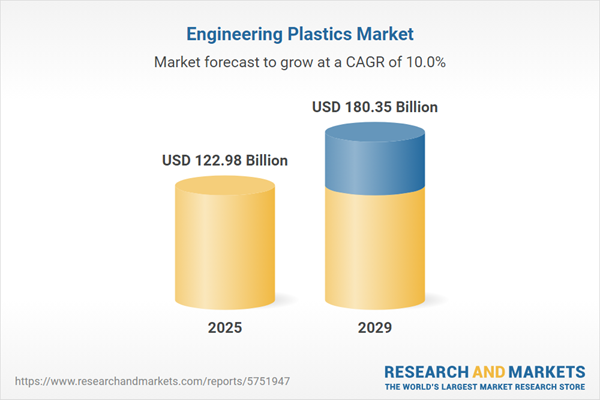

The engineering plastics market size is expected to see rapid growth in the next few years. It will grow to $180.35 billion in 2029 at a compound annual growth rate (CAGR) of 10%. The growth in the forecast period can be attributed to 3D printing and additive manufacturing, infrastructure modernization, aerospace applications, evolving consumer electronics sector, circular economy initiatives. Major trends in the forecast period include high-performance thermoplastics, miniaturization in electronics, smart and functional materials, customization and tailored solutions, health and safety compliance.

The expansion of the electronics and electrical industries is anticipated to drive the growth of the engineering plastics market. The electronics sector manufactures a range of products, including consumer electronics, electrical equipment, and components for various applications. Engineering plastics play a crucial role in the production of electronic goods such as computers, communication equipment, switchgear, storage batteries, and switchboards. As per the Ministry of Electronics and Information Technology, an Indian government agency, the electronics manufacturing industry is projected to increase from USD 75 billion in 2022 to USD 300 billion by 2026. Hence, the upsurge in the electronics and electrical industries is fostering the demand for engineering plastics.

The rising demand for automobiles is poised to fuel the growth of the engineering plastics market. Automobiles, designed for personal transportation and propelled by internal combustion engines or electric motors, utilize engineering plastics for various purposes. These plastics contribute to lightweight construction for enhanced fuel efficiency, durability for long-lasting components, and resistance to chemical and thermal stress in different vehicle parts. In August 2023, according to MarkLines Co., Ltd., a Japanese automotive industry portal, sales of passenger cars in the US saw a 12.7% increase from 248,704 in August 2022 to 280,223 in August 2023, while sales of light trucks rose by 17.2% from 905,069 in August 2022 to 1,060,946 in August 2023. Consequently, the growing demand for automobiles is propelling the engineering plastics market.

The utilization of bio-based or recycled materials has emerged as a prominent trend in the engineering plastics market. Key players in the market are actively developing bio-based or recycled materials as alternatives to traditional plastic solutions, aiming to enhance their market position. For instance, in August 2022, Toray Industries, Inc., a Japanese producer of engineering plastics like PPS, nylon, and PBT, achieved a significant milestone by developing the first fully bio-based adipic acid. Adipic acid is a component of nylon 66 (polyamide 66) and was produced from sugars extracted from non-edible feedstock using Toray's microbial fermentation technology and chemical purification methods. This achievement represents a unique synthesis method combining fermentation and chemical processes in the development of bio-based engineering plastics.

Major companies in the engineering plastics market are concentrating on the development of products made from a combination of materials, such as the combination of COCs (cyclic olefin copolymers) with polypropylene (PP), using a distinctive process to establish a competitive advantage in the market. The synergistic combination of COCs and PP in engineering plastics results in enhanced material properties, including improved transparency, chemical resistance, and heat stability, making them suitable for various applications. For example, in May 2023, Borealis AG, an Austria-based chemical company specializing in the manufacturing of polyethylene and polypropylene, introduced a novel category of engineering polymer called Stelora. This innovative polymer is designed for a diverse range of technically advanced applications, offering features such as high-temperature resistance, enhanced strength, and superior durability. Moreover, Stelora is an eco-friendly engineering polymer produced from renewable feedstock, aligning with sustainability goals and contributing to the shift toward a circular economy.

In May 2022, RadiciGroup, an Italy-based manufacturer and supplier of engineering polymers, acquired the engineering plastics business of Ester Industries Ltd. for $37 million. This strategic acquisition enables RadiciGroup to further strengthen its significant commercial presence in the Indian market. Ester Industries is an India-based manufacturer of engineering plastics.

Major companies operating in the engineering plastics market include Covestro AG, DuPont de Nemours Inc., LG Chem Ltd., Evonik Industries AG, Mitsubishi Chemical Engineering Corporation, BASF SE, Celanese Corporation, Solvay S.A., Dow Chemical Company, Saudi Basic Industries Corporation, LANXESS AG, Asahi Kasei Corporation, DSM Engineering Plastics, Polyplastics Co. Ltd., Teijin Limited, Toray Industries Inc., Arkema S.A., Chi Mei Corporation, Daicel Corporation, Eastman Chemical Company, EMS-Chemie Holding AG, Formosa Plastics Corporation, Huntsman Corporation, INEOS Styrolution Group GmbH, JSR Corporation, KOLON Industries Inc., Kuraray Co. Ltd., Mitsui Chemicals Inc, Nilit Ltd., Radici Group, RTP Company, Sumitomo Chemical Co. Ltd., Techno Polymer Co. Ltd., Tosoh Corporation, Ube Industries Ltd., Victrex plc, Zhejiang NHU Special Materials Co. Ltd.

Engineering plastics are a class of high-performance synthetic resins known for their exceptional durability and heat resistance, exhibiting superior mechanical and thermal properties compared to conventional commodity plastics. These plastics are specifically designed to withstand challenging mechanical and environmental conditions.

The primary types of engineering plastics include acrylonitrile butadiene styrene (ABS), polyamide, polycarbonate, thermoplastic polyester, polyacetal, fluoropolymer, and others. Acrylonitrile Butadiene Styrene (ABS) is commonly utilized for injection molding applications, favored for its cost-effectiveness in production. ABS is a terpolymer created by polymerizing styrene and acrylonitrile in the presence of polybutadiene. These engineering plastics are categorized based on performance parameters, distinguishing between high performance and low performance. They find applications in diverse industries, including automotive and transportation, consumer appliances, electrical and electronics, industrial and machinery, packaging, and various other end-use sectors.

The engineering plastics market research report is one of a series of new reports that provides engineering plastics market statistics, including engineering plastics industry global market size, regional shares, competitors with engineering plastics market share, detailed engineering plastics market segments, market trends and opportunities, and any further data you may need to thrive in the engineering plastics industry. This anomaly detection market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

Asia-Pacific was the largest region in the engineering plastics market in 2024. Asia-Pacific is expected to be the fastest-growing region in the engineering plastics market during the forecast period. The regions covered in the global engineering plastics market analysis report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

The countries covered in the engineering plastics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA.

The engineering plastics market consists of sales of polyetheretherketone, nylon 6, and polyetherimide (PEI). Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Engineering Plastics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on engineering plastics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for engineering plastics ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The engineering plastics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Acrylonitrile Butadiene Styrene; Polyamide; Polycarbonate; Thermoplastic Polyester; Polyacetal; Fluoropolymer; Other Types2) By Performance Parameter: High Performance; Low Performance

3) By End-Use Industry: Automotive And Transportation; Consumer Appliances; Electrical And Electronics; Industrial And Machinery; Packaging; Other End-Use Industries

Subsegments:

1) By Acrylonitrile Butadiene Styrene (ABS): General Purpose ABS; High-Impact ABS; Flame-Retardant ABS2) By Polyamide (Nylon): Nylon 6; Nylon 66; Other Nylon Grades

3) By Polycarbonate (PC): General Purpose Polycarbonate; Optical Grade Polycarbonate; Impact-Resistant Polycarbonate

4) By Thermoplastic Polyester (PET, PBT): Polyethylene Terephthalate (PET); Polybutylene Terephthalate (PBT)

5) By Polyacetal (POM): Homopolymer Polyacetal; Copolymer Polyacetal

6) By Fluoropolymer: Polytetrafluoroethylene (PTFE); Fluorinated Ethylene Propylene (FEP); Perfluoroalkoxy Alkane (PFA)

7) By Other Types: Polyetheretherketone (PEEK); Polyphenylene Sulfide (PPS); Other Specialty Engineering Plastics

Key Companies Mentioned: Covestro AG; DuPont de Nemours Inc.; LG Chem Ltd.; Evonik Industries AG; Mitsubishi Chemical Engineering Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Covestro AG

- DuPont de Nemours Inc.

- LG Chem Ltd.

- Evonik Industries AG

- Mitsubishi Chemical Engineering Corporation

- BASF SE

- Celanese Corporation

- Solvay S.A.

- Dow Chemical Company

- Saudi Basic Industries Corporation

- LANXESS AG

- Asahi Kasei Corporation

- DSM Engineering Plastics

- Polyplastics Co. Ltd.

- Teijin Limited

- Toray Industries Inc.

- Arkema S.A.

- Chi Mei Corporation

- Daicel Corporation

- Eastman Chemical Company

- EMS-Chemie Holding AG

- Formosa Plastics Corporation

- Huntsman Corporation

- INEOS Styrolution Group GmbH

- JSR Corporation

- KOLON Industries Inc.

- Kuraray Co. Ltd.

- Mitsui Chemicals Inc

- Nilit Ltd.

- Radici Group

- RTP Company

- Sumitomo Chemical Co. Ltd.

- Techno Polymer Co. Ltd.

- Tosoh Corporation

- Ube Industries Ltd.

- Victrex plc

- Zhejiang NHU Special Materials Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | January 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 122.98 Billion |

| Forecasted Market Value ( USD | $ 180.35 Billion |

| Compound Annual Growth Rate | 10.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 37 |