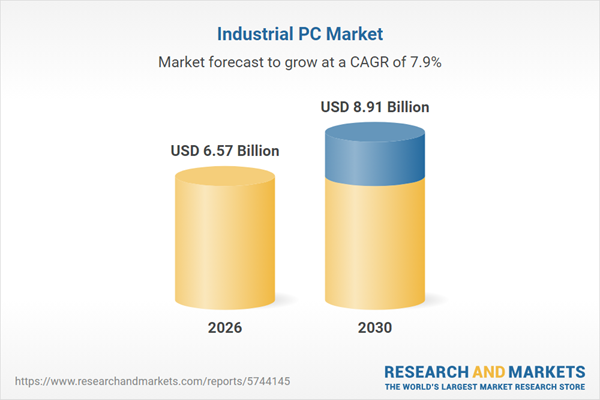

The industrial pc market size is expected to see strong growth in the next few years. It will grow to $8.91 billion in 2030 at a compound annual growth rate (CAGR) of 7.9%. The growth in the forecast period can be attributed to increase in ruggedized and fanless IPCs, rising adoption of modular embedded and DIN rail IPCs, expansion of edge and panel IPC deployment, growth in touchscreen and capacitive display integration, increase in real-time monitoring and industrial automation. Major trends in the forecast period include integration of AI-enabled industrial pcs, deployment of IoT-connected industrial systems, adoption of predictive maintenance analytics, implementation of edge computing solutions, expansion of smart factory automation.

The growing adoption of robotics is expected to drive the industrial PC market in the coming years. Robotics encompasses a multidisciplinary blend of engineering and scientific fields, including mechanical, electronic, and information engineering, as well as computer science. It focuses on the design, operation, and application of robots. Industrial PCs facilitate precise control and real-time monitoring of robotic operations in manufacturing and automation processes. For example, in September 2024, the International Federation of Robotics (IFR), a Germany-based non-profit organization, reported that industrial robot installations in the UK increased by 51%, reaching 3,830 units, while in the Americas, more than 50,000 units were installed for the third year in a row, totaling 55,389 units in 2023. Therefore, the growing adoption of robotics is propelling the industrial PC market.

Leading companies operating in the industrial PC market are introducing new industrial PC solutions such as the AC100 to deliver improved computing performance and flexibility. The AC100 is an industrial PC developed using the NVIDIA Jetson Xavier NX platform. For example, in September 2023, EKF, a UK-based manufacturer of products and services, launched the AC100, an industrial PC powered by NVIDIA Jetson Xavier NX and capable of providing up to 21 TOPS of computing. It includes DisplayPort, Ethernet, USB, and internal PCIe M.2 SSD interfaces. With integrated M.2 ports, it supports 4G/5G WWAN connectivity and two WiFi 6 modules. Additional options include fiber optic connectors and up to 8 TB NVMe SSD storage. The PC incorporates a PCIe packet switch for external device compatibility and operates on EKF's Linux4Tegra OS, based on Ubuntu 18.04 and Linux Kernel 4.9. It is available as a standalone board or with multiple enclosure configurations for diverse applications.

In October 2023, Advantech Co., Ltd., a Taiwan-based provider of industrial PCs, embedded systems, and IoT hardware solutions, acquired BitFlow, Inc. for an undisclosed amount. This acquisition strengthens the company’s presence in the industrial PC and machine vision markets, expands its portfolio of high-speed image acquisition and processing solutions, and supports the integration of advanced vision technologies into industrial automation and edge computing platforms. BitFlow, Inc. is a US-based provider of high-performance frame grabbers and image-acquisition hardware designed for use in industrial PCs for machine vision and industrial imaging applications.

Major companies operating in the industrial pc market are Advantech Co. Ltd., Beckhoff Automation Pvt. Ltd., Siemens AG., IEI Integration Corporation, Kontron AG, NEXCOM International Co Ltd, Avalue Technology Inc., DFI Inc., American Portwell Technology Inc., General Electric Company., Omron Corporation, Rockwell Automation Inc., Schneider Electric SE, B&R Industrial Automation GmbH, Acnodes Corporation, Aditech ICT Pvt. Ltd., ADLINK Technology Inc., Contec Co. Ltd., Crystal Group Inc., OnLogic Inc., Protech Systems Co. Ltd., VarTech Systems Inc., Mitsubishi Electric Corporation, Panasonic Corporation.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

Tariffs are impacting the industrial PC market by raising costs on imported rugged components, solid-state drives, and embedded systems. Automotive, semiconductor, chemical, and aerospace segments in North America, Europe, and Asia-Pacific are most affected. However, tariffs are encouraging local manufacturing, regional sourcing of components, and R&D investment for more resilient IPCs, enhancing supply chain security and promoting innovation.

The industrial PC market research report is one of a series of new reports that provides industrial PC market statistics, including industrial PC industry global market size, regional shares, competitors with a industrial PC market share, detailed industrial PC market segments, market trends and opportunities, and any further data you may need to thrive in the industrial PC industry. This industrial PC market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

An Industrial PC is a rugged computer designed for use in industrial settings, typically in manufacturing processes. These PCs are constructed with durable materials and components to enhance reliability and uptime. This means that they can withstand harsh environments and operate continuously, whereas a standard desktop PC might fail. They are capable of enduring challenging conditions like temperature fluctuations, dust, vibration, power surges, and noise.

There are several main types of industrial PCs, including panel IPC, rack mount IPC, box IPC, embedded IPC, din rail IPC, and others. Panel IPCs are utilized for tasks such as machine control, motion sequencing, display functions, data collection, and image processing. They come with various types of displays, including resistive and capacitive, and offer different storage options such as solid-state and rotating drives. These industrial PCs find applications in various industries, including automotive, healthcare, chemical, aerospace and defense, semiconductor and electronics, energy and power, oil and gas, among others. They are distributed through various sales channels, including direct sales and indirect sales.North America was the largest region in the industrial PC market in 2025. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the industrial pc market report are Asia-Pacific, South East Asia, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the industrial pc market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Taiwan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The industrial PC market consists of sales of Panel PCs (PPCs), Touch Panel PCs (TPCs), and Industrial Panel PCs (IPPCs). Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Industrial PC Market Global Report 2026 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses industrial pc market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 16 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on end user analysis.

- Benchmark performance against key competitors based on market share, innovation, and brand strength.

- Evaluate the total addressable market (TAM) and market attractiveness scoring to measure market potential.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for industrial pc? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The industrial pc market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, total addressable market (TAM), market attractiveness score (MAS), competitive landscape, market shares, company scoring matrix, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market. This section also examines key products and services offered in the market, evaluates brand-level differentiation, compares product features, and highlights major innovation and product development trends.

- The supply chain analysis section provides an overview of the entire value chain, including key raw materials, resources, and supplier analysis. It also provides a list competitor at each level of the supply chain.

- The updated trends and strategies section analyses the shape of the market as it evolves and highlights emerging technology trends such as digital transformation, automation, sustainability initiatives, and AI-driven innovation. It suggests how companies can leverage these advancements to strengthen their market position and achieve competitive differentiation.

- The regulatory and investment landscape section provides an overview of the key regulatory frameworks, regularity bodies, associations, and government policies influencing the market. It also examines major investment flows, incentives, and funding trends shaping industry growth and innovation.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- The total addressable market (TAM) analysis section defines and estimates the market potential compares it with the current market size, and provides strategic insights and growth opportunities based on this evaluation.

- The market attractiveness scoring section evaluates the market based on a quantitative scoring framework that considers growth potential, competitive dynamics, strategic fit, and risk profile. It also provides interpretive insights and strategic implications for decision-makers.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- Expanded geographical coverage includes Taiwan and Southeast Asia, reflecting recent supply chain realignments and manufacturing shifts in the region. This section analyzes how these markets are becoming increasingly important hubs in the global value chain.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The company scoring matrix section evaluates and ranks leading companies based on a multi-parameter framework that includes market share or revenues, product innovation, and brand recognition.

Scope

Markets Covered:

1) By Type: Panel IPC; Rack Mount IPC; Box IPC; Embedded IPC; DIN Rail IPC; Other Types2) By Display Type: Resistive; Capacitive; Other Display Types

3) By Storage Medium: Solid State; Rotating

4) By Sales Channel: Direct Sales; Indirect Sales

5) By End-User: Automotive; Healthcare; Chemical; Aerospace And Defense; Semiconductor And Electronics; Energy And Power; Oil And Gas; Other End Users

Subsegments:

1) By Panel IPC: Touchscreen Panel IPC; Standard Panel IPC2) By Rack Mount IPC: 1U Rack Mount IPC; 2U Rack Mount IPC; Custom Rack Mount IPC

3) By Box IPC: Fanless Box IPC; Standard Box IPC; Compact Box IPC

4) By Embedded IPC: Compact Embedded IPC; Modular Embedded IPC

5) By DIN Rail IPC: Standard DIN Rail IPC; Rugged DIN Rail IPC

6) By Other Types: Mobile IPC; All-in-One IPC

Companies Mentioned: Advantech Co. Ltd.; Beckhoff Automation Pvt. Ltd.; Siemens AG.; IEI Integration Corporation; Kontron AG; NEXCOM International Co Ltd; Avalue Technology Inc.; DFI Inc.; American Portwell Technology Inc.; General Electric Company.; Omron Corporation; Rockwell Automation Inc.; Schneider Electric SE; B&R Industrial Automation GmbH; Acnodes Corporation; Aditech ICT Pvt. Ltd.; ADLINK Technology Inc.; Contec Co. Ltd.; Crystal Group Inc.; OnLogic Inc.; Protech Systems Co. Ltd.; VarTech Systems Inc.; Mitsubishi Electric Corporation; Panasonic Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Taiwan; Russia; South Korea; UK; USA; Canada; Italy; Spain.

Regions: Asia-Pacific; South East Asia; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: Word, PDF or Interactive Report + Excel Dashboard

Added Benefits:

- Bi-Annual Data Update

- Customisation

- Expert Consultant Support

Companies Mentioned

The companies featured in this Industrial PC market report include:- Advantech Co. Ltd.

- Beckhoff Automation Pvt. Ltd.

- Siemens AG.

- IEI Integration Corporation

- Kontron AG

- NEXCOM International Co Ltd

- Avalue Technology Inc.

- DFI Inc.

- American Portwell Technology Inc.

- General Electric Company.

- Omron Corporation

- Rockwell Automation Inc.

- Schneider Electric SE

- B&R Industrial Automation GmbH

- Acnodes Corporation

- Aditech ICT Pvt. Ltd.

- ADLINK Technology Inc.

- Contec Co. Ltd.

- Crystal Group Inc.

- OnLogic Inc.

- Protech Systems Co. Ltd.

- VarTech Systems Inc.

- Mitsubishi Electric Corporation

- Panasonic Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | January 2026 |

| Forecast Period | 2026 - 2030 |

| Estimated Market Value ( USD | $ 6.57 Billion |

| Forecasted Market Value ( USD | $ 8.91 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |