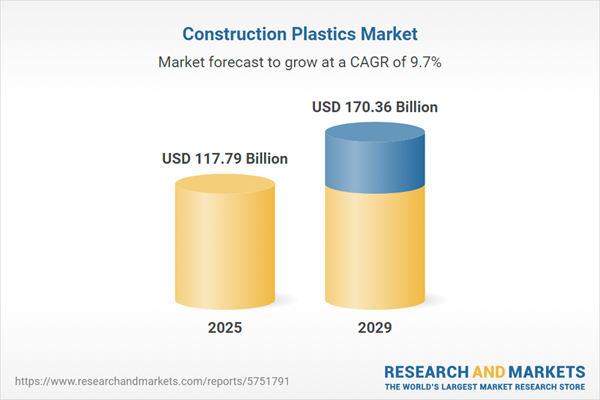

The construction plastics market size is expected to see strong growth in the next few years. It will grow to $170.36 billion in 2029 at a compound annual growth rate (CAGR) of 9.7%. The growth in the forecast period can be attributed to increasing digital construction workflows, circular economy practices, construction safety standards, emerging market growth, and growing adaptation to changing climate conditions. Major trends in the forecast period include utilization of lightweight and durable plastic materials, thermoplastic roofing, integration of smart plastic materials with sensors and data connectivity, soundproofing plastics, innovative solutions, and strategic collaborations.

An increase in building, construction, and infrastructural standards is a key factor driving the growth of the construction plastic market. Emerging markets that have experienced strong construction activity include China, Brazil, India, Saudi Arabia, and Indonesia. According to AECOM, the global construction market is projected to maintain its robust growth trajectory, with an anticipated rise from $13.35 trillion in 2023 to $17.6 trillion by 2026, reflecting a compound annual growth rate (CAGR) of approximately 5.3%. Despite significant opposition to plastic use, the construction industry's demand for plastics remains steadfast due to their lightweight nature, ease of handling, and low maintenance requirements. Additionally, the global market has seen substantial profits due to the absence of substitutes for high-quality plastics. Therefore, the rapid growth in building and construction and infrastructural standards is expected to drive the expansion of the construction plastics market.

The anticipated increase in economic growth is expected to drive the growth of the construction plastics market. Economic growth refers to the expansion of an economy's capacity to produce goods and services over time. This growth creates a favorable environment for the construction plastics industry by enhancing construction activity, infrastructure development, innovation, and investment in construction projects. For instance, in September 2023, the Bureau of Economic Analysis, a U.S.-based government agency, reported that the United States experienced a 2.4% increase in real GDP during the second quarter of 2023, showing an improvement from the 2% growth recorded in the previous quarter. Therefore, the rising economic growth is expected to propel the expansion of the construction plastics market in the future.

The rising preference for recycled plastics is an emerging trend in the market. The global population is becoming increasingly aware of the negative impact of plastic materials on the environment. As a result, there has been a rapid surge in demand for recycled eco-friendly plastics, including bioplastics made from plant-derived polymer resins and plastics that can decompose with the aid of bacteria. For example, in March 2023, BASF introduced the expanded IrgaCycle range of additive solutions, significantly enhancing plastics recycling efforts. This range offers targeted additive solutions that improve the quality of recycled materials, allowing for higher percentages of recycled content in end-use industries such as construction, automotive, and packaging. BASF remains committed to innovating sustainable materials to satisfy the growing demand for recycled plastics. Additionally, in February 2023, Kimberly-Clark India expanded its Project Ghar initiative, partnering with the Plastics for Change India Foundation to build sustainable housing for waste collectors.

Leading companies in the construction plastics market are creating innovative products like GreenVin Polyvinyl Chloride (PVC) to address the increasing demand for construction plastics. GreenVin PVC is considered a more eco-friendly alternative to traditional PVC and is widely used in the construction, automotive, and medical industries, where standard PVC is prevalent. For example, in October 2022, Westlake Vinnolit expanded its GreenVin product line by introducing GreenVin bio-attributed PVC, marking a significant step toward reducing carbon emissions. This new PVC is produced using renewable electricity and renewable ethylene sourced from biomass, resulting in an approximate 90% reduction in CO2 emissions compared to conventional PVC.

In April 2023, Axpo Holding AG, a Switzerland-based renewable energy producer, entered into a Power Purchase Agreement (PPA) to acquire Borealis AG within the next six months. This strategic arrangement aligns with Borealis' commitment to increasing its use of renewable energy and advancing sustainability objectives. The PPA enables Borealis to procure green energy from Axpo's wind farm in Finland, specifically for powering its Porvoo facility. Borealis AG, headquartered in Austria, operates as a prominent chemicals company in the industry.

Major companies operating in the construction plastics market include BASF SE, Asahi Kasei Corporation, Dow Inc., LyondellBasell Industries Holdings B.V., Borealis AG, Solvay SA, Saudi Basic Industries Corporation, Berry Plastics Corporation, TotalEnergies SE, Excelite Alliance Private Ltd., Ach Foam Technologies LLC, Chevron Phillips Chemical Company LLC, China Petrochemical Corporation, Engineered Profiles LLC, Formosa Plastics Corporation, Saint-gobain SA, Exxon Mobil Corporation, LG Chem Ltd., Braskem SA, Arkema SA, Covestro AG, Mitsubishi Chemical Corporation, Sumitomo Chemical Co Ltd., Eastman Chemical Company, Shin-Etsu Chemical Co Ltd., Geberit AG, Uponor Corporation, Wavin B.V., Pipelife International GmbH, REHAU AG + Co.

Construction plastics, a type of polymer material, play a crucial role in construction activities, offering versatility, an excellent strength-to-weight ratio, cost-effectiveness, low maintenance, and corrosion resistance. Plastics are increasingly replacing traditional construction materials due to their superior cost-effectiveness, weight-to-strength ratio, and ease of application.

The primary types of construction plastics include expanded polystyrene, polyethylene, polypropylene, and polyvinyl chloride (PVC). PVC, a thermoplastic composed of 57% chlorine and 43% carbon derived predominantly from oil or gas via ethylene, is less dependent on crude oil or natural gas compared to other polymers. PVC finds applications in window frames, flooring, and plumbing pipes. Construction plastics are predominantly used in insulation materials, pipes, and windows and doors. Major end-users of construction plastics include both non-residential and residential construction.

The construction plastics market research report is one of a series of new reports that provides construction plastics market statistics, including construction plastics industry global market size, regional shares, competitors with a construction plastics market share, detailed construction plastics market segments, market trends and opportunities, and any further data you may need to thrive in the construction plastics industry. This construction plastics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Asia-Pacific was the largest region in the construction plastics market in 2024. The regions covered in the construction plastic report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa.

The countries covered in the construction plastics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA.

The construction plastics market consists of sales of expanded polystyrene, polybutylene terephthalate, nylon, teflon, polycarbonate, and insulation materials. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Construction Plastics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on construction plastics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for construction plastics ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The construction plastics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Polyethylene; Polypropylene; Polyvinyl Chloride2) By Application: Insulation Materials; Pipes; Windows & Doors

3) By End-User: Non-Residential; Residential

Subsegments:

1) By Polyethylene: Low-Density Polyethylene (LDPE); Linear Low-Density Polyethylene (LLDPE); High-Density Polyethylene (HDPE); Cross-Linked Polyethylene (PEX)2) By Polypropylene: Homopolymer Polypropylene; Copolymer Polypropylene (Block and Random Copolymer); Biaxially Oriented Polypropylene (BOPP)

3) By Polyvinyl Chloride (PVC): Rigid PVC; Flexible PVC; PVC Blends and Composites

Key Companies Mentioned: BASF SE; Asahi Kasei Corporation; Dow Inc.; LyondellBasell Industries Holdings B.V.; Borealis AG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- BASF SE

- Asahi Kasei Corporation

- Dow Inc.

- LyondellBasell Industries Holdings B.V.

- Borealis AG

- Solvay SA

- Saudi Basic Industries Corporation

- Berry Plastics Corporation

- TotalEnergies SE

- Excelite Alliance Private Ltd.

- Ach Foam Technologies LLC

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation

- Engineered Profiles LLC

- Formosa Plastics Corporation

- Saint-gobain SA

- Exxon Mobil Corporation

- LG Chem Ltd.

- Braskem SA

- Arkema SA

- Covestro AG

- Mitsubishi Chemical Corporation

- Sumitomo Chemical Co Ltd.

- Eastman Chemical Company

- Shin-Etsu Chemical Co Ltd.

- Geberit AG

- Uponor Corporation

- Wavin B.V.

- Pipelife International GmbH

- REHAU AG + Co

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | January 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 117.79 Billion |

| Forecasted Market Value ( USD | $ 170.36 Billion |

| Compound Annual Growth Rate | 9.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |