Besides, the small molecule CDMOs in China are characterized by favorable cost structures, a skilled workforce, and a growing range of domestic projects, further becoming appealing partners for both local and international companies. In addition, the market's expansion is fueled by the rising demand for generics and innovative small molecule therapies, further propelling the trend toward integrated, end-to-end development and manufacturing solutions. In addition, growing technological advancements in the market have played a crucial role in enhancing the capabilities of China's CDMO sector, which further supports market growth.

Besides, innovations such as process optimization, real-time monitoring via Process Analytical Technology (PAT), and machine learning applications for predictive analytics are increasingly prioritized to improve efficiency and product quality. Moreover, the integration of continuous manufacturing technologies and advanced synthetic chemistry further supports the development of high-potency and complex molecules. This technological advancement has further supported the Chinese CDMOs to compete more effectively in the global arena, particularly for early-phase and high-value niche projects.

China Small Molecule CDMO Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. The analyst has segmented the China small molecule CDMO market report based on product, drug, and application.Product Outlook (Revenue, USD Million, 2021-2033)

- Active Pharmaceutical Ingredients (API)

- Finished Drug Products

Drug Outlook (Revenue, USD Million, 2021-2033)

- Innovators

- Generics

Application Outlook (Revenue, USD Million, 2021-2033)

- Oncology

- Cardiovascular Disease

- Central Nervous System (CNS) Conditions

- Autoimmune/Inflammation

- Others

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the industry across major regions and segments.

- Competitive Landscape: Explore the market presence of key players.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segmental and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listings for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The major companies profiled in this China Small Molecule CDMO market report include:- Lonza

- Catalent, Inc

- Thermo Fisher Scientific Inc.

- Bellen Chemistry

- Siegfried Holding AG

- Recipharm AB

- Eurofins Scientific

- WuXi AppTec

- Asymchem Laboratories

- Langhua Pharmaceutical (Viva Biotech subsidiary)

- Apeloa Pharmaceutical

- JiuZhou Pharmaceutical

Table Information

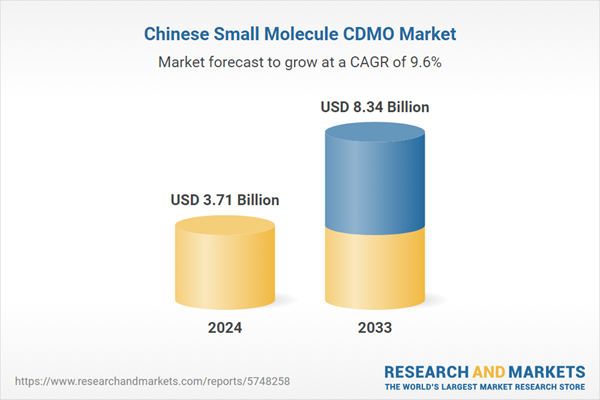

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 3.71 Billion |

| Forecasted Market Value ( USD | $ 8.34 Billion |

| Compound Annual Growth Rate | 9.5% |

| Regions Covered | China |

| No. of Companies Mentioned | 13 |