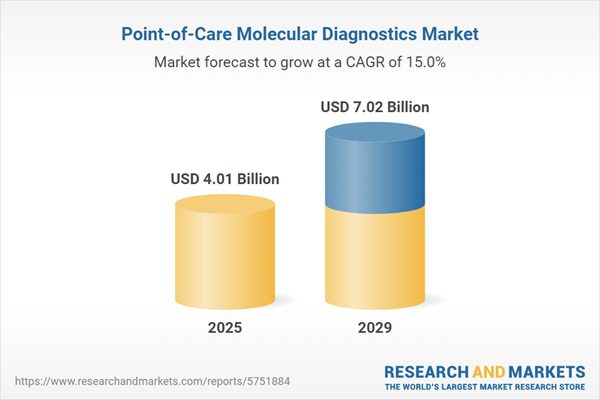

The point-of-care molecular diagnostics market size has grown rapidly in recent years. It will grow from $3.55 billion in 2024 to $4.01 billion in 2025 at a compound annual growth rate (CAGR) of 12.9%. The growth in the historic period can be attributed to increasing demand for rapid disease diagnosis, growth in infectious disease outbreaks, expansion of telemedicine and remote testing, regulatory support for point-of-care diagnostics, need for personalized and precision medicine.

The point-of-care molecular diagnostics market size is expected to see rapid growth in the next few years. It will grow to $7.02 billion in 2029 at a compound annual growth rate (CAGR) of 15%. The growth in the forecast period can be attributed to miniaturization of diagnostic devices, expansion of poc testing for cancer and genetic diseases, customized molecular diagnostics for diverse applications, integration of ai and machine learning for data analysis, emerging infectious disease surveillance. Major trends in the forecast period include lab-on-a-chip and microfluidic technologies, digital health and smartphone-based diagnostics, point-of-care COVID-19 and pandemic preparedness, ai-driven predictive diagnostics, crispr-based molecular testing.

The significant rise in the prevalence of infectious and respiratory diseases is anticipated to be a major driver for the growth of the point-of-care molecular diagnostics market. Microorganisms causing respiratory infections, whether viral or bacterial, can spread through various means, including coughing, sneezing, or direct contact. The severity of these diseases necessitates a range of treatments, including inhalers, oral medications, intravenous treatments, and point-of-care molecular diagnostics for effective patient care. For example, in England, according to the Office for National Statistics, the infection rate increased among individuals aged 35 to 69 and those in school years 12 to 24, highlighting the urgency for effective point-of-care molecular diagnostics to address infectious and respiratory diseases.

The increasing awareness regarding heart failure treatment is poised to propel the growth of the point-of-care (POC) molecular diagnostics market. Heart failure, a condition impacting the heart's ability to pump blood effectively, can benefit significantly from POC molecular diagnostics, offering swift and accurate diagnoses for early interventions and improved patient outcomes. The American Heart Association reports a rising number of heart failure diagnoses, projected to increase by 46% by 2030, exceeding 8 million people with heart failure. In India, coronary incidences have surged in both rural and urban populations. This growing awareness about heart failure treatment underscores the potential for POC molecular diagnostics to play a crucial role in this medical domain.

A key trend gaining traction in the point-of-care molecular diagnostics market is technological innovation. Major market players are dedicated to providing advanced solutions to strengthen their market positions. Companies are incorporating next-generation technologies such as enzyme-linked immunosorbent assay (ELISA), polymerase chain reaction (PCR), mass spectrometry (MS), situ hybridizations, spectral karyotyping imaging, DNA microarrays, etc., on POC devices, accelerating analysis times and reducing costs. For instance, Sensible Diagnostics introduced a 10-minute point-of-care PCR system, showcasing technological advancements to provide rapid results.

Strategic partnerships are being embraced by major players in the point-of-care molecular diagnostics market to launch POC CRISPR-based tests. For instance, CrisprBits collaborated with MolBio Diagnostics to leverage biotechnology expertise and translation, manufacturing, and distribution capabilities for developing POC tests detecting pathogens and genetic markers.

In July 2024, Roche Holding AG, a Switzerland-based global healthcare company focused on developing medicines, treatments, and diagnostics, acquired LumiraDx Ltd. for an undisclosed amount. This acquisition is intended to enhance Roche Holding AG's diagnostics portfolio, improve access to decentralized healthcare solutions, and expand testing capabilities, especially in underserved regions. LumiraDx Ltd. is a UK-based diagnostic company that specializes in creating innovative point-of-care (POC) testing solutions.

Major companies operating in the point-of-care molecular diagnostics market include Abbott Laboratories, F Hoffmann-La Roche Ltd., BioMérieux SA, Danaher Corporation, Quidel Corporation, BioMerieux SA, Bio-Rad Laboratories Inc., Sysmex Corporation, Illumina Inc., Myriad Genetics Inc., Siemens Healthcare GmbH, Almac Group, Biogenex Laboratories Inc., Cepheid Inc., Epic Sciences Inc., Foundation Medicine Inc., Genomic Health Inc., Grail Inc., Hologic Inc., HTG Molecular Diagnostics Inc., Inivata Ltd., Invivoscribe Inc., MolecularMD Corporation, Natera Inc., NeoGenomics Laboratories Inc., Personal Genome Diagnostics Inc., Prometheus Laboratories Inc., Ventana Medical Systems Inc., Vermillion Inc., Guardant Health Inc., Exact Sciences Corporation, Biocartis Group NV, ArcherDx Inc., Bio-Techne Corporation, AccuBiotech Co. Ltd., Becton, Dickinson and Company, Chembio Diagnostics Inc., Credo Diagnostics Biomedical Pvt. Ltd., EKF Diagnostics, GenePOC Inc.

North America was the largest region in the point-of-care molecular diagnostics market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the point-of-care molecular diagnostics market analysis report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa. The countries covered in the point-of-care molecular diagnostics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK and USA.

Point-of-care (POC) molecular diagnostics are tests designed to detect specific nucleic acids in clinical specimens, including feces, saliva, urine, blood, and tissue. These diagnostics rely on identifying targeted portions of microbial genetic material, specifically DNA or RNA. Widely utilized in the healthcare sector, POC molecular diagnostics are granted emergency usage authorization to diagnose various diseases. These diagnostics are instrumental in detecting disease antigens or antibodies in human samples, such as mononucleosis, influenza, and group A streptococcus (GAS).

The primary products and services in point-of-care molecular diagnostics include assays and kits, instruments and analyzers, and software and services. Assays and kits are equipment used to carry out analyses, especially in studying disease pathways. They are commonly employed for rapid and accurate diagnosis and monitoring of various diseases. Technologies such as reverse transcription-polymerase chain reaction (RT-PCR), in situ hybridization, and sequencing are utilized in POC molecular diagnostics for diagnosing diseases like respiratory diseases, hospital-acquired infections (HAIs), cancer/oncology, hepatitis, and hematology. Point-of-care molecular diagnostics are employed in decentralized labs, hospitals, home care, and assisted living healthcare facilities.

The point-of-care molecular diagnostics market research report is one of a series of new reports that provides point-of-care molecular diagnostics market statistics, including point-of-care molecular diagnostics industry global market size, regional shares, competitors with a point-of-care molecular diagnostics market share, detailed point-of-care molecular diagnostics market segments, market trends and opportunities, and any further data you may need to thrive in the point-of-care molecular diagnostics industry. This point-of-care molecular diagnostics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The point-of-care (POC) molecular diagnostics market includes revenues earned by AAT, antigen, or antibody tests. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Point-of-Care Molecular Diagnostics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on point-of-care molecular diagnostics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for point-of-care molecular diagnostics? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The point-of-care molecular diagnostics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product and Service: Assays and Kits; Instruments and Analyzers; Software and Services2) by Technology: Reverse Transcription - Polymerase Chain Reaction (RT-PCR); in Situ Hybridization; Sequencing

3) by Application: Respiratory Diseases; Hospital Acquired Infections (HAIs); Cancer/Oncology; Hepatitis; Hematology

4) by End-User: Decentralized Labs; Hospitals; Home Care; Assisted Living Healthcare Facilities

Subsegments:

1) by Assays and Kits: Nucleic Acid Amplification Tests (NAATs); Rapid Diagnostic Tests; Molecular Detection Kits; Reagents and Consumables2) by Instruments and Analyzers: PCR Machines; Microfluidic Devices; Sequencers; Point-of-Care Analyzers

3) by Software and Services: Data Management Software; Cloud-Based Solutions; Technical Support and Maintenance Services; Consultation and Training Services

Key Companies Mentioned: Abbott Laboratories; F Hoffmann-La Roche Ltd.; BioMérieux SA; Danaher Corporation; Quidel Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Point-of-Care Molecular Diagnostics market report include:- Abbott Laboratories

- F Hoffmann-La Roche Ltd.

- BioMérieux SA

- Danaher Corporation

- Quidel Corporation

- BioMerieux SA

- Bio-Rad Laboratories Inc.

- Sysmex Corporation

- Illumina Inc.

- Myriad Genetics Inc.

- Siemens Healthcare GmbH

- Almac Group

- Biogenex Laboratories Inc.

- Cepheid Inc.

- Epic Sciences Inc.

- Foundation Medicine Inc.

- Genomic Health Inc.

- Grail Inc.

- Hologic Inc.

- HTG Molecular Diagnostics Inc.

- Inivata Ltd.

- Invivoscribe Inc.

- MolecularMD Corporation

- Natera Inc.

- NeoGenomics Laboratories Inc.

- Personal Genome Diagnostics Inc.

- Prometheus Laboratories Inc.

- Ventana Medical Systems Inc.

- Vermillion Inc.

- Guardant Health Inc.

- Exact Sciences Corporation

- Biocartis Group NV

- ArcherDx Inc.

- Bio-Techne Corporation

- AccuBiotech Co. Ltd.

- Becton, Dickinson and Company

- Chembio Diagnostics Inc.

- Credo Diagnostics Biomedical Pvt. Ltd.

- EKF Diagnostics

- GenePOC Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 4.01 Billion |

| Forecasted Market Value ( USD | $ 7.02 Billion |

| Compound Annual Growth Rate | 15.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 40 |