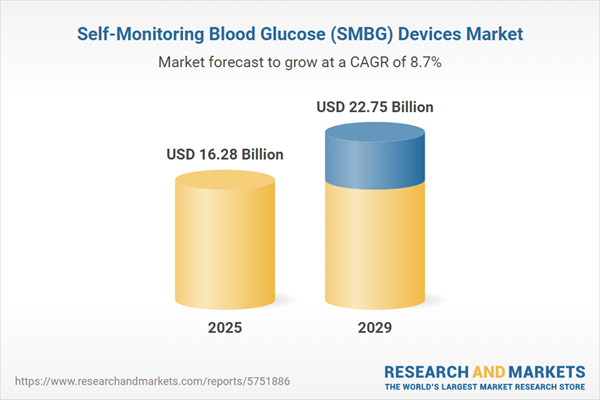

The self-monitoring blood glucose (SMBG) devices market size has grown strongly in recent years. It will grow from $15.23 billion in 2024 to $16.28 billion in 2025 at a compound annual growth rate (CAGR) of 6.9%. The growth in the historic period can be attributed to rise in prevalence of diabetes, increase in healthcare awareness, aging population, government initiatives and regulations, rise in healthcare spending.

The self-monitoring blood glucose (SMBG) devices market size is expected to see strong growth in the next few years. It will grow to $22.75 billion in 2029 at a compound annual growth rate (CAGR) of 8.7%. The growth in the forecast period can be attributed to rising home healthcare, telehealth expansion, rise in disposable income, rising demand for remote monitoring, rise in e-commerce. Major trends in the forecast period include continuous glucose monitoring (CGM) integration, artificial intelligence (AI) and machine learning, wearable smbg devices, non-invasive monitoring, mobile apps and connectivity.

The increasing prevalence of diabetes is anticipated to drive the growth of the self-monitoring blood glucose device market in the coming years. Self-monitoring of blood glucose involves individuals with diabetes using a glycemic reading device, such as a glucose meter, to measure their blood sugar levels. This allows them to adjust or monitor the effectiveness of their treatment options (diet, exercise, insulin, antidiabetics) or consult their physician based on the test results. For example, in March 2024, the Office for Health Improvement & Disparities, a UK government department, reported that between March 2022 and March 2023, the proportion of individuals with type 1 diabetes receiving all eight recommended care processes rose by 22%. For type 2 diabetes, this figure increased by 21%, with the percentage achieving target HbA1c levels reaching 37.9%, the highest ever recorded by the National Diabetes Audit (NDA). As a result, the rising prevalence of diabetes is fueling the growth of the self-monitoring blood glucose device market.

Another contributing factor to the growth of the self-monitoring blood glucose devices market is the rising geriatric population. This demographic, typically aged 65 and older, experiences age-related physical and cognitive changes, making effective diabetes management crucial. Self-monitoring blood glucose devices play a vital role in helping elderly individuals manage diabetes by facilitating timely adjustments to medication and lifestyle choices. As per the World Health Organization's October 2022 report, the global population aged 60 or older is expected to reach 2.1 billion by 2050, highlighting the increasing significance of catering to the healthcare needs of the elderly. Consequently, the growing geriatric population is a driving force behind the expansion of the self-monitoring blood glucose devices market.

A prominent trend in the self-monitoring blood glucose devices market is technological advancement. Leading companies in this market are actively engaged in developing cutting-edge products to enhance their market presence. For example, Know Labs Inc., a US-based company specializing in glucose monitoring devices, introduced the KnowU, a portable medical-grade glucose monitoring device leveraging Bio-RFID technology. This non-invasive device offers an affordable and convenient alternative to traditional, more invasive blood glucose monitoring devices, providing users with on-the-go monitoring capabilities.

The major players in the self-monitoring blood glucose devices market are increasingly focusing on sensor-based glucose monitoring devices to gain a competitive edge. These medical tools continuously or intermittently measure and report blood glucose levels, aiding individuals with diabetes in managing their condition effectively. In September 2022, Abbott Laboratories received approval from the USFDA for FreeStyle Libre 2 and FreeStyle Libre 3 sensors, allowing integration with Automated Insulin Delivery Systems (AIDs). This approval signifies a significant step toward enhancing diabetes care by automating insulin adjustments based on real-time glucose data from the sensors.

In September 2022, Biocorp, a French manufacturer of medical devices, including blood glucose monitoring products, formed a partnership with Novo Nordisk. This collaboration was announced for the development and distribution of the Mallya smart add-on device for Novo Nordisk's FlexTouch pen, designed for individuals with diabetes. Both Biocorp and Novo Nordisk believe that this partnership will enable them to offer optimal solutions for people living with diabetes. Novo Nordisk is a healthcare company based in Denmark.

Major companies operating in the self-monitoring blood glucose (SMBG) devices market include Abbott Laboratories, Bionime Corporation, B. Braun Melsungen AG, F. Hoffmann-La Roche Ltd, LifeScan Inc, PHC Holdings Corporation, Home Diagnostics Inc, Terumo Pharmaceutical Solutions, ARKRAY Inc, Ypsomed Holding AG, Dexcom Inc, Medtronic plc, Novo Nordisk A/S, Glysens Incorporated, Senseonics Holdings Inc., AgaMatrix Inc., All Medicus Co. Ltd., Ascensia Diabetes Care Holdings AG, Bayer AG, Becton Dickinson and Company, Bio-Rad Laboratories Inc., Bioptik Technology Inc., Cnoga Medical Ltd., ForaCare Inc., Glucovation Inc., Hainice Medical Inc., Infopia Co. Ltd., Insulet Corporation, Integrity Applications, Johnson & Johnson, Menarini Diagnostics, Nemaura Medical Inc., Nipro Corporation, Nova Biomedical Corporation, Omron Healthcare Inc., Optiscan Biomedical Corporation, OrSense Ltd., Pinnacle Technology Inc., Prodigy Diabetes Care LLC, PTS Diagnostics, TaiDoc Technology Corporation, Trividia Health Inc., WaveForm Technologies Inc.

North America was the largest region in the self-monitoring blood glucose (SMBG) devices market in 2024. Europe is expected to be the fastest-growing region in the forecast period. The regions covered in this self-monitoring blood glucose (SMBG) devices market analysis report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the self-monitoring blood glucose (SMBG) devices market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA.

A Self-Monitoring Blood Glucose (SMBG) device is a portable instrument designed to identify potential diabetes indicators. Typically, these devices assess glucose levels by extracting a small blood drop from patients through a finger prick. International guidelines recommend this method for effectively managing diabetes in patients. SMBG devices are instrumental in measuring the concentration of glucose in the blood.

The primary types of Self-Monitoring Blood Glucose (SMBG) devices include self-monitoring blood glucose meters, continuous glucose monitors, testing strips, and lancets. Self-monitoring blood glucose meters are handheld devices utilized by patients at home to monitor their blood glucose levels. These meters typically require a blood drop obtained through a pinprick. They are distributed through hospital pharmacies, retail pharmacies, online sales, and diabetes clinics and centers. These devices find application in various contexts such as Type 1 Diabetes, Type 2 Diabetes, and Gestational Diabetes.

The self-monitoring blood glucose (SMBG) devices market research report is one of a series of new reports that provides self-monitoring blood glucose (SMBG) devices market statistics, including self-monitoring blood glucose (SMBG) devices industry global market size, regional shares, competitors with a self-monitoring blood glucose (SMBG) devices market share, detailed self-monitoring blood glucose (SMBG) devices market segments, market trends and opportunities, and any further data you may need to thrive in the self-monitoring blood glucose (SMBG) devices industry. This self-monitoring blood glucose (SMBG) devices market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The self-monitoring blood glucose (SMBG) device market consists of sales of devices and instruments. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Self-Monitoring Blood Glucose (SMBG) Devices Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on self-monitoring blood glucose (smbg) devices market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for self-monitoring blood glucose (smbg) devices? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The self-monitoring blood glucose (smbg) devices market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product: Self-Monitoring Blood Glucose Meters; Continuous Glucose Monitors; Testing Strips; Lancets2) by Distribution Channel: Hospital Pharmacies; Retail Pharmacies; Online Sales; Diabetes Clinics & Centers

3) by Application: Type 1 Diabetes; Type 2 Diabetes; Gestational Diabetes

Subsegments:

1) by Self-Monitoring Blood Glucose Meters: Traditional Glucose Meters; Smart Glucose Meters2) by Continuous Glucose Monitors (CGMs): Real-Time CGMs; Flash Glucose Monitoring Systems

3) by Testing Strips: Standard Testing Strips; Test Strips for Specific Meters

4) by Lancets: Standard Lancets; Safety Lancets

Key Companies Mentioned: Abbott Laboratories; Bionime Corporation; B. Braun Melsungen AG; F. Hoffmann-La Roche Ltd; LifeScan Inc

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Self-Monitoring Blood Glucose (SMBG) Devices market report include:- Abbott Laboratories

- Bionime Corporation

- B. Braun Melsungen AG

- F. Hoffmann-La Roche Ltd

- LifeScan Inc

- PHC Holdings Corporation

- Home Diagnostics Inc

- Terumo Pharmaceutical Solutions

- ARKRAY Inc

- Ypsomed Holding AG

- Dexcom Inc

- Medtronic plc

- Novo Nordisk A/S

- Glysens Incorporated

- Senseonics Holdings Inc.

- AgaMatrix Inc.

- All Medicus Co. Ltd.

- Ascensia Diabetes Care Holdings AG

- Bayer AG

- Becton Dickinson and Company

- Bio-Rad Laboratories Inc.

- Bioptik Technology Inc.

- Cnoga Medical Ltd.

- ForaCare Inc.

- Glucovation Inc.

- Hainice Medical Inc.

- Infopia Co. Ltd.

- Insulet Corporation

- Integrity Applications

- Johnson & Johnson

- Menarini Diagnostics

- Nemaura Medical Inc.

- Nipro Corporation

- Nova Biomedical Corporation

- Omron Healthcare Inc.

- Optiscan Biomedical Corporation

- OrSense Ltd.

- Pinnacle Technology Inc.

- Prodigy Diabetes Care LLC

- PTS Diagnostics

- TaiDoc Technology Corporation

- Trividia Health Inc.

- WaveForm Technologies Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 16.28 Billion |

| Forecasted Market Value ( USD | $ 22.75 Billion |

| Compound Annual Growth Rate | 8.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 43 |