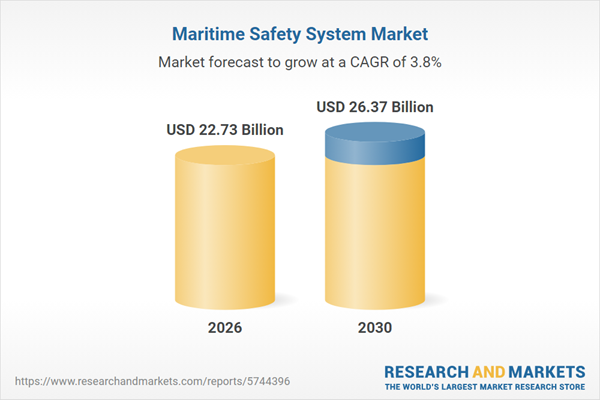

The maritime safety system market size is expected to see steady growth in the next few years. It will grow to $26.37 billion in 2030 at a compound annual growth rate (CAGR) of 3.8%. The growth in the forecast period can be attributed to increasing adoption of AIS and GMDSS, integration with automated incident reporting, expansion in coastal and offshore safety systems, rising demand for anti-piracy technologies, development of smart vessel monitoring solutions. Major trends in the forecast period include deployment of real-time maritime tracking systems, integration of advanced navigation solutions, adoption of satellite-based monitoring, implementation of automated security protocols, expansion of smart maritime safety systems.

The expansion of maritime trade and transportation is expected to drive the growth of the maritime safety system market. Increased consumer well-being leads to higher production levels. Lower emissions during long voyages, combined with maritime trade and transportation, support producers in maintaining competitiveness. The larger volume of goods transported in a single trip makes sea transport more cost-effective and environmentally friendly compared to other long-distance shipping methods. For example, in July 2023, the United Nations Conference on Trade and Development (UNCTAD), a Switzerland-based UN agency, reported that maritime trade volume was projected to grow by 2.4 percent in 2023. In 2022, containerized trade measured in metric tons fell by 3.7 percent, but UNCTAD anticipated a 1.2 percent increase in 2023 and growth of over 3 percent during the 2024-2028 period. Additionally, in 2022, oil and gas trade volumes experienced strong annual growth rates of 6 percent and 4.6 percent, respectively. Therefore, rising maritime trade and transportation are fueling the expansion of the maritime safety system market.

Leading companies operating in the marine safety system market are developing new products, such as single-man portable subsea ROVs, to reach larger customer bases, boost sales, and increase revenue. Single-man portable subsea remotely operated vehicles (ROVs) are compact, remotely controlled underwater machines designed for inspections, maintenance, and tasks in areas that are difficult for humans to access. For instance, in June 2023, SeaDrone Inc., a US-based provider of subsea inspection solutions, introduced the SeaDrone MINI, the latest model in its line of compact, single-operator subsea ROVs. A notable feature of this product is its professional-grade quality, making it suitable for users with varying levels of experience. The MINI ROV includes four 96-Wh batteries and is compatible with airline transport. Users can also opt for a 400-W hybrid surface power system to extend mission durations indefinitely. The standard MINI unit features a wide-angle video camera capable of capturing 12-megapixel still images and recording 1080/30p H.264 video. Depth and AHRS sensors enable automatic control of depth, heading, roll, and pitch in all operating modes. Integrated GPS functionality allows for geotagging of photos and videos, as well as marking saved landmarks.

In August 2024, Noatum, a logistics, maritime, and port services company based in Spain, acquired Safina B.V. for an undisclosed sum. This acquisition supports strategic growth by leveraging Safina's expertise, capacity, and reputation in Egypt's maritime agency market. Additionally, it aligns with the company's expansion in the Middle East, a crucial market for its global strategy, and integrates well with AD Ports Group's broader presence in Egypt, recently highlighted by the signing of concession agreements for managing and operating cruise and Ro-Ro terminals at the ports of Safaga, Hurghada, Sharm El Sheikh, and Sokhna. Safina Shipping Services is an Egypt-based provider of comprehensive shipping services, cargo handling, and vessel protection.

Major companies operating in the maritime safety system market are Anschutz GmbH, Honeywell International Inc., Elbit Systems Ltd., Saab AB, OSI Maritime Systems Ltd., BAE Systems plc, Thales Group, Smiths Group plc, Northrop Grumman Corporation, Westminster Group Plc, L3Harris Technologies Inc., Kongsberg Gruppen ASA, Leonardo S.p.a., Atlas Elektronik GmbH, Airbus SE, Terma Group AS, Nuctech Company Ltd., ARES Security Corporation, Rolta India Ltd., HALO Maritime Defense Systems Inc., Lockheed Martin Corporation, General Dynamics Corporation, Harris Corporation, Safran S.A., FLIR Systems Inc., Garmin Ltd., Furuno Electric Co. Ltd., Japan Radio Co. Ltd., Wärtsilä Corporation, Signalis SA, SRT Marine Systems PLC, Consilium Strategic Communications Ltd., MarineGuard Systems Ltd., Martek Marine Ltd., HENSOLDT UK.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

Tariffs are influencing the maritime safety system market by raising costs for imported sensors, satellite communication modules, and monitoring equipment. Shipping, marine construction, and cargo operators in Asia-Pacific, Europe, and North America are most affected due to reliance on imported components. Nevertheless, tariffs are promoting local manufacturing, regional sourcing, and innovation in smart maritime safety solutions, enhancing supply chain stability and adoption of advanced monitoring technologies.

The maritime safety system market research report is one of a series of new reports that provides maritime safety system market statistics, including maritime safety system industry global market size, regional shares, competitors with a maritime safety system market share, detailed maritime safety system market segments, market trends and opportunities, and any further data you may need to thrive in the maritime safety system industry. This maritime safety system market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The Maritime Safety System (MSS) refers to planned solutions and services implemented by shipping companies to ensure the safety of ships and the marine environment. MSS aims to provide a comprehensive approach to alert the system about the position and safety-related concerns of ships in the vicinity. It includes functionalities related to search and rescue coordination and protection from various security threats, such as terrorism, piracy, robbery, and illegal trafficking activities.

The main types of maritime safety systems include the Ship Security Reporting System, Automatic Identification System (AIS), Global Maritime Distress Safety System (GMDSS), Long Range Tracking and Identification (LRIT) System, Vessel Monitoring and Management System, and other systems like the Automated Manifest System (AMS) and Automated Mutual Assistance Vessel Rescue System (AMVER). The Security Reporting System involves electronic systems designed to prevent or mitigate potential risks in ships by implementing less hazardous processes and programs to reduce injuries and property loss. Maritime safety systems are employed for various purposes, including loss prevention and detection, security management, counter-piracy measures, coastal monitoring, safety of ships, and Pollution Prevention and Response (PPR) management. These systems find applications in diverse sectors such as government institutions, oil & gas, marine & construction, shipping & transportation, cargos & containers, and other end-users.Asia-Pacific was the largest region in the maritime safety system market in 2025 and is also expected to be the fastest-growing region in the forecast period. The regions covered in the maritime safety system market report are Asia-Pacific, South East Asia, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the maritime safety system market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Taiwan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The maritime safety system market consists of revenues earned by entities by providing maritime safety solutions such as navigation, tracking, sending, and receiving real-time data, assistance to vessels, and managing ship traffic. The market value includes the value of related goods sold by the service provider or included within the service offering. The maritime safety system market also includes sales of automatic identification systems, GMDSS systems, long-range tracking and identification (LRIT) system, automated manifest system (AMS), automated mutual assistance vessel rescue systems (AMVER), and vessel management systems. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in maritime safety system market related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Maritime Safety System Market Global Report 2026 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses maritime safety system market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 16 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on end user analysis.

- Benchmark performance against key competitors based on market share, innovation, and brand strength.

- Evaluate the total addressable market (TAM) and market attractiveness scoring to measure market potential.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for maritime safety system? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The maritime safety system market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, total addressable market (TAM), market attractiveness score (MAS), competitive landscape, market shares, company scoring matrix, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market. This section also examines key products and services offered in the market, evaluates brand-level differentiation, compares product features, and highlights major innovation and product development trends.

- The supply chain analysis section provides an overview of the entire value chain, including key raw materials, resources, and supplier analysis. It also provides a list competitor at each level of the supply chain.

- The updated trends and strategies section analyses the shape of the market as it evolves and highlights emerging technology trends such as digital transformation, automation, sustainability initiatives, and AI-driven innovation. It suggests how companies can leverage these advancements to strengthen their market position and achieve competitive differentiation.

- The regulatory and investment landscape section provides an overview of the key regulatory frameworks, regularity bodies, associations, and government policies influencing the market. It also examines major investment flows, incentives, and funding trends shaping industry growth and innovation.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- The total addressable market (TAM) analysis section defines and estimates the market potential compares it with the current market size, and provides strategic insights and growth opportunities based on this evaluation.

- The market attractiveness scoring section evaluates the market based on a quantitative scoring framework that considers growth potential, competitive dynamics, strategic fit, and risk profile. It also provides interpretive insights and strategic implications for decision-makers.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- Expanded geographical coverage includes Taiwan and Southeast Asia, reflecting recent supply chain realignments and manufacturing shifts in the region. This section analyzes how these markets are becoming increasingly important hubs in the global value chain.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The company scoring matrix section evaluates and ranks leading companies based on a multi-parameter framework that includes market share or revenues, product innovation, and brand recognition.

Scope

Markets Covered:

1) By System: Ship Security Reporting System; Automatic Identification System (AIS); Global Maritime Distress Safety System (GMDSS); Long Range Tracking and Identification (LRIT) System; Vessel Monitoring and Management System; Other Systems2) By Application: Loss prevention and detection; Security management; Counter piracy; Coastal monitoring; Safety of ship; Pollution Prevention and Response (PPR) management

3) By End User: Government Institutions; Oil & Gas; Marine & construction; Shipping & Transportation; Cargos & containers; Other End-Users

Subsegments:

1) By Ship Security Reporting System: Real-time Ship Reporting; Incident Reporting2) By Automatic Identification System (AIS): Class A (AIS); Class B AIS

3) By Global Maritime Distress Safety System (GMDSS): Search and Rescue Equipment; Emergency Position Indicating Radio Beacons (EPIRB); Maritime Safety Information (MSI)

4) By Long Range Tracking and Identification (LRIT) System: Satellite-based Tracking; Coastal Tracking

5) By Vessel Monitoring and Management System: Fleet Management; Navigation Systems

6) By Other Systems: Radar Systems; Surveillance Systems; Communication Systems

Companies Mentioned: Anschutz GmbH; Honeywell International Inc.; Elbit Systems Ltd.; Saab AB; OSI Maritime Systems Ltd.; BAE Systems plc; Thales Group; Smiths Group plc; Northrop Grumman Corporation; Westminster Group Plc; L3Harris Technologies Inc.; Kongsberg Gruppen ASA; Leonardo S.p.a.; Atlas Elektronik GmbH; Airbus SE; Terma Group AS; Nuctech Company Ltd.; ARES Security Corporation; Rolta India Ltd.; HALO Maritime Defense Systems Inc.; Lockheed Martin Corporation; General Dynamics Corporation; Harris Corporation; Safran S.A.; FLIR Systems Inc.; Garmin Ltd.; Furuno Electric Co. Ltd.; Japan Radio Co. Ltd.; Wärtsilä Corporation; Signalis SA; SRT Marine Systems PLC; Consilium Strategic Communications Ltd.; MarineGuard Systems Ltd.; Martek Marine Ltd.; HENSOLDT UK

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Taiwan; Russia; South Korea; UK; USA; Canada; Italy; Spain.

Regions: Asia-Pacific; South East Asia; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: Word, PDF or Interactive Report + Excel Dashboard

Added Benefits:

- Bi-Annual Data Update

- Customisation

- Expert Consultant Support

Companies Mentioned

The companies featured in this Maritime Safety System market report include:- Anschutz GmbH

- Honeywell International Inc.

- Elbit Systems Ltd.

- Saab AB

- OSI Maritime Systems Ltd.

- BAE Systems plc

- Thales Group

- Smiths Group plc

- Northrop Grumman Corporation

- Westminster Group Plc

- L3Harris Technologies Inc.

- Kongsberg Gruppen ASA

- Leonardo S.p.a.

- Atlas Elektronik GmbH

- Airbus SE

- Terma Group AS

- Nuctech Company Ltd.

- ARES Security Corporation

- Rolta India Ltd.

- HALO Maritime Defense Systems Inc.

- Lockheed Martin Corporation

- General Dynamics Corporation

- Harris Corporation

- Safran S.A.

- FLIR Systems Inc.

- Garmin Ltd.

- Furuno Electric Co. Ltd.

- Japan Radio Co. Ltd.

- Wärtsilä Corporation

- Signalis SA

- SRT Marine Systems PLC

- Consilium Strategic Communications Ltd.

- MarineGuard Systems Ltd.

- Martek Marine Ltd.

- HENSOLDT UK

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | January 2026 |

| Forecast Period | 2026 - 2030 |

| Estimated Market Value ( USD | $ 22.73 Billion |

| Forecasted Market Value ( USD | $ 26.37 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 36 |