Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

For instance, Indonesia is targeting 5.2% economic growth in 2024, driven by domestic consumption and investment, despite challenges from declining commodity prices and economic conditions in China. Domestic consumption, contributing 57% to GDP in 2023, remains a key driver, supported by an 8% salary increase for 3.7 million civil servants and higher election-related spending.

The motorcycle industry, the world's third-largest, continued its post-pandemic recovery, with sales reaching 6.5 million units (+2.2%), marking the third consecutive annual increase and a return to pre-COVID levels. The electric vehicle segment surged 62.9%, surpassing 100,000 sales for the first time, fueled by a $455 million government subsidy aimed at supporting 800,000 new electric motorcycles and converting 200,000 combustion models. Chinese EV leader Yadea expanded its footprint with a major investment in Indonesia, inaugurating a 28,000-square-meter production facility in Bekasi, West Java, with an annual capacity of 300,000 units.

Market Drivers:

Rising Motorcycle Ownership

Motorcycles are the most popular mode of transportation in Indonesia, particularly in dense urban areas and rural communities. With traffic congestion in cities like Jakarta and Surabaya, motorcycles offer a faster, more affordable alternative for daily commuting. The growing middle class and increasing disposable income have enabled more Indonesians to afford motorcycles. This has directly driven the demand for motorcycle tires, including replacement tires, because of the high usage and the frequent need for tire maintenance.Key Market Challenges

Raw Material Price Volatility

The tire industry is heavily dependent on raw materials like rubber, oil, and synthetic polymers, all of which are subject to price fluctuations. Global market volatility in these materials can lead to higher production costs for manufacturers, which may, in turn, raise tire prices for consumers. In Indonesia, where price sensitivity is high, manufacturers may find it challenging to balance the cost of production with the need to remain competitive while maintaining profitability.Key Market Trends

Increasing Use of Radial Tires

Radial tires are becoming more popular in Indonesia, particularly for passenger vehicles, due to their superior performance, longer lifespan, and better fuel efficiency compared to bias tires. As consumers and OEMs (original equipment manufacturers) seek tires that offer better stability and handling, radial tires have gained a larger market share. Radial tires’ lower rolling resistance and higher durability make them an attractive option for both new vehicle purchases and replacement tires in the Indonesian market. For instance, in March 2024, Sailun Group revealed its intention to establish a manufacturing facility in Indonesia, which will have the capacity to produce 3 million semi-steel radial tires, 600,000 all-steel radial tires, and 37,000 tonnes of off-the-road (OTR) tires each year. The company plans to allocate an investment of USD 251.44 million for this initiative, with USD 204.29 million designated for the construction of the plant located in Demak, Central Java.Key Market Players

- PT Gajah Tunggal Tbk

- PT Bridgestone Tire Indonesia

- PT Sumi Rubber Indonesia

- Hankook Tire & Technology

- Pirelli Tyre S.p.A

- Goodyear Tire and Rubber Company

- Continental Tyres Indonesia

- YHI INDONESIA, PT.

- Toyo Tires Indonesia

- PT MICHELIN INDONESIA

Report Scope:

In this report, the Indonesia Tire Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Indonesia Tire Market, By Vehicle Type:

- Passenger Vehicle

- Commercial Vehicle

- Two-Wheeler

Indonesia Tire Market, By Demand Category:

- OEM

- Replacement

Indonesia Tire Market, By Tire Construction Type:

- Radial

- Bias

Indonesia Tire Market, By Region:

- Java

- Sumatra

- Sulawesi

- Kalimantan

- Rest of Indonesia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Indonesia Tire Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- PT Gajah Tunggal Tbk

- PT Bridgestone Tire Indonesia

- PT Sumi Rubber Indonesia

- Hankook Tire & Technology

- Pirelli Tyre S.p.A

- Goodyear Tire and Rubber Company

- PT Continental Tyres Indonesia

- YHI Indonesia, PT.

- Toyo Tires Indonesia

- PT Michelin Indonesia

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 88 |

| Published | February 2025 |

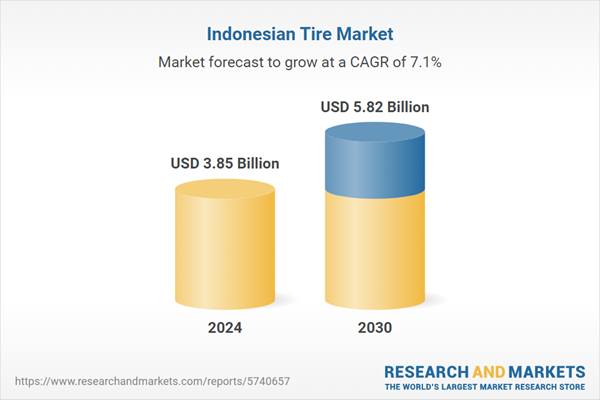

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.85 Billion |

| Forecasted Market Value ( USD | $ 5.82 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Indonesia |

| No. of Companies Mentioned | 10 |