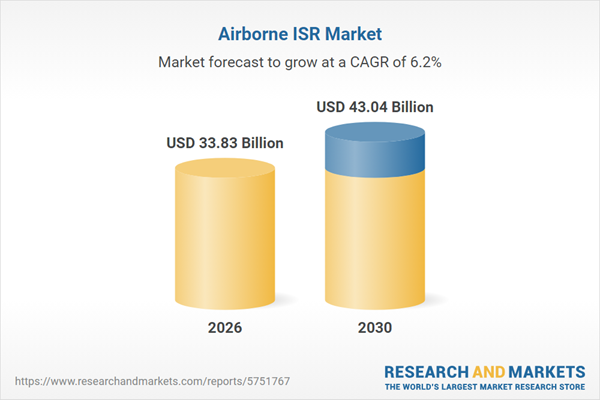

The airborne isr market size is expected to see strong growth in the next few years. It will grow to $43.04 billion in 2030 at a compound annual growth rate (CAGR) of 6.2%. The growth in the forecast period can be attributed to anticipated rise in multi-domain operations requiring integrated airborne ISR platforms, growing use of unmanned aerial systems to expand ISR mission endurance and flexibility, increasing demand for AI-enabled data analytics to process complex ISR information, investment in next-generation sensors and communication systems enhancing ISR performance, expanding geopolitical tensions driving procurement of advanced airborne ISR platforms. Major trends in the forecast period include increasing demand for long-range isr surveillance capabilities, rising integration of multi-sensor fusion payloads in airborne isr platforms, growing focus on real-time threat detection and early-warning systems, expansion of isr modernization programs across military fleets, advancement of signal intelligence (sigint) and electronic intelligence (elint) capabilities.

The growing threats of terror attacks are expected to propel demand for the airborne ISR market. Terrorist attacks refer to acts of violence carried out by groups to instill fear among populations and advance political objectives. Such attacks are increasing due to the rising influence of extremist organizations and their global networks. Airborne ISR strengthens counterterrorism efforts by providing real-time intelligence, surveillance, and reconnaissance to detect, monitor, and respond effectively to potential threats. For instance, in February 2024, according to the Institute for Economics & Peace, an Australia-based think tank, the global terrorism index reported that terrorism-related deaths outside Afghanistan rose by 4% in 2023 compared with 2022. Therefore, the rising threats of terror attacks are expected to boost demand for the airborne ISR market.

Major companies operating in the airborne ISR market are focusing on leveraging innovative multi-sensor technologies to enhance intelligence, surveillance, and reconnaissance (ISR) capabilities. Multi-sensor ISR technology, which integrates various sensors such as radar, electro-optical, and electronic intelligence systems, enables defense organizations to capture more accurate and comprehensive data, improve situational awareness, and optimize mission planning. For example, in July 2025, L3Harris Technologies Inc., a US-based aerospace and defense company, and ELT Group, an Italy-based electronics company, launched the first multi-sensor ISR test facility outside the U.S. Designed to support platforms such as the G550 Joint Airborne Multi-Mission, Multi-Sensor System (JAMMS) and electronic attack aircraft, the facility advances sensor testing and operational readiness for Italian and allied defense forces. It leverages ELT Group’s 70 years of expertise in electromagnetic spectrum operations, enabling high-fidelity simulation and testing of multi-sensor systems in real-world conditions, making defense operations more reliable, precise, and technologically advanced than existing alternatives.

In August 2025, Voyager Technologies, a US-based defense security company, acquired ElectroMagnetic Systems Inc. for an undisclosed amount. Through this acquisition, Voyager Technologies aims to utilize EMSI’s advanced AI-driven radar and automated target recognition technologies to enhance real-time intelligence, surveillance, and reconnaissance capabilities across multiple domains for national security and commercial markets, accelerating decision-making and expanding its high-tech defense portfolio. ElectroMagnetic Systems Inc. is a US-based technology company that provides airborne intelligence, surveillance, and reconnaissance (ISR) capabilities.

Major companies operating in the airborne isr market are Raytheon Technologies Corporation, Lockheed Martin Corporation, BAE Systems plc, Northrop Grumman Corporation, L3Harris Technologies Inc., General Atomics Aeronautical Systems Inc., The Boeing Company, Elbit Systems Ltd., Textron Inc., Thales Group, Leonardo S.p.A., Safran Group, Kratos Defense & Security Solutions Inc., Israel Aerospace Industries Ltd., Leidos Holdings Inc., FLIR Systems Inc., Airbus SE, General Dynamics Corporation, Rheinmetall AG, Mercury Systems Inc., AeroVironment Inc., PAL Aerospace Ltd., Israel Military Industries Ltd., Sierra Nevada Corporation, Insitu Inc., Esterline Technologies Corporation, Curtiss-Wright Corporation, RADA Electronic Industries Ltd., Top Aces Inc., CACI International Inc.

North America was the largest region in the airborne ISR market in 2025. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the airborne isr market report are Asia-Pacific, South East Asia, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

Tariffs are influencing the airborne ISR market by increasing import costs for critical components such as high-precision sensors, encrypted communication modules, and advanced processing hardware, leading to higher system integration costs. Platforms such as unmanned systems and military aircraft are most affected, especially in regions dependent on cross-border electronics supply chains, such as Asia-Pacific and Europe. However, tariffs also stimulate positive outcomes by encouraging domestic production of ISR electronics, strengthening local defense manufacturing, and promoting supply-chain resiliency within the airborne ISR ecosystem.

The airborne ISR market research report is one of a series of new reports that provides airborne ISR market statistics, including airborne ISR industry global market size, airborne ISR market regional shares, competitors with an airborne ISR market share, detailed airborne ISR market segments, airborne ISR market trends and opportunities, and any further data you may need to thrive in the airborne ISR industry. This airborne ISR market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

Airborne Intelligence, Surveillance, and Reconnaissance (ISR) encompass both hardware and software systems designed to procure accurate and real-time intelligence on adversary forces, employing advanced technologies to identify and mitigate potential threats. The primary objective of airborne ISR is to gather information about enemy activities, observing their behavior and monitoring their movements. The strategic utilization of ISR data can offer early warning of potential threats, enabling military forces to enhance their efficiency and coordination.

The key components of airborne ISR solutions include systems, software, and services. Airborne ISR systems involve the integration of hardware into military and civilian aircraft, facilitating on-board and off-board collection of targeting data for customized airborne mission systems. Deployed on military aircraft, helicopters, and unmanned systems, these solutions serve defense and homeland security purposes, supporting activities such as search and rescue operations, border and maritime patrol, target acquisition and tracking, critical infrastructure protection, and tactical support.

The countries covered in the airborne isr market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Taiwan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The airborne ISR market consists of sales of airborne ISR platform including fixed wing or airships and rotary wing. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Airborne ISR Market Global Report 2026 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses airborne isr market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 16 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on end user analysis.

- Benchmark performance against key competitors based on market share, innovation, and brand strength.

- Evaluate the total addressable market (TAM) and market attractiveness scoring to measure market potential.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for airborne isr? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The airborne isr market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, total addressable market (TAM), market attractiveness score (MAS), competitive landscape, market shares, company scoring matrix, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market. This section also examines key products and services offered in the market, evaluates brand-level differentiation, compares product features, and highlights major innovation and product development trends.

- The supply chain analysis section provides an overview of the entire value chain, including key raw materials, resources, and supplier analysis. It also provides a list competitor at each level of the supply chain.

- The updated trends and strategies section analyses the shape of the market as it evolves and highlights emerging technology trends such as digital transformation, automation, sustainability initiatives, and AI-driven innovation. It suggests how companies can leverage these advancements to strengthen their market position and achieve competitive differentiation.

- The regulatory and investment landscape section provides an overview of the key regulatory frameworks, regularity bodies, associations, and government policies influencing the market. It also examines major investment flows, incentives, and funding trends shaping industry growth and innovation.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- The total addressable market (TAM) analysis section defines and estimates the market potential compares it with the current market size, and provides strategic insights and growth opportunities based on this evaluation.

- The market attractiveness scoring section evaluates the market based on a quantitative scoring framework that considers growth potential, competitive dynamics, strategic fit, and risk profile. It also provides interpretive insights and strategic implications for decision-makers.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- Expanded geographical coverage includes Taiwan and Southeast Asia, reflecting recent supply chain realignments and manufacturing shifts in the region. This section analyzes how these markets are becoming increasingly important hubs in the global value chain.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The company scoring matrix section evaluates and ranks leading companies based on a multi-parameter framework that includes market share or revenues, product innovation, and brand recognition.

Report Scope

Markets Covered:

1) By Solution: Systems; Software; Services2) By Platform: Military Aircraft; Military Helicopters; Unmanned Systems

3) By Application: Search and Rescue Operations; Border and Maritime Patrol; Target Acquisition and Tracking; Critical Infrastructure Protection; Tactical Support; Others

4) By End User: Defense; Homeland Security

Subsegments:

1) By Systems: Airborne Sensor Systems; Unmanned Aerial Systems (UAS); Manned Aircraft Systems; Data Link Systems; Ground Control Stations2) By Software: ISR Data Processing Software; Mission Planning Software; Analysis and Visualization Software; Sensor Fusion Software; Data Management and Storage Software

3) By Services: ISR Training and Support Services; Maintenance and Repair Services; Mission Planning and Execution Services; Data Analysis and Interpretation Services; Consultancy Services for ISR Operations

Companies Mentioned: Raytheon Technologies Corporation; Lockheed Martin Corporation; BAE Systems plc; Northrop Grumman Corporation; L3Harris Technologies Inc.; General Atomics Aeronautical Systems Inc.; The Boeing Company; Elbit Systems Ltd.; Textron Inc.; Thales Group; Leonardo S.p.A.; Safran Group; Kratos Defense & Security Solutions Inc.; Israel Aerospace Industries Ltd.; Leidos Holdings Inc.; FLIR Systems Inc.; Airbus SE; General Dynamics Corporation; Rheinmetall AG; Mercury Systems Inc.; AeroVironment Inc.; PAL Aerospace Ltd.; Israel Military Industries Ltd.; Sierra Nevada Corporation; Insitu Inc.; Esterline Technologies Corporation; Curtiss-Wright Corporation; RADA Electronic Industries Ltd.; Top Aces Inc.; CACI International Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Taiwan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; South East Asia; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: Word, PDF or Interactive Report + Excel Dashboard

Added Benefits

- Bi-Annual Data Update

- Customisation

- Expert Consultant Support

Companies Mentioned

The companies featured in this Airborne ISR market report include:- Raytheon Technologies Corporation

- Lockheed Martin Corporation

- BAE Systems plc

- Northrop Grumman Corporation

- L3Harris Technologies Inc.

- General Atomics Aeronautical Systems Inc.

- The Boeing Company

- Elbit Systems Ltd.

- Textron Inc.

- Thales Group

- Leonardo S.p.A.

- Safran Group

- Kratos Defense & Security Solutions Inc.

- Israel Aerospace Industries Ltd.

- Leidos Holdings Inc.

- FLIR Systems Inc.

- Airbus SE

- General Dynamics Corporation

- Rheinmetall AG

- Mercury Systems Inc.

- AeroVironment Inc.

- PAL Aerospace Ltd.

- Israel Military Industries Ltd.

- Sierra Nevada Corporation

- Insitu Inc.

- Esterline Technologies Corporation

- Curtiss-Wright Corporation

- RADA Electronic Industries Ltd.

- Top Aces Inc.

- CACI International Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | January 2026 |

| Forecast Period | 2026 - 2030 |

| Estimated Market Value ( USD | $ 33.83 Billion |

| Forecasted Market Value ( USD | $ 43.04 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |