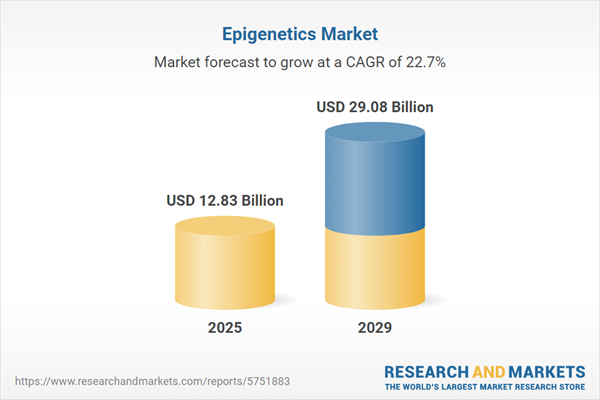

The epigenetics market size is expected to see exponential growth in the next few years. It will grow to $29.08 billion in 2029 at a compound annual growth rate (CAGR) of 22.7%. The growth in the forecast period can be attributed to epigenetic drug development, epigenetics in environmental health, epigenetics in precision agriculture, regulatory support, patient awareness and advocacy. Major trends in the forecast period include epitranscriptomics, single-cell epigenomics, epigenetic editing, epigenetic biomarkers, aging and longevity research, microbiome-epigenome interactions.

The rising prevalence of cancer and other diseases is significantly propelling the growth of the epigenetics market. As the incidence of diseases increases, so does the demand for epigenetics. For example, in May 2024, the National Cancer Institute (NCI), a U.S.-based government agency, reported that nearly 20 million new cancer cases were documented in 2022, resulting in approximately 9.7 million deaths related to the disease. Projections suggest that by 2040, the annual incidence of new cancer cases will rise to 29.9 million, with cancer-related deaths reaching 15.3 million. Additionally, the Centers for Disease Control and Prevention (CDC) estimates that around 659,000 people in the United States die from heart disease each year. The increasing prevalence of cancer and other diseases necessitates testing and understanding the genetic modifications that occur, which will inevitably boost the usage and demand for epigenetics. Therefore, the growing prevalence of cancer and other diseases is expected to drive the epigenetics market in the coming years.

The epigenetics market is expected to experience growth due to the increasing focus on precision medicine. Precision medicine involves tailoring medical approaches based on an individual's genetic, environmental, and lifestyle information for more effective disease management and treatment. In the realm of epigenetics, precision medicine utilizes individual epigenetic profiles and genetic data to formulate personalized healthcare strategies. In 2022, the Food and Drug Administration's Center for Drug Evaluation and Research approved 37 new molecular entities, with 34% of therapeutic new molecular entities classified as personalized medicines, according to the Personalized Medicine Coalition. This emphasis on precision medicine is contributing to the expansion of the epigenetics market.

Leading companies in the epigenetics market are concentrating on developing technologically advanced solutions, such as DNA sequencing methods, to enhance precision medicine and improve disease understanding and treatment outcomes. DNA sequencing methods are techniques that determine the order of nucleotides in a DNA molecule, allowing for detailed genetic analysis. This information is vital for identifying genetic variations associated with diseases and advancing precision medicine. For example, in March 2023, Illumina Inc., a U.S.-based biotechnology company, introduced Illumina Complete Long Read Technology, which facilitates both long-read and short-read sequencing on a single instrument, significantly improving versatility in genomic research. By reducing DNA input requirements and streamlining the workflow, this technology simplifies the library preparation process, making it more accessible for challenging samples. It also achieves high accuracy in variant calling, providing reliable data that is essential for comprehensive genomic analysis.

Leading companies in the epigenetics market are increasingly incorporating artificial intelligence (AI)-driven analytics into their operations to gain a competitive advantage. AI-driven analytics involves utilizing artificial intelligence technologies to automatically analyze and interpret large volumes of data. For example, in July 2023, FOXO Technologies, a US-based company, introduced Bioinformatics Services aimed at revolutionizing epigenetic data analysis. These services offer a versatile platform with advanced data solutions tailored to meet the specific needs of clients in academia, healthcare, and pharmaceutical research. FOXO's innovative suite of bioinformatic tools aims to enhance the speed and accuracy of data processing, analysis, and interpretation, facilitating quicker discoveries and advancing understanding of complex diseases.

In August 2022, Ipsen Biopharmaceuticals, Inc., a U.S.-based pharmaceutical company that specializes in developing and commercializing medicines for three therapeutic areas, acquired Epizyme, Inc. for $247 million. Through this acquisition, Ipsen Biopharmaceuticals, Inc. aims to enhance its oncology portfolio, broaden its pipeline with innovative treatments, and strengthen its market position in cancer care. Epizyme, Inc., also a U.S.-based commercial company, focuses on creating innovative therapies based on epigenetics.

Major companies operating in the epigenetics market include Illumina Inc., Thermo Fisher Scientific, Merck Millipore, Active Motif, Abcam PLC, Qiagen NV, Diagenode SA, CellCentric Ltd., Chroma Medicine Inc., Constellation Pharmaceuticals Inc., Domainex Ltd., Eisai Co. Ltd., Epigen Biosciences Inc., EpigenDx Inc., Epigenomics AG, Epizyme Inc., Gilead Sciences Inc., GlaxoSmithKline plc, Janssen Pharmaceuticals Inc., Locus Biosciences Inc., MDxHealth SA, Novartis AG, OncoDNA SA, Oryzon Genomics S.A., Pfizer Inc., Syndax Pharmaceuticals Inc., Valirx plc.

Epigenetics refers to changes in gene activity transmitted to younger cells without modifying the DNA sequence. These natural and necessary processes are vital for the functioning of many organisms, but anomalies can lead to disorders such as various types of cancer, reproductive illnesses, and cardiovascular diseases. Epigenetics plays a crucial role in the early detection of certain cancers.

The primary products employed in the epigenetics market include reagents, enzymes, instruments, and kits. Reagents are compounds or substances used for chemical analysis or epigenetic testing. Technologies utilized in epigenetics encompass DNA methylation, histone methylation, histone acetylation, large noncoding RNA, microRNA modification, and chromatin structures. Applications span oncology, metabolic diseases, developmental biology, immunology, cardiovascular diseases, and other fields. Epigenetic tools find applications in academic and research institutes, pharmaceutical and biotechnology companies, contract research organizations, and various other end-user segments.

The epigenetics market research report is one of a series of new reports that provides epigenetics market statistics, including epigenetics industry global market size, regional shares, competitors with an epigenetics market share, detailed epigenetics market segments, market trends and opportunities, and any further data you may need to thrive in the epigenetics industry. This epigenetics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

North America was the largest region in the epigenetics market in 2024. Asia-Pacific is expected to be the fastest-growing region in the epigenetics market during the forecast period. The regions covered in the global epigenetics market analysis report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

The countries covered in the epigenetics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK and USA.

The epigenetics market includes revenues earned by entities methylation, acetylation, phosphorylation, ubiquitylation, and sumolyation. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Epigenetics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on epigenetics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for epigenetics ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The epigenetics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Reagents; Enzymes; Instruments; Kits2) By Technology: DNA Methylation; Histone Methylation; Histone Acetylation; Large Noncoding RNA; MicroRNA Modification; Chromatin Structures

3) By Application: Oncology; Metabolic Diseases; Developmental Biology; Immunology; Cardiovascular Diseases; Other Applications

4) By End-User: Academic And Research Institutes; Pharmaceutical And Biotechnology Companies; Contract Research Organizations; Other End Users

Subsegments:

1) By Reagents: DNA Methylation Reagents; Histone Modification Reagents; RNA Modifications Reagents; Enzymes2) By Enzymes: DNA Methyltransferases; Histone Acetyltransferases; Histone Deacetylases; Other Epigenetic Enzymes

3) By Instruments: Sequencers; PCR Machines; Microarray Platforms; Mass Spectrometers

4) By Kits: DNA Methylation Kits; Chromatin Immunoprecipitation (ChIP) Kits; RNA-Seq Kits; Bisulfite Conversion Kits

Key Companies Mentioned: Illumina Inc.; Thermo Fisher Scientific; Merck Millipore; Active Motif; Abcam PLC

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Illumina Inc.

- Thermo Fisher Scientific

- Merck Millipore

- Active Motif

- Abcam PLC

- Qiagen NV

- Diagenode SA

- CellCentric Ltd.

- Chroma Medicine Inc.

- Constellation Pharmaceuticals Inc.

- Domainex Ltd.

- Eisai Co. Ltd.

- Epigen Biosciences Inc.

- EpigenDx Inc.

- Epigenomics AG

- Epizyme Inc.

- Gilead Sciences Inc.

- GlaxoSmithKline plc

- Janssen Pharmaceuticals Inc.

- Locus Biosciences Inc.

- MDxHealth SA

- Novartis AG

- OncoDNA SA

- Oryzon Genomics S.A.

- Pfizer Inc.

- Syndax Pharmaceuticals Inc.

- Valirx plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | January 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 12.83 Billion |

| Forecasted Market Value ( USD | $ 29.08 Billion |

| Compound Annual Growth Rate | 22.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |