Rapid increase in applications of medical cannabis in various indications including inflammation, epilepsy, sleep disorders, pain, anorexia, multiple sclerosis, and schizophrenia are estimated to drive the market’s growth. Regulator and consumer acceptance of legal marijuana is increasing which is positively impacting this growth. Moreover, there is a shift to prescription drugs from cannabis herbal preparations. Demand for quantified, packed, and processed products is significantly increasing which is driving the growth.

Coronavirus lockdowns caused a decline in customers buying from offline or retail shops, however, many key players shifted their focus to selling products on social media and e-commerce platforms. Overall industry has grown due to an increasing number of consumers with approval of its adult use in the state. Legal cannabis industry witnessed a downfall due to drug shortage. Primary reason for an overall decrease in revenue was the government-imposed restrictions on international commerce due to the pandemic.

Factors such as shifting preference from opioid drugs to cannabis-based treatments are expected to help fuel market growth. Increasing awareness about medicinal properties of marijuana is attributed to be a key growth factor. Recent research studies confirming anti-cancer properties of the product and rising preference of patients for cannabis treatment of chronic conditions such as Alzheimer’s and Parkinson’s disease over other available drug therapies are critical factors attributed to market’s growth.

Some key players are BeLeaf Medical, Show Me Alternatives, Missouri Wild Alchemy, Heya Wellness, Organic Remedies, Holistic Industries, and MOcann Extracts. These players focus on strategies such as new product launches, mergers & acquisitions, and regional expansions. Players are turning to expand their product portfolios through mergers and acquisitions of smaller companies. For instance, in 2020, Curaleaf announced two major acquisitions aimed at increasing its foothold in the U.S.

Missouri Legal Cannabis Market Report Highlights

- In 2023, flower segment accounted for the largest revenue share of 35.8% and it is anticipated to register a significant CAGR from 2024 to 2030.

- Pre-rolls product segment is expected to grow at the fastest CAGR during the forecast period

- In 2023, medical-use segment accounted for the largest market share of 89.0%. Use of cannabis for recreational purposes is expected to initiate in 2023 in Missouri

- Recreational end-use segment is expected to register a significant CAGR during the forecast period

Table of Contents

Companies Profiled

- BeLeaf Medical

- Blue Sage Cannabis Co.

- Show Me Alternatives

- Heya Wellness

- Missouri Wild Alchemy

- Organic Remedies

- Holistic Industries

- Kansas City Cannabis

- LOCAL CANNABIS COMPANY

- MOcann Extracts.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | November 2023 |

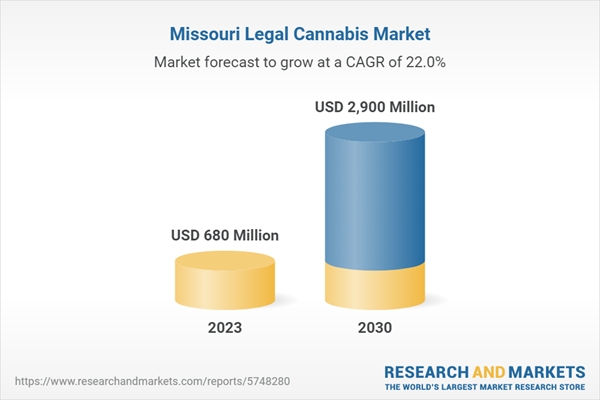

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 680 Million |

| Forecasted Market Value ( USD | $ 2900 Million |

| Compound Annual Growth Rate | 22.0% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |