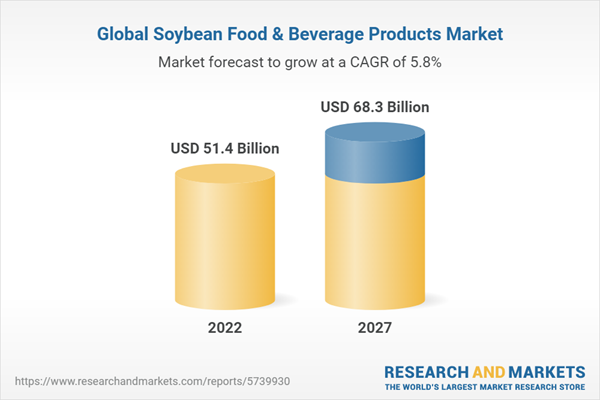

The global soybean food and beverage products market is estimated to be valued at USD 51.4 billion in 2022. It is projected to reach USD 68.3 billion by 2027, recording a CAGR of 5.8% during the forecast period. Affordability, convenience, taste, and health benefits are important factors that drive the growth of the soybean food and beverage products market. Increasing health concerns such as obesity and high blood pressure are driving manufacturers in the soybean food & beverage industry to develop sustainable measures, such as the usage of healthy and natural soybean oils, soybean ingredients, soybean food & additives etc. instead of artificial and synthetic ingredients as coloring and flavoring agents. Increased health-consciousness and calorie counting have resulted in an increase in demand for soybean food and beverage products; this market is also driven by product innovation and leading to higher purchase volumes of premium soybean food product offerings.

North America is projected to witness the growth of 6.3% during the forecast period

North America is the largest market for soy protein ingredients. In 2021, it accounted for a 21.3% share of the global soybean food & beverage products market. Growing lactose intolerance among people, which leads them to consume soy products rather than milk and its byproducts, is the secondary driver. Many people who are lactose intolerant live in the US, Europe, Africa, and Asia. Adding various flavors to soy products increases their appeal and demand among consumers. The price of soy is a major selling point because it is significantly less expensive than milk products. More customers are drawn to the products as a result. Given that soy has comparatively fewer calories and several health benefits, health consciousness individuals primarily drive the soy market.

Innovation & developments related to plant-based protein to augment vegan trend

According to a study published by the European Vegetarian Union in 2019, the vegan population in Europe contributes to more than 6% of the European population. This formed one of the prime factors driving the food & beverage manufacturers toward innovation and development of meat alternatives, dairy alternatives, and protein nutritional beverages, and a boost to plant-based food & beverages. Manufacturers such as Archer Daniels Midland Company (US), DuPont (US), Roquette Frères (France), Kerry Group (Ireland), Ingredion (US), Beyond Meat (US), and Tyson Foods (US) have been emphasizing the development of plant-based protein food & beverages.

Possibilities of nutritional and vitamin deficiencies among vegan is a restraint in the soybean food and beverage products market

Vegan diets have been beneficial for human health, but completely cutting animal-sourced food products might pose uncertainty in obtaining crucial nutrients. Plenty of plant protein sources include lentils, beans, chickpeas, nuts, seeds, soy products, and whole grains. Many consumers have been assuming that getting enough protein on a plant-based diet will not be a problem. Still, eradicating animal-sourced food products can cause a deficiency of vitamin B12, omega-3 fatty acids, iron, and creatinine. Soy proteins have large quantities of phytic acid, which has the potential to block the absorption of essential minerals such as calcium, magnesium, copper, iron, and zinc.

Therefore, vegetarians who consume tofu as an alternative to meat and dairy proteins are prone to a mineral deficiency. Omega-3 are essential fatty acids that are crucial for adverse effects on brain and heart health. They are largely sourced from fish and eggs but are also found in walnuts and hemp seeds at comparatively low levels. Meat consists of a type of iron, called heme iron, which is much better absorbed in the human body than non-heme iron sourced from plant-based food. Non-heme iron is poorly absorbed, and its absorption can be limited further by anti-nutrients present in plant-based food, such as phytic acid. Therefore, these deficiencies in plant-based food products are projected to restrain the global plant-based protein market during the forecast period.

Break-up of Primaries

- By Value Chain Side: Demand Side - 41% and Supply Side - 59%

- By Designation: Managers - 24%, CXOs - 31%, and Executives - 45%

- By Region: Europe - 18%, Asia-Pacific - 51%, North America - 21%, and RoW - 10%

Leading players profiled in this report:

- Willmar International Limited (Singapore)

- Cargill, Incorporated (US)

- CHS Inc. (US)

- ADM (US)

- Kikkoman Group (Japan)

- Alpro (Belgium)

- Barentz (Netherlands)

- Eden Food (US)

- Caramuru (Brazil)

- Hain Celestial Group (US)

- Patanjali Foods Limited (India)

- Vitasoy (Hong Kong)

- Galaxy Nutritional Foods (US)

- Foodchem International Corporation (China)

- Crown Soya Protein Group (China)

- The Scoular Company (US)

- Northern Soy (US)

- Solbar Ltd. (China)

- Farbest Tallman Foods Corporation (US)

- Perdue Agribusiness (US)

- Sotexpro (France)

- Bermil Group (Brazil)

- Rio Pardo Potential Vegetal S.A. (Brazil)

- Good Catch Foods (Pennysylvani)

- Living Foods (India)

Research Coverage

The report segments the soybean food and beverage products market on the basis of type, end-user, source, and region. In terms of insights, this report has focused on various levels of analyses - the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the global soybean food and beverage products , high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

- To get a comprehensive overview of the soybean food and beverage products market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights about the major countries/regions in which the soybean food and beverage products market is flourishing

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

Figure 1 Market Segmentation

1.3.1 Regions Covered

1.3.2 Inclusions & Exclusions

1.3.3 Years Considered

1.4 Currency Considered

Table 1 USD Exchange Rates, 2017-2021

1.5 Units Considered

1.6 Stakeholders

1.7 Recession Impact

2 Research Methodology

2.1 Research Data

Figure 2 Soybean Food and Beverage Products Market: Research Design

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

Figure 3 Breakdown of Primary Interviews: by Company Type, Designation, and Region

2.2 Market Size Estimation

2.2.1 Market Size Estimation: Bottom-Up Approach

Figure 4 Soybean Food and Beverage Products Market Size Estimation: Bottom-Up Approach

Figure 5 Soybean Food and Beverage Products Market Size Estimation (Demand Side)

2.2.2 Market Size Estimation: Top-Down Approach

Figure 6 Soybean Food and Beverage Products Market Size Estimation: Top-Down Approach

Figure 7 Soybean Food and Beverage Products Market Size Estimation, by Type (Supply Side)

2.3 Growth Rate Forecast Assumption

2.4 Data Triangulation

Figure 8 Data Triangulation

2.5 Assumptions

Table 2 Assumptions

2.6 Limitations & Associated Risks

Table 3 Limitations & Associated Risks

2.7 Impact of Recession

3 Executive Summary

Table 4 Soybean Food and Beverage Products Market Snapshot, 2022 vs. 2027

Figure 9 Soybean Food and Beverage Products Market, by Type, 2022 vs. 2027 (USD Million)

Figure 10 Soybean Food and Beverage Products Market, by Distribution Channel, 2022 vs. 2027

Figure 11 Soybean Food and Beverage Products Market, by Application, 2022 vs. 2027 (USD Million)

Figure 12 Soybean Food and Beverage Products Market: Regional Snapshot

4 Premium Insights

4.1 Opportunities for Soybean Food and Beverage Products Market Players

Figure 13 Rise in Demand for Plant-based Products to Fuel Demand for Soybean Food and Beverage Products

4.2 Soybean Food and Beverage Products Market, by Type and Region

Figure 14 Asia-Pacific to Account for Largest Market Share

4.3 Asia-Pacific: Soybean Food and Beverage Products Market, by Country and Type

Figure 15 China Consumed Majority of Soybean Food and Beverage Products in 2021

4.4 Soybean Food and Beverage Products Market: Major Regional Submarkets

Figure 16 China Accounted for Largest Market Share in 2021

5 Market Overview

5.1 Introduction

5.2 Macroeconomic Indicators

5.2.1 Growing Trend of Meat and Dairy Alternatives

Figure 17 US: Annual Sales of Plant-based Food & Beverages, 2018-2021 (USD Billion)

5.2.2 Growing Vegan and Flexitarian Population Worldwide

Figure 18 Global Vegan Population, 2014-2022

5.2.3 Increased Soybean Production

Figure 19 Soybean Production, 2016-2020 (Million Tons)

5.3 Market Dynamics

Figure 20 Soybean Food and Beverage Products Market: Drivers, Restraints, Opportunities, and Challenges

5.3.1 Drivers

5.3.1.1 Rising Instances of Lactose Intolerance and Milk Allergies Globally

5.3.1.2 Innovations & Developments Related to Plant-based Protein to Augment Vegan Trend

5.3.1.3 Preferred Alternative Over Meat and Dairy Proteins

5.3.2 Restraints

5.3.2.1 Allergies Associated with Plant-based Protein Sources

5.3.2.2 Possibilities of Nutritional & Vitamin Deficiencies Among Vegans

5.3.3 Opportunities

5.3.3.1 Soy Used for Customization of Food & Beverage to Create Versatile Products

5.3.4 Challenges

5.3.4.1 Concerns Over Quality of Food & Beverages due to Adulteration of GM Ingredients

6 Industry Trends

6.1 Introduction

6.2 Regulatory Framework

6.2.1 Regulatory Bodies, Government Agencies, and Other Organizations

Table 5 North America: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 6 Europe: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 7 Asia-Pacific: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 8 South America: List of Regulatory Bodies, Government Agencies, and Other Organizations

Table 9 Africa: List of Regulatory Bodies, Government Agencies, and Other Organizations

6.2.2 North America

6.2.2.1 US

Table 10 Soymilk Composition

6.2.2.2 Canada

6.2.3 Europe

6.2.4 Asia-Pacific

6.2.4.1 China

6.2.4.2 India

6.2.5 South America

6.2.5.1 Argentina

6.2.5.2 Brazil

6.3 Patent Analysis

Figure 21 Number of Patents Approved for Soybean Food and Beverage Products, 2012-2021

Figure 22 Jurisdictions with Highest Patent Approvals for Soybean Food and Beverage Products, 2012-2021

Table 11 List of Key Patents Pertaining to Soybean Food and Beverage Products, 2018-2022

6.4 Value Chain Analysis

6.4.1 Research & Development

6.4.2 Sourcing of Raw Materials

6.4.3 Production & Processing

6.4.4 Distribution, Marketing, and Sales

Figure 23 Soybean Food and Beverage Products Market: Value Chain

6.5 Trends/Disruptions Impacting Buyers in Soybean Food and Beverage Products Market

Figure 24 Revenue Shift for Soybean Food and Beverage Products Market

6.6 Market Ecosystem

6.6.1 Demand Side

6.6.2 Supply Side

Figure 25 Soybean Food and Beverage Products: Market Map

Table 12 Soybean Food and Beverage Products Market: Ecosystem View

6.7 Trade Analysis

6.7.1 Soybean Oil

Figure 26 Import Value of Soybean Food and Beverage Products for Key Countries, 2017-2021

Table 13 Top 10 Importers of Crude Soybean Oil, 2021 (USD)

Figure 27 Export Value of Soybean Food and Beverage Products for Key Countries, 2017-2021

Table 14 Top 10 Exporters of Crude Soybean Oil, 2021 (USD)

6.7.2 Soybeans

Figure 28 Export Value of Soybean for Key Countries, 2017-2021

Table 15 Export Value of Soybean for Key Countries, 2021 (USD)

Figure 29 Import Value of Soybean for Key Countries, 2017-2021

Table 16 Import Value of Soybean for Key Countries, 2021 (USD)

6.8 Pricing Analysis

6.8.1 Average Selling Price Analysis: Soybean Food and Beverage Products Market, by Type, 2017-2021 (USD/KG)

Figure 30 Pricing Analysis for Soybean Food and Beverage Products Market, by Type, 2017-2021 (USD/KG)

6.8.2 Average Selling Price Analysis: Soybean Food and Beverage Products Market, by Region, 2017-2021 (USD/KG)

Figure 31 Pricing Analysis for Soybean Food and Beverage Products Market, by Region, 2017-2021 (USD/KG)

Figure 32 Average Selling Price Trend of Key Players, by Type, 2017-2021 (USD/KG Average Selling Price Trend of Key Players, by Type, 2017-2021 (USD/KG)

6.9 Technology Analysis

6.9.1 3-D Printing

6.9.2 Isolated Soybean Proteins

Table 17 Composition of ISP (% Weight) in Soybean Protein Products

Figure 33 Production of Isolated Soybean Proteins: Technology Analysis

6.9.3 Extrusion

6.10 Case Studies

6.10.1 ADM and Benson Hill Partner to Scale Innovation in Ultra-High Protein Soy

6.10.2 CDF Corporation and Kikkoman Group Collaborate to Pack and Transport Soy Sauce Safely

6.11 Key Conferences & Events, 2022-2023

Table 18 Soybean Food and Beverage Products Market: Detailed List of Conferences & Events, 2022-2023

6.12 Porter's Five Forces Analysis

Table 19 Soybean Food and Beverage Products Market: Porter's Five Forces Analysis

6.12.1 Threat of New Entrants

6.12.2 Threat of Substitutes

6.12.3 Bargaining Power of Suppliers

6.12.4 Bargaining Power of Buyers

6.12.5 Intensity of Competitive Rivalry

6.13 Key Stakeholders and Buying Criteria

6.13.1 Key Stakeholders in Buying Process

Figure 34 Influence of Stakeholders on Buying Soybean Food and Beverage Products Application

Table 20 Influence of Stakeholders on Buying for Top Three Applications

6.13.2 Buying Criteria

Figure 35 Key Buying Criteria for Top Applications

Table 21 Key Buying Criteria for Soybean Food and Beverage Products Applications

6.14 Recession Impact on Soybean Food & Beverage Products Market

6.14.1 Macroeconomic Indicators of Recession

Figure 36 Indicators of Recession

Figure 37 World Inflation Rate: 2011-2021

Figure 38 Global GDP: 2011-2021 (USD Trillion)

Figure 39 Global Food Ingredients Market: Earlier Forecast vs Recession Forecast

Figure 40 Recession Indicators and Their Impact on Soybean Food and Beverage Products Market

Figure 41 Global Soybean Food and Beverage Products Market: Earlier Forecast vs Recession Forecast

7 Soybean Food & Beverage Products Market, by Type

7.1 Introduction

Figure 42 Soybean Food & Beverage Products Market, by Type, 2022 vs. 2027 (USD Million)

Table 22 Market, by Type, 2017-2021 (USD Million)

Table 23 Market, by Type, 2022-2027 (USD Million)

Table 24 Market, by Type, 2017-2021 (Kilotons)

Table 25 Market, by Type, 2022-2027 (Kilotons)

7.2 Soybean Food Products

7.2.1 Soybean Food Products to Boost Soybean Food Market

Table 26 Soybean Food Products: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 27 Soybean Food Products: Market, by Region, 2022-2027 (USD Million)

Table 28 Soybean Food Products: Market, by Type, 2017-2021 (USD Million)

Table 29 Soybean Food Products: Market, by Type, 2022-2027 (USD Million)

7.2.2 Fermented

7.2.2.1 Fermented Foods Rich in Antioxidants to Provide Health Benefits

Table 30 Fermented Soybean Food Products: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 31 Fermented Soybean Food Products: Market, by Region, 2022-2027 (USD Million)

Table 32 Fermented Soybean Food Products: Market, by Type, 2017-2021 (USD Million)

Table 33 Fermented Soybean Food Products: Soybean Food & Beverage Products Market, by Type, 2022-2027 (USD Million)

7.2.2.2 Soy Sauce

7.2.2.2.1 Nutritious and Umami Flavor to Augment Demand for Soy Sauces

Table 34 Soy Sauce: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 35 Soy Sauce: Market, by Region, 2022-2027 (USD Million)

7.2.2.3 Natto

7.2.2.3.1 Ready-To-Eat Market to Surge Demand

Table 36 Natto: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 37 Natto: Market, by Region, 2022-2027 (USD Million)

7.2.2.4 Tempeh

7.2.2.4.1 Growing Consumption of Tempeh Likely to Drive Demand

Table 38 Tempeh: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 39 Tempeh: Market, by Region, 2022-2027 (USD Million)

7.2.2.5 Miso

7.2.2.5.1 Demand for Healthy and Organic Food

Table 40 Miso: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 41 Miso: Market, by Region, 2022-2027 (USD Million)

7.2.2.6 Soy Cheese

7.2.2.6.1 Shift Toward Soy Cheese to Drive Market

Table 42 Soy Cheese: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 43 Soy Cheese: Market, by Region, 2022-2027 (USD Million)

7.2.2.7 Soy Yogurt

7.2.2.7.1 Growing Population of Lactose Intolerance to Surge Demand for Plant-based Yogurt

Table 44 Soy Yogurt: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 45 Soy Yogurt: Market, by Region, 2022-2027 (USD Million)

7.2.2.8 Soy Nut Butter

7.2.2.8.1 Shift Toward Soy Nut Butter to Lose Weight

Table 46 Soy Nut Butter: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 47 Soy Nut Butter: Market, by Region, 2022-2027 (USD Million)

7.2.2.9 Tofu

7.2.2.9.1 Veganism to Contribute to Growth of Tofu Globally

Table 48 Tofu: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 49 Tofu: Market, by Region, 2022-2027 (USD Million)

7.2.2.10 Soy Mayonnaise

7.2.2.10.1 Increased Demand for Plant-based Food Products to Raise Demand for Soy Mayonnaise

Table 50 Soy Mayonnaise: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 51 Soy Mayonnaise: Market, by Region, 2022-2027 (USD Million)

7.2.2.11 Yuba

7.2.2.11.1 Increase in Demand for Yuba in Asian Countries

Table 52 Yuba: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 53 Yuba: Market, by Region, 2022-2027 (USD Million)

7.2.2.12 Other Fermented Soybean Food Products

Table 54 Other Fermented Soybean Food Products: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 55 Other Fermented Soybean Food Products: Market, by Region, 2022-2027 (USD Million)

7.2.3 Non-Fermented

7.2.3.1 Demand for Gluten-Free, Organic, and Natural Food Products

Table 56 Non-Fermented Soybean Food Products: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 57 Non-Fermented Soybean Food Products: Market, by Region, 2022-2027 (USD Million)

Table 58 Non-Fermented Soybean Food Products: Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 59 Non-Fermented Soybean Food Products: Market, by Type, 2022-2027 (USD Million)

7.2.3.2 Soy Flour

7.2.3.2.1 Wide Range of Applications for Soy Flour to Support Market Growth

Table 60 Soy Flour: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 61 Soy Flour: Market, by Region, 2022-2027 (USD Million)

7.2.3.3 Soy Grits

7.2.3.3.1 High Quality Protein and Low Saturated Fat to Drive Demand for Soy Grits

Table 62 Soy Grits: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 63 Soy Grits: Market, by Region, 2022-2027 (USD Million)

7.2.3.4 Soymilk

7.2.3.4.1 Demand for Low-Calorie Food & Beverages to Drive Demand for Soymilk

Table 64 Soymilk: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 65 Soymilk: Market, by Region, 2022-2027 (USD Million)

7.2.3.5 Soy Nuts

7.2.3.5.1 Abundance of Antioxidants in Soy Nuts

Table 66 Soy Nuts: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 67 Soy Nuts: Market, by Region, 2022-2027 (USD Million)

7.3 Soybean Additives/Ingredients

7.3.1 High Nutritional Value of Soy Additives to Cater to Demand Among Population

Table 68 Soybean Additives/Ingredients: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 69 Soybean Additives/Ingredients: Market, by Region, 2022-2027 (USD Million)

Table 70 Soybean Additives/Ingredients: Market, by Type, 2017-2021 (USD Million)

Table 71 Soybean Additives/Ingredients: Market, by Type, 2022-2027 (USD Million)

7.3.2 Soy Protein Concentrate

7.3.2.1 Paleo Diet to Impact Soy Protein Concentrate Market

Table 72 Soy Protein Concentrates: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 73 Soy Protein Concentrates: Market, by Region, 2022-2027 (USD Million)

7.3.3 Soy Protein Isolates

7.3.3.1 Consumer Awareness Toward Environment to Drive Market for Soy Protein Isolate

Table 74 Soy Protein Isolates: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 75 Soy Protein Isolates: Market, by Region, 2022-2027 (USD Million)

7.3.4 Textured Soy Protein

7.3.4.1 Significant Rise in Demand for Plant-based Meat Alternatives

Table 76 Textured Soy Protein: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 77 Textured Soy Protein: Market, by Region, 2022-2027 (USD Million)

7.3.5 Soy Fiber

7.3.5.1 Demand for Soy Fibers to Cater Demand of Vegetarians and Vegans

Table 78 Soy Fiber: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 79 Soy Fiber: Market, by Region, 2022-2027 (USD Million)

7.3.6 Other Soybean Additives/Ingredients

Table 80 Other Soybean Additives/Ingredients: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 81 Other Soybean Additives/Ingredients: Market, by Region, 2022-2027 (USD Million)

7.4 Soybean Oils

7.4.1 Demand for Soybean Oil to Increase due to Its Rising Usage in Prepared Foods

Table 82 Soybean Oils: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 83 Soybean Oils: Market, by Region, 2022-2027 (USD Million)

Table 84 Soybean Oils: Market, by Type, 2017-2021 (USD Million)

Table 85 Soybean Oils: Market, by Type, 2022-2027 (USD Million)

7.4.2 Processed Soybean Oil

7.4.2.1 High Smoke Point of Soybean Oil to Increase Demand in Food Industries

Table 86 Processed Soybean Oils: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 87 Processed Soybean Oils: Market, by Region, 2022-2027 (USD Million)

7.4.3 Lecithin

7.4.3.1 Usage of Lecithin in Food & Beverage and Pharmaceutical Industry

Table 88 Lecithin: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 89 Lecithin: Market, by Region, 2022-2027 (USD Million)

8 Soybean Food & Beverage Products Market, by Application

8.1 Introduction

Figure 43 Soybean Food & Beverage Products Market, by Application, 2022 vs. 2027 (USD Million)

Table 90 Market, by Application, 2017-2021 (USD Million)

Table 91 Market, by Application, 2022-2027 (USD Million)

8.2 Bakery & Confectionery

8.2.1 Use of Soy Flour as a Binding Agent to Propel Demand

Table 92 Bakery & Confectionery: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 93 Bakery & Confectionery: Market, by Region, 2022-2027 (USD Million)

8.3 Dairy Products

8.3.1 Soymilk an Alternative to Cow Milk to Boost Beverage Market

Table 94 Dairy Products: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 95 Dairy Products: Market, by Region, 2022-2027 (USD Million)

8.4 Meat Products

8.4.1 Soy as an Alternative to Meat Products to Surge Demand

Table 96 Meat Products: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 97 Meat Products: Market, by Region, 2022-2027 (USD Million)

8.5 Functional Food & Supplements

8.5.1 Soy Foods Show Lower Cholesterol Level When Incorporated in Functional Foods

Table 98 Functional Food & Supplements: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 99 Functional Food & Supplements: Market, by Region, 2022-2027 (USD Million)

8.6 Infant Foods

8.6.1 Rising Instances of Lactose Intolerance to Drive Demand for Soy-based Ingredients

Table 100 Infant Foods: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 101 Infant Foods: Market, by Region, 2022-2027 (USD Million)

8.7 Animal Feed & Pet Food

8.7.1 High Digestibility of Soy and Low Fiber Intake in Cattle to Drive Demand for Soy Meal

Table 102 Animal Feed & Pet Food: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 103 Animal Feed & Pet Food: Market, by Region, 2022-2027 (USD Million)

8.8 Other Applications

Table 104 Other Applications: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 105 Other Applications: Market, by Region, 2022-2027 (USD Million)

9 Soybean Food & Beverage Products Markets Market, by Source

9.1 Introduction

Figure 44 Soybean Food & Beverage Products Market, by Source, 2022 vs. 2027 (USD Million)

Table 106 Market, by Source, 2017-2021 (USD Million)

Table 107 Market, by Source, 2022-2027 (USD Million)

9.2 Non-GM/GE

9.2.1 Significant Shift Toward Nutritious and Healthy Plant-based Drinks to Cater Demand for Non-GMO Beverages

Table 108 Non-GM/Non-GE: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 109 Non-GM/Non-GE: Market, by Region, 2022-2027 (USD Million)

9.3 GM

9.3.1 Genetically Modified Food Market to Grow due to Increased Awareness Toward Healthy Lifestyle

Table 110 GM: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 111 GM: Market, by Region, 2022-2027 (USD Million)

10 Soybean Food & Beverage Products Market, by Distribution Channel

10.1 Introduction

Figure 45 Soybean Food & Beverage Products Market, by Distribution Channel, 2022 vs. 2027 (USD Million)

Table 112 Market, by Distribution Channel, 2017-2021 (USD Million)

Table 113 Market, by Distribution Channel, 2022-2027 (USD Million)

10.2 Supermarkets

10.2.1 Wide Range of Soy Products at Lower Prices to Attract Customers

Table 114 Supermarkets: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 115 Supermarkets: Market, by Region, 2022-2027 (USD Million)

10.3 Hypermarkets

10.3.1 Availability of Soymilk, Tofu, and Soy Cheese to Drive Demand

Table 116 Hypermarkets: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 117 Hypermarkets: Market, by Region, 2022-2027 (USD Million)

10.4 Convenience Store

10.4.1 Ready-To-Eat Meals to Surge Demand for Convenience Stores

Table 118 Convenience Stores: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 119 Convenience Stores: Market, by Region, 2022-2027 (USD Million)

10.5 Departmental Stores

10.5.1 Availability of Wide Range of Goods in Departmental Stores

Table 120 Departmental Stores: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 121 Departmental Stores: Market, by Region, 2022-2027 (USD Million)

10.6 Specialty Stores

10.6.1 Premium Products in Specialty Stores to Increase Demand for Soy-based Products

Table 122 Specialty Stores: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 123 Specialty Stores: Market, by Region, 2022-2027 (USD Million)

10.7 Online Retailers

10.7.1 Convenience and User-Friendly Platforms to Become Viable Choice

Table 124 Online Retailers: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 125 Online Retailers: Market, by Region, 2022-2027 (USD Million)

10.8 Other Distribution Channels

Table 126 Other Distribution Channels: Soybean Food & Beverage Products Market, by Region, 2017-2021 (USD Million)

Table 127 Other Distribution Channels: Market, by Region, 2022-2027 (USD Million)

11 Soybean Food & Beverage Products Market, by Region

11.1 Introduction

Figure 46 Soybean Food & Beverage Products Market: Geographic Growth Opportunities

Table 128 Market, by Region, 2017-2021 (USD Million)

Table 129 Market, by Region, 2022-2027 (USD Million)

Table 130 Market, by Region, 2017-2021 (Kilotons)

Table 131 Market, by Region, 2022-2027 (Kilotons)

11.2 North America

Figure 47 North America: Soybean Food & Beverage Products Market Snapshot

Table 132 North America: Market, by Country, 2017-2021 (USD Million)

Table 133 North America: Market, 2022-2027 (USD Million)

Table 134 North America: Market, by Type, 2017-2021 (USD Million)

Table 135 North America: Market, by Type, 2022-2027 (USD Million)

Table 136 North America: Market, by Type, 2017-2021 (Kilotons)

Table 137 North America: Market, by Type, 2022-2027 (Kilotons)

Table 138 North America: Soybean Food Products Market, by Type, 2017-2021 (USD Million)

Table 139 North America: Market, by Type, 2022-2027 (USD Million)

Table 140 North America: Fermented Soybean Food Products Market, by Type, 2017-2021 (USD Million)

Table 141 North America: Market, by Type, 2022-2027 (USD Million)

Table 142 North America: Non-Fermented Soybean Food Products Market, by Type, 2017-2021 (USD Million)

Table 143 North America: Non-Fermented Soybean Food Products Market, by Type, 2022-2027 (USD Million)

Table 144 North America: Soybean Additives/Ingredients Market, by Type, 2017-2021 (USD Million)

Table 145 North America: Soybean Additives/Ingredients Market, by Type, 2022-2027 (USD Million)

Table 146 North America: Soybean Oil Market, by Type, 2017-2021 (USD Million)

Table 147 North America: Soybean Oil Market, by Type, 2022-2027 (USD Million)

Table 148 North America: Soybean Food & Beverage Products Market, by Application, 2017-2021 (USD Million)

Table 149 North America: Market, by Application, 2022-2027 (USD Million)

Table 150 North America: Market, by Distribution Channel, 2017-2021 (USD Million)

Table 151 North America: Market, by Distribution Channel, 2022-2027 (USD Million)

Table 152 North America: Market, by Source, 2017-2021 (USD Million)

Table 153 North America: Soybean Food & Beverage Products Market, by Source, 2022-2027 (USD Million)

11.2.1 North America: Recession Impact Analysis

Figure 48 North America: Inflation Rates, by Key Country, 2018-2021

Figure 49 North America: Recession Impact Analysis

11.2.2 US

11.2.2.1 Rising Inclination Toward Fiber-Rich Diet to Augment Demand for Soy-based Flour

Table 154 US: Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 155 US: Market, by Type, 2022-2027 (USD Million)

11.2.3 Canada

11.2.3.1 Canada Exports Most of Its Soybean to Cater to Needs of Consumers Globally

Table 156 Canada: Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 157 Canada: Market, by Type, 2022-2027 (USD Million)

11.2.4 Mexico

11.2.4.1 Rising Demand for Soybean Meal in Animal Feed Industry to Spur Market Demand

Table 158 Mexico: Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 159 Mexico: Market, by Type, 2022-2027 (USD Million)

11.3 Europe

Table 160 Europe: Soybean Food & Beverage Products Market, by Country, 2017-2021 (USD Million)

Table 161 Europe: Market, 2022-2027 (USD Million)

Table 162 Europe: Market, by Type, 2017-2021 (USD Million)

Table 163 Europe: Market, by Type, 2022-2027 (USD Million)

Table 164 Europe: Market, by Type, 2017-2021 (Kilotons)

Table 165 Europe: Market, by Type, 2022-2027 (Kilotons)

Table 166 Europe: Soybean Food Products Market, by Type, 2017-2021 (USD Million)

Table 167 Europe: Soybean Food Products Market, by Type, 2022-2027 (USD Million)

Table 168 Europe: Fermented Soybean Food Products Market, by Type, 2017-2021 (USD Million)

Table 169 Europe: Fermented Soybean Food Products Market, by Type, 2022-2027 (USD Million)

Table 170 Europe: Non-Fermented Soybean Food Products Market, by Type, 2017-2021 (USD Million)

Table 171 Europe: Non-Fermented Soybean Food Products Market, by Type, 2022-2027 (USD Million)

Table 172 Europe: Soybean Additives/Ingredients Market, by Type, 2017-2021 (USD Million)

Table 173 Europe: Soybean Additives/Ingredients Market, by Type, 2022-2027 (USD Million)

Table 174 Europe: Soybean Oil Market, by Type, 2017-2021 (USD Million)

Table 175 Europe: Soybean Oil Market, by Type, 2022-2027 (USD Million)

Table 176 Europe: Soybean Food & Beverage Products Market, by Application, 2017-2021 (USD Million)

Table 177 Europe: Market, by Application, 2022-2027 (USD Million)

Table 178 Europe: Market, by Distribution Channel, 2017-2021 (USD Million)

Table 179 Europe: Market, by Distribution Channel, 2022-2027 (USD Million)

Table 180 Europe: Market, by Source, 2017-2021 (USD Million)

Table 181 Europe: Market, by Source, 2022-2027 (USD Million)

11.3.1 Europe: Recession Impact Analysis

Figure 50 Europe: Inflation Rates, by Key Country, 2018-2021

Figure 51 European Soybean Food & Beverage Products Market: Recession Impact Analysis

11.3.2 Spain

11.3.2.1 Robust Growth of Plant-based Food Sector

Table 182 Spain: Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 183 Spain: Market, by Type, 2022-2027 (USD Million)

11.3.3 Germany

11.3.3.1 Increasing Demand for Meat Alternatives and Flexitarian Diet to Spur Growth

Table 184 Germany: Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 185 Germany: Market, by Type, 2022-2027 (USD Million)

11.3.4 France

11.3.4.1 Government Initiatives and Measures to Increase Production of Plant-based Protein

Table 186 France: Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 187 France: Market, by Type, 2022-2027 (USD Million)

11.3.5 UK

11.3.5.1 Increase in Demand for Tofu as a Meat Alternative and a Ready-To-Eat Product

Table 188 UK: Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 189 UK: Market, by Type, 2022-2027 (USD Million)

11.3.6 Italy

11.3.6.1 Soy-based Food & Beverage Products to Boost Market

Table 190 Italy: Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 191 Italy: Market, by Type, 2022-2027 (USD Million)

11.3.7 The Netherlands

11.3.7.1 Vegan Substitutes to Grow Tremendously to Prevent Greenhouse Gas Emissions

Table 192 The Netherlands: Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 193 The Netherlands: Market, by Type, 2022-2027 (USD Million)

11.3.8 Belgium

11.3.8.1 Farmers Grow Soy Crops to Cut Down on Import Prices

Table 194 Belgium: Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 195 Belgium: Market, by Type, 2022-2027 (USD Million)

11.3.9 Russia

11.3.9.1 Soybean is Consumed as an Animal Alternative Protein

Table 196 Russia: Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 197 Russia: Market, by Type, 2022-2027 (USD Million)

11.3.10 Rest of Europe

Table 198 Rest of Europe: Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 199 Rest of Europe: Market, by Type, 2022-2027 (USD Million)

11.4 Asia-Pacific

Figure 52 Asia-Pacific: Market Snapshot

Table 200 Asia-Pacific: Soybean Food & Beverage Products Market, by Country, 2017-2021 (USD Million)

Table 201 Asia-Pacific: Market, 2022-2027 (USD Million)

Table 202 Asia-Pacific: Market, by Country, 2017-2021 (Kilo Ton)

Table 203 Asia-Pacific: Market, 2022-2027 (Kilo Ton)

Table 204 Asia-Pacific: Market, by Type, 2017-2021 (USD Million)

Table 205 Asia-Pacific: Market, by Type, 2022-2027 (USD Million)

Table 206 Asia-Pacific: Market, by Type, 2017-2021 (Kilotons)

Table 207 Asia-Pacific: Market, by Type, 2022-2027 (Kilotons)

Table 208 Asia-Pacific: Soybean Food Products Market, by Type, 2017-2021 (USD Million)

Table 209 Asia-Pacific: Soybean Food Products Market, by Type, 2022-2027 (USD Million)

Table 210 Asia-Pacific: Fermented Soybean Food Products Market, by Type, 2017-2021 (USD Million)

Table 211 Asia-Pacific: Fermented Soybean Food Products Market, by Type, 2022-2027 (USD Million)

Table 212 Asia-Pacific: Non-Fermented Soybean Food Products Market, by Type, 2017-2021 (USD Million)

Table 213 Asia-Pacific: Non-Fermented Soybean Food Products Market, by Type, 2022-2027 (USD Million)

Table 214 Asia-Pacific: Soybean Additives/Ingredients Market, by Type, 2017-2021 (USD Million)

Table 215 Asia-Pacific: Soybean Additives/Ingredients Market, by Type, 2022-2027 (USD Million)

Table 216 Asia-Pacific: Soybean Oil Market, by Type, 2017-2021 (USD Million)

Table 217 Asia-Pacific: Soybean Oil Market, by Type, 2022-2027 (USD Million)

Table 218 Asia-Pacific: Soybean Food & Beverage Products Market, by Application, 2017-2021 (USD Million)

Table 219 Asia-Pacific: Market, by Application, 2022-2027 (USD Million)

Table 220 Asia-Pacific: Market, by Distribution Channel, 2017-2021 (USD Million)

Table 221 Asia-Pacific: Market, by Distribution Channel, 2022-2027 (USD Million)

Table 222 Asia-Pacific: Market, by Source, 2017-2021 (USD Million)

Table 223 Asia-Pacific: Market, by Source, 2022-2027 (USD Million)

11.4.1 Asia-Pacific: Recession Impact Analysis

Figure 54 Asia-Pacific Soybean Food & Beverage Products Market: Recession Impact Analysis

11.4.2 China

11.4.2.1 China Requires Soybean Meal to Feed Pigs

Table 224 China: Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 225 China: Market, by Type, 2022-2027 (USD Million)

11.4.3 India

11.4.3.1 Health Benefits of Plant-based Beverages to Increase Market for Soymilk

Table 226 India: Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 227 India: Market, by Type, 2022-2027 (USD Million)

11.4.4 Japan

11.4.4.1 Increase in Consumption of Protein-Rich Soy-based Food for Aging Population to Drive Market

Table 228 Japan: Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 229 Japan: Market, by Type, 2022-2027 (USD Million)

11.4.5 Australia & New Zealand

11.4.5.1 Soy Food Consumed as a Health Supplement to Spur Market Growth

Table 230 Australia and New Zealand: Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 231 Australia and New Zealand: Market, by Type, 2022-2027 (USD Million)

11.4.6 South Korea

11.4.6.1 Rise in Demand for Vegan Food to Spur Market Growth

Table 232 South Korea: Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 233 South Korea: Market, by Type, 2022-2027 (USD Million)

11.4.7 Rest of Asia-Pacific

Table 234 Rest of Asia-Pacific: Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 235 Rest of Asia-Pacific: Market, by Type, 2022-2027 (USD Million)

11.5 South America

Table 236 South America: Soybean Food & Beverage Products Market, by Country, 2017-2021 (USD Million)

Table 237 South America: Market, 2022-2027 (USD Million)

Table 238 South America: Market, by Country, 2017-2021 (Kilotons)

Table 239 South America: Market, 2022-2027 (Kilotons)

Table 240 South America: Market, by Type, 2017-2021 (USD Million)

Table 241 South America: Market, by Type, 2022-2027 (USD Million)

Table 242 South America: Market, by Type, 2017-2021 (Kilotons)

Table 243 South America: Market, by Type, 2022-2027 (Kilotons)

Table 244 South America: Soybean Food Products Market, by Type, 2017-2021 (USD Million)

Table 245 South America: Soybean Food Products Market, by Type, 2022-2027 (USD Million)

Table 246 South America: Fermented Soybean Food Products Market, by Type, 2017-2021 (USD Million)

Table 247 South America: Fermented Soybean Food Products Market, by Type, 2022-2027 (USD Million)

Table 248 South America: Non-Fermented Soybean Food Products Market, by Type, 2017-2021 (USD Million)

Table 249 South America: Non-Fermented Soybean Food Products Market, by Type, 2022-2027 (USD Million)

Table 250 South America: Soybean Additives/Ingredients Market, by Type, 2017-2021 (USD Million)

Table 251 South America: Soybean Additives/Ingredients Market, by Type, 2022-2027 (USD Million)

Table 252 South America: Soybean Oil Market, by Type, 2017-2021 (USD Million)

Table 253 South America: Soybean Oil Market, by Type, 2022-2027 (USD Million)

Table 254 South America: Soybean Food & Beverage Products Market, by Application, 2017-2021 (USD Million)

Table 255 South America: Market, by Application, 2022-2027 (USD Million)

Table 256 South America: Market, by Distribution Channel, 2017-2021 (USD Million)

Table 257 South America: Market, by Distribution Channel, 2022-2027 (USD Million)

Table 258 South America: Market, by Source, 2017-2021 (USD Million)

Table 259 South America: Market, by Source, 2022-2027 (USD Million)

11.5.1 South America: Recession Impact Analysis

Figure 55 South America: Inflation Rates, by Key Country, 2018-2021

Figure 56 South America Soybean Food & Beverage Products Market: Recession Impact Analysis

11.5.2 Brazil

11.5.2.1 Boost in Soybean Production and Processing Ecosystem to Drive Market

Table 260 Brazil: Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 261 Brazil: Market, by Type, 2022-2027 (USD Million)

11.5.3 Argentina

11.5.3.1 Rise in Obesity Rate to Drive Demand for Protein-Enriched Food Products

Table 262 Argentina: Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 263 Argentina: Market, by Type, 2022-2027 (USD Million)

11.5.4 Rest of South America

Table 264 Rest of South America: Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 265 Rest of South America: Market, by Type, 2022-2027 (USD Million)

11.6 Rest of the World (RoW)

Table 266 Rest of the World: Soybean Food & Beverage Products Market, by Country, 2017-2021 (USD Million)

Table 267 Rest of the World: Market, 2022-2027 (USD Million)

Table 268 Rest of the World: Market, by Country, 2017-2021 (Kilo Ton)

Table 269 Rest of the World: Market, 2022-2027 (Kilo Ton)

Table 270 Rest of the World: Market, by Type, 2017-2021 (USD Million)

Table 271 Rest of the World: Market, by Type, 2022-2027 (USD Million)

Table 272 Rest of the World: Market, by Type, 2017-2021 (Kilotons)

Table 273 Rest of the World: Market, by Type, 2022-2027 (Kilotons)

Table 274 Rest of the World: Soybean Food Products: Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 275 Rest of the World: Soybean Food Products: Soybean Food & Beverage Products Market, by Type, 2022-2027 (USD Million)

Table 276 Rest of the World: Fermented Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 277 Rest of the World: Fermented Soybean Food & Beverage Products Market, by Type, 2022-2027 (USD Million)

Table 278 Rest of the World: Non-Fermented Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 279 Rest of the World: Non-Fermented Soybean Food & Beverage Products Market, by Type, 2022-2027 (USD Million)

Table 280 Rest of the World: Soybean Additives/Ingredients Market, by Type, 2017-2021 (USD Million)

Table 281 Rest of the World: Soybean Additives/Ingredients Market, by Type, 2022-2027 (USD Million)

Table 282 Rest of the World: Soybean Oil Market, by Type, 2017-2021 (USD Million)

Table 283 Rest of the World: Soybean Oil Market, by Type, 2022-2027 (USD Million)

Table 284 Rest of the World: Soybean Food & Beverage Products Market, by Application, 2017-2021 (USD Million)

Table 285 Rest of the World: Market, by Application, 2022-2027 (USD Million)

Table 286 Rest of the World: Market, by Distribution Channel, 2017-2021 (USD Million)

Table 287 Rest of the World: Market, by Distribution Channel, 2022-2027 (USD Million)

Table 288 Rest of the World: Market, by Source, 2017-2021 (USD Million)

Table 289 Rest of the World: Market, by Source, 2022-2027 (USD Million)

11.6.1 Rest of the World Soybean Food & Beverage Products Market: Recession Impact Analysis

Figure 57 Rest of the World: Inflation Rates, by Key Country, 2018-2021

Figure 58 Rest of the World Market: Recession Impact Analysis

11.6.2 Middle East

11.6.2.1 Modification of Soybean into Various Forms and Flavors to Drive Market

Table 290 Middle East: Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 291 Middle East: Market, by Type, 2022-2027 (USD Million)

11.6.3 Africa

11.6.3.1 Rising Demand for Functional Foods Fortified with Protein to Drive Market

Table 292 Africa: Soybean Food & Beverage Products Market, by Type, 2017-2021 (USD Million)

Table 293 Africa: Market, by Type, 2022-2027 (USD Million)

12 Competitive Landscape

12.1 Overview

12.2 Strategies Adopted by Key Players

Table 294 Strategies Adopted by Key Soybean Food & Beverage Products Manufacturers

12.3 Market Share Analysis

Table 295 Soy Foods and Beverages Product Market: Degree of Competition

12.4 Segmental Revenue Analysis of Key Players

Figure 59 Five-Year Segmental Analysis of Key Players in the Market, 2017-2021 (USD Billion)

12.5 Key Player Evaluation Quadrant (Key Players)

12.5.1 Stars

12.5.2 Emerging Leaders

12.5.3 Pervasive Players

12.5.4 Participants

Figure 60 Soybean Food & Beverage Products Market Company Evaluation Quadrant, 2022 (Key Players)

12.6 Product Footprint (Key Players)

Table 296 Company Footprint, by Type (Key Players)

Table 297 Company Footprint, by Application (Key Players)

Table 298 Company Footprint, by Region (Key Players)

Table 299 Overall Company Footprint (Key Players)

12.7 Startup/SME Evaluation Quadrant

12.7.1 Progressive Companies

12.7.2 Starting Blocks

12.7.3 Responsive Companies

12.7.4 Dynamic Companies

Figure 61 Soybean Food and Beverage Products Market Company Evaluation Quadrant, 2022 (Startup/SME)

12.7.5 Competitive Benchmarking of Other Players

Table 300 Detailed List of Other Players

Table 301 Competitive Benchmarking of Other Players

12.8 Competitive Scenario

12.8.1 Product Launches

Table 302 Product Launches, 2017-2022

12.8.2 Deals

Table 303 Deals, 2017-2022

12.8.3 Others

Table 304 Others, 2017-2022

13 Company Profiles

(Business Overview, Products/Solutions Offered, Recent Developments & Analyst's View)*

13.1 Key Players

13.1.1 Wilmar International Limited

Table 305 Wilmar International Limited: Business Overview

Figure 62 Wilmar International Limited: Company Snapshot

Table 306 Willmar International Limited: Products Offered

Table 307 Willmar International Limited: Deals

13.1.2 Cargill, Incorporated

Table 308 Cargill, Incorporated: Business Overview

Figure 63 Cargill, Incorporated: Company Snapshot

Table 309 Cargill, Incorporated: Products Offered

Table 310 Cargill, Incorporated: Deals

Table 311 Cargill, Incorporated: Others

13.1.3 CHS Inc.

Table 312 CHS Inc.: Business Overview

Figure 64 CHS Inc.: Company Snapshot

Table 313 CHS Inc.: Products Offered

Table 314 CHS Inc.: Others

13.1.4 ADM

Table 315 ADM: Business Overview

Figure 65 ADM: Company Snapshot

Table 316 ADM: Products Offered

Table 317 ADM: Deals

Table 318 ADM: Others

13.1.5 Kikkoman Group

Table 319 Kikkoman Group: Business Overview

Figure 66 Kikkoman Group: Company Snapshot

Table 320 Kikkoman Group: Products Offered

Table 321 Kikkoman Group: Product Launches

13.1.6 Alpro

Table 322 Alpro: Business Overview

Table 323 Alpro: Products Offered

Table 324 Alpro: Product Launches

Table 325 Alpro: Deals

Table 326 Alpro: Others

13.1.7 Barentz

Table 327 Barentz: Business Overview

Figure 67 Barentz: Company Snapshot

Table 328 Barentz: Products Offered

Table 329 Barentz: Deals

13.1.8 Eden Foods

Table 330 Eden Foods: Business Overview

Table 331 Eden Foods: Products Offered

13.1.9 Caramuru

Table 332 Caramuru: Business Overview

Figure 68 Caramuru: Company Snapshot

Table 333 Caramuru: Products Offered

Table 334 Caramuru: Deals

13.1.10 Hain Celestial Group

Table 335 Hain Celestial Group: Business Overview

Table 336 Hain Celestial Group: Products Offered

13.1.11 Patanjali Foods Limited

Table 337 Patanjali Foods Limited: Business Overview

Figure 69 Patanjali Foods Limited: Company Snapshot

Table 338 Patanjali Foods Limited: Products Offered

13.1.12 Vitasoy

Table 339 Vitasoy: Business Overview

Figure 70 Vitasoy: Company Snapshot

Table 340 Vitasoy: Products Offered

Table 341 Vitasoy: Product Launches

13.1.13 Galaxy Nutritional Foods

Table 342 Galaxy Nutritional Foods: Business Overview

Table 343 Galaxy Nutritional Foods: Products Offered

13.1.14 Foodchem International Corporation

Table 344 Foodchem International Corporation: Business Overview

Table 345 Foodchem International Corporation: Products Offered

13.1.15 Crown Soya Protein Group

Table 346 Crown Soya Protein Group: Business Overview

Table 347 Crown Soya Protein Group: Products Offered

13.2 Startups/SMEs/Other Players

13.2.1 The Scoular Company

Table 348 The Scoular Company: Business Overview

Table 349 The Scoular Company: Products Offered

13.2.2 Northern Soy

Table 350 Northern Soy: Business Overview

Table 351 Northern Soy: Products Offered

13.2.3 Solbar Ltd.

Table 352 Solbar Ltd.: Business Overview

Table 353 Solbar Ltd.: Products Offered

13.2.4 Farbest Tallman Foods Corporation

Table 354 Farbest Tallman Foods Corporation: Business Overview

Table 355 Farbest Tallman Foods Corporation: Products Offered

13.2.5 Perdue Agribusiness

Table 356 Perdue Agribusiness: Business Overview

Table 357 Perdue Agribusiness: Products Offered

13.2.6 Sotexpro

Table 358 Sotexpro: Business Overview

13.2.7 Bremill Group

Table 359 Bremill Group: Business Overview

13.2.8 Rio Pardo Proteina Vegetal SA

Table 360 Rio Pardo Proteina Vegetal SA: Business Overview

13.2.9 Good Catch Foods

Table 361 Good Catch Foods: Business Overview

13.2.10 Living Foods

Table 362 Living Foods: Business Overview

*Details on Business Overview, Products/Solutions Offered, Recent Developments & Analyst's View Might Not be Captured in Case of Unlisted Companies.

14 Adjacent and Related Markets

14.1 Introduction

Table 363 Adjacent Markets

14.2 Research Limitations

14.3 Soy Protein Ingredients Market

14.3.1 Market Definition

14.3.2 Market Overview

Table 364 Soy Protein Ingredients Market, by Form, 2018-2021 (USD Million)

Table 365 Soy Protein Ingredients Market, by Form, 2022-2027 (USD Million)

14.4 Protein Ingredients Market

14.4.1 Market Definition

14.4.2 Market Overview

Table 366 Protein Ingredients Market, by Source, 2020-2025 (USD Million)

14.5 Plant-based Protein Market

14.5.1 Market Definition

14.5.2 Market Overview

Table 367 Plant-based Protein Market, by Type, 2018-2021 (USD Million)

Table 368 Plant-based Protein Market, by Type, 2022-2027 (USD Million)

15 Appendix

15.1 Discussion Guide

15.2 Knowledgestore: The Subscription Portal

15.3 Customization Options

Companies Mentioned

- ADM

- Alpro

- Barentz

- Benson Hill

- Bremill Group

- Caramuru

- Cargill, Incorporated

- CDF Corporation

- CHS Inc.

- Crown Soya Protein Group

- Eden Foods

- Farbest Tallman Foods Corporation

- Foodchem International Corporation

- Galaxy Nutritional Foods

- Good Catch Foods

- Hain Celestial Group

- Kikkoman Group

- Living Foods

- Northern Soy

- Patanjali Foods Limited

- Perdue Agribusiness

- Rio Pardo Proteina Vegetal SA

- Solbar Ltd.

- Sotexpro

- The Scoular Company

- Vitasoy

- Wilmar International Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 336 |

| Published | February 2023 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 51.4 Billion |

| Forecasted Market Value ( USD | $ 68.3 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |