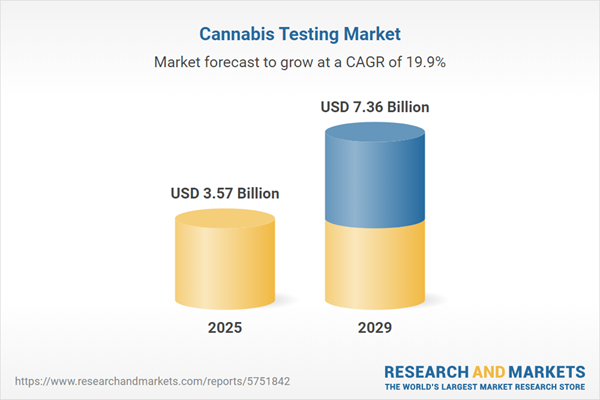

The cannabis testing market size is expected to see rapid growth in the next few years. It will grow to $7.36 billion in 2029 at a compound annual growth rate (CAGR) of 19.9%. The growth in the forecast period can be attributed to continued legalization, stricter regulations, quality control in cultivation, genetic testing, increasing research and development, public awareness and education. Major trends in the forecast period include technological advancements, quality control in cultivation, microbial testing, cannabinoid profiling, testing for pesticides and residues.

The expanding utilization of cannabis for medicinal purposes is anticipated to drive the growth trajectory of the cannabis testing market. Cannabis has gained prominence as a therapeutic agent, notably for alleviating tension, muscle issues, and reducing nausea and vomiting post-chemotherapy. Its efficacy in calming epileptic seizures and mitigating seizure intensity further underscores its medicinal value. According to the World Health Organization's 2022 statistics, approximately 2.5% of the global population, among the 147 million surveyed individuals, reported cannabis consumption. This surge in cannabis usage for medicinal applications acts as a significant impetus propelling the demand for cannabis testing services and solutions. As the therapeutic use of cannabis continues to expand, the cannabis testing market is poised to witness substantial growth to ensure product quality, safety, and regulatory compliance in the evolving landscape of medicinal cannabis.

The anticipated rise in neurological conditions is set to propel the growth trajectory of the cannabis testing market. Neurological conditions encompass a spectrum of disorders affecting the nervous system, comprising the brain, spinal cord, and peripheral nerves, leading to diverse cognitive, motor, and sensory impairments. Within the realm of neurological conditions, cannabis testing assumes significance as a tool for analyzing cannabinoids. This analysis aims to explore the potential therapeutic benefits of cannabis and its effects on symptoms associated with these conditions, such as pain, spasticity, and seizures. According to the World Federation of Neurology's findings in October 2023, over 40% of the global population currently experiences some form of neurological condition. Alarmingly, this burden is projected to nearly double by 2050. This surge in neurological conditions fuels the demand for cannabis testing, as researchers and medical professionals increasingly explore cannabis-based therapies to address symptoms and enhance the quality of life for individuals affected by these conditions. As the prevalence of neurological disorders continues to grow, the cannabis testing market is poised to expand, driven by the quest for effective treatments and therapeutic interventions within this domain.

Strategic partnerships have become a prominent trend among major industry players, aimed at bolstering their market positions. A notable instance is the collaboration forged in March 2022 between Digipath Inc., a US-based cannabis testing laboratory, and CASPR Technologies, a Nigeria-based provider specializing in smart environmental indoor technology for healthcare settings. This partnership between Digipath and CASPR entails an initiative to validate and assess the effectiveness of CASPR's technology in botanical applications, with a specific focus on cannabis and hemp. Through this collaboration, Digipath aims to leverage its testing expertise to evaluate the functionality and suitability of CASPR's technology within the realm of cannabis and hemp, highlighting the industry's increasing emphasis on strategic alliances to advance technological innovations and solutions within the cannabis testing landscape.

Major companies within the cannabis testing market are heavily invested in pioneering innovative tests, notably the development of roadside cannabis tests, to cater to the critical need for accurate impairment assessment. This strategic focus aims not only to fulfill this essential requirement but also to establish a competitive advantage in the market. Roadside cannabis tests function as diagnostic tools employing neurodiagnostics to evaluate recent cannabis use and associated impairment. An illustrative example is the April 2023 launch of OcuPro by Oculogica, a US-based medical device manufacturer. OcuPro stands as a groundbreaking roadside cannabis test utilizing neurodiagnostics to precisely assess recent cannabis use and the resultant impairment. Piloted in various Missouri police departments, this device operates by recording and analyzing eye-pupil characteristics, effectively distinguishing recent cannabis use within a narrow timeframe of 60-90 minutes from usage occurring over several hours. In contrast to traditional tests reliant on THC analysis from bodily samples, OcuPro directly addresses the pressing need for a scientifically validated impairment test specifically for recent cannabis use. This innovation holds immense significance in enforcing regulations against driving under the influence of cannabis, underscoring the pivotal role of advanced testing methodologies in ensuring road safety and regulatory compliance.

In May 2023, ACT Laboratories, a prominent US-based network specializing in cannabis and hemp testing, completed the acquisition of Green Scientific Labs for an undisclosed sum. This strategic acquisition was directed towards broadening and diversifying its portfolio, specifically in the realm of ready-to-drink (RTD) products. Green Scientific Labs, known for its expertise in testing hemp, cannabis, and marijuana, operates as a testing laboratory within the United States. ACT Laboratories' acquisition of Green Scientific Labs represents a strategic move to leverage Green Scientific Labs' proficiency in testing these substances, aiming to expand and enhance its offerings within the ready-to-drink (RTD) product category. This strategic alignment through acquisition signifies ACT Laboratories' commitment to fortifying its presence and capabilities within the cannabis and hemp testing landscape while leveraging the specialized expertise of Green Scientific Labs to fuel growth and diversification within the RTD market segment.

Major companies operating in the cannabis testing market include Thermo Fisher Scientific Inc., Danaher Corporation, Merck KGaA, SGS Canada Inc., Eurofins Scientific SE, Agilent Technologies Inc., Sartorius AG, PerkinElmer Inc., Shimadzu Corporation, Waters Corporation, Ab Sciex LLC, LGC Limited, Tentamus Group, Phenomenex Inc., Saskatchewan Research Council (SRC), Restek Corporation, SC Laboratories, Anresco Labs, Praxis Labs, Accelerated Technology Laboratories Inc., GreenLeaf Lab, ACT Laboratories, PharmLabs LLC, Abko Labs, BelCosta Labs, Medicinal Genomics, CW Analytical Laboratories Inc, DigiPath Inc, CDX Analytics, Steep Hill Halent Laboratories Inc.

North America was the largest region in the cannabis testing market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the cannabis testing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the cannabis testing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Cannabis analysis examines individual samples to ascertain tetrahydrocannabinol (THC), cannabidiol (CBD), terpene levels, and potential impurities such as residual solvents, molds, or pesticides. These tests aim to alleviate stress, muscle pain, nausea, and vomiting.

Cannabis testing encompasses various test types including potency, pesticide screening, residual solvent screening, heavy metal analysis, terpene profiling, mycotoxin detection, and more. Instruments utilized for this purpose involve technologies such as chromatography, spectroscopy, and others, featuring different portability options such as stand-alone and handheld devices. These tools are deployed in testing laboratories, drug manufacturers, research institutes, and various other end-user settings.

The cannabis testing market research report is one of a series of new reports that provides cannabis testing market statistics, including global market size, regional shares, competitors with a cannabis testing market share, detailed cannabis testing market segments, market trends and opportunities, and any further data you may need to thrive in the cannabis testing industry. This cannabis testing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The cannabis testing market includes revenues earned by entities by cannabinoid profile & potency analysis, heavy metal screening, mycotoxin screening, molds & mildews, pesticides & herbicides and residual solvents. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Cannabis Testing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on cannabis testing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for cannabis testing? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The cannabis testing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Test Type: Potency Testing; Pesticide Screening; Residual Solvent Screening; Heavy Metal Testing; Terpene Testing; Mycotoxin Testing; Other Test Types2) By Technology: Chromatography; Spectroscopy; Other Technologies

3) By Portability: Standalone; Hand Held Devices

4) By End User: Testing Laboratories; Drug Manufacturers; Research Institutes; Other End Users

Subsegments:

1) By Potency Testing: THC Testing; CBD Testing; Other Cannabinoids Testing2) By Pesticide Screening: Herbicide Testing; Insecticide Testing; Fungicide Testing

3) By Residual Solvent Screening: Solvent Class Testing; Total Residual Solvent Analysis

4) By Heavy Metal Testing: Lead Testing; Arsenic Testing; Cadmium Testing; Mercury Testing

5) By Terpene Testing: Major Terpene Profile Analysis; Minor Terpene Analysis

6) By Mycotoxin Testing: Aflatoxin Testing; Ochratoxin Testing; Other Mycotoxins

7) By Other Test Types: Microbial Testing; Moisture Content Testing; Foreign Material Testing

Key Companies Mentioned: Thermo Fisher Scientific Inc.; Danaher Corporation; Merck KGaA; SGS Canada Inc.; Eurofins Scientific SE

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Merck KGaA

- SGS Canada Inc.

- Eurofins Scientific SE

- Agilent Technologies Inc.

- Sartorius AG

- PerkinElmer Inc.

- Shimadzu Corporation

- Waters Corporation

- Ab Sciex LLC

- LGC Limited

- Tentamus Group

- Phenomenex Inc.

- Saskatchewan Research Council (SRC)

- Restek Corporation

- SC Laboratories

- Anresco Labs

- Praxis Labs

- Accelerated Technology Laboratories Inc.

- GreenLeaf Lab

- ACT Laboratories

- PharmLabs LLC

- Abko Labs

- BelCosta Labs

- Medicinal Genomics

- CW Analytical Laboratories Inc

- DigiPath Inc

- CDX Analytics

- Steep Hill Halent Laboratories Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.57 Billion |

| Forecasted Market Value ( USD | $ 7.36 Billion |

| Compound Annual Growth Rate | 19.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |