Technological Advancements in Mass Spectrometry Fuels the North America Lipidomics Equipment Market

Mass spectrometers are commonly used for the identification and quantification of lipids. The high-energy collisional-activated dissociation (CAD) technique of mass spectrometry results in charge remote fragmentation (CRF) reactions, which help detect the location of small structural bond details. Several advanced mass spectrometers, including sector mass spectrometry, matrix-assisted laser desorption ionization-time-of-flight (MALDI-TOF), liquid chromatography-mass spectrometry (LC-MS), and tandem mass spectrometer have been made available for researchers and technicians. Further, these instruments are being integrated with automation, miniaturization, artificial intelligence (AI), and smart technologies to enhance their efficiencies and accuracies. In 2018, Thermo Scientific launched Genesys 50 UV/vis spectrometer that has a single-cell configuration for low sample throughput needs, with a removable, washable sampling compartment for easy clean-up. In the same year, Shimadzu, in collaboration with PREMIER Biosoft, launched Shimadzu's LCMS-9030 Quadrupole Time of Flight (Q-TOF) mass spectrometry (MS) system for lipidomics and glycomics data analysis. The product features informatics support powered by software solutions of PREMIER Biosoft. Therefore, the introduction of such new enhanced mass spectrometers and micropumps is boosting the growth of the North America lipidomics equipment market.North America Lipidomics Equipment Market Overview

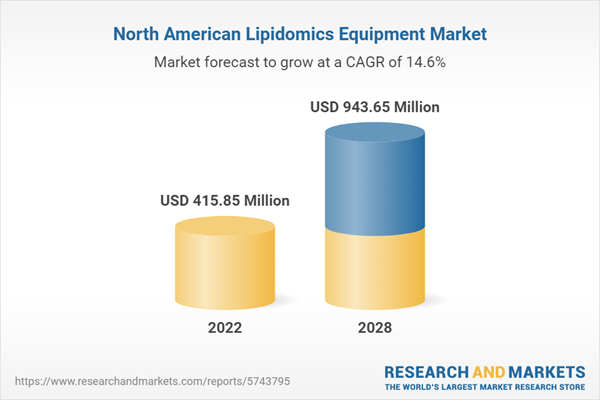

The North America lipidomics equipment market has been segmented into the US, Canada, and Mexico. The US held the largest share of the North America lipidomics equipment market in 2022. The market growth in the country is primarily driven by the increasing prevalence of chronic diseases such as cancer. For instance, according to the National Cancer Institute, the country will see 1,735,350 new cancer cases in 2020. Breast cancer, lung and bronchus bronchial cancer, prostate cancer, colon and rectal cancer, melanoma cancer, and liver cancer are the most common types of cancer. The incidence rate of cancer is increasing at an alarming rate in the country, increasing the demand for cancer diagnoses. Increasing investments and rising funds dedicated to the pharma manufacturing companies and academic and research institutes for developing various medicines, the growing geriatric population, increasing incidence of infectious diseases, and other therapeutics are among the major driving factors. Additionally, most foreign companies in the healthcare sector have R&D centers in the United States. Because these facilities rely on lipidomics services to provide high-quality outcomes, this industry is projected to grow rapidly. Chronic illnesses account for seven out of ten fatalities in the United States. Currently, more than half of Americans live with a chronic illness. The incidence of these diseases is expected to reach 170 million in the United States by 2030, boosting the pharmaceutical industry and, in turn, the demand for lipidomics equipment in the country.North AmericaLipidomics Equipment Market Revenue and Forecast to 2028 (US$ Million)

North America Lipidomics Equipment Market Segmentation

The North America lipidomics equipment market is segmented based on type, offerings, services, end user, and country.- Based on type, the North America lipidomics equipment market is bifurcated into targeted and untargeted. The targeted segment held a larger market share in 2022.

- Based on offerings, the North America lipidomics equipment market is segmented into MS-based lipidomics techniques, assays for lipid metabolism, lipid flux using heavy isotope-labeled precursors, software & services, and others. The MS-based lipidomics techniques segment held the largest market share in 2022. The MS-based lipidomics techniques segment is further categorized into mass spectrometers equipped with ion sources (turbo-) ESI/nano-ESI/APCI, autosamplers, micropumps, UV detectors, UPLC, variable-length fluorescence detectors, and others.

- Based on services, the North America lipidomics equipment market has been segmented into biomarker identification, bioinformatic analysis & data interpretation, molecular analysis of a broad spectrum of phospholipids (lipid fingerprinting), analysis & identification of unusual lipids, semiquantitative & quantitative analysis, lipid flux studies, and others. The biomarker identification segment held the largest market share in 2022.

- Based on end user, the North America lipidomics equipment market is segmented into molecular research, cellular research, clinical research, tissue & organ research, data research, organism research, technical services & prototyping, production, and others. The molecular research segment held the largest market share in 2022.

- Based on country, the North America lipidomics equipment market has been categorized into the US, Canada, and Mexico. Our regional analysis states that the US dominated the market in 2022.

Table of Contents

1. Introduction1.1 Scope of the Study

1.2 Research Report Guidance

1.3 Market Segmentation

1.3.1 North America Lipidomics Equipment Market - By Type

1.3.2 North America Lipidomics Equipment Market - By Offerings

1.3.3 North America Lipidomics Equipment Market - By Services

1.3.4 North America Lipidomics Equipment Market - By End User

1.3.5 North America Lipidomics Equipment Market - By Country

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. North America Lipidomics Equipment Market - Market Landscape

4.1 Overview

4.2 North America PEST Analysis

4.3 Experts Opinion

5. North America Lipidomics Equipment Market - Key Market Dynamics

5.1 Market Drivers

5.1.1 Technological Advancements in Mass Spectrometry

5.1.2 Growing Applications of Lipidomics in Biomedical Sciences

5.2 Market Restraints

5.2.1 Premium Product Pricing

5.3 Future Trends

5.3.1 Fully Automated Lipidomics Equipment

5.4 Impact Analysis

6. Lipidomics Equipment Market - North America Analysis

6.1 North America Lipidomics Equipment Market Revenue Forecast & Analysis

7. North America Lipidomics Equipment Market Analysis - By Type

7.1 Overview

7.2 North America Lipidomics Equipment Market, by Type, 2021 & 2028 (%)

7.3 Targeted

7.3.1 Overview

7.3.2 Targeted Market Revenue and Forecast to 2028 (US$ Million)

7.4 Untargeted

7.4.1 Overview

7.4.2 Untargeted Market Revenue and Forecast to 2028 (US$ Million)

8. North America Lipidomics Equipment Market Analysis - By Offerings

8.1 Overview

8.2 North America Lipidomics Equipment Market, by Offerings, 2021 & 2028 (%)

8.3 MS-Based Lipidomics Techniques

8.3.1 Overview

8.3.2 MS-Based Lipidomics Techniques Market Revenue and Forecast to 2028 (US$ Million)

8.3.3 Mass Spectrometers equipped with ion sources (turbo-)ESI/nano-ESI/APCI

8.3.3.1 Overview

8.3.3.2 Mass Spectrometers equipped with ion sources (turbo-)ESI/nano-ESI/APCI Market Revenue and Forecast to 2028 (US$ Million)

8.3.4 Autosamplers

8.3.4.1 Overview

8.3.4.2 Autosamplers Market Revenue and Forecast to 2028 (US$ Million)

8.3.5 Micropumps

8.3.5.1 Overview

8.3.5.2 Micropumps Market Revenue and Forecast to 2028 (US$ Million)

8.3.6 UV Detectors

8.3.6.1 Overview

8.3.6.2 UV Detectors Market Revenue and Forecast to 2028 (US$ Million)

8.3.7 UPLC

8.3.7.1 Overview

8.3.7.2 UPLC Market Revenue and Forecast to 2028 (US$ Million)

8.3.8 Variable Length Fluorescence Detector

8.3.8.1 Overview

8.3.8.2 Variable Length Fluorescence Detector Market Revenue and Forecast to 2028 (US$ Million)

8.3.9 Others

8.3.9.1 Overview

8.3.9.2 Others Market Revenue and Forecast to 2028 (US$ Million)

8.4 Assays for Lipid Metabolism

8.4.1 Overview

8.4.2 Assays for Lipid Metabolism Market Revenue and Forecast to 2028 (US$ Million)

8.5 Lipid Flux Using Heavy Isotope-Labeled Precursors

8.5.1 Overview

8.5.2 Lipid Flux Using Heavy Isotope-Labeled Precursors Market Revenue and Forecast to 2028 (US$ Million)

8.6 Software & Services

8.6.1 Overview

8.6.2 Software & Services Market Revenue and Forecast to 2028 (US$ Million)

8.7 Others

8.7.1 Overview

8.7.2 Others Market Revenue and Forecast to 2028 (US$ Million)

9. North America Lipidomics Equipment Market Analysis - By Services

9.1 Overview

9.2 North America Lipidomics Equipment Market, by Services, 2021 & 2028 (%)

9.3 Biomarker Identification

9.3.1 Overview

9.3.2 Biomarker Identification Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

9.4 Bioinformatics Analysis & Data Interpretation

9.4.1 Overview

9.4.2 Bioinformatics Analysis & Data Interpretation Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

9.5 Molecular Analysis of a Broad Spectrum of Phospholipids (Lipid Fingerprinting)

9.5.1 Overview

9.5.2 Molecular Analysis of a Broad Spectrum of Phospholipids (Lipid Fingerprinting) Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

9.6 Analysis & Identification of Unusual Lipids

9.6.1 Overview

9.6.2 Analysis & Identification of Unusual Lipids Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

9.7 Semiquantitative & Quantitative Analysis

9.7.1 Overview

9.7.2 Semiquantitative & Quantitative Analysis Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

9.8 Lipid Flux Studies

9.8.1 Overview

9.8.2 Lipid Flux Studies Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

9.9 Others

9.9.1 Overview

9.9.2 Others Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

10. North America Lipidomics Equipment Market Analysis - By End User

10.1 Overview

10.2 North America Lipidomics Equipment Market, by End User, 2021 & 2028 (%)

10.3 Molecular Research

10.3.1 Overview

10.3.2 Molecular Research Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

10.4 Cellular Research

10.4.1 Overview

10.4.2 Cellular Research Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

10.5 Clinical Research

10.5.1 Overview

10.5.2 Clinical Research Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

10.6 Tissue & Organ Research

10.6.1 Overview

10.6.2 Tissue & Organ Research Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

10.7 Data Research

10.7.1 Overview

10.7.2 Data Research Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

10.8 Organism Research

10.8.1 Overview

10.8.2 Organism Research Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

10.9 Technical Services & Prototyping

10.9.1 Overview

10.9.2 Technical Services & Prototyping Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

10.10 Production

10.10.1 Overview

10.10.2 Production Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

10.11 Others

10.11.1 Overview

10.11.2 Others Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

11. North America Lipidomics Equipment Market - Country Analysis

11.1 Overview

11.1.2 North America: Lipidomics Equipment Market, by Country, 2021 & 2028 (%)

11.1.2.1 US: Lipidomics Equipment Market - Revenue and Forecast to 2028 (US$ Million)

11.1.2.1.1 Overview

11.1.2.1.2 US: Lipidomics Equipment Market - Revenue and Forecast to 2028 (US$ Million)

11.1.2.1.3 US: Lipidomics Equipment Market, by Type, 2020-2028 (US$ Million)

11.1.2.1.4 US: Lipidomics Equipment Market, by Offerings, 2020-2028 (US$ Million)

11.1.2.1.4.1 US: Lipidomics Equipment Market, by MS-Based Lipidomics Techniques, 2020-2028 (US$ Million)

11.1.2.1.5 US: Lipidomics Equipment Market, by Services, 2020-2028 (US$ Million)

11.1.2.1.6 US: Lipidomics Equipment Market, by End User, 2020-2028 (US$ Million)

11.1.2.2 Canada: Lipidomics Equipment Market - Revenue and Forecast to 2028 (US$ Million)

11.1.2.2.1 Overview

11.1.2.2.2 Canada: Lipidomics Equipment Market - Revenue and Forecast to 2028 (US$ Million)

11.1.2.2.3 Canada: Lipidomics Equipment Market, by Type, 2020-2028 (US$ Million)

11.1.2.2.4 Canada: Lipidomics Equipment Market, by Offerings, 2020-2028 (US$ Million)

11.1.2.2.4.1 Canada: Lipidomics Equipment Market, by MS-Based Lipidomics Techniques, 2020-2028 (US$ Million)

11.1.2.2.5 Canada: Lipidomics Equipment Market, by Services, 2020-2028 (US$ Million)

11.1.2.2.6 Canada: Lipidomics Equipment Market, by End User, 2020-2028 (US$ Million)

11.1.2.3 Mexico: Lipidomics Equipment Market - Revenue and Forecast to 2028 (US$ Million)

11.1.2.3.1 Overview

11.1.2.3.2 Mexico: Lipidomics Equipment Market - Revenue and Forecast to 2028 (US$ Million)

11.1.2.3.3 Mexico: Lipidomics Equipment Market, by Type, 2020-2028 (US$ Million)

11.1.2.3.4 Mexico: Lipidomics Equipment Market, by Offerings, 2020-2028 (US$ Million)

11.1.2.3.4.1 Mexico: Lipidomics Equipment Market, by MS-Based Lipidomics Techniques, 2020-2028 (US$ Million)

11.1.2.3.5 Mexico: Lipidomics Equipment Market, by Services, 2020-2028 (US$ Million)

11.1.2.3.6 Mexico: Lipidomics Equipment Market, by End User, 2020-2028 (US$ Million)

12. Industry Landscape

12.1 Overview

12.2 Organic Developments

12.2.1 Overview

12.3 Inorganic Developments

12.3.1 Overview

13. Company Profiles

13.1 Thermo Fisher Scientific Inc.

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Bruker

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Agilent Technologies, Inc.

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 PerkinElmer Inc.

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Sciex

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Metabolon, Inc.

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Cayman Chemical

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Creative Proteomics

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Shimadzu Corporation

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 IonBench

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

14.1 About the Publisher

14.2 Glossary of Terms

List of Tables

Table 1. North America Lipidomics Equipment Market -Revenue and Forecast to 2028 (US$ Million)

Table 2. US Lipidomics Equipment Market, by Type - Revenue and Forecast to 2028 (US$ Million)

Table 3. US Lipidomics Equipment Market, by Offerings - Revenue and Forecast to 2028 (US$ Million)

Table 4. US Lipidomics Equipment Market, by MS-Based Lipidomics Techniques - Revenue and Forecast to 2028 (US$ Million)

Table 5. US Lipidomics Equipment Market, by Services - Revenue and Forecast to 2028 (US$ Million)

Table 6. US Lipidomics Equipment Market, by End User - Revenue and Forecast to 2028 (US$ Million)

Table 7. Canada Lipidomics Equipment Market, by Type - Revenue and Forecast to 2028 (US$ Million)

Table 8. Canada Lipidomics Equipment Market, by Offerings- Revenue and Forecast to 2028 (US$ Million)

Table 9. Canada Lipidomics Equipment Market, by MS-Based Lipidomics Techniques- Revenue and Forecast to 2028 (US$ Million)

Table 10. Canada Lipidomics Equipment Market, by Services - Revenue and Forecast to 2028 (US$ Million)

Table 11. Canada Lipidomics Equipment Market, by End User - Revenue and Forecast to 2028 (US$ Million)

Table 12. Mexico Lipidomics Equipment Market, by Type - Revenue and Forecast to 2028 (US$ Million)

Table 13. Mexico Lipidomics Equipment Market, by Offerings- Revenue and Forecast to 2028 (US$ Million)

Table 14. Mexico Lipidomics Equipment Market, by MS-Based Lipidomics Techniques- Revenue and Forecast to 2028 (US$ Million)

Table 15. Mexico Lipidomics Equipment Market, by Services - Revenue and Forecast to 2028 (US$ Million)

Table 16. Mexico Lipidomics Equipment Market, by End User - Revenue and Forecast to 2028 (US$ Million)

Table 17. Organic Developments

Table 18. Inorganic Developments in the Lipidomics Equipment Market

Table 19. Glossary of Terms

List of Figures

Figure 1. North America Lipidomics Equipment Market Segmentation

Figure 2. North America Lipidomics Equipment Market, By Country

Figure 3. North America Lipidomics Equipment Market Overview

Figure 4. North America Lipidomics Equipment Market, By Type

Figure 5. North America Lipidomics Equipment Market, By Country

Figure 6. North America: PEST Analysis

Figure 7. Experts Opinion

Figure 8. North America Lipidomics Equipment Market Impact Analysis of Driver and Restraints

Figure 9. North America Lipidomics Equipment Market - Revenue Forecast and Analysis

Figure 10. North America Lipidomics Equipment Market, by Type, 2021 & 2028 (%)

Figure 11. North America Targeted Market Revenue and Forecast to 2028 (US$ Million)

Figure 12. North America Untargeted Market Revenue and Forecast to 2028 (US$ Million)

Figure 13. North America Lipidomics Equipment Market, by Offerings, 2021 & 2028 (%)

Figure 14. North America MS-Based Lipidomics Techniques Market Revenue and Forecast to 2028 (US$ Million)

Figure 15. North America Mass Spectrometers equipped with ion sources (turbo-)ESI/nano-ESI/APCI Market Revenue and Forecast to 2028 (US$ Million)

Figure 16. North America Autosamplers Market Revenue and Forecast to 2028 (US$ Million)

Figure 17. North America Micropumps Market Revenue and Forecast to 2028 (US$ Million)

Figure 18. North America UV Detectors Market Revenue and Forecast to 2028 (US$ Million)

Figure 19. North America UPLC Market Revenue and Forecast to 2028 (US$ Million)

Figure 20. North America Variable Length Fluorescence Detector Market Revenue and Forecast to 2028 (US$ Million)

Figure 21. North America Others Market Revenue and Forecast to 2028 (US$ Million)

Figure 22. North America Assays for Lipid Metabolism Market Revenue and Forecast to 2028 (US$ Million)

Figure 23. North America Lipid Flux Using Heavy Isotope-Labeled Precursors Market Revenue and Forecast to 2028 (US$ Million)

Figure 24. North America Software & Services Market Revenue and Forecast to 2028 (US$ Million)

Figure 25. North America Others Market Revenue and Forecast to 2028 (US$ Million)

Figure 26. North America Lipidomics Equipment Market, by Services, 2021 & 2028 (%)

Figure 27. North America Biomarker Identification Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

Figure 28. North America Bioinformatics Analysis & Data Interpretation Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

Figure 29. North America Molecular Analysis of a Broad Spectrum of Phospholipids (Lipid Fingerprinting) Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

Figure 30. North America Analysis & Identification of Unusual Lipids Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

Figure 31. North America Semiquantitative & Quantitative Analysis Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

Figure 32. North America Lipid Flux Studies Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

Figure 33. North America Others Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

Figure 34. North America Lipidomics Equipment Market, by End User, 2021 & 2028 (%)

Figure 35. North America Molecular Research Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

Figure 36. North America Cellular Research Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

Figure 37. North America Clinical Research Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

Figure 38. North America Tissue & Organ Research Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

Figure 39. North America Data Research Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

Figure 40. North America Organism Research Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

Figure 41. North America Technical Services & Prototyping Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

Figure 42. North America Production Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

Figure 43. North America Others Lipidomics Equipment Market Revenue and Forecasts to 2028 (US$ Million)

Figure 44. North America: Lipidomics Equipment Market, by Key Country - Revenue (2021) (US$ Million)

Figure 45. North America: Lipidomics Equipment Market, by Country, 2021 & 2028 (%)

Figure 46. US: Lipidomics Equipment Market - Revenue and Forecast to 2028 (US$ Million)

Figure 47. Canada: Lipidomics Equipment Market - Revenue and Forecast to 2028 (US$ Million)

Figure 48. Mexico: Lipidomics Equipment Market - Revenue and Forecast to 2028 (US$ Million)

Companies Mentioned

- Agilent Technologies, Inc.

- Bruker

- Cayman Chemical

- Creative Proteomics

- IonBench

- Metabolon, Inc.

- PerkinElmer Inc.

- Sciex

- Shimadzu Corporation.

- Thermo Fisher Scientific Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 174 |

| Published | January 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 415.85 Million |

| Forecasted Market Value ( USD | $ 943.65 Million |

| Compound Annual Growth Rate | 14.6% |

| Regions Covered | North America |

| No. of Companies Mentioned | 10 |