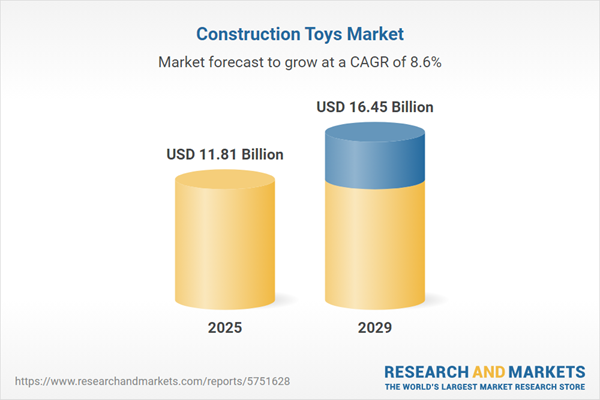

The construction toys market size is expected to see strong growth in the next few years. It will grow to $16.45 billion in 2029 at a compound annual growth rate (CAGR) of 8.6%. The growth in the forecast period can be attributed to e-commerce growth, sustainability concerns, inclusive toy design, parental consciousness, rise of maker culture, focus on safety standards. Major trends in the forecast period include incorporation of stem learning, integration of augmented reality (AR), expansion of licensing partnerships, modular and customizable sets, digital integration for interactive play, 3D printing options.

An increase in disposable income is anticipated to drive the growth of the construction toys market during the forecast period. Rising disposable income is leading to a notable surge in leisure spending globally, as consumers are more willing to invest in enhancing their standard of living. This trend results in the purchase of a wide range of consumer and recreational products, including toys. For example, in September 2024, the Office for National Statistics, a UK-based executive office of the UK Statistics Authority, reported that gross disposable household income (GDHI) in the UK rose by 6.3% in 2022 compared to 2021. Specifically, England saw a GDHI increase of 6.5%, while Northern Ireland, Scotland, and Wales experienced growth rates of 6.3%, 5.5%, and 4.4%, respectively. This increase in disposable income indicates a recovering economy and differing regional economic conditions across the UK. Therefore, the rise in disposable income is driving the growth of the construction toys market.

The growth of the construction market is expected to be fueled by an increase in the child population. The child population refers to individuals below a certain age threshold, typically anyone under 18 years old. A larger child population generally translates to heightened demand for children's toys, which in turn creates a more substantial market for companies specializing in construction toys, resulting in increased sales and profits. For instance, in January 2023, a report from the Centers for Disease Control and Prevention (CDC), a US-based national public health organization, indicated that the United States experienced a 1% rise in registered births, totaling 3,664,292, compared to the previous year. Consequently, the rise in the child population is driving the growth of the construction toys market.

Product innovation stands as a pivotal trend gaining significant traction and is anticipated to drive the growth of the construction toys market in the upcoming forecast period. Major players within the construction toys sector are intensifying their focus on developing cutting-edge products to fortify their market standing. For instance, in October 2023, Ravensburger, a Germany-based toy company, unveiled its latest offering, the GraviTrax Starter-Set Bounce marble run - a premier gaming gift designed for children who revel in immersive play and construction. GraviTrax represents a STEM-based construction toy track system, empowering kids aged eight and above to unleash their creativity by constructing intricate marble run tracks and watching their marbles navigate the course. This innovative system not only fosters imaginative play but also serves as an educational tool, offering insights into concepts such as gravity, magnetism, and kinetic energy, all while delivering a thrilling and engaging experience. Moreover, the GraviTrax system encourages problem-solving skills through its rebuildable features, enabling users to explore new possibilities repeatedly, fostering continuous learning and enjoyment.

The construction toys market is witnessing a significant trend with the introduction of learning and educational toys. Leading companies are developing educational toys to gain a competitive advantage over their rivals. For example, in November 2023, LeapFrog Enterprises, Inc., a US-based manufacturer specializing in learning toys for children, unveiled a new collection of eco-friendly wooden toys designed to enhance early childhood education through interactive play. This launch includes notable products such as the ABCs & Activities Wooden Table, which encourages children to sort blocks and recognize shapes and letters, and the Touch & Learn Wooden Activity Cube, tailored for toddlers over 12 months and featuring games involving musical instruments and shape sorting.

In January 2024, Spin Master Corp., a Canadian children's entertainment company, acquired Melissa And Doug LLC for $950 million. This acquisition is intended to strengthen Spin Master's position within the children's entertainment industry. By acquiring Melissa And Doug, Spin Master aims to enhance its offerings in early childhood development toys, which are becoming increasingly popular among parents seeking sustainable and screen-free play alternatives. Melissa And Doug LLC is a US-based manufacturer known for its range of children's toys, including wooden puzzles, blocks, and stacking toys.

Major companies operating in the construction toys market include LEGO Group, BANDAI NAMCO Holdings Inc., Hasbro Inc., Mattel Inc., VTech Holdings Limited, Kawada Ltd., Tegu Inc., Mega Brands Inc., Melissa & Doug Corporation, Spin Master Corp., Magformers International Inc., Hornby Hobbies Limited, Learning Resources Inc., PlayMonster LLC, K'NEX Brands L.P., Revell GmbH, Gebrüder Märklin & Cie. GmbH, Enlighten Bricks Co. Ltd., Geomagworld S.p.A., Cobi Sp. z o.o., Meccano Ltd., Thames & Kosmos LLC, The Tinkershop LLC, Tamiya Inc., Schylling Inc., KnuckleStrutz LLC, Polydron Educational Ltd., Wange Laoxing Toys Co. Ltd., Xingbao Group Co. Ltd., LaQ Co. Ltd.

North America was the largest region in the construction toys market in 2024. The regions covered in the construction toys market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the construction toys market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Construction toys, building blocks allowing children to construct and redesign structures, encourage creativity and learning through assembly and disassembly.

Construction toys come in various types such as bricks & blocks, tinker toys, and other variants. Bricks and blocks, also known as building blocks, comprise solid shapes used in construction games, ranging from plain wooden planks to intricate plastic interlocking bricks. Tinker toys, such as the Tinkertoy construction set, consist of small pieces assembled to create shapes or objects. Other construction toy categories encompass train sets, architectural sets, educational sets, and more. Raw materials used in manufacturing these toys include wood, polymer, metal, and other materials. They are distributed through diverse channels such as supermarkets, hypermarkets, convenience stores, and online platforms.

The construction toys market research report is one of a series of new reports that provides construction toys market statistics, including construction toys industry global market size, regional shares, competitors with a construction toys market share, detailed construction toys market segments, market trends and opportunities, and any further data you may need to thrive in the construction toys industry. This construction toys market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The construction toy market consists of sales of figures, gear sets, magnetic sets, and stacking blocks. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Construction Toys Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on construction toys market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for construction toys? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The construction toys market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Bricks and Blocks; Tinker Toy; Other Products2) By Raw Material: Wood; Polymer; Metal; Other Raw Materials

3) By Distribution Channel: Supermarkets and Hypermarkets; Convenience Stores; Online

Subsegments:

1) By Bricks and Blocks: Building Bricks; Foam Blocks; Magnetic Building Blocks2) By Tinker Toy: Classic Tinker Toy Sets; Modern Tinker Toy Variants; Specialty Tinker Kits

3) By Other Products: Construction Vehicles; Construction Kits; Role-Playing Construction Sets

Key Companies Mentioned: LEGO Group; BANDAI NAMCO Holdings Inc.; Hasbro Inc.; Mattel Inc.; VTech Holdings Limited

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- LEGO Group

- BANDAI NAMCO Holdings Inc.

- Hasbro Inc.

- Mattel Inc.

- VTech Holdings Limited

- Kawada Ltd.

- Tegu Inc.

- Mega Brands Inc.

- Melissa & Doug Corporation

- Spin Master Corp.

- Magformers International Inc.

- Hornby Hobbies Limited

- Learning Resources Inc.

- PlayMonster LLC

- K'NEX Brands L.P.

- Revell GmbH

- Gebrüder Märklin & Cie. GmbH

- Enlighten Bricks Co. Ltd.

- Geomagworld S.p.A.

- Cobi Sp. z o.o.

- Meccano Ltd.

- Thames & Kosmos LLC

- The Tinkershop LLC

- Tamiya Inc.

- Schylling Inc.

- KnuckleStrutz LLC

- Polydron Educational Ltd.

- Wange Laoxing Toys Co. Ltd.

- Xingbao Group Co. Ltd.

- LaQ Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 11.81 Billion |

| Forecasted Market Value ( USD | $ 16.45 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |