This report analyses product types, connectivity, applications, sales channels, and regional market development for passenger car telematics. Furthermore, we have also covered market analysis for major countries in this report, such as the US, China, Germany, and others, where the opportunities for passenger car telematics are profitable.

The report is prepared in a simple, easy-to-understand format; tables and figures are included to illustrate historical, current, and future market scenarios. The report also covers leading companies with information on product types, business footprint, revenue, employee strength, etc. We have also covered a list of other companies in the global and regional markets with their product-related information. The analyst has also covered the patent analysis for the passenger car telematics market, which represents a significant investment area for investors.

The report includes the impact of COVID-19 and the Russia-Ukraine war on the global and regional markets.

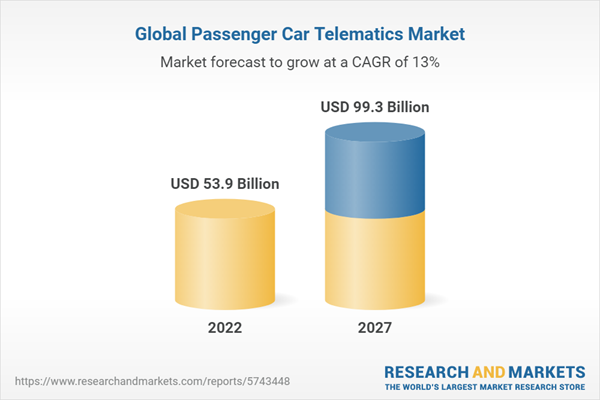

2021 is considered a historic/base year, 2022 is an estimated year, and the market values are forecasted for five years until 2027. All market values are in the ($) billion.

Report Includes

- 28 data tables and 15 additional tables

- A detailed review and up-to-date assessment of the global market for passenger car telematics services and solutions

- Analyses of the global market trends, with market revenue data for 2021, estimates for 2022 and 2023, and projections of compound annual growth rates (CAGRs) through 2027

- Highlights of the market potential for passenger car telematics, industry growth drivers, and areas of focus to forecast this market into various segments and subsegments

- Estimation of the actual market size for passenger car telematics in USD million values, revenue forecast, and corresponding market share analysis by product type, connectivity, application, sales channel, and geographic region

- In-depth information (facts and figures) concerning market drivers, market deterrents and other macroeconomic forces affecting the current and future market outlook

- Discussion of the industry value chain analysis providing a systematic study of key intermediaries involved, with emphasis on manufacturers, suppliers, and solutions providers of passenger car telematics

- Updated information on recent mergers, acquisitions, partnerships, agreements, collaborations, joint ventures, and market expansions in the passenger car telematics industry

- A relevant patent analysis with significant allotments of patents on passenger car telematics technology

- Identification of the major stakeholders and analysis of the competitive landscape based on recent developments and segmental revenues

- Descriptive company profiles of the leading global players, including Continental AG, LG Electronics, Powerfleet Inc., Tata motors, and Verizon Connect

Table of Contents

Chapter 1 Introduction

1.1 Overview

1.2 Study Goals and Objectives

1.3 Reasons for Doing this Study

1.4 Scope of Report

1.5 Information Sources

1.6 Intended Audience

1.7 Research Methodology

1.8 Geographical Breakdown

1.9 Analyst's Credentials

1.10 Custom Research

1.11 Related Research Reports

Chapter 2 Summary and Highlights

Chapter 3 Market Overview

3.1 Current Market Overview

3.2 History and Evolution of Passenger Car Telematics

3.3 Applications

3.3.1 Ridesharing

3.3.2 Car Tracking

3.3.3 Emergency Warning Systems for Cars

3.3.4 Car Maintenance and Remote Diagnostics

3.3.5 Risk Assessment by Insurance Companies

3.3.6 Weather Conditions Monitoring

3.3.7 Geofencing

3.3.8 Satellite Navigation

3.4 Benefits

3.4.1 Increased Efficiency

3.4.2 Improved Safety

3.4.3 Minimized Operating Cost

3.4.4 Superior Driver Ux/Entertainment

3.4.5 Enhanced Security

3.5 Challenges

3.5.1 Power Dependency

3.5.2 Privacy Concerns

3.5.3 Jamming

3.5.4 System Installation Takes Time

3.5.5 Cost

3.6 Types of Telematic Systems

3.6.1 Obd Ii Telematics Systems

3.6.2 Bluetooth-Powered Telematics Systems

3.6.3 Smartphone-Based Telematics Systems

3.6.4 Black Box Telematics Systems

3.6.5 Oem Hard-Wired Telematics Systems

3.6.6 12V Plug-In Self-Installation Telematics Systems

3.7 Telematics Sales Channel

3.7.1 Oems (Original Equipment Manufacturers)

3.7.2 Aftermarket

3.8 Telematics Hardware

3.9 Telematics Software and Services

3.10 Value Chain Analysis

3.10.1 Content Creation

3.10.2 Application Development

3.10.3 Content Aggregation

3.10.4 Network Transport

3.10.5 Telematics Hardware

3.10.6 Access Interface

3.11 Porter's Five Forces Model

3.11.1 Supplier Power

3.11.2 Buyer Power

3.11.3 Threat of New Entrants

3.11.4 Threat of Substitute

3.11.5 Competitive Rivalry

3.12 Impact of the Covid-19 Pandemic

3.13 Impact of the Russia-Ukraine War

3.14 Industry Expert Insights

Chapter 4 Global Market Dynamics

4.1 Market Drivers

4.2 Market Restraints

4.3 Current Market Trends

4.4 Market Opportunities

Chapter 5 Market Breakdown by Region

5.1 Overview

5.2 Global Market for Passenger Car Telematics by Region

5.2.1 North American Market for Passenger Car Telematics by Country

5.2.2 European Market for Passenger Car Telematics by Country

5.2.3 Asia-Pacific Market for Passenger Car Telematics by Country

5.2.4 Rest of the World Market for Passenger Car Telematics by Country

Chapter 6 Market Breakdown by Product Type

6.1 Overview

6.2 Global Market for Passenger Car Telematics by Product Type

6.2.1 North American Market for Passenger Car Telematics by Product Type

6.2.2 European Market for Passenger Car Telematics by Product Type

6.2.3 Asia-Pacific Market for Passenger Car Telematics by Product Type

6.2.4 Rest of the World Market for Passenger Car Telematics by Product Type

Chapter 7 Market Breakdown by Type of Connectivity

7.1 Overview

7.2 Global Market for Passenger Car Telematics by Type of Connectivity

7.2.1 North American Market for Passenger Car Telematics by Type of Connectivity

7.2.2 European Market for Passenger Car Telematics by Type of Connectivity

7.2.3 Asia-Pacific Market for Passenger Car Telematics by Type of Connectivity

7.2.4 Rest of the World Market for Passenger Car Telematics by Type of Connectivity

Chapter 8 Market Breakdown by Application

8.1 Overview

8.2 Global Market for Passenger Car Telematics by Application

8.2.1 North American Market for Passenger Car Telematics by Application

8.2.2 European Market for Passenger Car Telematics by Application

8.2.3 Asia-Pacific Market for Passenger Car Telematics by Application

8.2.4 Rest of the World Market for Passenger Car Telematics by Application

Chapter 9 Market Breakdown by Sales Channel

9.1 Overview

9.2 Global Market for Passenger Car Telematics by Sales Channel

9.2.1 North American Market for Passenger Car Telematics by Sales Channel

9.2.2 European Market for Passenger Car Telematics by Sales Channel

9.2.3 Asia-Pacific Market for Passenger Car Telematics by Sales Channel

9.2.4 Rest of the World Market for Passenger Car Telematics by Sales Channel

Chapter 10 Patent Analysis

10.1 Overview

10.2 Descriptions of Patents on Passenger Car Telematics

Chapter 11 Competitive Landscape

11.1 Overview

11.2 Analysis of Company Strategies

11.2.1 Product Launches

11.2.2 Expansion

11.2.3 Acquisitions, Collaborations, Contracts, Partnerships, Agreements, and Joint Ventures

11.3 Leading Telematics Hardware Suppliers

11.3.1 Oem Suppliers

11.3.2 Aftermarket Suppliers

11.4 Key Developments

11.5 List of Resources

Chapter 12 Company Profiles

- Cartrack

- Continental AG

- Fleet Complete

- Geotab Inc.

- Insurance & Mobility Solutions

- Lg Electronics

- Masternaut Ltd.

- Microlise Ltd.

- Mix Telematics

- Octo Group S.P.A.

- Omnimatics Sdn. Bhd

- Powerfleet Inc.

- Samsara Inc.

- Tata Motors

- Teletrac Navman U.S. Ltd.

- Verizon Connect

- Visteon Corp.

- Zonar Systems

12.1 Other Players

Chapter 13 Appendix: Acronyms

List of Tables

Summary Table: Global Market for Passenger Car Telematics, by Region, Through 2027

Table 1: Passenger Car Telematics Feature, by Packages

Table 2: Market Drivers on the Demand Side

Table 3: Shipment of Telematic Devices for Various Connectivity Networks, 2016 and 2020

Table 4: Global Market for Passenger Car Telematics, by Region, Through 2027

Table 5: North American Market for Passenger Car Telematics, by Country, Through 2027

Table 6: Penetration Rate of Telematics in the European Countries

Table 7: European Market for Passenger Car Telematics, by Country, Through 2027

Table 8: Implementation of Telematic Services in the Japanese and South Korean Markets

Table 9: Asia-Pacific Market for Passenger Car Telematics, by Country, Through 2027

Table 10: Rest of the World Market for Passenger Car Telematics, by Region, Through 2027

Table 11: Global Market for Passenger Car Telematics, by Product Type, Through 2027

Table 12: North American Market for Passenger Car Telematics, by Product Type, Through 2027

Table 13: European Market for Passenger Car Telematics, by Product Type, Through 2027

Table 14: Asia-Pacific Market for Passenger Car Telematics, by Product Type, Through 2027

Table 15: Rest of the World Market for Passenger Car Telematics, by Product Type, Through 2027

Table 16: Global Market for Passenger Car Telematics, by Type of Connectivity, Through 2027

Table 17: North American Market for Passenger Car Telematics, by Type of Connectivity, Through 2027

Table 18: European Market for Passenger Car Telematics, by Type of Connectivity, Through 2027

Table 19: Asia-Pacific Market for Passenger Car Telematics, by Type of Connectivity, Through 2027

Table 20: Rest of the World Market for Passenger Car Telematics, by Type of Connectivity, Through 2027

Table 21: Challenges Faced by Fleet Operators

Table 22: Global Market for Passenger Car Telematics, by Application, Through 2027

Table 23: Comparison Between Traditional Car Insurance and Telematics-Based Car Insurance

Table 24: North American Market for Passenger Car Telematics, by Application, Through 2027

Table 25: European Market for Passenger Car Telematics, by Application, Through 2027

Table 26: Asia-Pacific Market for Passenger Car Telematics, by Application, Through 2027

Table 27: Rest of the World Market for Passenger Car Telematics, by Application, Through 2027

Table 28: Global Market for Passenger Car Telematics, by Sales Channel, Through 2027

Table 29: North American Market for Passenger Car Telematics, by Sales Channel, Through 2027

Table 30: European Market for Passenger Car Telematics, by Sales Channel, Through 2027

Table 31: Asia-Pacific Market for Passenger Car Telematics, by Sales Channel, Through 2027

Table 32: Rest of the World Market for Passenger Car Telematics, by Sales Channel, Through 2027

Table 33: New Product Launches, by Key Players, January 2021-December 2021

Table 34: Expansions, by Key Players, January 2021-March 2022

Table 35: Contracts/Partnership/Agreements/Joint Ventures/Acquisitions/Collaborations, by Key Players, January 2021-November 2022

Table 36: List of Resources Used for Passenger Car Telematics

Table 37: CARTRACK: Financial Overview, 2018-2020

Table 38: MiX Telematics: Financial Overview, 2020-2022

Table 39: Samsara Inc.: App Marketplace

Table 40: Samsara Inc.: Financial Overview, 2020-2022

Table 41: Other Players in the Market for Passenger Car Telematics

Table 42: Acronyms and Abbreviations Used in This Report

List of Figures

Summary Figure: Global Market Share of Passenger Car Telematics, by Region, 2021

Figure 1: Evolution of Telematics - From the World’s First Satellite to the Connected Cars of Today

Figure 2: Applications of Passenger Car Telematics

Figure 3: Benefits of Telematics

Figure 4: Challenges for Telematics

Figure 5: Telematics System Types

Figure 6: Advantages of OEM Telematics

Figure 7: Advantages of Aftermarket Telematics

Figure 8: Value Chain for Passenger Car Telematics

Figure 9: Porter’s Five Forces Model for the Market for Passenger Car Telematics

Figure 10: Global Market Dynamics for Passenger Car Telematics

Figure 11: Restraints for Global Market for Passenger Car Telematics

Figure 12: Current Trends in the Global Market for Passenger Car Telematics

Figure 13: Global Installation for Telematic Devices, by Network Type, 2014-2024

Figure 14: Opportunities in the Global Market for Passenger Car Telematics

Figure 15: Telematics Applications in Electric Vehicles

Figure 16: Global Market Shares of Passenger Car Telematics, by Region, 2021

Figure 17: North American Market Shares of Passenger Car Telematics, by Country, 2021

Figure 18: European Market Shares of Passenger Car Telematics, by Country, 2021

Figure 19: Asia-Pacific Market Shares of Passenger Car Telematics, by Country, 2021

Figure 20: Rest of the World Market Shares of Passenger Car Telematics, by Region, 2021

Figure 21: Types of Hardware Used in Telematics

Figure 22: Global Market Shares of Passenger Car Telematics, by Product Type, 2021

Figure 23: North American Market Shares of Passenger Car Telematics, by Product Type, 2021

Figure 24: European Market Shares of Passenger Car Telematics, by Product Type, 2021

Figure 25: Asia-Pacific Market Shares of Passenger Car Telematics, by Product Type, 2021

Figure 26: Rest of the World Market Shares of Passenger Car Telematics, by Product Type, 2021

Figure 27: Global Market Shares of Passenger Car Telematics, by Type of Connectivity, 2021

Figure 28: North American Market Shares of Passenger Car Telematics, by Type of Connectivity, 2021

Figure 29: European Market Shares of Passenger Car Telematics, by Type of Connectivity, 2021

Figure 30: Asia-Pacific Market Shares of Passenger Car Telematics, by Type of Connectivity, 2021

Figure 31: Rest of the World Market Shares of Passenger Car Telematics, by Type of Connectivity, 2021

Figure 32: Global Market Shares of Passenger Car Telematics, by Application, 2021

Figure 33: North American Market Shares of Passenger Car Telematics, by Application, 2021

Figure 34: European Market Shares of Passenger Car Telematics, by Application, 2021

Figure 35: Asia-Pacific Market Shares of Passenger Car Telematics, by Application, 2021

Figure 36: Rest of the World Market Shares of Passenger Car Telematics, by Application, 2021

Figure 37: Global Market Shares of Passenger Car Telematics, by Sales Channel, 2021

Figure 38: North American Market Shares of Passenger Car Telematics, by Sales Channel, 2021

Figure 39: European Market Shares of Passenger Car Telematics, by Sales Channel, 2021

Figure 40: Asia-Pacific Market Shares of Passenger Car Telematics, by Sales Channel, 2021

Figure 41: Rest of the World Market Shares of Passenger Car Telematics, by Sales Channel, 2021

Figure 42: Patents on Passenger Car Telematics, by Company, 2021 and 2022

Figure 43: Distribution of Key Strategies Adopted by Top Companies in the Global Market for Passenger Car Telematics

Figure 44: Ecostructure of the Market for Passenger Car Telematics

Figure 45: MiX Telematics: Sales Share, by Business Segment, 2022

Figure 46: MiX Telematics: Sales Share, by Region, 2021

Figure 47: Samsara Inc.: Annual Recurring Revenue (AAR) Share, by Industry Segment, Jan. 29, 2022

Figure 48: Visteon Corp.: Sales Shares, by Product Type, 2021

Figure 49: Visteon Corp.: Sales Shares, by Region, 2021

Companies Mentioned

- Cartrack

- Continental AG

- Fleet Complete

- Geotab Inc.

- Insurance & Mobility Solutions

- Lg Electronics

- Masternaut Ltd.

- Microlise Ltd.

- Mix Telematics

- Octo Group S.P.A.

- Omnimatics Sdn. Bhd

- Powerfleet Inc.

- Samsara Inc.

- Tata Motors

- Teletrac Navman U.S. Ltd.

- Verizon Connect

- Visteon Corp.

- Zonar Systems

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | February 2023 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 53.9 Billion |

| Forecasted Market Value ( USD | $ 99.3 Billion |

| Compound Annual Growth Rate | 13.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |