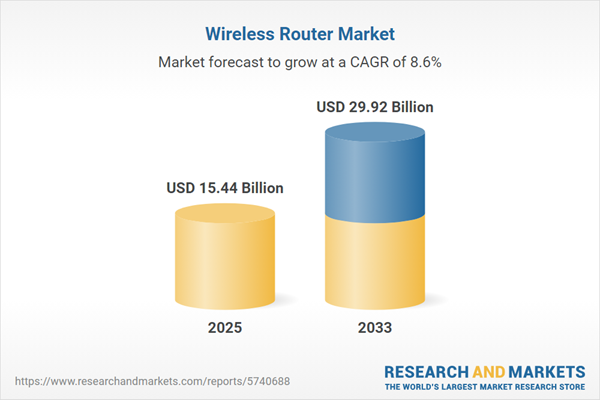

The global wireless router market is anticipated to surge from US$ 15.44 billion in 2025 to US$ 29.92 billion by 2033, representing a CAGR of 8.62% from 2025 to 2033. Increasing demand for high-speed internet access, greater installation of smart home and IoT devices, and the implementation of new technologies like Wi-Fi 6 and 5G are stimulating this growth. This, in turn, can be expected to contribute significantly to speeding up the growth rate of the global industrial wireless VPN cellular router market.The Wireless Router Market was valued at US$ 11.43 Billion in 2022

The wireless router is a networking device that connects the internet to various digital devices, such as smartphones, laptops, smart TVs, and IoT appliances, through wireless communication. It works by converting data from a modem into radio signals and thereby connecting users to the internet without any physical cables. Modern wireless routers can manage multiple frequencies, have advanced security protocols, and achieve higher speeds of data transmission. They have found their places in home networks, offices, and industrial settings due to this. Wireless routers have turned increasingly efficient and are capable of handling heavy bandwidth demands with newer capabilities such as Wi-Fi 6, mesh networking, and integrated smart home controls.

Globally, wireless routers have become very popular with the rapid growth in internet usage, remote work, online education, and digital entertainment. The surge in smart home devices - from connected thermostats to security systems - has further fueled demand for reliable wireless connectivity. At present, all types of enterprises rely on wireless routers for smooth communication, cloud access, and operational automation. Furthermore, the spread of 5G and IoT ecosystems also increases demand for more speed, security, and robustness in networking. In this backdrop, wireless routers continue to play an important role in enabling efficient and flexible lifestyles that are connected.

Top Manufacturers

Cisco

Founded: 1984Headquarters: United States of America

Cisco Systems Inc. is a technology company that designs and sells a wide range of networking, security, collaboration, and observability technologies. The company provides switches, modules, wireless products, controllers, access points, routers, and interfaces. Its products and technologies help customers manage more users, devices, and things that are connected to their networks. Its products and services are used by businesses of all sizes, public institutions, governments, and service providers in improving connectivity, security, and collaboration. The company distributes its products through a network of third-party vendors, channel partners, and direct sales. It operates business across the Americas, Europe, Middle East, and Africa (EMEA), and Asia Pacific, Japan, and China (APJC) regions.

AT&T

Founded: 1885Headquarters: United States of America

AT&T Inc (AT&T) is a provider of telecommunication and technology services globally. The company provides wireless communication services, broadband and internet services, and telecommunication equipment. Its major products and services include wireless and wireline telecom, broadband services, and advanced connectivity services like fiber ethernet and fixed wireless. The company markets its products and services under the brand names of AT&T, AT&T Business, Cricket, AT&T PREPAID, AT&T Fiber, and AT&T Internet Air. The company's products and services cater to both business and consumer markets. AT&T operates through a network of company-owned stores, agents, and third-party retail stores. Geographically, the company serves markets in the United States, Europe, Mexico, Latin America and Asia-Pacific among others.

Verizona

Founded: 1983Headquarters: United States of America

Verizon Communications Inc. is a provider of communications, technology, information, and entertainment products and services to businesses, consumers, and government entities. The company offers wireless and wireline communications services and products, such as corporate networking solutions, data center and cloud services, security and managed network services, data, voice, local dial tone and broadband services, and local and long-distance voice services. It provides network access to deliver IoT services and products. It offers its services to small and medium businesses, global enterprises, public sector, and wholesale customers. It has business presence across the Americas, Europe, the Middle East, Africa, and Asia-Pacific.

Comcast

Founded: 1963Headquarters: United States of America

Comcast Corp (Comcast) is a media and technology company. The company's products and services include video, voice-over internet protocol, wireless, advertising, distribution, entertainment, content licensing and broadband services. Comcast provides services such as broadband, wireless, video and voice services under the brands Xfinity, Comcast Business, Sky and NOW. It also includes media and entertainment brands under NBC, Telemundo, Universal, Peacock, and Sky, along with operating Universal theme parks. Comcast's services are divided into residential and business customers and the service portfolio is designed to help clients address challenges in multiple sectors such as media, entertainment and telecommunications. Comcast sells its products through an internal direct sales force and utilizes an extensive network of channel partners and distribution networks. The company operates in North America, Europe, and Asia.

Charter Communication

Founded: 1993Headquarters: United States of America

Charter Communications Inc. provides entertainment and broadband communication services. The company provides video, voice, and internet services to both residential and commercial customers. It offers subscription-based video services, including video on demand, high-definition television, digital video recorder service, internet services, voice, and mobile services. Business services offered by the firm include static intellectual properties, business Wi-Fi, e-mail and security, and multi-line telephone services. Its commercial services include internet access, data networking, fiber connectivity, video entertainment services, and business telephone services. The company's products and services are intended for small and medium-sized businesses, larger enterprises, and government entities.

Product Launches in the Wireless Router Market

Lumen Technology

Dec 2023, Lumen Technologies is bringing the future of wireless connectivity into view with the unveiling of a custom-designed Wi-Fi 7 capable device. Lumen's new wireless technology will deliver faster speeds and an enhanced Wi-Fi experience for Quantum Fiber multi-gig customers compared to Wi-Fi 6/6E devices, setting a new benchmark for businesses and smart homes of the future. The Quantum Fiber Wi-Fi 7 capable device will be showcased at CES, January 9-12 in Las Vegas. Find the Quantum Fiber exhibit suite in the Smart Home section #35-209.Viasat

July 2024 -- Viasat Inc., a global leader in satellite communications, today announced the introduction of Viasat's Secure Wireless Hub, or SWH, a wearable tactical gateway solution for dismounted soldiers that is easy to carry and simple to use. The SWH solution was developed as part of a multi-phase effort with U.S. Special Operations Command to identify and develop advanced tactical communications capabilities for mobile ground forces.SWOT Analysis of the Company

Netgear

Strengths include strong brand reputation, advanced technology portfolio, and leadership in premium networking solutions.

The main strengths Netgear has in the wireless router market include its brand recognition, strong portfolio of technologies, and leading premium networking solutions. Globally renowned for high-performance routers, Netgear has always come up with products boasting robust speed, enhanced security, and state-of-the-art features such as Wi-Fi 6, mesh networking, and parental controls. Its Nighthawk and Orbi product lines are widely recognized for meeting the demands of gamers, smart home users, and small businesses requiring fast and reliable connectivity. The main benefits of Netgear's heavy R&D investment include competitiveness in continuous innovation, allowing the company to stay ahead in a fiercely competitive market. Furthermore, its powerful global distribution network, including retail, e-commerce, and enterprise channels, bolsters ease of access for customers all over the world. With ease of use for nontechnical end-users through user-friendly interfaces, the integration of cybersecurity, and scalability, Netgear maintains a robust competitive advantage and is among the best options for customers seeking advanced wireless networking solutions.TP-Link Technologies Co., Ltd.

Strengths: Low-cost manufacturing and diversified product line.TP-Link Technologies Co., Ltd. is outstanding in the wireless router market due to its dominant global market share, cost-effective manufacturing, and broad product portfolio. As one of the world’s largest providers of networking devices, TP-Link benefits from economies of scale, which enable it to provide high-quality routers at competitive prices intended for budget-friendly consumers and enterprise clients alike. The product gamut of the company ranges from entry-level routers to advanced Wi-Fi 6, mesh systems, and business-grade solutions, thus placing it strongly across a wide category of users. TP-Link has been committed to reliability and ease of use, gaining widespread regard in households and small businesses around the world. Its wide network of global distribution and strong after-sales support further adds to customer satisfaction. With continuous development in smart connectivity, cloud management, and IoT integration, TP-Link ensures a strong position in the fast-growing wireless router market.

Recent Development in the Wireless Router Market

Huawei Technologies Co., Ltd.

Feb 2022, Huawei unveiled IntelligentRAN, its new wireless network architecture, at today's Pre-MWC Briefing and Product and Solution Launch event. This architecture is designed to help carriers build autonomous networks using service operation intelligence, experience optimization, and simplified O&M. Huawei's Vice President and Chief Marketing Officer of Wireless Solutions at the launch, explaining how key technologies were incorporated into the architecture to support ADN over wireless networks: "Intelligence improves wireless networks greatly by supporting correlative data analysis and prediction to make decisions more adaptive. This is where IntelligentRAN comes in. It will enable networks to realize zero service waiting, consistent experience, zero network faults, and optimal experience and energy efficiency. Using Mobile Intelligent Engine (MIE), it will better coordinate data, models, and decisions between base stations and networks, paving the way to wireless intelligence."ASUS Tek Computer Inc.

October 2025 - ASUS Republic of Gamers today announced the ROG Rapture GT-BE19000AI, the world's first AI router. Combining breakthrough intelligence, platform-level flexibility, and next-generation performance, it is the ideal solution in an era where gaming, streaming, and smart home devices demand more from networks. The GT-BE19000AI delivers intelligence, automation, and reliability.Sustainability Goal

D-Link Corporation D-Link Corporation has integrated sustainability into its wireless router business at all levels, from designing energy-efficient products and using sustainable materials in production to reducing its environmental impact across global operations. It further develops wireless routers that have lower power consumption, a higher percentage of recyclable components, and environmentally friendly chipsets that pass more critical energy standards. D-Link has also developed sustainable packages using less plastic and shifting to recycled and biodegradable materials. In manufacturing, the company is committed to lowering carbon emissions, improving waste management, and ensuring compliance with international environmental regulations, such as RoHS and WEEE. D-Link is continuing its investment in greener technologies in its current product roadmap, including low-energy networking solutions and cloud-managed systems further optimized for resource consumption. Further, it promotes firmware updates, repair support, and hardware longevity, thereby assuring long product life. Combining technological innovation with eco-friendly practices, D-Link is creating a more sustainable and energy-efficient wireless networking ecosystem.Tenda Technology Co., Ltd.

Tenda Technology Co. Ltd. focuses on sustainability: It lays great emphasis on energy-efficient networking devices with environmentally responsible production processes and reduced material waste in its portfolio of wireless routers. The company is committed to designing routers that meet the global energy standard and using optimized components to minimize the total power consumption. Given the importance of sustainable sourcing, Tenda ensures that all raw materials adhere to environmental compliance regulations like RoHS. Besides, the company reduces unnecessary plastic use through lighter and recyclable package materials. In addition to this, Tenda minimizes emissions by promoting greener technologies and managing resources in a more streamlined manner at its factories. The brand extends long-term software updates for its products, increasing their life, and encourages their repairability rather than replacement. Additionally, it is enhancing internal sustainability by raising the awareness of all its employees and integrating eco-friendly practices across departments. These efforts make Tenda a responsible provider of accessible, energy-efficient wireless networking solutions.Market Segmentation

Wireless Router Market

- Historical Trends

- Forecast Analysis

Market Share Analysis - Wireless Router Market

Cisco

Overview

- Company History and Mission

- Business Model and Operations

Workforce

Key Persons

- Executive Leadership

- Operational Management

- Division Leaders

- Board Composition

Recent Development & Strategies

- Mergers & Acquisitions

- Partnerships

- Investments

Sustainability Analysis

- Renewable Energy Adoption

- Energy-Efficient Infrastructure

- Use of Sustainable Packaging Materials

- Water Usage and Conservation Strategies

- Waste Management and Circular Economy Initiatives

Product Analysis

- Product Profile

- Quality Standards

- Product Pipeline

- Product Benchmarking

Strategic Assessment: SWOT Analysis

- Strengths

- Weaknesses

- Opportunities

- Threats

Revenue Analysis

The above information will be available for all the following companies:

- Cisco

- AT&T

- Verizona

- Comcast

- Charter Communication

- Lumen Technology

- Viasat

- Netgear

- TP-Link Technologies Co., Ltd.

- Huawei Technologies Co., Ltd.

- ASUS Tek Computer Inc.

- D-Link Corporation

- Linksys (Belkin International, Inc.)

- Tenda Technology Co., Ltd.

- Zyxel Communications Corp.

- Ubiquiti Inc.

- Buffalo Inc. (Melco Holdings)

- Legrand SA

- Qualcomm Incorporated (networking equipment)

- Belkin International, Inc.

Table of Contents

Companies Mentioned

- Cisco

- AT&T

- Verizona

- Comcast

- Charter Communication

- Lumen Technology

- Viasat

- Netgear

- TP-Link Technologies Co., Ltd.

- Huawei Technologies Co., Ltd.

- ASUS Tek Computer Inc.

- D-Link Corporation

- Linksys (Belkin International, Inc.)

- Tenda Technology Co., Ltd.

- Zyxel Communications Corp.

- Ubiquiti Inc.

- Buffalo Inc. (Melco Holdings)

- Legrand SA

- Qualcomm Incorporated (networking equipment)

- Belkin International, Inc.

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | December 2025 |

| Forecast Period | 2025 - 2033 |

| Estimated Market Value ( USD | $ 15.44 Billion |

| Forecasted Market Value ( USD | $ 29.92 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |