Styrenic block copolymer (SBC) and its derivatives are thermoplastic elastomers that are made by ionic copolymerization of styrene and butadiene (SBS) and styrene and 2-methyl-1,3-butadiene (SIS). They have mechanical properties of rubber and the processing characteristics of thermoplastic. They offer high crystal clarity, thermal stability, and high resistance and indicate no cytotoxic and mutagenic potential. They are added in additives and other high-performance polymeric compounds for the formulation of many products, such as polymer modification, asphalt and bitumen modification, vulcanized compounding, and adhesives and sealants. Besides this, as SBC and its derivatives are more environment friendly as compared than polyvinyl chloride (PVC), they are used in different industry verticals across the globe.

SBC and Its Derivatives Market Trends:

SBC and its derivatives are employed in the construction industry for various paving and roofing applications. This, coupled with the increasing number of housing units on account of the rising global population and inflating disposable income, represents one of the key factors bolstering the market growth around the world. Moreover, the expanding number of remodeling and renovation activities in residential and commercial areas, especially in urban areas, is favoring the market growth. In addition, the growing investments in the expansion of smart cities by governments of numerous countries are influencing the market positively. Apart from this, the increasing utilization of SBC and its derivatives in the manufacturing of footwear on account of their numerous properties, such as excellent elasticity, gas barrier, slip resistance, flexing endurance, wear resistance, and low-temperature resistance, are contributing to the market growth. Furthermore, SBC and its derivatives are used in numerous medical applications, including comfort bedding, IV connectors, IV bags, IV drip chambers, IV bottles, IV tubing, medical stoppers, films, and orthopedics and respiratory tool. They are resistant to ultraviolet (UV) and offer good mechanical strength, high transparency, and flexibility. Besides this, the rising utilization of SBC and its derivatives in the packaging of drugs and vaccines and significant growth in the pharmaceutical industry is creating a positive outlook for the market. Additionally, SBC and its derivatives are utilized in manufacturing different components of vehicles, which include hoses, gaskets, belts, and other parts. This, coupled with the increasing sales of luxury vehicles, is strengthening the growth of the market.Key Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the global SBC and its derivatives market report, along with forecasts at the global, regional, and country level from 2025-2033. Our report has categorized the market based on product type and application.Product Type Insights:

- Styrene-Isoprene-Styrene (SIS)

- Styrene-Butadiene-Styrene (SBS)

- Styrene-Ethylene-Butadiene-Styrene (SEBS)

- SEPS and Other H-SBC

Application Insights:

- Footwear

- Adhesives, Sealants and Coatings

- Roofing and Paving

- Advanced Materials

- Others

Regional Insights:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global SBC and its derivatives market. Detailed profiles of all major companies have also been provided. Some of the companies covered include Asahi Kasei Corporation, Avient Corporation, BASF SE, China Petroleum & Chemical Corporation, Denka Company Limited, Dynasol Group, Kraton Corporation (DL Chemical Co., Ltd.), LG Chem Ltd. (LG Corporation), LYC Group, TRSC Corporation, Versalis (Eni S.p.A.), etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.Key Questions Answered in This Report

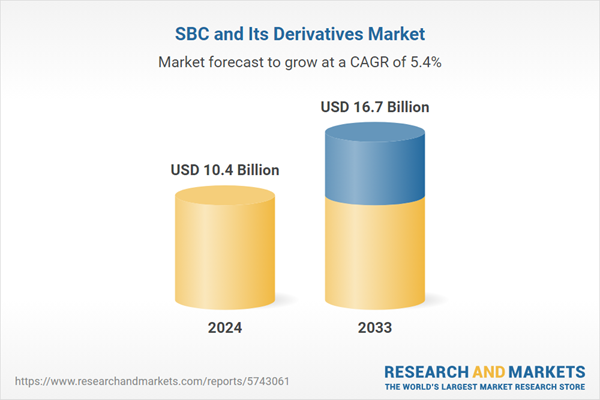

- What was the size of the global SBC and its derivatives market in 2024?

- What is the expected growth rate of the global SBC and its derivatives market during 2025-2033?

- What are the key factors driving the global SBC and its derivatives market?

- What has been the impact of COVID-19 on the global SBC and its derivatives market?

- What is the breakup of the global SBC and its derivatives market based on the product type?

- What is the breakup of the global SBC and its derivatives market based on the application?

- What are the key regions in the global SBC and its derivatives market?

- Who are the key players/companies in the global SBC and its derivatives market?

Table of Contents

Companies Mentioned

- Asahi Kasei Corporation

- Avient Corporation

- BASF SE

- China Petroleum & Chemical Corporation

- Denka Company Limited

- Dynasol Group

- Kraton Corporation (DL Chemical Co. Ltd.)

- LG Chem Ltd. (LG Corporation)

- LYC Group

- TRSC Corporation

- Versalis (Eni S.p.A.)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 139 |

| Published | March 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 10.4 Billion |

| Forecasted Market Value ( USD | $ 16.7 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |