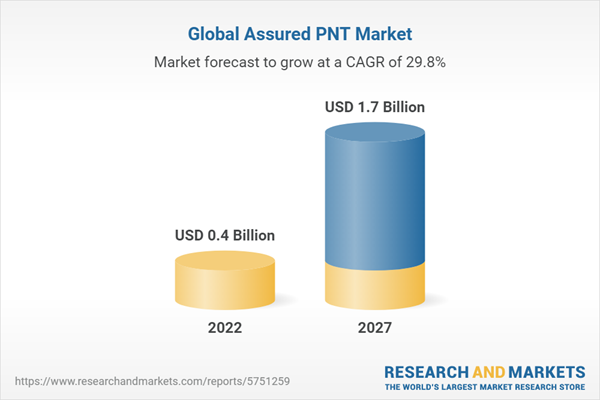

The global assured PNT market is projected to grow from USD 0.4 billion in 2022 to USD 1.7 billion by 2027, at a CAGR of 29.8% from 2022 to 2027. The availability of low-cost military navigation components and ongoing military modernization programs in various countries across the globe are further driving the market growth. However, the operational complexity involved in assembling and maintaining military systems is a key restraint to market growth. The assured PNT market is expected to grow in the next few years due to the advent of advanced technologies, such as artificial intelligence (AI), machine learning (ML), and 5G.

Based on the platform, the assured PNT market has been segmented into air, land, and naval

Tactical-grade marine military navigation used in naval ships displays the route or map during combat. Defense naval vessels are specifically designed and used by coastguards and naval forces. Defense vessels differ from commercial ships in their applications, design, construction method, and technologies. Defense ships are classified into two types, namely, surface naval ships and underwater naval ships. The naval segment covers the submarines, destroyers, frigates, and corvettes market. The naval segment is projected to grow with the highest CAGR due to rising demand and increasing procurement of naval fleets by the US and China.

The assured PNT market is segmented into defense and homeland security based on the end-user

The defense segment is expected to lead the market during the forecast period due to the growing demand for border surveillance and situational awareness among defense forces and their increased use of UAVs. Assured PNT systems help countries to gain an advantage in GPS/GNSS contested areas to mitigate the risks associated with spoofing and jamming and enable them to identify a precise location.

North America is expected to account for the largest share in 2021

The assured PNT market has been studied for five major regions: North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. While studying the market, the usage and lifecycle phases of assured PNT systems have been considered across different regions. North America is witnessing increased investments in developing and deploying new and advanced navigation systems to achieve improved interoperability between various units and platforms of defense forces. This region can be considered a maturing market for assured PNT as developments here focus on existing infrastructure advancements.

Breakup of Primaries

The break-up of the profile of primary participants in the airborne ISR market:

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: C Level - 75% and Manager Level - 25%

- By Region: North America - 20%, Europe - 25%, Asia-Pacific - 30%, Middle East - 10%, and Rest of the World - 15%

Research Coverage

The report segments the assured PNT market based on platform, component, end-user, and region. The assured PNT market is segmented into air, land, and naval platforms. The assured PNT is segmented into defense and homeland security based on the end-user. By component, the market is segmented into atomic clocks, antennas, transponders, sensors, power amplifiers, receivers, and others. The assured PNT market has been studied in North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America.

The scope of the study includes thorough information on the important aspects impacting the growth of the assured PNT market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted in order to provide insights into their business overview, solutions, and services, as well as key strategies such as contracts, partnerships, agreements, new product and service launches, mergers and acquisitions, and recent developments in the assured PNT market. This research includes a competitive analysis of upcoming startups in the assured PNT market ecosystem.

Reasons to Buy this Report

The research will provide industry leaders and potential entrants with information on the closest estimations of revenue figures for the assured PNT market. This study will assist stakeholders in better understanding the competitive environment and gaining new insights to position their businesses better and develop appropriate go-to-market strategies. The study also assists stakeholders in understanding the pulse of the industry and offers data on major market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: The leading companies provide comprehensive information about assured PNT.

- Product Development/Innovation: In-depth information on future technologies, R&D efforts, and new product and service launches in the assured PNT market.

- Market Development: In-depth information on profitable markets - the study examines the assured PNT market in several areas.

- Market Diversification: Comprehensive data on new goods and services, new geographies, current advancements, and investments in the assured PNT market.

- Competitive Assessment: An in-depth examination of the assured PNT industry's major companies' market shares, growth strategies, and service offerings is provided.

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Assured PNT Market Segmentation

1.3.2 Regional Scope

1.3.3 Years Considered

Figure 1 Years Considered

1.4 Currency Considered

Table 1 USD Exchange Rates

1.5 Inclusions and Exclusions

Table 2 Assured PNT Market: Inclusions and Exclusions

1.6 Limitations

1.7 Market Stakeholders

2 Research Methodology

2.1 Research Data

Figure 2 Research Process Flow

Figure 3 Assured PNT Market: Research Design

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Insights from Industry Experts

Figure 4 Breakdown of Primary Interviews: by Company Type, Designation, and Region

2.1.2.2 Key Primary Sources

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Indicators

2.2.2.1 Increase in Military Expenditure on Sensor-based Autonomous Defense Systems

2.2.2.2 Rising Incidences of Regional Disputes, Terrorism, and Political Conflicts

2.2.3 Supply-Side Indicators

2.2.3.1 Adoption of Mems in Aircraft and Defense Applications

2.2.3.2 Financial Trends of Major US Defense Contractors

2.2.4 Recession Impact Analysis

Figure 5 Quarterly Revenue Analysis of Top Five Key Players

2.3 Market Size Estimation

2.4 Research Approach & Methodology

2.4.1 Bottom-Up Approach

2.4.1.1 Market Size Estimation

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

2.4.2 Top-Down Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

2.5 Data Triangulation

Figure 8 Data Triangulation

2.6 Assumptions

Figure 9 Research Assumptions

2.7 Risk Analysis

3 Executive Summary

Figure 10 Land Platforms to Dominate Assured PNT Market During Forecast Period

Figure 11 Defense to Lead End-user Segment During Forecast Period

Figure 12 North America to Command Largest Share of Market

4 Premium Insights

4.1 Attractive Opportunities for Players in Assured PNT Market

Figure 13 Rising Demand for Missiles and Artillery Systems to Boost Assured PNT Market from 2022 to 2027

4.2 Assured PNT Market, by Platform

Figure 14 Land Platforms to Lead Assured PNT Market During Forecast Period

4.3 Assured PNT Market, by End-user

Figure 15 Defense to be Largest End-user Segment from 2022 to 2027

4.4 Assured PNT Market, by Country

Figure 16 US Market Projected to Grow at Highest CAGR from 2022 to 2027

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 17 Assured PNT Market Dynamics

5.2.1 Drivers

5.2.1.1 High Demand for Assured Global Positioning System (GPS) in Military Applications

5.2.1.2 Increasing Demand for Accuracy in Navigation

5.2.1.3 Availability of Miniaturized Components at Affordable Prices

5.2.1.4 Increasing Preference for Use of UAVs in Modern Warfare

5.2.1.5 Use of UAVs as Loitering Munition by Defense Forces

Table 3 Countries That Use Loitering Munition

5.2.1.6 Advent of Next-Generation Military Platforms and Weapon Technologies

5.2.2 Restraints

5.2.2.1 Absence of Established Operational Parameters

5.2.3 Opportunities

5.2.3.1 Ongoing R&D Programs

5.2.3.2 Increasing Application to Mitigate Effects of Threats

5.2.3.3 Increasing Demand for New-Generation Air and Missile Defense Systems

5.2.3.4 Integration of Anti-Jamming Capabilities with Navigation Systems

5.2.4 Challenges

5.2.4.1 Limited Development of Feasible Technologies

5.2.4.2 High Cost of Development of Military Navigation Equipment

5.3 Value Chain Analysis

Figure 18 Value Chain Analysis: Assured PNT Market

5.4 Pricing Analysis

5.4.1 Cost of Inertial Navigation Systems Used for Various Grades and Manufacturers of Ins

5.5 Trade Analysis

Table 4 Import Value of Radar Apparatus, Radio Navigational Aid Apparatus, and Radio Remote Control Apparatus [Product Harmonized System Code: 8526, USD Million (2017-2021)]

Table 5 Exported Value of Radar Apparatus, Radio Navigational Aid Apparatus, and Radio Remote Control Apparatus [(Product Harmonized System Code: 8526, USD Million (2017-2021)]

5.6 Disruptions Impacting Customer Business

5.6.1 Revenue Shift and New Revenue Pockets for Assured PNT Market

Figure 19 Trends and Disruptions Impacting Customers

5.7 Market Ecosystem

5.7.1 Prominent Companies

5.7.2 Private and Small Enterprises

5.7.3 End-users

Figure 20 Assured PNT Ecosystem

Table 6 Assured PNT Market Ecosystem

5.8 Recession Impact Analysis

5.8.1 Uncertainty Analysis

5.8.2 Factors Impacting Assured PNT Market, 2022-2023

5.8.3 Probable Scenario Impact of Assured PNT Market

5.9 Technology Analysis

5.9.1 GNSS and Internet of Things

5.9.2 5G and GNSS

5.9.3 GNSS and Machine Learning/Artificial Intelligence

5.9.4 Compact GPS Anti-Jam Systems

5.9.5 Alternative to GPS Anti-Jam Technology

5.10 Case Study Analysis

5.10.1 GPS Anti-Jamming Tech by Novatel and Junction Box by Forsberg Selected to Protect Royal Navy T26 Frigate

5.10.2 Novatel's Anti-Jam Antenna Selected for Canadian Army Observation Post Vehicles

5.10.3 Passive Anti-Jam Antenna Used to Combat Gnss Interference

5.11 Porter's Five Forces

Table 7 Assured PNT Market: Porter's Five Forces Analysis

Figure 21 Porter's Five Forces Analysis: Assured PNT Market

5.11.1 Threat of New Entrants

5.11.2 Threat of Substitutes

5.11.3 Bargaining Power of Suppliers

5.11.4 Bargaining Power of Buyers

5.11.5 Intensity of Competitive Rivalry

5.12 Operational Data

Table 8 Main Battle Tanks Volume Analysis, by Country, 2018-2021

Table 9 Infantry Fighting Vehicles Volume Analysis, by Country, 2018-2021

5.13 Tariff and Regulatory Landscape

5.13.1 European Union Regulation No. 1285/2013 - Implementation and Exploitation of European Satellite Navigation Systems

5.13.2 European Union Regulation No. 2015/758 - eCall In-Vehicle System

5.13.3 US Space-based Positioning, Navigation, and Timing Policy

5.13.4 GDPR

5.13.5 ICAO Policy on GNSS

5.13.6 Regulatory Bodies, Government Agencies, and Other Organizations

Table 10 Regulatory Bodies, Government Agencies, and Other Organizations

5.14 Key Conferences & Events in 2023

Table 11 Assured PNT Market: Conferences & Events, 2023

5.15 Key Stakeholders & Buying Criteria

5.15.1 Key Stakeholders in Buying Process

Figure 22 Influence of Stakeholders on Buying Process for Top Three Platforms

Table 12 Influence of Stakeholders on Buying Process for Top Three Platforms (%)

5.15.2 Key Buying Criteria

Figure 23 Key Buying Criteria for Top Three Platforms

Table 13 Key Buying Criteria for Top Three Platforms

6 Industry Trends

6.1 Introduction

6.2 Technology Trends

6.2.1 Error-Free Digital Output Through Air Data Computers

6.2.2 Simulation and Debriefing Through Weapons-Integrated Battlefield Management Systems

6.2.3 Wireless Inertial Measurement Units - for Use in Robotics and UAVs

6.2.4 Micro-Electro-Mechanical Systems - for Real-Time Control

6.2.5 High-End INS - Widely Used in Marine Applications

6.2.5.1 Ring Laser Gyro Inertial Navigation Sensors

6.2.5.2 Fiber Optic Gyro Inertial Navigation Sensors

6.2.6 GPS-Aided INS - Offers Enhanced Data

6.2.7 Air Data Inertial Reference Unit Eliminates Need for Extra Components

6.2.8 Multi-Sensor Data Fusion for UAV Navigation

6.2.8.1 Use of Sense & Avoid Technology

6.2.9 Advanced Inertial Navigation Systems for UUVs

6.3 Supply Chain Analysis

Figure 24 Supply Chain Analysis

6.4 Impact of Megatrends

6.4.1 Artificial Intelligence

6.5 Innovations and Patent Registrations

Table 14 Assured PNT: Key Patents (2020-2022)

7 Assured PNT Market, by Component

7.1 Introduction

7.2 Atomic Clocks

7.3 Antennas

7.4 Transponders

7.5 Sensors

7.6 Power Amplifiers

7.7 Receivers

7.8 Others

8 Assured PNT Market, by Platform

8.1 Introduction

Figure 25 Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 15 Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 16 Assured PNT Market, by Platform, 2022-2027 (USD Million)

8.2 Land

8.2.1 Combat Vehicles

8.2.1.1 Increasing Integration of New PNT Systems in Modernized Vehicle Platforms

8.2.1.1.1 Main Battle Tanks (MBTs)

8.2.1.1.1.1 Increasing Demand for MBTs in Cross-Country Operations

8.2.1.1.2 Infantry Fighting Vehicles (IFVs)

8.2.1.1.2.1 Increased Procurement of IFVs by Emerging Economies

8.2.1.1.3 Armored Personnel Carriers (APCs)

8.2.1.1.3.1 Demand for Weapon System-Armored Personnel Carriers

8.2.1.1.4 Armored Amphibious Vehicles (AAVs)

8.2.1.1.4.1 Increasing Demand to Carry Troops from Sea to Land Battlefields

8.2.1.1.5 Mine-Resistant Ambush Protected (MRAP) Vehicles

8.2.1.1.5.1 Used for Protection of Troops from IEDs and Mines

8.2.1.1.6 Light Protected Vehicles (LPVs)

8.2.1.1.6.1 Increasing Use of LPVs for Border Patrolling and Surveillance Activities

8.2.2 Unmanned Ground Vehicles

8.2.2.1 Demand Driven by Need for Protection and Rescue Duties

8.2.3 Soldiers

8.2.3.1 Replace GPS Receivers and Single Source of Positioning & Navigation

8.3 Air

8.3.1 Military Aircraft

8.3.1.1 Increasing Demand for New Aircraft with Advanced Capabilities

8.3.1.1.1 Special Mission Aircraft

8.3.1.1.1.1 Evolving Warfare Techniques to Drive Demand

8.3.1.1.2 Fighter Aircraft

8.3.1.1.2.1 Growing Procurement due to Increasing Geopolitical Rifts

8.3.2 Military Helicopters

8.3.2.1 Increasing Use in Combat Search & Rescue Operations

8.3.3 Unmanned Aerial Vehicles

8.3.3.1 Increasing Proliferation of Drones for ISR Missions

8.4 Naval

8.4.1 Destroyers

8.4.1.1 Increasing Procurement by US and China

8.4.2 Frigates

8.4.2.1 Rising Construction and Maintenance of Frigates Drive Demand

8.4.3 Corvettes

8.4.3.1 Growing Focus of China on Induction of Advanced Corvettes by 2030

8.4.4 Submarines

8.4.4.1 Increasing Efforts of US, China, and India to Develop Advanced Submarines

9 Assured PNT Market, by End-user

9.1 Introduction

Figure 26 Assured PNT Market, by End-user, 2022-2027 (USD Million)

Table 17 Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 18 Assured PNT Market, by End-user, 2022-2027 (USD Million)

9.2 Defense

9.2.1 Expansion of Operational Awareness and New Capabilities to Drive Segment

9.3 Homeland Security

9.3.1 Increasing R&D Activities for Resilient PNT to Fuel Growth

10 Regional Analysis

10.1 Introduction

Figure 27 North America to Dominate Assured PNT Market from 2022 to 2027

10.2 Recession Impact Analysis

Table 19 Recession Impact Analysis

Table 20 Assured PNT Market, by Region, 2019-2021 (USD Million)

Table 21 Assured PNT Market, by Region, 2022-2027 (USD Million)

10.3 North America

10.3.1 Recession Impact Analysis: North America

10.3.2 PESTLE Analysis: North America

Figure 28 Assured PNT Market: North America Snapshot

Table 22 North America: Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 23 North America: Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 24 North America: Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 25 North America: Assured PNT Market, by End-user, 2022-2027 (USD Million)

Table 26 North America: Assured PNT Market, by Country, 2019-2021 (USD Million)

Table 27 North America: Assured PNT Market, by Country, 2022-2027 (USD Million)

10.3.3 US

10.3.3.1 Presence of Leading Manufacturers in Country

Table 28 US: Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 29 US: Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 30 US: Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 31 US: Assured PNT Market, by End-user, 2022-2027 (USD Million)

10.3.4 Canada

10.3.4.1 High Investments in Development and Upgrade of Weapons

Table 32 Canada: Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 33 Canada: Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 34 Canada: Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 35 Canada: Assured PNT Market, by End-user, 2022-2027 (USD Million)

10.4 Europe

10.4.1 Recession Impact Analysis: Europe

10.4.2 PESTLE Analysis: Europe

Figure 29 Assured PNT Market: Europe Snapshot

Table 36 Europe: Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 37 Europe: Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 38 Europe: Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 39 Europe: Assured PNT Market, by End-user, 2022-2027 (USD Million)

Table 40 Europe: Assured PNT Market, by Country, 2019-2021 (USD Million)

Table 41 Europe: Assured PNT Market, by Country, 2022-2027 (USD Million)

10.4.3 Russia

10.4.3.1 Increasing Investments in AI as Part of Modernization

Table 42 Russia: Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 43 Russia: Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 44 Russia: Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 45 Russia: Assured PNT Market, by End-user, 2022-2027 (USD Million)

10.4.4 UK

10.4.4.1 Need for Secure Guidance Systems by Royal Armed Forces

Table 46 UK: Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 47 UK: Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 48 UK: Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 49 UK: Assured PNT Market, by End-user, 2022-2027 (USD Million)

10.4.5 France

10.4.5.1 Focus on Internal Security and Interoperability of Defense Forces

Table 50 France: Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 51 France: Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 52 France: Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 53 France: Assured PNT Market, by End-user, 2022-2027 (USD Million)

10.4.6 Germany

10.4.6.1 High Demand from Government Agencies to Maintain Law & Order

Table 54 Germany: Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 55 Germany: Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 56 Germany: Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 57 Germany: Assured PNT Market, by End-user, 2022-2027 (USD Million)

10.4.7 Italy

10.4.7.1 Focus on Battlefield Readiness Technologies That Employ PNT Systems

Table 58 Italy: Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 59 Italy: Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 60 Italy: Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 61 Italy: Assured PNT Market, by End-user, 2022-2027 (USD Million)

10.4.8 Rest of Europe

10.4.8.1 Geopolitical Rifts to Encourage Adoption of Modern Vehicle Platforms

Table 62 Rest of Europe: Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 63 Rest of Europe: Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 64 Rest of Europe: Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 65 Rest of Europe: Assured PNT Market, by End-user, 2022-2027 (USD Million)

10.5 Asia-Pacific

10.5.1 Recession Impact Analysis: Asia-Pacific

10.5.2 PESTLE Analysis: Asia-Pacific

Figure 30 Assured PNT Market: Asia-Pacific Snapshot

Table 66 Asia-Pacific: Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 67 Asia-Pacific: Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 68 Asia-Pacific: Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 69 Asia-Pacific: Assured PNT Market, by End-user, 2022-2027 (USD Million)

Table 70 Asia-Pacific: Assured PNT Market, by Country, 2019-2021 (USD Million)

Table 71 Asia-Pacific: Assured PNT Market, by Country, 2022-2027 (USD Million)

10.5.3 China

10.5.3.1 Increasing Defense Spending and Conflicts with Other Countries

Table 72 China: Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 73 China: Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 74 China: Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 75 China: Assured PNT Market, by End-user, 2022-2027 (USD Million)

10.5.4 India

10.5.4.1 Rising Military Expenditure and Ongoing Modernization Programs

Table 76 India: Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 77 India: Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 78 India: Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 79 India: Assured PNT Market, by End-user, 2022-2027 (USD Million)

10.5.5 Japan

10.5.5.1 Use of Military Navigation Systems in Defense on the Rise

Table 80 Japan: Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 81 Japan: Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 82 Japan: Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 83 Japan: Assured PNT Market, by End-user, 2022-2027 (USD Million)

10.5.6 South Korea

10.5.6.1 Installation of GPS Anti-Jammers due to Ongoing Disputes with North Korea

Table 84 South Korea: Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 85 South Korea: Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 86 South Korea: Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 87 South Korea: Assured PNT Market, by End-user, 2022-2027 (USD Million)

10.5.7 Australia

10.5.7.1 Demand for Modern Digital Technologies in Military Equipment

Table 88 Australia: Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 89 Australia: Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 90 Australia: Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 91 Australia: Assured PNT Market, by End-user, 2022-2027 (USD Million)

10.5.8 Rest of Asia-Pacific

10.5.8.1 Increased Technological Advancements in Navigation Systems

Table 92 Rest of Asia-Pacific: Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 93 Rest of Asia-Pacific: Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 94 Rest of Asia-Pacific: Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 95 Rest of Asia-Pacific: Assured PNT Market, by End-user, 2022-2027 (USD Million)

10.6 Middle East & Africa

10.6.1 Recession Impact Analysis: Middle East & Africa

10.6.2 PESTLE Analysis: Middle East & Africa

Figure 31 Assured PNT Market: Middle East & Africa Snapshot

Table 96 Middle East & Africa: Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 97 Middle East & Africa: Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 98 Middle East & Africa: Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 99 Middle East & Africa: Assured PNT Market, by End-user, 2022-2027 (USD Million)

Table 100 Middle East & Africa: Assured PNT Market, by Country, 2019-2021 (USD Million)

Table 101 Middle East & Africa: Assured PNT Market, by Country, 2022-2027 (USD Million)

10.6.3 Saudi Arabia

10.6.3.1 Growing Need for Cyber Defense

Table 102 Saudi Arabia: Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 103 Saudi Arabia: Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 104 Saudi Arabia: Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 105 Saudi Arabia: Assured PNT Market, by End-user, 2022-2027 (USD Million)

10.6.4 Israel

10.6.4.1 Military Modernization Programs and Development of Defense Capabilities in Focus

Table 106 Israel: Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 107 Israel: Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 108 Israel: Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 109 Israel: Assured PNT Market, by End-user, 2022-2027 (USD Million)

10.6.5 South Africa

10.6.5.1 Need for Advanced Systems to Mitigate Spoofing and Jamming Threats

Table 110 South Africa: Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 111 South Africa: Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 112 South Africa: Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 113 South Africa: Assured PNT Market, by End-user, 2022-2027 (USD Million)

10.6.6 Rest of Middle East & Africa

Table 114 Rest of Middle East & Africa: Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 115 Rest of Middle East & Africa: Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 116 Rest of Middle East & Africa: Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 117 Rest of Middle East & Africa: Assured PNT Market, by End-user, 2022-2027 (USD Million)

10.7 Latin America

10.7.1 Recession Impact Analysis: Latin America

Figure 32 Assured PNT Market: Latin America Snapshot

Table 118 Latin America: Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 119 Latin America: Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 120 Latin America: Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 121 Latin America: Assured PNT Market, by End-user, 2022-2027 (USD Million)

Table 122 Latin America: Assured PNT Market, by Country, 2019-2021 (USD Million)

Table 123 Latin America: Assured PNT Market, by Country, 2022-2027 (USD Million)

10.7.2 Brazil

10.7.2.1 Focus on Strengthening Border Monitoring Capabilities

Table 124 Brazil: Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 125 Brazil: Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 126 Brazil: Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 127 Brazil: Assured PNT Market, by End-user, 2022-2027 (USD Million)

10.7.3 Mexico

10.7.3.1 Increasing Defense Spending to Fight Organized Crime

Table 128 Mexico: Assured PNT Market, by Platform, 2019-2021 (USD Million)

Table 129 Mexico: Assured PNT Market, by Platform, 2022-2027 (USD Million)

Table 130 Mexico: Assured PNT Market, by End-user, 2019-2021 (USD Million)

Table 131 Mexico: Assured PNT Market, by End-user, 2022-2027 (USD Million)

11 Competitive Landscape

11.1 Introduction

Table 132 Key Developments by Leading Market Players Between 2018 and 2022

11.2 Revenue Analysis of Key Market Players, 2021

Figure 33 Revenue Analysis of Key Companies in Last Five Years

11.3 Market Share Analysis

Figure 34 Assured PNT: Market Share Analysis, 2021

Table 133 Assured PNT Market: Degree of Competition

11.4 Company Evaluation Quadrant

11.4.1 Assured PNT Market Competitive Leadership Mapping

Figure 35 Assured PNT Market (Global) Company Evaluation Matrix, 2021

11.4.1.1 Stars

11.4.1.2 Pervasive Players

11.4.1.3 Emerging Leaders

11.4.1.4 Participants

11.4.1.5 Competitive Benchmarking

Table 134 Company Footprint

Table 135 Company End-user Footprint

Table 136 Company Platform Footprint

Table 137 Company Region Footprint

11.5 Competitive Scenario and Trends

11.5.1 Product Launches

Table 138 Assured PNT Market: Product Launches, 2018-2022

11.5.2 Deals

Table 139 Assured PNT Market: Deals, 2018-2022

12 Company Profiles

(Business Overview, Products/Solutions/Services Offered, Recent Developments, Analyst's View (Key Strengths/Right to Win, Strategic Choices Made, Weakness/Competitive Threats)*

12.1 Introduction

12.2 Key Players

12.2.1 BAE Systems PLC

Table 140 BAE Systems PLC: Business Overview

Figure 36 BAE Systems PLC: Company Snapshot

Table 141 BAE Systems PLC: Product Launches

Table 142 BAE Systems PLC: Deals

12.2.2 General Dynamics Corporation

Table 143 General Dynamics Corporation: Business Overview

Figure 37 General Dynamics Corporation: Company Snapshot

12.2.3 Leonardo DRS

Table 144 Leonardo DRS: Business Overview

Figure 38 Leonardo S.p.A.: Company Snapshot

Table 145 Leonardo DRS: Product Launches

12.2.4 Lockheed Martin Corporation

Table 146 Lockheed Martin Corporation: Business Overview

Figure 39 Lockheed Martin Corporation: Company Snapshot

Table 147 Lockheed Martin Corporation: Deals

12.2.5 Northrop Grumman Corporation

Table 148 Northrop Grumman Corporation: Business Overview

Figure 40 Northrop Grumman Corporation: Company Snapshot

Table 149 Northrop Grumman Corporation: Deals

12.2.6 Raytheon Technologies Corporation

Table 150 Raytheon Technologies Corporation: Business Overview

Figure 41 Raytheon Technologies Corporation: Company Snapshot

Table 151 Raytheon Technologies Corporation: Product Launches

Table 152 Raytheon Technologies Corporation: Deals

12.2.7 Thales Group

Table 153 Thales Group: Business Overview

Figure 42 Thales Group: Company Snapshot

12.2.8 L3Harris Technologies

Table 154 L3Harris Technologies: Business Overview

Figure 43 L3Harris Technologies: Company Snapshot

Table 155 L3Harris Technologies: Deals

12.2.9 Hexagon AB

Table 156 Hexagon AB: Business Overview

Figure 44 Hexagon AB: Company Snapshot

Table 157 Hexagon AB: Product Launches

12.2.10 Israel Aerospace Industries

Table 158 Israel Aerospace Industries: Business Overview

Figure 45 Israel Aerospace Industries: Company Snapshot

12.2.11 Spirent Communications

Table 159 Spirent Communications: Business Overview

Figure 46 Spirent Communications: Company Snapshot

Table 160 Spirent Communications: Product Launches

Table 161 Spirent Communications: Deals

12.2.12 Rheinmetall AG

Table 162 Rheinmetall AG: Business Overview

Figure 47 Rheinmetall AG: Company Snapshot

Table 163 Rheinmetall AG: Deals

12.2.13 Cobham Ltd.

Table 164 Cobham Ltd.: Business Overview

Table 165 Cobham Ltd.: Deals

12.2.14 Curtiss-Wright Corporation

Table 166 Curtiss-Wright Corporation: Business Overview

Figure 48 Curtiss-Wright Corporation: Company Snapshot

12.2.15 Orolia

Table 167 Orolia: Business Overview

Table 168 Orolia: Deals

12.2.16 Honeywell International, Inc.

Table 169 Honeywell International, Inc.: Business Overview

Figure 49 Honeywell International, Inc.: Company Snapshot

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, Analyst's View (Key Strengths/Right to Win, Strategic Choices Made, Weakness/Competitive Threats)* Might Not be Captured in Case of Unlisted Companies

13 Appendix

13.1 Discussion Guide

13.2 Knowledgestore: The Subscription Portal

13.3 Customization Options

Companies Mentioned

- BAE Systems PLC

- Cobham Ltd.

- Curtiss-Wright Corporation

- General Dynamics Corporation

- Hexagon AB

- Honeywell International, Inc.

- Israel Aerospace Industries

- L3Harris Technologies

- Leonardo DRS

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Orolia

- Raytheon Technologies Corporation

- Rheinmetall AG

- Spirent Communications

- Thales Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 206 |

| Published | March 2023 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 0.4 Billion |

| Forecasted Market Value ( USD | $ 1.7 Billion |

| Compound Annual Growth Rate | 29.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |