stork, SNC Lavalin, J. Murphy & Sons Limited, Arcadis, Alstom, Areva, Artelia, llc aecon, 10Clouds, Techno Engineering & Associates, GT Ground Engineering & Construction Services, International Business Machines Corporation, Capgemini, AKTIAS tech, Oracle, Deaton Engineering, Inc, Aricent Group, EPAM Systems, Inc, GlobalLogic, Jensen Hughes, Henderson Engineers, Thermal Specialties, MCW Group of Companies, McElhanney, Quasar Consulting Group, Accenture SRL, Globant, Cognizant Technology Solutions Corporation, Saudi Engineering Group International (SEGI), HRS Engineering Ltd, Oiltek Engineering Co. Ltd, Mugesan Engineering & Marine Specialist Co. Inc, Al Mostaqbal Consulting Engineering, Aroma International Building Contracting LLC, Al Baha Engineering Consultants, Smartcities Building Contracting LLC, Thelo DB, Dorman Long Engineering Limited, Decagon, Advanced Engineering Consultants (ACE), CDR Engineering Consultancy Nigeria Limited, ILF Engineers Nigeria Limited, Africa Engineering Consulting Services (AECS), Ingplan Consulting Engineers.

North America was the largest region in the engineering services market in 2024. Western Europe was the second largest region in the global engineering services market share. The regions covered in the engineering services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the engineering services market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sharp rise in U.S. tariffs and the ensuing trade tensions in spring 2025 are taking a toll on the professional services sector, especially within legal, consulting, architectural, and engineering fields. Increased duties on imported technology, software, office hardware, and digital infrastructure have pushed up operational costs for firms that rely on global systems and resources. Cross-border consulting engagements are experiencing delays and higher expenses due to elevated travel costs and limited access to international data and tools. Moreover, industries heavily impacted by tariffs such as manufacturing, construction, and logistics are reducing their reliance on outsourced services, dampening demand for professional support. In response, service providers are reassessing pricing models, strengthening ties with domestic vendors, and accelerating the adoption of AI and automation to maintain profitability and client satisfaction in an increasingly volatile environment.

Engineering services play a vital role in offering extensive consultation to companies seeking expert advice and solutions. These firms can undertake projects, engaging in tasks such as evaluating, designing, simulating, and testing the product.

The primary categories of engineering services include civil engineering services, environmental engineering services, construction engineering services, mechanical engineering services, and other engineering services. Civil engineering services cover a broad spectrum of activities, ranging from the planning, design, and construction of commercial and residential structures to the development of transportation infrastructure such as roads, bridges, and railways. Additionally, these services extend to water distribution systems, such as dams, sewers, and sewage treatment, as well as environmental infrastructure, including landscaping, urban planning, and parks. Industrial infrastructure, construction management, construction technology, and more are also part of civil engineering services. Various engineering disciplines, such as civil, mechanical, electrical, piping, and structural engineering, are delivered through both offshore and onsite models. These services find applications across diverse sectors, including automotive, industrial manufacturing, healthcare, aerospace, telecommunications, information technology, energy and utilities, among others.

The engineering services market research report is one of a series of new reports that provides engineering services market statistics, including engineering services industry global market size, regional shares, competitors with an engineering services market share, detailed engineering services market segments, market trends and opportunities, and any further data you may need to thrive in the engineering services industry. This engineering services market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The engineering services market consists of revenue earned by entities that advise, prepare feasibility studies, prepare preliminary and final plans and designs, provide technical services during the construction or installation phase, and inspect and evaluate engineering projects. Engineering services’ companies apply physical laws and principles of engineering in the design, development, and utilization of machines, materials, instruments, structures, processes, and systems. Engineering services include technical application of engineering in product designing, innovations and others in industries such as building construction, mining, power and energy, transportation, manufacturing and others. The engineering services market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Engineering Services Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on engineering services market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for engineering services? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The engineering services market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Type: Civil Engineering Services, Electrical Engineering Services, Mechanical Engineering Services, Others Engineering Services3) by Engineering Disciplines: Civil, Mechanical, Electrical, Piping and Structural Engineering, Other Engineering Disciplines

2) by End-User: Transportation Infrastructure, Other Infrastructure, Automotive, Industrial Manufacturing, Healthcare Sector, Aerospace, Telecommunications, Information Technology, Oil and Gas, Energy and Utilities, Other End-Users

Subsegments:

1) by Civil Engineering Services: Structural Engineering; Geotechnical Engineering; Transportation Engineering; Environmental Engineering; Construction Management2) by Electrical Engineering Services: Power Systems Engineering; Telecommunications Engineering; Control Systems Engineering; Electronics Design Engineering; Lighting Design

3) by Mechanical Engineering Services: Product Design and Development; HVAC (Heating, Ventilation, and Air Conditioning) Engineering; Robotics and Automation; Thermal Engineering; Manufacturing Engineering

4) by Other Engineering Services: Chemical Engineering Services; Aerospace Engineering Services; Software Engineering Services; Industrial Engineering Services; Marine Engineering Services

Companies Mentioned: AECOM; WorleyParsons Limited; Babcock International; Fluor Corporation; Bechtel Corporation; Kiewit Corporation; WSP Global Inc; John Wood Group PLC; NV5 Global Inc; Arup Group; DNV; SGS S.a; ICS Engineering Services; Engineers India Limited; Laserbond; Cyient; Wipro; Samsung Engineering; Porsche Engineering (Shanghai) Co Ltd; Hyundai Engineering (HEC); UGL; Cybage Software Pvt. Ltd; China Overseas Engineering Group; China Engineering Consultants, Inc. (CECI); China International Engineering Consulting Corporation; SMEC; ALTEN Group; JLL engineering services; Dyson UK; Stork; SNC Lavalin; J. Murphy & Sons Limited; Arcadis; Alstom; Areva; Artelia; llc aecon; 10Clouds; Techno Engineering & Associates; GT Ground Engineering & Construction Services; International Business Machines Corporation; Capgemini; AKTIAS tech; Oracle; Deaton Engineering, Inc; Aricent Group; EPAM Systems, Inc; GlobalLogic; Jensen Hughes; Henderson Engineers; Thermal Specialties; MCW Group of Companies; McElhanney; Quasar Consulting Group; Accenture SRL; Globant; Cognizant Technology Solutions Corporation; Saudi Engineering Group International (SEGI); HRS Engineering Ltd; Oiltek Engineering Co. Ltd; Mugesan Engineering & Marine Specialist Co. Inc; Al Mostaqbal Consulting Engineering; Aroma International Building Contracting LLC; Al Baha Engineering Consultants; Smartcities Building Contracting LLC; Thelo DB; Dorman Long Engineering Limited; Decagon; Advanced Engineering Consultants (ACE); CDR Engineering Consultancy Nigeria Limited; ILF Engineers Nigeria Limited; Africa Engineering Consulting Services (AECS); Ingplan Consulting Engineers

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain.

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Engineering Services market report include:- AECOM

- WorleyParsons Limited

- Babcock International

- Fluor Corporation

- Bechtel Corporation

- Kiewit Corporation

- WSP Global Inc

- John Wood Group PLC

- NV5 Global Inc

- Arup Group

- DNV

- SGS S.a

- ICS Engineering Services

- Engineers India Limited

- Laserbond

- Cyient

- Wipro

- Samsung Engineering

- Porsche Engineering (Shanghai) Co Ltd

- Hyundai Engineering (HEC)

- UGL

- Cybage Software Pvt. Ltd

- China Overseas Engineering Group

- China Engineering Consultants, Inc. (CECI)

- China International Engineering Consulting Corporation

- SMEC

- ALTEN Group

- JLL engineering services

- Dyson UK

- Stork

- SNC Lavalin

- J. Murphy & Sons Limited

- Arcadis

- Alstom

- Areva

- Artelia

- llc aecon

- 10Clouds

- Techno Engineering & Associates

- GT Ground Engineering & Construction Services

- International Business Machines Corporation

- Capgemini

- AKTIAS tech

- Oracle

- Deaton Engineering, Inc

- Aricent Group

- EPAM Systems, Inc

- GlobalLogic

- Jensen Hughes

- Henderson Engineers

- Thermal Specialties

- MCW Group of Companies

- McElhanney

- Quasar Consulting Group

- Accenture SRL

- Globant

- Cognizant Technology Solutions Corporation

- Saudi Engineering Group International (SEGI)

- HRS Engineering Ltd

- Oiltek Engineering Co. Ltd

- Mugesan Engineering & Marine Specialist Co. Inc

- Al Mostaqbal Consulting Engineering

- Aroma International Building Contracting LLC

- Al Baha Engineering Consultants

- Smartcities Building Contracting LLC

- Thelo DB

- Dorman Long Engineering Limited

- Decagon

- Advanced Engineering Consultants (ACE)

- CDR Engineering Consultancy Nigeria Limited

- ILF Engineers Nigeria Limited

- Africa Engineering Consulting Services (AECS)

- Ingplan Consulting Engineers

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.14 Trillion |

| Forecasted Market Value ( USD | $ 1.31 Trillion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 74 |