Furthermore, increasing government initiatives to promote generic drug products for reducing the overall healthcare expenditure on pharmaceuticals and the patent expiry of major products. For instance, the Therapeutic Goods Administration (TGA) Australia aims to offer affordable, efficient, high-quality, and accessible generic drugs to citizens for their treatment. In support of generic drugs, the TGA has been trying to reduce regulatory and reimbursement burdens such as changing the landscape of generic drugs and reducing barriers through international collaboration with manufacturers to launch their generic drugs in the market. Such initiatives of the Australian government open new avenues in the market.

In the U.S., every year millions of Americans use a generic drug for their treatment, hence, generic drugs remain the best bargain in the health care insurance programs, and given the recent enactment of healthcare reform legislation such as the introduction of the Patient Protection and Affordable Health Care Act. P.L. 111-148. Under this act, prescription drug coverage is mandated by the government as part of these new health insurance plans. The introduction of such policies may improve the quality and efficiency of healthcare, thereby, driving market growth.

The rising disease burden of infectious & non-infectious diseases coupled with the increasing geriatric population which is prone to chronic diseases such as diabetes, and hypertension, among others, may positively affect the market growth. According to an article published, in September 2022, around 17.9 million general population suffer from cardiovascular diseases (CVD) every year worldwide. Diseases including TB, diabetes, cardiovascular diseases, and HIV were among the major causes of death. The increasing incidence and prevalence of these diseases is expected to drive the market.

Generic Pharmaceuticals Market Report Highlights

- The small molecule segment by type held the largest share of 91.2% in 2022 and the large molecule segment is expected to grow at the fastest rate. The increasing approval and uptake of biosimilars is expected to drive the growth of the large molecule segment.

- Based on the route of administration, the injectable segment is the fastest-growing segment due to the rising approval for biosimilar drugs.

- By application, cardiovascular diseases dominated the market with a share of 18.27% in 2022, owing to the highest prescription rate of generic statins coupled with a high disease burden.

- Specialty generics are expected to grow moderately due to increasing investments and the focus of pharmaceutical companies to develop value-added products. In 2019, the U.S. FDA approved 110 complex generics.

- Based on distribution channel, the retail pharmacy segment dominated the market space in 2022. Retail pharmacy chains across the world are investing in advanced technologies and undertaking new initiatives to improve sales and attract more customers.

- North America held the majority share in 2022. Favorable government initiatives coupled with an evolving reimbursement landscape for pharmaceutical products support continual growth.

Table of Contents

Chapter 1 Methodology and Scope1.1 Market segmentation

1.1.1 Estimates and Forecast Timeline

1.2 Research Methodology

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 Internal Database

1.3.3 Secondary Sources

1.3.4 Primary Research

1.3.5 Details of Primary Research

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Validation

1.6 Model Details

1.6.1 Commodity Flow Analysis

1.6.1.1 Approach 1: Commodity Flow Approach

1.6.1.2 Approach 2: Country-wise market estimation using bottom-up approach

1.7 Global Market: CAGR Calculation

1.8 Research Assumptions

1.9 List of Secondary Sources

1.10 List of Primary Sources

1.11 Primary Research Analysis

1.11.1 Market scenario

1.11.2 Key KoL responses

1.12 Objectives

1.12.1 Objective 1:

1.12.2 Objective 2:

1.13 List of Abbreviations

Chapter 2 Executive Summary

2.1 Market Snapshot

2.2 Segment Snapshot

2.3 Competitive Snapshoty

Chapter 3 Market Variables, Trends & Scope

3.1 Penetration and Growth Prospect Mapping

3.2 Regulatory Landscape

3.3 SWOT Analysis, By Factor (Political & Legal, Economic, and Technological)

3.4 Porter’s Five Forces Analysis

3.5 User Perspective Analysis

3.6 Generic Pharmaceuticals Market Dynamics

3.6.1 Market Driver Analysis

3.6.1.1 Patent expiry of biologics and small molecules

3.6.1.2 Increasing ANDA approval and Generic Product Launches

3.6.1.3 Government initiatives to promote usage of generics

3.6.1.4 Increasing Disease Burden and Rising Geriatric Population

3.6.2 Market Restraint Analysis

3.6.2.1 Pricing Pressures

Chapter 4 Generic Pharmaceuticals Market - Segment Analysis, By Type, 2018 - 2030 (USD Billion)

4.1 Generic Pharmaceuticals Market: Type Movement Analysis

4.2 Simple Generics

4.2.1 Simple Generics Market Estimates and Forecast, 2018 - 2030 (USD Billion)

4.3 Specialty Generics

4.3.1 Specialty Generics Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4 Biosimilars

4.4.1 Biosimilars Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 5 Generic Pharmaceuticals Market - Segment Analysis, By Application, 2018 - 2030 (USD Billion)

5.1 Generic Pharmaceuticals Market: Application Movement Analysis

5.2 Central Nervous System Disorders

5.2.1 Central Nervous System Disorders Market Estimates and Forecast, 2018 - 2030 (USD Billion)

5.3 Respiratory Diseases

5.3.1 Respiratory Diseases Market Estimates and Forecast, 2018 - 2030 (USD Billion)

5.4 Hormones and Related Diseases

5.4.1 Hormones and Related Diseases Market Estimates and Forecast, 2018 - 2030 (USD Billion)

5.5 Gastrointestinal Diseases

5.5.1 Gastrointestinal Diseases Market Estimates and Forecast, 2018 - 2030 (USD Billion)

5.6 Cardiovascular Diseases

5.6.1 Cardiovascular Diseases Market Estimates and Forecast, 2018 - 2030 (USD Billion)

5.7 Infectious Diseases

5.7.1 Infectious Diseases Market Estimates and Forecast, 2018 - 2030 (USD Billion)

5.8 Cancer

5.8.1 Cancer Market Estimates and Forecast, 2018 - 2030 (USD Billion)

5.9 Diabetes

5.9.1 Diabetes Market Estimates and Forecast, 2018 - 2030 (USD Billion)

5.10 Others

5.10.1 Others Market Estimates and Forecast, 2018 - 2030 (USD Billion)

Chapter 6 Generic Pharmaceuticals Market - Segment Analysis, By Product, 2018 - 2030 (USD Billion)

6.1 Generic Pharmaceuticals Market: Product Movement Analysis

6.2 Small Molecule

6.2.1 Small Molecule Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.3 Large Molecule

6.3.1 Large molecule Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 7 Generic Pharmaceuticals Market - Segment Analysis, By Route of Administration, 2018 - 2030 (USD Billion)

7.1 Generic Pharmaceuticals Market: Route of Administration Movement Analysis

7.2 Oral

7.2.1 Oral Market Estimates and Forecast, 2018 - 2030 (USD Billion)

7.3 Injectable

7.3.1 Injectable Market Estimates and Forecast, 2018 - 2030 (USD Billion)

7.4 Inhalable

7.4.1 Inhalable Market Estimates and Forecast, 2018 - 2030 (USD Billion)

7.5 Others

7.5.1 Others Market Estimates and Forecast, 2018 - 2030 (USD Billion)

Chapter 8 Generic Pharmaceuticals Market - Segment Analysis, By Distribution Channel, 2018 - 2030 (USD Billion)

8.1 Generic Pharmaceuticals Market: Distribution Channel Movement Analysis

8.2 Hospital Pharmacy

8.2.1 Hospital Pharmacy Market Estimates and Forecast, 2018 - 2030 (USD Billion)

8.3 Retail Pharmacy

8.3.1 Retail Pharmacy Market Estimates and Forecast, 2018 - 2030 (USD Billion)

8.4 Online Pharmacy

8.4.1 Online Pharmacy Market Estimates and Forecast, 2018 - 2030 (USD Billion)

Chapter 9 Generic Pharmaceuticals Market - Segment Analysis, By Region, 2018 - 2030 (USD Billion)

9.1 Generic Pharmaceuticals Market, Market Share by Region, 2022 & 2030

9.2 North America

9.2.1 SWOT Analysis

9.2.1.1 North America Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.2 U.S.

9.2.2.1 Key Country Dynamics

9.2.2.2 Target Disease Prevalence

9.2.2.3 Competitive Scenario

9.2.2.4 Regulatory Framework

9.2.2.5 Reimbursement Scenario

9.2.2.6 U.S. Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.3 Canada

9.2.3.1 Key Country Dynamics

9.2.3.2 Target Disease Prevalence

9.2.3.3 Competitive Scenario

9.2.3.4 Regulatory Framework

9.2.3.5 Reimbursement Scenario

9.2.3.6 Canada Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2 Europe

9.2.1 SWOT Analysis:

9.2.1.1 Europe Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.2 Germany

9.2.2.1 Key Country Dynamics

9.2.2.2 Target Disease Prevalence

9.2.2.3 Competitive Scenario

9.2.2.4 Regulatory Framework

9.2.2.5 Reimbursement Scenario

9.2.2.6 Germany Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.3 U.K.

9.2.3.1 Key Country Dynamics

9.2.3.2 Target Disease Prevalence

9.2.3.3 Competitive Scenario

9.2.3.4 Regulatory Framework

9.2.3.5 Reimbursement Scenario

9.2.3.6 UK Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.4 France

9.2.4.1 Key Country Dynamics

9.2.4.2 Target Disease Prevalence

9.2.4.3 Competitive Scenario

9.2.4.4 Regulatory Framework

9.2.4.5 Reimbursement Scenario

9.2.4.6 France Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.5 Italy

9.2.5.1 Key Country Dynamics

9.2.5.2 Target Disease Prevalence

9.2.5.3 Competitive Scenario

9.2.5.4 Regulatory Framework

9.2.5.5 Reimbursement Scenario

9.2.5.6 Italy Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.6 Spain

9.2.6.1 Key Country Dynamics

9.2.6.2 Target Disease Prevalence

9.2.6.3 Competitive Scenario

9.2.6.4 Regulatory Framework

9.2.6.5 Reimbursement Scenario

9.2.6.6 Spain Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.7 Denmark

9.2.7.1 Key Country Dynamics

9.2.7.2 Target Disease Prevalence

9.2.7.3 Competitive Scenario

9.2.7.4 Regulatory Framework

9.2.7.5 Reimbursement Scenario

9.2.7.6 Denmark Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.8 Sweden

9.2.8.1 Key Country Dynamics

9.2.8.2 Target Disease Prevalence

9.2.8.3 Competitive Scenario

9.2.8.4 Regulatory Framework

9.2.8.5 Reimbursement Scenario

9.2.8.6 Sweden Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.9 Norway

9.2.9.1 Key Country Dynamics

9.2.9.2 Target Disease Prevalence

9.2.9.3 Competitive Scenario

9.2.9.4 Regulatory Framework

9.2.9.5 Reimbursement Scenario

9.2.9.6 Norway Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.2.9.7 Rest of Europe Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3 Asia Pacific

9.3.1 SWOT Analysis:

9.3.1.1 Asia Pacific Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.2 Japan

9.3.2.1 Key Country Dynamics

9.3.2.2 Target Disease Prevalence

9.3.2.3 Competitive Scenario

9.3.2.4 Regulatory Framework

9.3.2.5 Reimbursement Scenario

9.3.2.6 Japan Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.3 China

9.3.3.1 Key Country Dynamics

9.3.3.2 Target Disease Prevalence

9.3.3.3 Competitive Scenario

9.3.3.4 Regulatory Framework

9.3.3.5 Reimbursement Scenario

9.3.3.6 China Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.4 India

9.3.4.1 Key Country Dynamics

9.3.4.2 Target Disease Prevalence

9.3.4.3 Competitive Scenario

9.3.4.4 Regulatory Framework

9.3.4.5 Reimbursement Scenario

9.3.4.6 India Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.5 Australia

9.3.5.1 Key Country Dynamics

9.3.5.2 Target Disease Prevalence

9.3.5.3 Competitive Scenario

9.3.5.4 Regulatory Framework & Reimbursement Scenario

9.3.5.5 Australia Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.6 Thailand

9.3.6.1 Key Country Dynamics

9.3.6.2 Target Disease Prevalence

9.3.6.3 Competitive Scenario

9.3.6.4 Regulatory Framework & Reimbursement Scenario

9.3.6.5 Thailand Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.7 South Korea

9.3.7.1 Key Country Dynamics

9.3.7.2 Target Disease Prevalence

9.3.7.3 Competitive Scenario

9.3.7.4 Regulatory Framework & Reimbursement Scenario

9.3.7.5 South Korea Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.3.7.6 Rest of Asia Pacific Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4 Latin America

9.4.1 SWOT Analysis:

9.4.1.1 Latin America Generic Pharmaceutical market estimates and forecasts, 2018 - 2030 (USD Billion)

9.4.2 Brazil

9.4.2.1 Key Country Dynamics

9.4.2.2 Target Disease Prevalence

9.4.2.3 Competitive Scenario

9.4.2.4 Regulatory Framework

9.4.2.5 Reimbursement Scenario

9.4.2.6 Brazil Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.3 Mexico

9.4.3.1 Key Country Dynamics

9.4.3.2 Target Disease Prevalence

9.4.3.3 Competitive Scenario

9.4.3.4 Regulatory Framework

9.4.3.5 Reimbursement Scenario

9.4.3.6 Mexico Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.4 Argentina

9.4.4.1 Key Country Dynamics

9.4.4.2 Target Disease Prevalence

9.4.4.3 Competitive Scenario

9.4.4.4 Regulatory Framework

9.4.4.5 Reimbursement Scenario

9.4.4.6 Argentina Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.4.4.7 Rest of Latin America Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.5 Middle East & Africa (MEA)

9.5.1 SWOT Analysis:

9.5.1.1 Middle East & Africa Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.5.2 South Africa

9.5.2.1 Key Country Dynamics

9.5.2.2 Target Disease Prevalence

9.5.2.3 Competitive Scenario

9.5.2.4 Regulatory Framework

9.5.2.5 Reimbursement Scenario

9.5.2.6 South Africa Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.5.3 Saudi Arabia

9.5.3.1 Key Country Dynamics

9.5.3.2 Target Disease Prevalence

9.5.3.3 Competitive Scenario

9.5.3.4 Regulatory Framework

9.5.3.5 Reimbursement Scenario

9.5.3.6 Saudi Arabia Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.5.4 UAE

9.5.4.1 Key Country Dynamics

9.5.4.2 Target Disease Prevalence

9.5.4.3 Competitive Scenario

9.5.4.4 Regulatory Framework

9.5.4.5 Reimbursement Scenario

9.5.4.6 UAE Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.5.5 Kuwait

9.5.5.1 Key Country Dynamics

9.5.5.2 Target Disease Prevalence

9.5.5.3 Competitive Scenario

9.5.5.4 Regulatory Framework

9.5.5.5 Reimbursement Scenario

9.5.5.6 Kuwait Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

9.5.5.7 Rest of MEA Generic Pharmaceutical Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 10 Generic Pharmaceuticals Market - Competitive Analysis

10.1 Recent Developments & Impact Analysis, by Key Market Participants

10.1.1 New Product Launch

10.1.2 Merger and Acquisition

10.1.3 Licensing Agreements

10.1.4 Conferences and Campaigns

10.2 Company Categorization

10.2.1 Innovators

10.2.2 Market Leaders

10.3 Vendor Landscape

10.3.1 List of key distributors and channel partners

10.3.2 Key customers

10.4 Public Companies

10.4.1 Key company market share analysis, 2022

10.4.2 Company market position analysis

10.4.3 Heat map analysis

10.4.4 Competitive Dashboard Analysis

10.4.4.1 Market Differentiators

10.5 Private Companies

10.5.1 List of key emerging companies

10.5.2 Regional Network Map

10.6 Company Profile

10.6.1 Teva Pharmaceutical Industries Ltd

10.6.1.1 Company overview

10.6.1.2 Financial performance

10.6.1.3 Product benchmarking

10.6.1.4 Strategic initiatives

10.6.2 Viatris Inc.)

10.6.2.1 Company overview

10.6.2.2 Financial performance

10.6.2.3 Product benchmarking

10.6.2.4 Strategic initiatives

10.6.3 Sun Pharmaceutical Industries Ltd.

10.6.3.1 Company overview

10.6.3.2 Financial performance

10.6.3.3 Product benchmarking

10.6.3.4 Strategic initiatives

10.6.4 LUPIN

10.6.4.1 Company overview

10.6.4.2 Financial performance

10.6.4.3 Product benchmarking

10.6.4.4 Strategic initiatives

10.6.5 Novartis AG

10.6.5.1 Company overview

10.6.5.2 Sandoz International GmbH

10.6.5.3 Financial performance

10.6.5.4 Product benchmarking

10.6.5.5 Strategic initiatives

10.6.6 Allergan

10.6.6.1 Company overview

10.6.6.2 Financial performance

10.6.6.3 Product benchmarking

10.6.6.4 Strategic initiatives

10.6.7 AstraZeneca

10.6.7.1 Company overview

10.6.7.2 Financial performance

10.6.7.3 Product benchmarking

10.6.7.4 Strategic initiatives

10.6.8 Sawai Pharmaceutical Co., Ltd.

10.6.8.1 Company overview

10.6.8.2 Financial performance

10.6.8.3 Product benchmarking

10.6.8.4 Strategic initiatives

10.6.9 Hikma Pharmaceuticals PLC

10.6.9.1 Company overview

10.6.9.2 Financial performance

10.6.9.3 Product benchmarking

10.6.9.4 Strategic initiatives

10.6.10 Dr. Reddy’s Laboratories Ltd.

10.6.10.1 Company overview

10.6.10.2 Financial performance

10.6.10.3 Product benchmarking

10.6.10.4 Strategic initiatives

10.6.11 Cipla Inc.

10.6.11.1 Company overview

10.6.11.2 Financial performance

10.6.11.3 Product benchmarking

10.6.11.4 Strategic initiatives

10.6.12 Sanofi

10.6.12.1 Company overview

10.6.12.2 Financial performance

10.6.12.3 Product benchmarking

10.6.12.4 Strategic initiatives

10.6.13 Aurobindo Pharma

10.6.13.1 Company overview

10.6.13.2 Financial performance

10.6.13.3 Product benchmarking

10.6.13.4 Strategic initiatives

10.6.14 Endo International plc

10.6.14.1 Company overview

10.6.14.2 Financial performance

10.6.14.3 Product benchmarking

10.6.14.4 Strategic initiatives

List of Tables

Table 1 List of secondary sources

Table 2 List of Abbreviation

Table 3 Regulatory framework

Table 4 Patent expiry

Table 5 First generic products

Table 6 Healthcare expenses on pharmaceuticals

Table 7 Complex generic approved by U.S.FDA (2019)

Table 8 Prevalence of GERD

Table 9 Estimated new cancer case statistics, 2022

Table 10 Total Glaucoma Cases (2020)

Table 11 First generic oral products approved in 2019

Table 12 Leading market players anticipated to witness highest growth

Table 13 List of key distributor

Table 14 North America Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 15 North America Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 16 North America Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 17 North America Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 18 North America Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 19 U.S. Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 20 U.S. Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 21 U.S. Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 22 U.S. Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 23 U.S. Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 24 Canada Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 25 Canada Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 26 Canada Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 26 Canada Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 27 Canada Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 28 Europe Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 29 Europe Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 29 Europe Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 30 Europe Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 31 Europe Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 32 U.K. Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 33 U.K. Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 34 U.K. Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 35 U.K. Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 36 U.K. Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 37 Germany Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 38 Germany Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 39 Germany Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 40 Germany Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 41 Germany Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 42 Italy Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 43 Italy Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 44 Italy Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 45 Italy Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 46 Italy Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 47 France Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 48 France Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 49 France Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 50 France Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 51 France Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 52 Spain Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 53 Spain Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 54 Spain Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 55 Spain Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 56 Spain Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 57 Denmark Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 58 Denmark Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 59 Denmark Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 60 Denmark Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 61 Denmark Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 62 Sweden Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 63 Sweden Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 64 Sweden Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 65 Sweden Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 66 Sweden Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 67 Norway Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 68 Norway Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 69 Norway Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 70 Norway Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 71 Norway Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 72 Asia Pacific Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 73 Asia Pacific Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 74 Asia Pacific Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 75 Asia Pacific Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 76 Asia Pacific Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 77 Japan Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 78 Japan Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 79 Japan Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 80 Japan Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 81 Japan Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 82 China Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 83 China Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 84 China Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 85 China Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 86 China Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 87 India Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 88 India Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 89 India Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 90 India Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 91 India Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 92 Australia Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 93 Australia Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 94 Australia Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 95 Australia Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 96 Australia Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 97 South Korea Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 98 South Korea Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 99 South Korea Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 100 South Korea Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 101 South Korea Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 102 Thailand Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 103 Thailand Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 104 Thailand Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 105 Thailand Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 106 Thailand Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 107 Latin America Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 108 Latin America Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 109 Latin America Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 110 Latin America Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 111 Latin America Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 112 Brazil Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 113 Brazil Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 114 Brazil Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 115 Brazil Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 116 Brazil Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 117 Mexico Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 118 Mexico Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 119 Mexico Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 120 Mexico Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 121 Mexico Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 122 Argentina Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 123 Argentina Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 124 Argentina Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 125 Argentina Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 126 Argentina Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 127 MEA Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 128 MEA Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 129 MEA Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 130 MEA Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 131 MEA Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 132 South Africa Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 133 South Africa Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 134 South Africa Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 135 South Africa Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 136 South Africa Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 137 Saudi Arabia Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 138 Saudi Arabia Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 139 Saudi Arabia Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 140 Saudi Arabia Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 141 Saudi Arabia Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 142 UAE Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 143 UAE Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 144 UAE Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 145 UAE Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 146 UAE Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

Table 147 KUWAIT Generic pharmaceuticals Market, By Type, 2018 - 2030 (USD Billion)

Table 148 KUWAIT Generic pharmaceuticals Market, By Application, 2018 - 2030 (USD Billion)

Table 149 KUWAIT Generic pharmaceuticals Market, By Product, 2018 - 2030 (USD Billion)

Table 150 KUWAIT Generic pharmaceuticals Market, By Route of Administration, 2018 - 2030 (USD Billion)

Table 151 KUWAIT Generic pharmaceuticals Market, By Distribution Channel, 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 Generic Pharmaceuticals market segmentation

Fig. 2 Market research process

Fig. 3 Data triangulation techniques

Fig. 4 Primary research pattern

Fig. 5 Market research approaches

Fig. 6 Value-chain-based sizing & forecasting

Fig. 7 QFD modeling for market share assessment

Fig. 8 Market formulation & validation

Fig. 9 Commodity Flow Analysis

Fig. 10 Generic Pharmaceuticals Market Snapshot

Fig. 11 Penetration and growth prospect mapping

Fig. 12 SWOT Analysis, By Factor (Political & Legal, Economic, and Technological)

Fig. 13 Porter’s Five Forces Analysis

Fig. 14 User Perspective Analysis

Fig. 15 Generic Pharmaceuticals Market Driver Impact

Fig. 16 Disease burden of non-communicable diseases (in Million), in 2018

Fig. 17 Generic Pharmaceuticals Market Restraint Impact

Fig. 18 Generic Pharmaceuticals market: Type outlook and key takeaways

Fig. 19 Generic Pharmaceuticals market: Type movement analysis

Fig. 20 Simple generics market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 21 Specialty generics market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 22 Biosimilars Market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 23 Generic Pharmaceuticals market: Application outlook and key takeaways

Fig. 24 Generic Pharmaceuticals market: Application movement analysis

Fig. 25 Central nervous system disorders market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 26 Respiratory diseases market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 27 Hormones and related diseases market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 28 Gastrointestinal diseases market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 29 Cardiovascular diseases market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 30 Infectious diseases market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 31 Cancer market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 32 Diabetes market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 33 Others market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 34 Generic Pharmaceuticals market: Product outlook and key takeaways

Fig. 35 Generic Pharmaceuticals market: Product movement analysis

Fig. 36 Small molecule market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 37 Large molecule market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 38 Generic Pharmaceuticals Market: Route of Administration Outlook and Key Takeaways

Fig. 39 Generic Pharmaceuticals market: Route of administration movement analysis

Fig. 40 Oral market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 41 Injectable market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 42 Inhalable market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 43 Others market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 44 Generic Pharmaceuticals Market: Distribution Channel Outlook and Key Takeaways

Fig. 45 Generic Pharmaceuticals Market: Distribution Channel Movement Analysis

Fig. 46 Hospital pharmacy market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 47 Retail pharmacy market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 48 Online pharmacy market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 49 Regional marketplace: Key takeaways

Fig. 50 Regional outlook, 2020 & 2030

Fig. 51 North America

Fig. 52 North America. market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 53 U.S.

Fig. 54 U.S. market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 55 Canada

Fig. 56 Canada market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 57 Europe

Fig. 58 Europe market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 59 U.K.

Fig. 60 U.K. market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 61 Germany

Fig. 62 Germany market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 63 France

Fig. 64 France market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 65 Spain

Fig. 66 Spain market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 67 Italy

Fig. 68 Italy market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 69 Denmark

Fig. 70 Denmark market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 71 Sweden

Fig. 72 Sweden market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 73 Norway

Fig. 74 Norway market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 75 Asia-Pacific

Fig. 76 Asia-Pacific market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 77 Japan

Fig. 78 Japan market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 79 China

Fig. 80 China market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 81 India

Fig. 82 India market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 83 Australia

Fig. 84 Australia market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 85 South Korea

Fig. 86 South Korea market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 87 Thailand

Fig. 88 Thailand market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 89 Latin America

Fig. 90 Latin America market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 91 Brazil

Fig. 92 Brazil market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 93 Mexico

Fig. 94 Mexico market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 95 Argentina

Fig. 96 Argentina market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 97 Middle East & Africa

Fig. 98 MEA market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 99 South Africa

Fig. 100 South Africa market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 101 Saudi Arabia

Fig. 102 Saudi Arabia market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 103 UAE

Fig. 104 UAE market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 105 Kuwait

Fig. 106 Kuwait market estimates and forecast, 2018 - 2030 (USD Billion)

Fig. 107 Market position analysis

Fig. 108 Profit margin

Fig. 109 Heat map analysis

Fig. 110 Market differentiators

Fig. 111 Regional Network Map

Companies Mentioned

- Teva Pharmaceutical Industries Ltd

- Viatris Inc.

- Sun Pharmaceutical Industries Ltd.

- LUPIN

- Novartis AG

- Allergan

- AstraZeneca

- Sawai Pharmaceutical Co., Ltd.

- Hikma Pharmaceuticals PLC

- Dr. Reddy’s Laboratories Ltd.

- Cipla Inc.

- Sanofi

- Aurobindo Pharma

- Endo International plc

Table Information

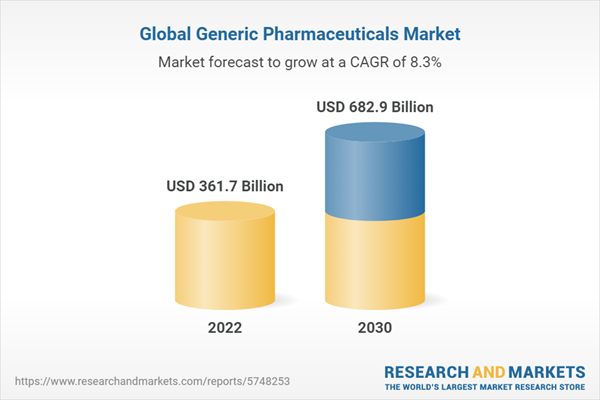

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | February 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 361.7 Billion |

| Forecasted Market Value ( USD | $ 682.9 Billion |

| Compound Annual Growth Rate | 8.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |