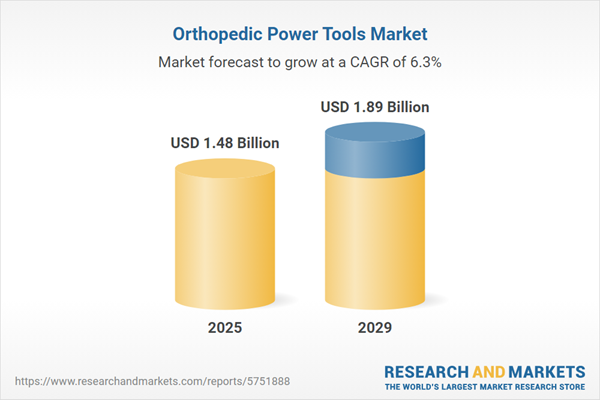

The orthopedic power tools market size has grown strongly in recent years. It will grow from $1.39 billion in 2024 to $1.48 billion in 2025 at a compound annual growth rate (CAGR) of 6.8%. The growth in the historic period can be attributed to aging population, trauma cases, hospital infrastructure, patient safety, surgeon training and education.

The orthopedic power tools market size is expected to see strong growth in the next few years. It will grow to $1.89 billion in 2029 at a compound annual growth rate (CAGR) of 6.3%. The growth in the forecast period can be attributed to telemedicine, home healthcare, sports medicine, non-invasive orthopedics, sustainable practices. Major trends in the forecast period include orthopedic implants, orthopedic device innovations, orthopedic robotics, bone reshaping and fusion, artificial intelligence (ai) and surgical navigation.

The rising prevalence of orthopedic disorders globally is anticipated to drive growth in the orthopedic power tools market. Orthopedics focuses on treating abnormalities or functional limitations of the skeletal system, particularly the spine and its related structures, such as ligaments and muscles. Orthopedic power tools play a key role in addressing these conditions. For example, in June 2024, a report by the Australian Bureau of Statistics, an Australian statistical agency, revealed that musculoskeletal conditions accounted for 12.8% of the total disease burden (DALY), 23.1% of non-fatal burden (YLD), and 0.8% of fatal burden (YLL) in 2023. Additionally, in 2022, these conditions were the underlying and/or associated cause of 10,446 deaths (40 per 100,000 population), representing 5.5% of all deaths. Consequently, the demand for orthopedic power tools is expected to rise as orthopedic disorders become more common in the forecast period.

The growth of the orthopedic power tools market is expected to be driven by the increasing geriatric population. This demographic, often referred to as the elderly or senior population, consists of individuals classified as elderly due to their advanced age. Orthopedic power tools offer advantages such as minimizing tissue trauma, reducing surgical time, enhancing precision and efficiency, facilitating rapid bone fixation and recovery, and minimizing blood loss in the geriatric population. As per the World Health Organization's October 2022 report, globally, 1 in 6 people will be 60 or older by 2030, with the number of individuals in this age group doubling to 2.1 billion by 2050. Hence, the growing geriatric population is expected to drive the growth of the orthopedic power tools market.

The adoption of advanced and innovative technology is a significant trend in the orthopedic power tools market. Innovations aimed at improving the sterilization of orthopedic power tools are enhancing the efficiency of treatment procedures. For example, in March 2023, Stryker, a US-based medical technology company, introduced the CD NXT System, a breakthrough in power tool technology. This proprietary system enables real-time depth measurement during drilling, providing fast, accurate, and consistent digital depth readings across multiple surgeries, thereby improving surgical precision and outcomes.

Leading companies in the orthopedic power tools market are focusing on innovative products, such as robotic systems, to boost their revenues. Robotic-assisted solutions refer to technologies that use robotic systems to enhance surgical procedures or rehabilitation processes, offering greater precision, control, and minimally invasive options for improved patient outcomes. For example, in October 2023, Johnson & Johnson MedTech, a U.S.-based medical technology company, introduced the VELYS Robotic-Assisted Solution through its orthopaedics division, DePuy Synthes, in the European market. This cutting-edge system was successfully used for Total Knee procedures in Germany, Belgium, and Switzerland. With this launch, DePuy Synthes expands its Digital Surgery Platform, providing advanced technologies to address the limitations of previous-generation orthopedic robots, thus improving precision in joint replacement surgeries.

In June 2022, Conmed Corporation, a US-based medical technology company, acquired In2Bones Global Inc. for an undisclosed amount. This acquisition enhances Conmed's product offerings for treating illnesses and injuries affecting the upper and lower extremities, contributing to its broader line of products and comprehensive patient care solutions. In2Bones Global Inc. is a US-based company specializing in the manufacture of orthopedic power tools.

Major companies operating in the orthopedic power tools market include De Soutter Medical Ltd., B Braun Melsungen AG, Aygun Surgical Instruments Co. Inc., Medtronic plc, DePuy Synthes Inc., ConMed Corporation, Stryker Corporation, Zimmer Biomet Holdings Inc., Arthrex Inc., Smith and Nephew plc, Exactech Inc., Allo Tech Co. Ltd., Microaire Surgical Instruments Inc., Adeor Medical AG, Manman Manufacturing Company Pvt. Ltd., Bosch Healthcare Solutions GmbH, DynaMedic Co. Ltd., Arbutus Medical Inc., Aesculap AG, Becton Dickinson and Company, Biomet Inc., Brasseler USA, Ceterix Orthopaedics Inc., Corin Group, Elite Surgical Pvt. Ltd., GPC Medical Ltd., Integra LifeSciences Holdings Corp., Intrauma S.p.A., Medicon Genossenschaft, Medline Industries Inc., Ortho Solutions GmbH, OsteoMed Inc.

North America was the largest region in the orthopedic power tools market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in orthopedic power tools market share report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the orthopedic power tools market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK and USA.

Orthopedic power tools are instruments used for surgical procedures on bones or bone fragments. These tools are designed to perform various functions such as drilling, sawing, reaming, screwing, and more. They play a crucial role in different aspects of orthopedic surgery, ranging from wound treatment using pulse lavage to procedures like drilling and reaming in the treatment of long bone fractures with screws and intramedullary nails.

The main categories of orthopedic power tools include large bone orthopedic power tools, small bone orthopedic power tools, high-speed bone orthopedic power tools, and orthopedic reamers. Large bone orthopedic power tools are specifically designed for procedures such as hip and complete knee replacements, reaming, intramedullary nailing, drilling, and driving screws in large bones. These tools enable orthopedic surgeons to manage complex surgeries more efficiently. Orthopedic power tools can be powered by various sources, including pneumatic, battery-operated, and electric systems. These tools find extensive use in orthopedic hospitals, orthopedic clinics, and ambulatory surgical centers, contributing to the treatment of various orthopedic conditions.

The orthopedic power tools market research report is one of a series of new reports that provides orthopedic power tools market statistics, including orthopedic power tools industry global market size, regional shares, competitors with an orthopedic power tools market share, detailed orthopedic power tools market segments, market trends and opportunities, and any further data you may need to thrive in the orthopedic power tools industry. This orthopedic power tools market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The orthopedic power tools market consists of sales of battery, pneumatic, and electric. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Orthopedic Power Tools Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on orthopedic power tools market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for orthopedic power tools? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The orthopedic power tools market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product Type: Large Bone Orthopedic Power Tools, Small Bone Orthopedic Power Tools, High Speed Bone Orthopedic Power Tools, Orthopedic Reamers2) by Technology: Pneumatic Powered, Battery Operated, Electric Powered

3) by End User: Orthopedic Hospitals, Orthopedic Clinics, Ambulatory Surgical Centers

Subsegments:

1) by Large Bone Orthopedic Power Tools: Saws; Drills; Screwdrivers2) by Small Bone Orthopedic Power Tools: Micro Saws; Micro Drills; Micro Screwdrivers

3) by High Speed Bone Orthopedic Power Tools: High-Speed Drills; High-Speed Saws; High-Speed Motors

4) by Orthopedic Reamers: Cannulated Reamers; Solid Reamers; Variable Diameter Reamers

Key Companies Mentioned: De Soutter Medical Ltd.; B Braun Melsungen AG; Aygun Surgical Instruments Co. Inc.; Medtronic plc; DePuy Synthes Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Orthopedic Power Tools market report include:- De Soutter Medical Ltd.

- B Braun Melsungen AG

- Aygun Surgical Instruments Co. Inc.

- Medtronic plc

- DePuy Synthes Inc.

- ConMed Corporation

- Stryker Corporation

- Zimmer Biomet Holdings Inc.

- Arthrex Inc.

- Smith and Nephew plc

- Exactech Inc.

- Allo Tech Co. Ltd.

- Microaire Surgical Instruments Inc.

- Adeor Medical AG

- Manman Manufacturing Company Pvt. Ltd.

- Bosch Healthcare Solutions GmbH

- DynaMedic Co. Ltd.

- Arbutus Medical Inc.

- Aesculap AG

- Becton Dickinson and Company

- Biomet Inc.

- Brasseler USA

- Ceterix Orthopaedics Inc.

- Corin Group

- Elite Surgical Pvt. Ltd.

- GPC Medical Ltd.

- Integra LifeSciences Holdings Corp.

- Intrauma S.p.A.

- Medicon Genossenschaft

- Medline Industries Inc.

- Ortho Solutions GmbH

- OsteoMed Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.48 Billion |

| Forecasted Market Value ( USD | $ 1.89 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 33 |