Speak directly to the analyst to clarify any post sales queries you may have.

Moreover, post-covid, the market is again expected to regain its growth. Nowadays, consumers are shifting their preferences as they are expected to be price sensitive, inclined towards price and value brands, engage, maintain, and accelerate with online shopping, and focus more on health & hygiene. Post-pandemic, the value chain is also adapted to digitization leading to a reduction in production & supply-chain risk. With digitization & real-time analytics & reporting, customers can track their supply chain more closely weekly compared to quarterly and annual reports. Thus, many companies are strategizing their plan and adapting to the change due to COVID-19.

MARKET TRENDS & DRIVERS

Increase In Pouch Packaging Across End-Users

In the Europe flexible packaging market, some major driving factors are boosting a shift toward flexible packaging. Flexible pouch packaging replaces metal, glass, and rigid plastic packaging. Compared to rigid packaging products, the demand for packaged food and drinks combined with the ease of use and cost-effectiveness of pouches mainly fuels demand for the product in the region. Moreover, pouches are expected to witness the fastest growth rate of 5.41% by product segment in the Europe flexible packaging market during the forecast period.Pouches consume less space and are also light in weight. Further, pouches decrease transport-related costs relative to rigid packagings such as metal cans and glass bottles. Pouches are widely used for packing various food items, including dairy, candy, confectionery, smoothies, and baby foods, due to their lightweight, and convenient reseal ability. Pouches use less material, electricity, and water during processing and occupy lower space after being disposable in landfills. This enhances sustainability compared to rigid packaging items such as plastic cups, trays, and containers. The push for pouches is mainly because of the technological advancements on the supplier front. The machinery used to produce pouches has significantly improved and can manufacture a greater number of pouches at a faster rate.

Increased Focus On Sustainable Flexible Packaging

Since plastic packaging has a higher share in the overall Europe flexible packaging market, the environmental impact associated with using plastic as a packaging material is also high. The pressure on F&B, consumer goods, and pharmaceutical companies to reduce dependency on plastic is regularly increasing, and the same has been passed on to packaging vendors. Sustainability is not limited to materials but extends to the production process, logistics, functionality, and end-use of expired products. Both the buyers and suppliers of flexible packaging products are looking to impact the environment positively. By 2030, the European Commission plans to ensure that all plastic-based packaging will be either reusable or recyclable. Sustainable, flexible packaging is currently more heavily dependent on recovering plastic products and recycling them and less on the processes. The advantages associated with process changes have not been fully realized, and the industry is more tilted toward material sustainability. Also, the industry is still facing challenges concerning recycling multi-layer plastic products (especially premium pouches that have a laminated film apart from PE film).SEGMENTATION INSIGHTS

- Flexible plastic held the largest material share in the Europe flexible packaging market and was valued at USD 42.62 billion in 2022.

- In European countries, polyethylene is in high demand and is one of the market leaders in plastic packaging polymers. It is used for making reusable bags, trays and containers, agricultural film, film for food packaging, and more.

- The consumer packaging segment is growing moderately due to increased consumption. The uneven growth is expected to continue; however, the emerging markets in European countries will exhibit around three times higher growth than the other regional markets.

- Bakery & confectionery segment in Europe's flexible packaging market was valued at USD 10.10 billion in 2022. Modified atmospheric packaging technology is adopted in bakery packaging, which has three types: thermoforming systems, pre-formed container machinery, and HFFS or VFFS systems.

- In Germany, the frozen food market has a good infrastructure and a large consumer base with high buying power. Globally, the region is the biggest consumer and exporter of frozen vegetables. The Europe frozen food flexible packaging market is anticipated to grow at a CAGR of 6.00% during the forecast period.

- In the Europe flexible packaging market, the flexographic printing segment is estimated at over 187.43 billion units in 2022. The key driving factors in the segment included the demand for more packaging colors and line screen values.

Segmentation by Material

- Flexible Plastic

- Flexible Paper

- Foil

Segmentation by Flexible Plastic

- PE (Polyethylene)

- BOPP (Biaxially Oriented Polypropylene)

- CPP (Cast Polypropylene)

- BOPET (Biaxially-oriented Polyethylene Terephthalate)

- PA (Polyamide)

- PET (Polyethylene Terephthalate)

- PVC (Polyvinyl Chloride)

- EVOH (Ethylene-Vinyl Alcohol)

- Others

Segmentation by Application

- Consumer Packaging

- Industrial Packaging

Segmentation by Consumer Flexible Packaging End-Users

- Bakery & Confectionery

- Meat, Poultry & Seafood

- Dairy

- Ready-To-Eat (RTE)

- Healthcare

- Frozen Food

- Tea & Coffee

- Personal Care

- Petfood

- Other end-users

Segmentation by Product

- Bags and Sacks

- Pouches

- Others

Segmentation by Printing

- Flexography Printing

- Rotogravure Printing

REGIONAL ANALYSIS

Germany dominates the Europe flexible packaging market with the highest industry share. Germany's well-established pharmaceutical market participants include Bayer, BASF, and Hoechst. Apart from drugs, the demand for sterile plastic packaging for medical devices is also driving the region’s flexible packaging market. Due to COVID-19, pharmaceutical and F&B packaged food demand has tremendously increased, driving flexible packaging demand. With over 80 million customers, the F&B industry is the largest in Europe and generated around 220 billion in 2020. This increase in the production of food and beverage products is fuelling the demand for flexible packaging, which require ease in logistics and longer shelf life during exports. The German market is highly responsive to consumer demand, regulatory measures, and sustainability demands. Hence, the demand for flexible packaging in Germany is expected to rise during the forecast period.The flexible packaging market in the UK is projected to grow at a CAGR of 2.27% during the forecast period. The packaging industry in the region is thriving, with approximately $13.90 billion in sales annually as of June 2018. The packaging industry has been a major contributor to the country's GDP. Food and pharmaceutical companies are driving the growth of the flexible packaging market. Blister packs and pouches for medical devices witnessed the highest demand because of the aging population, self-use medical devices, and increased OTC drugs, vitamins, and other supplementary intakes.

Segmentation By Geography

- Europe

- UK

- Germany

- France

- Spain

- Italy

- Benelux

- Austria

- Scandinavia

- Switzerland

- Rest of Europe

COMPETITIVE LANDSCAPE

The key vendors in the Europe flexible packaging market players include Amcor, Berry Global, Mondi, Sealed Air, TC Transcontinental, Sonoco, Huhtamaki, Constantia Flexibles, Ahlstrom, Greif, WestRock, Smurfit Kappa, Alu Flex Pack, Aptar Group. Small and medium enterprises dominate a vast segment of the market. The larger players have adopted an inorganic growth strategy to expand their operations in many regions.Stretch films, protective wraps, and pouches have seen a huge demand in the last few years. The Europe flexible packaging market has witnessed many M&A transactions in the last few years; the consolidation is expected to grow further in the region. During August 2022, Amcor focused on growing its presence in the Czech Republic by investment and acquisition of one of the world-class flexible packaging plants. The company focused on expanding its European segments, especially for coffee and pet food.

Key Company Profiles

- Amcor

- Berry Global

- Mondi

- Sealed Air

- TC Transcontinental Packaging

- Sonoco

- Huhtamaki

- Constantia Flexibles

- Ahlstrom

- Greif

- WestRock

- Smurfit Kappa

- Alu Flex Pack

- Aptar Group

Other Prominent Vendors

- Alinvest

- Aran Group

- Aluberg

- Bischof + Klein

- Bioplast

- Carcano

- Danaflex

- ProAmpac

- Wipak Group

- Saica

- Etapak (Baskı Ambalaj)

- Innovia Films

- UFlex

- International Paper

- Novolex

- Sigma Plastics

- Symetal

- Krajcár Packaging

- ITP

- Gascogne Flexible

- Schur Flexibles

- Schmid Folien

- RKW Group

- Pouch Partners

- Perlen Packaging

- Goglio Packaging

- Kleiner Flexible Packaging

- Stora Enso

- Di Mauro

- Eurofoil

- Gerosa Group

- LEEB Flexibles

- PolyPak

- PPG

- Walki

- All4Labels

- SIG Combibloc Group

- Ringmetall SE

- The Reflex Group

- Süpack

- Coveris

- Wipf AG

- Clondalkin Packaging

- Korozo Group

- Grupo Lantero

- Gualapack Group

KEY QUESTIONS ANSWERED

- How big is the Europe flexible packaging market?

- What is the growth rate of the Europe flexible packaging market?

- What factors impact the growth of the Europe flexible packaging market?

- Which are the key players in the Europe flexible packaging market?

- Which country holds the most significant Europe flexible packaging market share?

Table of Contents

1 Research Methodology2 Research Objectives

3 Research Process

4 Scope & Coverage

4.1 Market Definition

4.1.1 Inclusions

4.1.2 Exclusions

4.1.3 Market Estimation Caveats

4.2 Base Year

4.3 Scope of the Study

4.3.1 Market Segmentation by Material

4.3.2 Market Segmentation by Application

4.3.3 Market Segmentation by End-user

4.3.4 Market Segmentation by Product

4.3.5 Market Segmentation by Printing

4.3.6 Market Segmentation by Geography

5 Report Assumptions & Caveats

5.1 Key Caveats

5.2 Currency Conversion

5.3 Market Derivation

6 Market at a Glance

7 Premium Insights

7.1 Market Definition

7.2 Report Overview

7.3 Covid-19 Impact Analysis

7.4 Opportunities & Challenge Analysis

7.5 Segment Analysis

7.6 Regional Analysis

7.7 Competitive Landscape

7.8 Frequently Asked Questions

8 Introduction

8.1 Overview

8.1.1 Flexible Plastic Packaging

8.1.2 Food & Beverages

8.1.3 Pouches

8.1.4 Key Strategies

8.1.5 Major Highlights

8.1.6 Mega Trends

8.1.7 Flexible Packaging: Beyond 2023

8.2 Key Insights

8.2.1 Raw Material

8.2.2 Pricing

8.3 Impact of Covid-19

8.3.1 Packaging Sector 2020

8.3.2 Post-Covid Highligths

8.3.3 Impact on Flexible Packaging Supply Chain

8.3.4 Pharmaceutical Packaging

8.3.5 Major Vendor Concerns

8.4 Value Chain Analysis

8.4.1 Material Suppliers

8.4.2 Manufacturers

8.4.3 Distributors

8.4.4 Application

8.5 Key Developments & Acquisitions

8.5.1 Key Acquisitions

8.5.2 Key Developments

8.6 Expert Opinion

9 Market Opportunities & Trends

9.1 High Focus on Sustainable & Flexible Packaging

9.2 Use of High-Barrier Plastic Packaging Materials

9.3 Preference for Flexible Packaging Over Rigid Packaging

9.4 Unprecedented Growth of E-Commerce Industry

9.5 Adoption of Modified Atmospheric Packaging Products

10 Market Growth Enablers

10.1 Rising Demand from Healthcare Industry

10.2 High Demand for Lightweight Products

10.3 Surge in Adoption of Pouch Packaging

10.4 High Consumption of Processed and Packaged Food

10.5 High Demand for Shelf-Life-Extending Packaging

10.6 Demand for Sustainable Packaging Products from Personal Care Industry

11 Market Restraints

11.1 Recycling Challenges Associated With Flexible Packaging Products

11.2 Higher Operational Costs

11.3 Highly Fragmented Marketplace

11.4 Rising Raw Material Prices

12 Market Landscape

12.1 Market Overview

12.1.1 Regional Insights

12.1.2 Flexible Plastic: Market Dynamics

12.1.3 Flexible Paper: Market Dynamics

12.1.4 Flexible Foils: Market Dynamics

12.2 Market Size & Forecast

12.3 Product

12.3.1 Market Size & Forecast

12.4 Material

12.4.1 Market Size & Forecast

12.5 Application

12.5.1 Market Size & Forecast

12.6 End-user

12.6.1 Market Size & Forecast

12.7 Printing

12.7.1 Market Size & Forecast

12.8 Five Forces Analysis

12.8.1 Threat of New Entrants

12.8.2 Bargaining Power of Suppliers

12.8.3 Bargaining Power of Buyers

12.8.4 Threat of Substitutes

12.8.5 Competitive Rivalry

13 Material

13.1 Market Snapshot & Growth Engine

13.2 Market Overview

13.2.1 Flexible Plastic

13.2.2 Flexible Paper

13.2.3 Foil

13.3 Flexible Plastic

13.3.1 Market Overview

13.3.2 Market Size & Forecast

13.3.3 Pe (Polyethylene): Market Size & Forecast

13.3.4 Bopp (Biaxially Oriented Polypropylene): Market Size & Forecast

13.3.5 Cpp (Cast Polypropylene): Market Size & Forecast

13.3.6 Bopet (Biaxially-Oriented Polyethylene Terephthalate): Market Size & Forecast

13.3.7 Pa (Polyamide): Market Size & Forecast

13.3.8 Pet (Polyethylene Terephthalate): Market Size & Forecast

13.3.9 Pvc (Polyvinyl Chloride): Market Size & Forecast

13.3.10 Evoh (Ethylene-Vinyl Alcohol): Market Size & Forecast

13.3.11 Others: Market Size & Forecast

13.4 Flexible Paper

13.4.1 Market Overview

13.4.2 Market Size & Forecast

13.5 Foil

13.5.1 Market Overview

13.5.2 Impact Analysis During Covid-19 Pandemic

13.5.3 Market Size & Forecast

14 Application

14.1 Market Snapshot & Growth Engine

14.2 Market Overview

14.2.1 Post-Covid Scenario

14.2.2 Raw Material Insights

14.3 Consumer Packaging

14.3.1 Market Overview

14.3.2 Market Size & Forecast

14.3.3 Impact Analysis During Covid-19

14.3.4 Post Covid-19 Scenario

14.4 Industrial Packaging

14.4.1 Market Overview

14.4.2 Market Size & Forecast

14.4.3 Impact Analysis During Covid-19 Pandemic

14.4.4 Post Covid-19 Scenario

15 End-user

15.1 Market Snapshot & Growth Engine

15.2 Market Overview

15.2.1 Food & Beverage (Bakery & Confectionery, Dairy, Meat, Poultry & Seafood, Rte, Frozen Food, Tea & Coffee, and Others)

15.2.2 Healthcare

15.2.3 Personal Care

15.2.4 Pet Food

15.3 Bakery & Confectionery

15.3.1 Market Overview

15.3.2 Market Size & Forecast

15.3.3 Impact Analysis During Covid-19 Pandemic

15.3.4 Post Covid-19 Scenario

15.4 Meat, Poultry, & Seafood

15.4.1 Market Overview

15.4.2 Market Size & Forecast

15.4.3 Impact Analysis During Covid-19 Pandemic

15.4.4 Post Covid-19 Scenario

15.5 Dairy

15.5.1 Market Overview

15.5.2 Market Size & Forecast

15.5.3 Impact Analysis During Covid-19 Pandemic

15.5.4 Post Covid-19 Scenario

15.6 Ready-To-Eat (Rte)

15.6.1 Market Overview

15.6.2 Market Size & Forecast

15.6.3 Impact Analysis of Covid-19

15.6.4 Post Covid-19 Scenario

15.7 Healthcare

15.7.1 Market Overview

15.7.2 Market Size & Forecast

15.7.3 Impact Analysis During Covid-19 Pandemic

15.7.4 Post Covid-19 Scenario

15.8 Frozen Food

15.8.1 Market Overview

15.8.2 Market Size & Forecast

15.8.3 Impact Analysis During Covid-19 Pandemic

15.8.4 Post Covid-19 Scenario

15.9 Tea & Coffee

15.9.1 Market Overview

15.9.2 Market Size & Forecast

15.9.3 Impact Analysis During Covid-19 Pandemic

15.9.4 Post Covid-19 Scenario

15.10 Personal Care

15.10.1 Market Overview

15.10.2 Market Size & Forecast

15.10.3 Impact Analysis During Covid-19 Pandemic

15.10.4 Post Covid-19 Scenario

15.11 Petfood

15.11.1 Market Overview

15.11.2 Market Size & Forecast

15.11.3 Demand Insights in Covid-19

15.11.4 Post Covid-19 Scenario

15.12 Other

15.12.1 Market Overview

15.12.2 Market Size & Forecast

16 Product

16.1 Market Snapshot & Growth Engine

16.2 Market Overview

16.2.1 Bags & Sacks: Segment Insights

16.2.2 Pouches: Segment Insights

16.3 Bags & Sacks

16.3.1 Market Overview

16.3.2 Market Size & Forecast

16.3.3 Impact Analysis During Covid-19 Pandemic

16.4 Pouches

16.4.1 Market Overview

16.4.2 Market Size & Forecast

16.4.3 Impact Analysis During Covid-19 Pandemic

16.5 Others

16.5.1 Market Overview

16.5.2 Market Size & Forecast

17 Printing

17.1 Market Snapshot & Growth Engine

17.2 Market Overview

17.2.1 Regional Insight

17.3 Flexographic

17.3.1 Market Overview

17.3.2 Market Size & Forecast

17.3.3 Impact Analysis During Covid-19 Pandemic

17.4 Rotogravure

17.4.1 Market Overview

17.4.2 Market Size & Forecast

17.4.3 Impact Analysis During Covid-19 Pandemic

18 Europe

18.1 Market Overview

18.1.1 Demand Factors

18.1.2 Key Insights

18.1.3 Growth Driven by High Demand for Plastic Pouches

18.1.4 Impact Analysis During Covid-19 Pandemic

18.1.5 Post Covid-19 Scenario

18.2 Pest Analysis

18.2.1 Political

18.2.2 Economic

18.2.3 Social

18.2.4 Technology

18.3 Market Size & Forecast

18.4 Material

18.4.1 Market Size & Forecast

18.5 Product

18.5.1 Market Size & Forecast

18.6 Application

18.6.1 Market Size & Forecast

18.7 End-user

18.7.1 Market Size & Forecast

18.8 Key Countries

18.9 Germany

18.9.1 Market Size & Forecast

18.9.2 Impact Analysis During Covid-19 Pandemic

18.9.3 Material: Market Size & Forecast

18.9.4 Product: Market Size & Forecast

18.9.5 Application: Market Size & Forecast

18.9.6 End-user: Market Size & Forecast

18.10 France

18.10.1 Market Size & Forecast

18.10.2 Impact Analysis During Covid-19 Pandemic

18.10.3 Material: Market Size & Forecast

18.10.4 Product: Market Size & Forecast

18.10.5 Application: Market Size & Forecast

18.10.6 End-user: Market Size & Forecast

18.11 UK

18.11.1 Market Size & Forecast

18.11.2 Impact Analysis During Covid-19 Pandemic

18.11.3 Material: Market Size & Forecast

18.11.4 Product: Market Size & Forecast

18.11.5 Application: Market Size & Forecast

18.11.6 End-user: Market Size & Forecast

18.12 Italy

18.12.1 Market Size & Forecast

18.12.2 Impact Analysis During Covid-19 Pandemic

18.12.3 Material: Market Size & Forecast

18.12.4 Product: Market Size & Forecast

18.12.5 Application: Market Size & Forecast

18.12.6 End-user: Market Size & Forecast

18.13 Benelux

18.13.1 Market Size & Forecast

18.13.2 Belgium

18.13.3 Netherlands

18.13.4 Luxembourg

18.13.5 Impact Analysis During Covid-19 Pandemic

18.13.6 Material: Market Size & Forecast

18.13.7 Product: Market Size & Forecast

18.13.8 Application: Market Size & Forecast

18.13.9 End-user: Market Size & Forecast

18.14 Spain

18.14.1 Market Size & Forecast

18.14.2 Impact Analysis During Covid-19 Pandemic

18.14.3 Material: Market Size & Forecast

18.14.4 Product: Market Size & Forecast

18.14.5 Application: Market Size & Forecast

18.14.6 Consumer Flexible Packaging End-user: Market Size & Forecast

18.15 Austria

18.15.1 Market Size & Forecast

18.15.2 Impact Analysis During Covid-19 Pandemic

18.15.3 Material: Market Size & Forecast

18.15.4 Product: Market Size & Forecast

18.15.5 Application: Market Size & Forecast

18.15.6 Consumer Flexible Packaging End-user: Market Size & Forecast

18.16 Scandinavia

18.16.1 Market Size & Forecast

18.16.2 Denmark

18.16.3 Norway

18.16.4 Sweden

18.16.5 Impact Analysis During Covid-19 Pandemic

18.16.6 Material: Market Size & Forecast

18.16.7 Product: Market Size & Forecast

18.16.8 Application: Market Size & Forecast

18.16.9 End-user: Market Size & Forecast

18.17 Switzerland

18.17.1 Market Size & Forecast

18.17.2 Material: Market Size & Forecast

18.17.3 Product: Market Size & Forecast

18.17.4 Application: Market Size & Forecast

18.17.5 End-user: Market Size & Forecast

18.18 Rest of Europe

18.18.1 Market Size & Forecast

18.18.2 Material: Market Size & Forecast

18.18.3 Product: Market Size & Forecast

18.18.4 Application: Market Size & Forecast

18.18.5 End-user: Market Size & Forecast

19 Competitive Landscape

19.1 Competition Overview

20 Key Company Profiles

20.1 Amcor

20.1.1 Business Overview

20.1.2 Product Offerings

20.1.3 Key Strategies

20.1.4 Key Strengths

20.1.5 Key Opportunities

20.2 Berry Global

20.2.1 Business Overview

20.2.2 Product Offerings

20.2.3 Key Strategies

20.2.4 Key Strengths

20.2.5 Key Opportunities

20.3 Mondi

20.3.1 Business Overview

20.3.2 Product Offerings

20.3.3 Key Strategies

20.3.4 Key Strengths

20.3.5 Key Opportunities

20.4 Sealed Air

20.4.1 Business Overview

20.4.2 Product Offerings

20.4.3 Key Strategies

20.4.4 Key Strengths

20.4.5 Key Opportunities

20.5 Tc Transcontinental

20.5.1 Business Overview

20.5.2 Product Offerings

20.5.3 Key Strategies

20.5.4 Key Strengths

20.5.5 Key Opportunities

20.6 Sonoco

20.6.1 Business Overview

20.6.2 Product Offerings

20.6.3 Key Strategies

20.6.4 Key Strengths

20.6.5 Key Opportunities

20.7 Huhtamaki

20.7.1 Business Overview

20.7.2 Product Offerings

20.7.3 Key Strategies

20.7.4 Key Strengths

20.7.5 Key Opportunities

20.8 Constantia Flexibles

20.8.1 Business Overview

20.8.2 Product Offerings

20.8.3 Key Strategies

20.8.4 Key Strengths

20.8.5 Key Opportunities

20.9 Ahlstrom

20.9.1 Business Overview

20.9.2 Product Offerings

20.9.3 Key Strategies

20.9.4 Key Strengths

20.9.5 Key Opportunities

20.10 Greif

20.10.1 Business Overview

20.10.2 Product Offerings

20.10.3 Key Strategies

20.10.4 Key Strengths

20.10.5 Key Opportunities

20.11 Westrock Company

20.11.1 Business Overview

20.11.2 Product Offerings

20.11.3 Key Strategies

20.11.4 Key Strengths

20.11.5 Key Opportunities

20.12 Smurfit Kappa

20.12.1 Business Overview

20.12.2 Product Offerings

20.12.3 Key Strategies

20.12.4 Key Strengths

20.12.5 Key Opportunities

20.13 Alu Flex Pack

20.13.1 Business Overview

20.13.2 Product Offerings

20.13.3 Key Strategies

20.13.4 Key Strengths

20.13.5 Key Opportunities

20.14 Aptar Group

20.14.1 Business Overview

20.14.2 Product Offerings

20.14.3 Key Strategies

20.14.4 Key Strengths

20.14.5 Key Opportunities

21 Other Prominent Vendors

21.1 Alinvest

21.1.1 Business Overview

21.1.2 Product Offerings

21.2 Aran Group

21.2.1 Business Overview

21.2.2 Product Offerings

21.3 Aluberg

21.3.1 Business Overview

21.3.2 Product Offerings

21.4 Bischof+Klein

21.4.1 Business Overview

21.4.2 Product Offerings

21.5 Bioplast

21.5.1 Business Overview

21.5.2 Product Offerings

21.6 Carcano

21.6.1 Business Overview

21.6.2 Product Offerings

21.7 Danaflex

21.7.1 Business Overview

21.7.2 Product Offerings

21.8 Proampac

21.8.1 Business Overview

21.8.2 Product Offerings

21.9 Wipak Group

21.9.1 Business Overview

21.9.2 Product Offerings

21.10 Saica

21.10.1 Business Overview

21.10.2 Product Offerings

21.11 Etapack

21.11.1 Business Overview

21.11.2 Product Offerings

21.12 Innovia Films

21.12.1 Business Overview

21.12.2 Product Offerings

21.13 Uflex

21.13.1 Business Overview

21.13.2 Product Offerings

21.14 International Paper

21.14.1 Business Overview

21.14.2 Product Offerings

21.15 Novolex

21.15.1 Business Overview

21.15.2 Product Offerings

21.16 Sigma Plastics

21.16.1 Business Overview

21.16.2 Product Offerings

21.17 Symetal

21.17.1 Business Overview

21.17.2 Product Offerings

21.18 Krajcar Pack

21.18.1 Business Overview

21.18.2 Product Offerings

21.19 Itp

21.19.1 Business Overview

21.19.2 Product Offerings

21.20 Gascogne Flexible

21.20.1 Business Overview

21.20.2 Product Offerings

21.21 Schur Flexibles

21.21.1 Business Overview

21.21.2 Product Offerings

21.22 Schmid and Folien

21.22.1 Business Overview

21.22.2 Product Offerings

21.23 Rkw

21.23.1 Business Overview

21.23.2 Product Offerings

21.24 Pouch Partners

21.24.1 Business Overview

21.24.2 Product Offerings

21.25 Perlen Packaging

21.25.1 Business Overview

21.25.2 Product Offerings

21.26 Goglio Packaging

21.26.1 Business Overview

21.26.2 Product Offerings

21.27 Kleiner Flexible Packaging

21.27.1 Business Overview

21.27.2 Product Offerings

21.28 Stora Enso

21.28.1 Business Overview

21.28.2 Product Offerings

21.29 Di Mauro

21.29.1 Business Overview

21.29.2 Product Offerings

21.30 Eurofoil

21.30.1 Business Overview

21.30.2 Product Offerings

21.31 Gerosa Group

21.31.1 Business Overview

21.31.2 Product Offerings

21.32 Leeb Flexibles

21.32.1 Business Overview

21.32.2 Product Offerings

21.33 Polypak Packaging

21.33.1 Business Overview

21.33.2 Product Offerings

21.34 Ppg

21.34.1 Business Overview

21.34.2 Product Offerings

21.35 Walki

21.35.1 Business Overview

21.35.2 Product Offerings

21.36 All4Labels

21.36.1 Business Overview

21.36.2 Product Offerings

21.37 Sig Combibloc Group

21.37.1 Business Overview

21.37.2 Product Offerings

21.38 Ringmetall Se

21.38.1 Business Overview

21.38.2 Product Offerings

21.39 the Reflex Group

21.39.1 Business Overview

21.39.2 Product Offerings

21.40 Südpack

21.40.1 Business Overview

21.40.2 Product Offerings

21.41 Coveris

21.41.1 Business Overview

21.41.2 Product Offerings

21.42 Wipf AG

21.42.1 Business Overview

21.42.2 Product Offerings

21.43 Clondalkin Packaging

21.43.1 Business Overview

21.43.2 Product Offerings

21.44 Korozo Group

21.44.1 Business Overview

21.44.2 Product Offerings

21.45 Grupo Lantero

21.45.1 Business Overview

21.45.2 Product Offerings

21.46 Gualapack Group

21.46.1 Business Overview

21.46.2 Product Offerings

22 Report Summary

22.1 Key Takeaways

22.2 Strategic Recommendations

23 Quantitative Summary

23.1 Market by Country

23.2 Europe

23.2.1 Material: Market Size & Forecast

23.2.2 Product: Market Size & Forecast

23.2.3 Application: Market Size & Forecast

23.2.4 End-user: Market Size & Forecast

23.3 Germany

23.3.1 Material: Market Size & Forecast

23.3.2 Product: Market Size & Forecast

23.3.3 Application: Market Size & Forecast

23.3.4 End-user: Market Size & Forecast

23.4 France

23.4.1 Material: Market Size & Forecast

23.4.2 Product: Market Size & Forecast

23.4.3 Application: Market Size & Forecast

23.4.4 End-user: Market Size & Forecast

23.5 UK

23.5.1 Material: Market Size & Forecast

23.5.2 Product: Market Size & Forecast

23.5.3 Application: Market Size & Forecast

23.5.4 End-user: Market Size & Forecast

23.6 Italy

23.6.1 Material: Market Size & Forecast

23.6.2 Product: Market Size & Forecast

23.6.3 Application: Market Size & Forecast

23.7 Benelux

23.7.1 Material: Market Size & Forecast

23.7.2 Product: Market Size & Forecast

23.7.3 Application: Market Size & Forecast

23.7.4 End-user: Market Size & Forecast

23.8 Spain

23.8.1 Material: Market Size & Forecast

23.8.2 Product: Market Size & Forecast

23.8.3 Application: Market Size & Forecast

23.8.4 End-user: Market Size & Forecast

23.9 Austria

23.9.1 Material: Market Size & Forecast

23.9.2 Product: Market Size & Forecast

23.9.3 Application: Market Size & Forecast

23.9.4 End-user: Market Size & Forecast

23.10 Scandinavia

23.10.1 Material: Market Size & Forecast

23.10.2 Product: Market Size & Forecast

23.10.3 Application: Market Size & Forecast

23.10.4 End-user: Market Size & Forecast

23.11 Switzerland

23.11.1 Material: Market Size & Forecast

23.11.2 Product: Market Size & Forecast

23.11.3 Application: Market Size & Forecast

23.11.4 End-user: Market Size & Forecast

23.12 Rest of Europe

23.12.1 Material: Market Size & Forecast

23.12.2 Product: Market Size & Forecast

23.12.3 Application: Market Size & Forecast

23.12.4 End-user: Market Size & Forecast

24 Appendix

24.1 Abbreviations

Companies Mentioned

- Amcor

- Berry Global

- Mondi

- Sealed Air

- TC Transcontinental Packaging

- Sonoco

- Huhtamaki

- Constantia Flexibles

- Ahlstrom

- Greif

- WestRock

- Smurfit Kappa

- Alu Flex Pack

- Aptar Group

- Alinvest

- Aran Group

- Aluberg

- Bischof + Klein

- Bioplast

- Carcano

- Danaflex

- ProAmpac

- Wipak Group

- Saica

- Etapak (Baskı Ambalaj)

- Innovia Films

- UFlex

- International Paper

- Novolex

- Sigma Plastics

- Symetal

- Krajcár Packaging

- ITP

- Gascogne Flexible

- Schur Flexibles

- Schmid Folien

- RKW Group

- Pouch Partners

- Perlen Packaging

- Goglio Packaging

- Kleiner Flexible Packaging

- Stora Enso

- Di Mauro

- Eurofoil

- Gerosa Group

- LEEB Flexibles

- PolyPak

- PPG

- Walki

- All4Labels

- SIG Combibloc Group

- Ringmetall SE

- The Reflex Group

- Süpack

- Coveris

- Wipf AG

- Clondalkin Packaging

- Korozo Group

- Grupo Lantero

- Gualapack Group

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

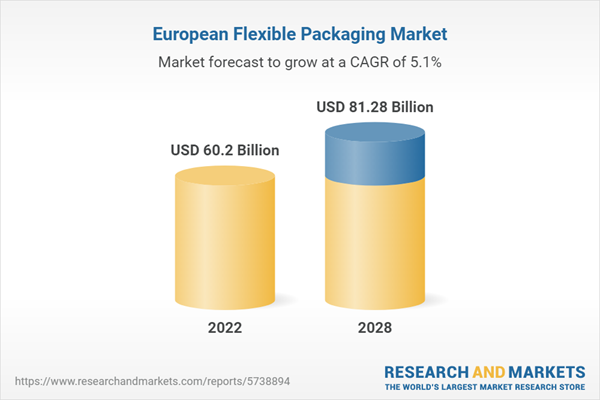

| Report Attribute | Details |

|---|---|

| No. of Pages | 375 |

| Published | February 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 60.2 Billion |

| Forecasted Market Value ( USD | $ 81.28 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 60 |