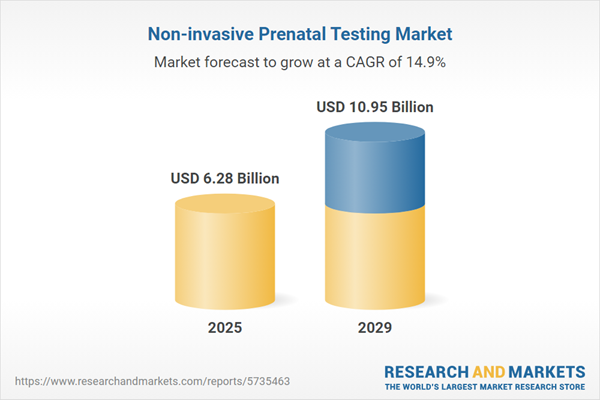

The non-invasive prenatal testing market size has grown rapidly in recent years. It will grow from $5.48 billion in 2024 to $6.28 billion in 2025 at a compound annual growth rate (CAGR) of 14.7%. The growth in the historic period can be attributed to improved accuracy, reduced risk, increased maternal age, growing awareness, clinical guidelines.

The non-invasive prenatal testing market size is expected to see rapid growth in the next few years. It will grow to $10.95 billion in 2029 at a compound annual growth rate (CAGR) of 14.9%. The growth in the forecast period can be attributed to expanding test offerings, wider accessibility, rising maternal age, fetal anomaly detection, telemedicine and digital health. Major trends in the forecast period include expanded test panels, wider adoption of nipt, technological advancements, non-invasive fetal aneuploidy diagnosis (nifad).

The high incidence rate of Down syndrome is a significant factor propelling the growth of the non-invasive prenatal testing (NIPT) market, especially with the increasing trend of older maternal age, which raises concerns about fetal well-being. Down syndrome, a chromosomal condition resulting from an error in cell division, leads to an extra chromosome 21 and can impact the cognitive and physical development of the fetus. NIPT screening tests offer a safe and non-invasive means of detecting Down syndrome, posing no harm to the mother or baby and carrying no risk of miscarriage. These tests can identify over 99% of Down syndrome cases. In the USA, the National Down Syndrome Society and the Centers for Disease Control and Prevention report that 1 in every 700 babies is born with Down syndrome, and 80% of children with Down syndrome are born to older mothers. The increased risk associated with advanced maternal age is a driving force behind the growth of the NIPT market.

The growing trend of increasing maternal age is expected to drive the growth of the non-invasive prenatal testing (NIPT) market. Factors such as pursuing education, career advancement, financial stability, personal choice, delayed marriage, improved contraception, and societal shifts are contributing to women making more informed decisions about family planning. As women delay childbirth, the risk of chromosomal abnormalities increases, leading more expectant mothers to choose NIPT to monitor the health of their pregnancies. For example, a report from the Centers for Disease Control and Prevention published in June 2023 highlighted a 2% increase in the provisional birth rate for women aged 35 to 39, from 53.7 births per 1,000 women in 2021 to 54.9 in 2022. Similarly, the number of births to women in their late 30s rose by 2% from 2021 to 2022. In the 40-44 age group, the provisional birth rate increased by 4%, reaching 12.5 births per 1,000 women in 2022, up from 12 in 2021. This age group's birth rate has shown nearly continuous growth since 1985 (3.8). Additionally, the number of births in this age group increased by 6% from 2021 to 2022. The provisional birth rate for women aged 45-49 (including those aged 50 and older) also rose to 1.1 births per 1,000 women in 2022, up from 0.9 in 2021, marking the first change in this rate since 2015. The number of births in this group surged by 12% from 2021 to 2022. As maternal age continues to rise, the demand for non-invasive prenatal testing is expected to grow accordingly in the forecast period.

The integration of next-generation sequencing technology has significantly enhanced the capabilities of researchers, enabling them to conduct a wide range of applications and study biological systems at a higher level. Next-generation sequencing allows for the simultaneous sequencing of thousands to millions of DNA molecules, reducing both time and cost while optimizing results for genome and DNA testing. Major companies like Illumina, Eurofins, Natera, Roche, and Annoroad have adopted this technology for non-invasive prenatal testing. The China Food and Drug Administration (CFDA) has approved the medical instrument product registration for Annoroad's NGS instrument NextSeq 550AR.

The non-invasive prenatal testing market is subject to strict regulation by various international and country-specific agencies. For instance, the US Food and Drug Administration (FDA) issues certifications for Laboratory Developed Tests (LDTs) and Clinical Laboratory Improvement Amendments (CLIA). Manufacturers must obtain a 510(k) premarket notification for in vitro diagnostic tests, with LDTs and CLIA certification based on the number of tests conducted during clinical trials. For instance, for trisomy 21 (Down syndrome), with an incidence rate of 1/1000, at least 100,000 samples would need to be tested to meet the requirements of a 510(k). A 510(k) premarket notification ensures that the new product is as safe and effective as other legally-marketed devices, and manufacturers must register such notifications before commercially marketing new products.

In January 2024, Natera, Inc., a US-based clinical genetic testing company, acquired reproductive health assets from Invitae for $42.5 million. This acquisition allows Natera to strengthen its offerings in non-invasive prenatal and carrier screening, which are key components of reproductive health. Invitae is a US-based biotechnology company that provides non-invasive prenatal testing services.

Non-invasive prenatal testing (NIPT) is a procedure where maternal blood is drawn and analyzed to detect potential abnormalities in the developing fetus. Non-invasive prenatal testing kits and equipment serve the purpose of identifying genetic irregularities, primarily chromosome defects, during the first trimester of pregnancy.

The key categories of non-invasive prenatal testing encompass consumables and instruments. Consumables refer to products that are used and depleted during their application. Instruments include NGS systems, PCR instruments, microarrays, ultrasound devices, and other equipment like centrifuges, UV systems, incubators, and microscopes. Various consumables comprise assay kits and reagents, as well as disposables. These applications pertain to the detection of conditions such as trisomy, microdeletion, genetics, and the Rh factor, and are typically employed by hospitals and diagnostic laboratories.

The non-invasive prenatal testing market research report is one of a series of new reports that provides non-invasive prenatal testing market statistics, including non-invasive prenatal testing industry global market size, regional shares, competitors with a non-invasive prenatal testing market share, detailed non-invasive prenatal testing market segments, market trends and opportunities, and any further data you may need to thrive in the non-invasive prenatal testing industry. This non-invasive prenatal testing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Major companies operating in the non-invasive prenatal testing market include F. Hoffmann-La Roche AG, Illumina Inc., Laboratory Corporation of America Holdings, Natera Inc., PerkinElmer Inc., Quest Diagnostics Inc., Agilent Technologies Inc., BGI Diagnosis Co Ltd., Berry Genomics Co, LifeCodexx AG, Myriad Genetics Inc., NIPD Genetics Co Ltd., Sequenom Inc., Annoroad Gene Technology Co Ltd., Centogene AG, Counsyl Inc., EUROFINS Genoma Group, Eurofins Scientific SE, Next Biosciences, Premaitha Health PLC, Ariosa Diagnostics Inc., Beijing Genomics Institute, Yourgene Health PLC, GE Healthcare Technologies Inc., Koninklijke Philips NV, Thermo Fisher Scientific Inc., Pacific Biosciences of California Inc., QIAGEN NV, MedGenome Labs Ltd., Progenity Inc.

North America was the largest region in the non-invasive prenatal testing market in 2024. Western Europe was the second largest region in the non-invasive prenatal testing market. The regions covered in the non-invasive prenatal testing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the non-invasive prenatal testing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The non-invasive prenatal testing market includes revenue earned by ultrasound detection, fetal cells in maternal blood tests, cell-free DNA in maternal plasma tests, and biochemical screening tests. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Non-invasive Prenatal Testing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on non-invasive prenatal testing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for non-invasive prenatal testing ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The non-invasive prenatal testing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Consumables; Instruments2) By Application: Trisomy; Microdeletion; Genetics; Rh factor

3) By End User: Hospital; Diagnostic Labs

Subsegment:

1) By Consumables: Assay Kits; Reagents; Disposables2) By Instruments: Next-Generation Sequencers (NGS); Polymerase Chain Reaction (PCR) Systems; Ultrasound Devices; Others (Microarrays and Mass Spectrometers)

Key Companies Mentioned: F. Hoffmann-La Roche AG; Illumina Inc.; Laboratory Corporation of America Holdings; Natera Inc.; PerkinElmer Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Non-invasive Prenatal Testing market report include:- F. Hoffmann-La Roche AG

- Illumina Inc.

- Laboratory Corporation of America Holdings

- Natera Inc.

- PerkinElmer Inc.

- Quest Diagnostics Inc.

- Agilent Technologies Inc.

- BGI Diagnosis Co Ltd.

- Berry Genomics Co

- LifeCodexx AG

- Myriad Genetics Inc.

- NIPD Genetics Co Ltd.

- Sequenom Inc.

- Annoroad Gene Technology Co Ltd.

- Centogene AG

- Counsyl Inc.

- EUROFINS Genoma Group

- Eurofins Scientific SE

- Next Biosciences

- Premaitha Health Plc

- Ariosa Diagnostics Inc.

- Beijing Genomics Institute

- Yourgene Health PLC

- GE Healthcare Technologies Inc.

- Koninklijke Philips NV

- Thermo Fisher Scientific Inc.

- Pacific Biosciences of California Inc.

- QIAGEN NV

- MedGenome Labs Ltd.

- Progenity Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 6.28 Billion |

| Forecasted Market Value ( USD | $ 10.95 Billion |

| Compound Annual Growth Rate | 14.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |