Open banking involves the practice of sharing financial information electronically with third-party or independent financial service providers. The solution provides access to consumer banking information, such as transactions and payment history, from financial institutions using application programming interfaces (APIs). The technology delivers a secure network to share financial information between parties, making it easier for consumers to compare the details of accounts and other banking services. Open banking helps small businesses save time through online accounting and assists fraud detection companies in monitoring customer accounts and identifying problems. It also offers improved customer experience, new revenue streams, and a sustainable service model.

Open Banking Market Trends:

The increasing need for more flexible and worthy investment options across the globe is creating a positive outlook for the market. In line with this, the widespread utilization of new wave applications and services is acting as another growth-inducing factor. Open banking offers access to better banking services and innovative and personalized financial products.Additionally, the increasing adoption of new applications and services that help customers attain consolidated details of accounts from various financial service providers is favoring the market growth. Apart from this, the integration of big data analytics in open banking to collect, process, and analyze structured and unstructured data is providing a thrust to the market growth.

Moreover, the utilization of artificial intelligence (AI) and the Internet of Things (IoT) to manage financial crime risk and control financial objectives, funds, and data, is propelling the market growth. Furthermore, the increasing demand for open banking across the value chain of the financial services industry, including consumers, businesses, Fintech companies, banks, and financial institutions, to provide more customized and relevant product offerings to customers is positively influencing the market growth. Other factors, including changing consumer preferences, the implementation of various government initiatives to mandatorily open APIs, and significant growth in the banking, financial services, and insurance (BFSI) industry, are supporting the market growth.

Key Market Segmentation:

This report provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on services, deployment, and distribution channel.Breakup by Services:

- Banking and Capital Markets

- Payments

- Digital Currencies

- Value Added Services

Breakup by Deployment:

- Cloud-based

- On-premises

Breakup by Distribution Channel:

- Bank Channels

- App Markets

- Distributors

- Aggregators

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players being Banco Bilbao Vizcaya Argentaria S.A., Clarity Group Inc., Credit Agricole (SAS Rue La Boétie), Finastra (Misys International Limited), Finleap connect, Jack Henry & Associates Inc, Mambu, NCR Corporation, Nordigen Solution, Revolut Ltd, Riskonnect Inc. and Societe Generale.Key Questions Answered in This Report:

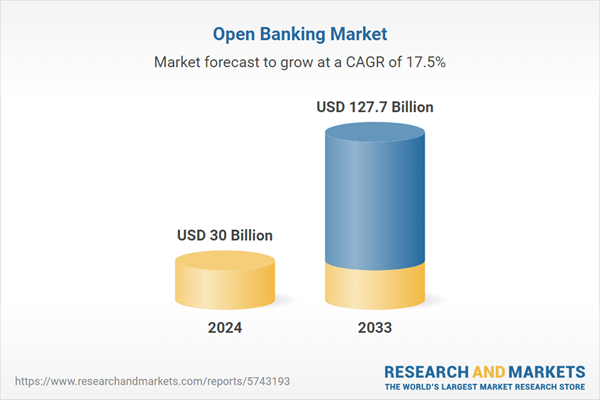

- What was the size of the global open banking market in 2024?

- What is the expected growth rate of the global open banking market during 2025-2033?

- What are the key factors driving the global open banking market?

- What has been the impact of COVID-19 on the global open banking market?

- What is the breakup of the global open banking market based on the services?

- What is the breakup of the global open banking market based on deployment?

- What is the breakup of the global open banking market based on the distribution channel?

- What are the key regions in the global open banking market?

- Who are the key players/companies in the global open banking market?

Table of Contents

Companies Mentioned

- Banco Bilbao Vizcaya Argentaria S.A.

- Clarity Group Inc.

- Credit Agricole (SAS Rue La Boétie)

- Finastra (Misys International Limited)

- Finleap connect

- Jack Henry & Associates Inc

- Mambu

- NCR Corporation

- Nordigen Solution

- Revolut Ltd

- Riskonnect Inc.

- Societe Generale

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | April 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 30 Billion |

| Forecasted Market Value ( USD | $ 127.7 Billion |

| Compound Annual Growth Rate | 17.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |