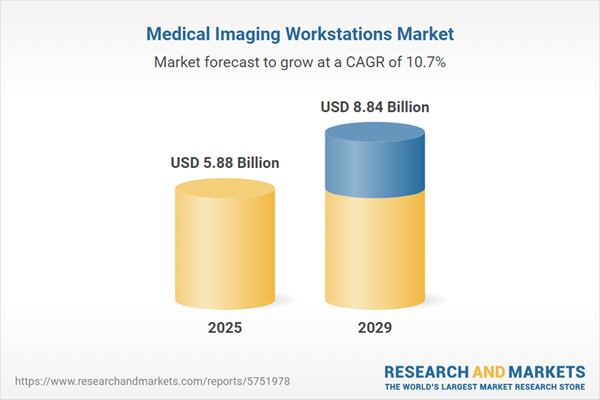

The medical imaging workstations market size has grown strongly in recent years. It will grow from $5.43 billion in 2024 to $5.88 billion in 2025 at a compound annual growth rate (CAGR) of 8.3%. The growth in the historic period can be attributed to clinical diagnosis, medical training and education, picture archiving and communication systems (pacs), radiology department efficiency, precision medicine:.

The medical imaging workstations market size is expected to see rapid growth in the next few years. It will grow to $8.84 billion in 2029 at a compound annual growth rate (CAGR) of 10.7%. The growth in the forecast period can be attributed to sustainable workstation solutions, patient-centric care, multi-modal imaging integration, telehealth services, global health preparedness. Major trends in the forecast period include artificial intelligence (ai)-enhanced automation, data security and privacy, interoperability and data exchange, integration with electronic health records (ehr), advancements in medical imaging.

The growth of the medical imaging workstations market is anticipated to be propelled by the increasing number of outpatients. Outpatients are individuals who require medical care without the need to stay overnight in a hospital. In recent years, there has been a significant rise in outpatient visits, while inpatient discharges, particularly for imaging services, have decreased. The shift from inpatient to outpatient settings for imaging services is driven by new payer demands and patient preferences, leading to a substantial increase in standalone outpatient facilities. According to Becker's Hospital Review in March 2023, 95% of health leaders expect a rise in outpatient volumes, with 40% anticipating increases of 10% or more. Consequently, the growing number of outpatients is poised to drive the growth of the medical imaging workstation market.

The increasing prevalence of chronic diseases is expected to fuel the growth of the medical imaging workstations market. Chronic diseases are long-term medical conditions that often last a person's lifetime. Medical imaging workstations play a crucial role in the diagnosis and monitoring of chronic diseases, providing clinicians with advanced tools for effective analysis and management of patient data. According to the World Health Organization in September 2023, non-communicable diseases (NCDs) or chronic conditions account for 74% of the total deaths worldwide each year, with 41 million fatalities. These include deaths related to cardiovascular diseases, cancer, chronic respiratory diseases, and diabetes. Thus, the rising prevalence of chronic diseases is a significant driver of the medical imaging workstations market.

Technological advancements represent a key trend gaining traction in the medical imaging workstation market. Healthcare organizations are adopting advanced medical imaging technologies that produce more detailed images, complemented by analytic and visualization capabilities. Major companies in the medical imaging workstation market are actively developing new technologies to enhance their market positions. For example, in March 2022, Royal Philips, a Netherlands-based multinational conglomerate, introduced the Ultrasound Workspace, an advanced vendor-neutral echocardiography image processing and reporting technology. This innovative solution offers seamless diagnostic workflows, vendor-neutral 2D/3D echocardiography viewing, remote browser-based accessibility, and AI-powered automatic picture analysis and quantification tools to enhance productivity and diagnostic quality.

Major companies in the medical imaging workstations market are focusing on implementing dynamic gamma functions to enhance their competitive position. This feature analyzes the entire screen content and selects the appropriate gamma curve for each individual pixel in real time, providing optimized contrast, brightness, and gamma for color images without requiring any user input. For example, in February 2022, Canon Medical Systems Europe, a Netherlands-based provider of medical imaging solutions, introduced the UltraExtend NXSource. This solution offers a cost-effective approach for efficient and budget-friendly clinical case management and follow-up. UltraExtend NX delivers a comprehensive offline workflow that includes the organization, review, and analysis of clinical data, as well as the documentation and reporting of results. The software platform leverages Canon's raw data architecture, enabling users to optimize their workflow while freeing up the ultrasound machine for more time-consuming procedures.

In March 2022, Canon Medical Systems Corporation, a Japan-based medical equipment company, acquired Nordisk Røntgen Teknik A/S for an undisclosed amount. Through this acquisition, Canon Medical aims to provide access to advanced multipurpose and motorized digital radiographic imaging technologies developed and manufactured in Europe. Nordisk Røntgen Teknik A/S is a Danish-based company specializing in diagnostic X-ray systems, medical imaging workstations, and the manufacture of medical equipment.

Major companies operating in the medical imaging workstations market include General Electric Company, Koninklijke Philips NV, Siemens Medical Systems Inc., Fujifilm Healthcare Corporation, Canon Medical Systems Corporation, PaxeraHealth, Hologic Inc., Carestream Health India Pvt. Ltd., Carl Zeiss AG, Capsa Healthcare, Esaote SpA, Medicor Imaging, NGI Group, Chimaera GmbH, Hitachi Medical Systems, Toshiba Medical Systems Corporation, Samsung Medison Co. Ltd., Shimadzu Corporation, Agfa-Gevaert NV, Sectra AB, Merge Healthcare Inc., Intelerad Medical Systems Incorporated, McKesson Corporation, Agilent Technologies India Pvt. Ltd., Analogic Corporation, Barco NV, ContextVision AB, EDDA Technology Inc., Infinitt Healthcare Co. Ltd., Mirada Medical Limited.

North America was the largest region in the medical imaging workstations market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the medical imaging workstations market analysis report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa. The countries covered in the medical imaging workstations market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK and USA.

Medical imaging workstations refer to both systems and software utilized in the radiology departments of hospitals or diagnostic centers. These workstations play a crucial role in providing diagnostic information based on medical imaging, assisting in the viewing and interpretation of images for accurate patient diagnosis. As integral components of digital imaging systems, medical imaging workstations contribute to clear visualization of abnormalities, aiding healthcare professionals in their diagnostic processes.

The primary modalities associated with medical imaging workstations include magnetic resonance imaging (MRI), computed tomography (CT), ultrasound, mammography, and various other modalities. In the context of magnetic resonance imaging, these workstations are employed to examine patients' brains, spinal cords, nerves, muscles, and ligaments, generating high-resolution, three-dimensional anatomical images. Magnetic resonance imaging is a non-invasive technique that provides intricate anatomical details. Key components of medical imaging workstations include visualization software, display units, display controller cards, and central processing units. These components are utilized in both thick client workstations and thin client workstations, supporting applications in diagnostic imaging, clinical review, and advanced imaging. Medical imaging workstations find application in hospitals, diagnostic centers, ambulatory centers, and various other end-user settings.

The medical imaging workstations market research report is one of a series of new reports that provides medical imaging workstations market statistics, including medical imaging workstations industry global market size, regional shares, competitors with a medical imaging workstations market share, detailed medical imaging workstations market segments, market trends and opportunities, and any further data you may need to thrive in the medical imaging workstations industry. This medical imaging workstations market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The medical imaging workstations market consists of sales of CRTs or flat panel displays, calibration hardware and software. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Medical Imaging Workstations Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on medical imaging workstations market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for medical imaging workstations? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The medical imaging workstations market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) Covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Modality: Magnetic Resonance Imaging; Computed Tomography; Ultrasound; Mammography; Other Modalities2) By Component: Visualization Software; Display Units; Display Controller Cards; Central Processing Units

3) By Usage: Thick Client Workstations; Thin Client Workstations

4) By Application: Diagnostic Imaging; Clinical Review; Advanced Imaging

5) By End-User: Hospitals; Diagnostic Centers; Ambulatory Centers; Other End-user

Subsegments:

1) By Magnetic Resonance Imaging (MRI): Closed MRI Workstations; Open MRI Workstations; MRI Post-Processing Workstations2) By Computed Tomography (CT): Standard CT Workstations; Advanced CT Post-Processing Workstations; Mobile CT Workstations

3) By Ultrasound: Portable Ultrasound Workstations; Cart-Based Ultrasound Workstations; Ultrasound Image Processing Workstations

4) By Mammography: Digital Mammography Workstations; Stereotactic Biopsy Workstations; 3D Mammography Workstations

5) By Other Modalities: X-ray Workstations; Nuclear Medicine Workstations; Fluoroscopy Workstations

Key Companies Mentioned: General Electric Company; Koninklijke Philips NV; Siemens Medical Systems Inc.; Fujifilm Healthcare Corporation; Canon Medical Systems Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Medical Imaging Workstations market report include:- General Electric Company

- Koninklijke Philips NV

- Siemens Medical Systems Inc.

- Fujifilm Healthcare Corporation

- Canon Medical Systems Corporation

- PaxeraHealth

- Hologic Inc.

- Carestream Health India Pvt. Ltd.

- Carl Zeiss AG

- Capsa Healthcare

- Esaote SpA

- Medicor Imaging

- NGI Group

- Chimaera GmbH

- Hitachi Medical Systems

- Toshiba Medical Systems Corporation

- Samsung Medison Co. Ltd.

- Shimadzu Corporation

- Agfa-Gevaert NV

- Sectra AB

- Merge Healthcare Inc.

- Intelerad Medical Systems Incorporated

- McKesson Corporation

- Agilent Technologies India Pvt. Ltd.

- Analogic Corporation

- Barco NV

- ContextVision AB

- EDDA Technology Inc.

- Infinitt Healthcare Co. Ltd.

- Mirada Medical Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 5.88 Billion |

| Forecasted Market Value ( USD | $ 8.84 Billion |

| Compound Annual Growth Rate | 10.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |