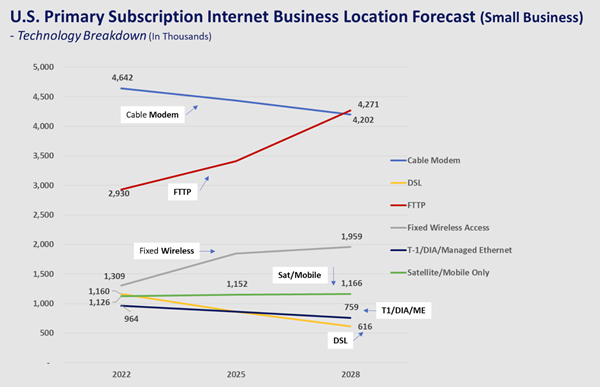

This five year forecast measures the number of primary broadband internet subscriptions connecting small, medium and mid-market firms in the United States. It breaks these connections down based on the technology used to deliver services, including cable modem, fiber to the premises (FTTP), DSL, satellite and fixed wireless access. It also includes enterprise-grade connectivity solutions such as dedicated internet access (DIA), Managed Ethernet, and T-1 data services.

The broadband market is about to hit a period of turbulence we haven’t seen in a long time - driven by choice and investment said Matt Davis, Principal Analyst. Fixed wireless access business offerings are forecasted to almost double over the forecast period and combined with the government-funded fiber infrastructure blitz, is poised to shake up the commercial broadband marketplace over the next five years.

“Choice” + “Investment” = Disruption

This forecast measures the number of primary broadband internet subscriptions connecting small, medium and mid-market firms in the United States. It breaks these connections down based on the technology used to deliver services, including cable modem, fiber to the premises (FTTP), DSL, satellite and fixed wireless access. It also includes enterprise-grade connectivity solutions such as dedicated internet access (DIA), Managed Ethernet, and T-1 data services.

The post-covid “new normal” will be one of the most disruptive periods for the broadband landscape we have experienced in recent memory. This disruption will come in the form of choice on one hand, and investment on the other.

“Choice” comes in the form of fixed wireless access (FWA) internet that has exploded onto the broadband landscape in the past few years. Driven by investments in 5G mobility, the core infrastructure for FWA is in place and has been utilized to deliver broadband services to homes and businesses that had limited broadband options in the past. What was once a fringe broadband solution relegated to situations where fixed broadband services proved unfeasible, FWA is now being driven by major initiatives from the largest mobile providers.

“Investment” refers to the fiber broadband expansion that began to accelerate over the past decade and is projected to see a significant boost over the forecast period. While fiber growth was increasing steadily, the 2022 Broadband Equity, Access and Deployment (BEAD Program) is poised to turbo-charge fiber broadband deployment in the U.S.

Together, the combination of increased availability of these new broadband options and unprecedented levels of government funding will re-shape the U.S. business broadband landscape over the five-year forecast period.

High Level Forecast

The technology categories in Chart 1 add up to serve the overall U.S. SMB broadband addressable market. The U.S. business market is growing slowly but is estimated to have slightly shrunk in 2020 due to the Covid-19 pandemic. This is a unique dynamic unseen in past reports. However, after returning to normal net addition territory in 2021 and continuing throughout the forecast, SMB growth is expected to resume a steady increase that generally correlates with the condition of the economy as a whole.

This forecast assumes that the vast majority of U.S. business locations require some form of broadband connectivity. These are counted as “marketable broadband business locations” and include non-home-based business sites, remote and branch offices, franchise locations and government facilities. Home-based businesses are predominantly served with residential-grade broadband and must be separated due to the risk of double-counting subscribers. The overall growth of U.S. business firms is forecasted to be slow (CAGR of +1%), but the broadband technologies connecting them will fight it out for market share - a disruptive struggle for subscribers beneath a calm surface. Please see Chart 1 below:

Target Audience Includes:

Corporate Strategy, Market Intelligence, Business Strategy, Marketing, and Product Strategy at U.S.-based Internet Service Providers/Communications Providers/Wireless Operators and international technology vendors that supply hardware and software to U.S. ISPs (Nokia, Adtran, Calix, Cisco, etc.)

Table of Contents

1. Introduction

Companies Mentioned

- AT&T

- Charter Spectrum

- Comcast Xfinity

- T-Mobile

- Verizon