A unique medical diet is essential for a number of rare disorders in order to prevent severe impairments and promote healthy growth in children and adults. For instance, maple syrup urine disease, food protein-induced enterocolitis syndrome, and short bowel syndrome are some of the common orphan diseases that have specific dietary requirements. Hypoallergenic formulas free of wheat, soy, dairy, and other possible allergens are frequently provided to new-borns and kids with FPIES. These factors continue to be crucial for the expansion.

The COVID-19 pandemic increased the burden on healthcare services and of treatment sensitivity for critically ill patients. Patients who tested positive for COVID-19 typically suffered from weakened immunity and disruption in respiratory & other systems. For instance, according to an article published in Elsevier Public Health Emergency Collection, around half of the critically ill COVID-19 patients developed gastrointestinal problems, such as gastrointestinal hypomotility. Patients experienced various other abdominal issues, which led to increased adoption of medical foods.

The U.S. medical foods for orphan disease market is consolidated, wherein Danone, Abbott, Nestlé, Mead Johnsons, and Relief Therapeutics account for the majority share. These players are adopting several strategies to increase their shares. The development of new products and high R&D investments to develop disease-specific formulas are some of the strategies players implement.

U.S. Medical Foods For Orphan Disease Market Report Highlight

- The oral route segment accounted for the highest revenue share in terms of route of administration in 2022 and its revenue share was 70.8%. However, the enteral route is anticipated to grow at the fastest rate over the forecast period.

- The powder segment accounted for 35.3% of the revenue share in 2022, the liquid segment is also expected to grow at a lucrative rate over the forecast period.

- The others segment accounted for the majority revenue share in 2022. However, FPIES segment is also expected to grow at a lucrative rate over the forecast period.

- Institutional sales held the majority share of 41.1% the market in terms of sales channel in 2022. However, the online sales segment is expected to grow lucratively over the forecast period.

Table of Contents

Chapter 1 Methodology and Scope1.1 Market Segmentation and Scope

1.2 Market Definition

1.3 Research Methodology

1.3.1 Information Procurement

1.3.1.1 Purchased Database:

1.3.1.2 Internal Database

1.3.2 Primary Research:

1.4 Research Scope and Assumptions

1.5 Estimation Process

1.6 List to Data Sources

Chapter 2 Executive Summary

2.1 Market Outlook

2.2 Segment Outlook

2.3 Competitive Insights

2.4 U.S. Medical Foods for Orphan Disease Market Snapshot

Chapter 3 U.S. Medical Foods for Orphan Disease Market Variables, Trends & Scope

3.1 Penetration and Growth Prospect Mapping

3.2 Pricing Analysis

3.3 User Perspective Analysis

3.3.1 Consumer Behavior Analysis

3.3.2 Market Influencer Analysis

3.4 Technology Outlook

3.4.1 Technology Timeline

3.5 Market Lineage Outlook

3.5.1 Parent Market Outlook

3.5.1.1 Nutritional Supplements Market

3.5.2 Ancillary Market Outlook

3.5.2.1 Parenteral Nutrition Market

3.5.2.2 Enteral Feeding Devices Market

3.6 Regulatory Framework

3.6.1 Reimbursement Framework

3.6.1.1 U.S.

3.6.2 Standards, Compliance, & Safety

3.7 Market Dynamics

3.7.1 Market Driver Analysis

3.7.1.1 Rising Trend Of Personalized Treatment

3.7.1.2 Rising Prevalence Of Orphan Diseases Requiring Nutritional Management Of Patients

3.7.2 Market Restraint Analysis

3.7.2.1 Lack Of Awareness Amongst The Medical Community

3.7.2.1 High Cost Of Medical Foods

3.7.3 Industry Challenge

3.7.3.1 Complications Associated With Small-Bore Connectors

3.7.3.1 Risks Associated With Enteral Feeding

3.8 U.S. Medical Foods For Orphan Disease Market Analysis Tools

3.8.1 U.S. Medical Foods For Orphan Disease Market - Porter’s Analysis

3.8.1.1 Bargaining Power Of Supplier: Moderate

3.8.1.2 Bargaining Power Of Buyer: Moderate

3.8.1.3 Threat Of New Entrants: Low

3.8.1.4 Threat Of Substitution: Low

3.8.1.5 Competitive Rivalry: High

3.8.2 Pestel Analysis

3.8.2.1 Political And Legal Landscape

3.8.2.2 Economic And Social Landscape

3.8.2.3 Technological Landscape

3.9 Impact Of Covid-19 On The U.S. Medical Foods For Orphan Disease Market

Chapter 4 U.S. Medical Foods For Orphan Disease Market: Route Of Administration Estimates & Trend Analysis

4.1 U.S. Medical Foods For Orphan Disease Market: Application Movement Analysis, USD Million, 2022 & 2030

4.2 Oral

4.2.1 Oral Market Estimates And Forecasts For Diabetic Neuropathy, 2018 - 2030 (USD Million)

4.3 Enteral

4.3.1 Enteral Market Estimates And Forecasts For Depression, 2018 - 2030 (USD Million)

Chapter 5 U.S. Medical Foods For Orphan Disease Market: Product Estimates & Trend Analysis

5.1 U.S. Medical Foods For Orphan Disease Market: Product Movement Analysis, 2022 & 2030 USD Million

5.2 Pills

5.2.1 U.S. Medical Foods For Orphan Disease Market Forecasts For Pills Formulation, 2018 - 2030 (USD Million)

5.3 Powder

5.3.1 U.S. Medical Foods For Orphan Disease Market Estimates And Forecasts For Powder Formulation, 2018 - 2030 (USD Million)

5.4 Liquid

5.4.1 U.S. Medical Foods For Orphan Disease Market Estimates And Forecasts For Liquid Formulation, 2018 - 2030 (USD Million)

5.5 Others

5.5.1 U.S. Medical Foods For Orphan Disease Market Estimates And Forecasts For Other Formulations, 2018 - 2030 (USD Million)

Chapter 6 U.S. Medical Foods For Orphan Disease Market: Application Estimates & Trend Analysis

6.1 U.S. Medical Foods For Orphan Disease Market: Application Movement Analysis, 2022 & 2030 USD Million

6.2 Phenylketonuria

6.2.1 U.S. Medical Foods For Orphan Disease Market Estimates And Forecasts For Phenylketonuria, 2018 - 2030 (USD Million)

6.3 Eosinophilic Esophagitis

6.3.1 U.S. Medical Foods For Orphan Disease Market Estimates And Forecasts For Eosinophilic Esophagitis, 2018 - 2030 (USD Million)

6.4 Fpies

6.4.1 U.S. Medical Foods For Orphan Disease Market Estimates And Forecasts For Fpies, 2018 - 2030 (USD Million)

6.5 Tyrosinemia

6.5.1 U.S. Medical Foods For Orphan Disease Market Estimates And Forecasts For Tyrosinemia, 2018 - 2030 (USD Million)

6.6 Msud

6.6.1 U.S. Medical Foods For Orphan Disease Market Estimates And Forecasts For Msud, 2018 - 2030 (USD Million)

6.7 Homocystinuria

6.7.1 U.S. Medical Foods For Orphan Disease Market Estimates And Forecasts For Homocystinuria, 2018 - 2030 (USD Million)

6.8 Other Orphan Diseases

6.8.1 U.S. Medical Foods For Orphan Disease Market Estimates And Forecasts For Other Orphan Disease, 2018 - 2030 (USD Million)

Chapter 7 U.S. Medical Foods For Orphan Disease Market: Sales Channel Estimates & Trend Analysis

7.1 U.S. Medical Foods For Orphan Disease Market: Sales Channel Movement Analysis, 2022 & 2030 USD Million

7.2 Online Sales

7.2.1 U.S. Medical Foods For Orphan Disease Market Estimates And Forecasts For Online Sales Channel, 2018 - 2030 (USD Million)

7.3 Retail Sales

7.3.1 U.S. Medical Foods For Orphan Disease Market Estimates And Forecasts For Retail Sales Channel, 2018 - 2030 (USD Million)

7.4 Institutional Sales

7.4.1 U.S. Medical Foods For Orphan Disease Market Estimates And Forecasts For Institutional Sales Channel, 2018 - 2030 (USD Million)

Chapter 8 Competitive Analysis

8.1 Recent Developments and Impact Analysis by Key Market Participants

8.2 Company/Competition Categorization (Key Innovators, Market Leaders, and Emerging Players)

8.3 Company Market Position Analysis

Chapter 9 Company Profiles

9.1 DANONE

9.1.1 Company overview

9.1.2 Financial performance

9.1.3 Product benchmarking

9.1.4 Strategic initiatives

9.2 NESTLE

9.2.1 Company overview

9.2.2 Financial performance

9.2.3 Product benchmarking

9.2.4 Strategic initiatives

9.3 ABBOTT

9.3.1 Company overview

9.3.2 Financial performance

9.3.3 Product benchmarking

9.3.4 Strategic initiatives

9.4 MEAD JOHNSON & COMPANY, LLC

9.4.1 Company overview

9.4.2 Financial performance

9.4.3 Product benchmarking

9.4.4 Strategic initiatives

9.5 Relief Therapeutics

9.5.1 Company overview

9.5.2 Financial performance

9.5.3 Product benchmarking

9.5.4 Strategic initiatives

List of Tables

Table 1 U.S. medical foods for orphan diseases market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 2 U.S. medical foods for orphan diseases market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 3 U.S. medical foods for orphan diseases market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 4 U.S. medical foods for orphan diseases market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 U.S. Medical Foods for Orphan Disease market segmentation

Fig. 2 Market research process

Fig. 3 Information procurement

Fig. 4 Primary research pattern

Fig. 5 U.S. Medical Foods for Orphan Disease market summary, 2022 (USD Million)

Fig. 6 U.S. Medical Foods for Orphan Disease market summary, 2022 (USD Million)

Fig. 7 U.S. Medical Foods for Orphan Disease market summary, 2022 (USD Million)

Fig. 8 U.S. Medical Foods for Orphan Disease market summary, 2022 (USD Million)

Fig. 9 Penetration & growth prospect mapping

Fig. 10 Consumer decision-making process

Fig. 11 Evolution of medical foods

Fig. 12 Parent market analysis, 2021

Fig. 13 Timeline for new ENFit Connectors

Fig. 14 Market driver analysis (Current & future impact)

Fig. 15 Market restraint analysis (Current & future impact)

Fig. 16 U.S. Medical Foods for Orphan Disease market, route of administration outlook key takeaways (USD Million)

Fig. 17 U.S. Medical Foods for Orphan Disease market: route of administration movement analysis (USD Million) 2022 & 2030

Fig. 18 Oral Disease market estimates and forecasts for diabetic neuropathy, 2018 - 2030 (USD Million)

Fig. 19 Enteral market estimates and forecasts for depression, 2018 - 2030 (USD Million)

Fig. 20 U.S. Medical foods for orphan disease market, product outlook: Key takeaways, USD Million

Fig. 21 U.S. Medical foods for orphan disease market: Product movement analysis, 2022 & 2030, (USD Million)

Fig. 22 U.S. Medical foods for orphan disease market estimates and forecasts for pills formulation, 2018 - 2030 (USD Million)

Fig. 23 U.S. Medical foods for orphan disease market estimates and forecasts for powder formulation, 2018 - 2030 (USD Million)

Fig. 24 U.S. Medical foods for orphan disease market estimates and forecasts for liquid formulation, 2018 - 2030 (USD Million)

Fig. 25 U.S. Medical foods for orphan disease market estimates and forecasts for other formulations, 2018 - 2030 (USD Million)

Fig. 26 U.S. Medical foods for orphan disease market, application outlook: Key takeaways, USD Million

Fig. 27 U.S. Medical foods for orphan disease market: application movement analysis, 2022 & 2030, (USD Million)

Fig. 28 U.S. Medical foods for orphan disease market estimates and forecasts for phenylketonuria, 2018 - 2030 (USD Million)

Fig. 29 U.S. Medical foods for orphan disease market estimates and forecasts for Eosinophilic Esophagitis, 2018 - 2030 (USD Million)

Fig. 30 U.S. Medical foods for orphan disease market estimates and forecasts for FPIES, 2018 - 2030 (USD Million)

Fig. 31 U.S. Medical foods for orphan disease market estimates and forecasts for tyrosinemia, 2018 - 2030 (USD Million)

Fig. 32 U.S. Medical foods for orphan disease market estimates and forecasts for MSUD, 2018 - 2030 (USD Million)

Fig. 33 U.S. Medical foods for orphan disease market estimates and forecasts for Homocystinuria, 2018 - 2030 (USD Million)

Fig. 34 U.S Medical foods for orphan disease market estimates and forecasts for other orphan disease, 2018 - 2030 (USD Million)

Fig. 35 U.S. Medical Foods for Orphan Disease market, sales channel outlook: Key takeaways, USD Million

Fig. 36 U.S. Medical Foods for Orphan Disease market: Sales channel movement analysis, 2022 & 2030, (USD Million)

Fig. 37 U.S. Medical foods for orphan disease market estimates and forecasts for online sales channel, 2018 - 2030 (USD Million)

Fig. 38 U.S. Medical foods for orphan disease market estimates and forecasts for retail sales channel, 2018 - 2030 (USD Million)

Fig. 39 U.S. Medical foods for orphan disease market estimates and forecasts for institutional sales channel, 2018 - 2030 (USD Million)

Companies Mentioned

- DANONE

- NESTLE

- ABBOTT

- MEAD JOHNSON & COMPANY, LLC

- Relief Therapeutics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | February 2023 |

| Forecast Period | 2022 - 2030 |

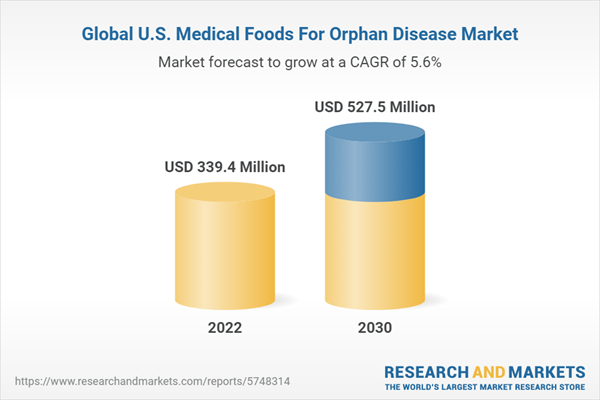

| Estimated Market Value ( USD | $ 339.4 Million |

| Forecasted Market Value ( USD | $ 527.5 Million |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | United States |

| No. of Companies Mentioned | 5 |