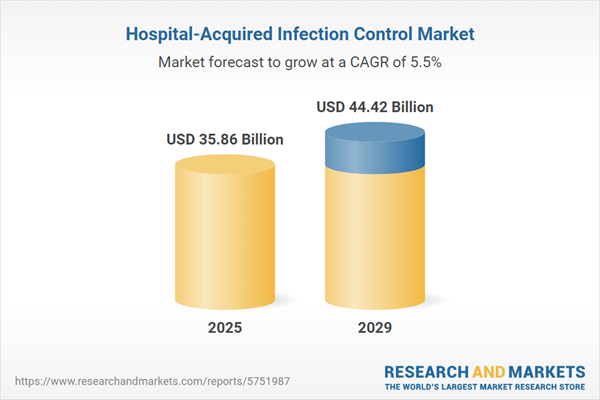

The hospital-acquired infection control market size is expected to see strong growth in the next few years. It will grow to $44.42 billion in 2029 at a compound annual growth rate (CAGR) of 5.5%. The growth in the forecast period can be attributed to rise of multidrug-resistant pathogens, pandemic preparedness, increased surveillance and monitoring, antimicrobial stewardship programs, international collaboration. Major trends in the forecast period include adoption of real-time location systems (RTLS), integration of artificial intelligence (AI) for surveillance, shift towards single-use and disposable devices, emphasis on staff training and education, increased utilization of disinfection technologies.

The hospital-acquired infection control market is anticipated to experience growth driven by the surge in COVID-19 cases. COVID-19, caused by the SARS-CoV-2 virus, has led to an increased demand for infection control products and services, emphasizing personal hygiene and the production of medical supplies. As of August 8, 2022, global COVID-19 cases reached 581.6 million, according to the World Health Organization, underscoring the market's expansion due to the ongoing pandemic.

Rising healthcare expenditures are expected to drive the growth of the hospital-acquired infection control market. Healthcare expenditures encompass the total spending on healthcare services, products, and activities within a defined timeframe, whether at the individual, community, national, or global level. As healthcare spending increases, hospitals and healthcare facilities are likely to allocate more resources toward adopting advanced infection prevention technologies. This includes innovative solutions such as advanced disinfection systems, smart monitoring devices, and other technologies that enhance overall infection control measures. For example, in May 2024, the Office for National Statistics, a UK-based government agency, reported a 5.6% increase in total healthcare expenditure in nominal terms between 2022 and 2023, compared to a mere 0.9% growth in 2022. Consequently, the rising healthcare expenditure is poised to fuel the growth of the hospital-acquired infection control market in the future.

Leading companies in the hospital-acquired infection control market are concentrating on creating new technological solutions, such as AI systems aimed at the early identification of sepsis to improve patient outcomes through prompt diagnosis and treatment. An AI system designed to assist in recognizing sepsis refers to advanced technological solutions that employ artificial intelligence and machine learning algorithms to detect initial signs of sepsis in patients. For example, in April 2024, Prenosis Inc., a US-based medical clinic, obtained FDA marketing authorization for the Sepsis ImmunoScore, the first AI-driven system created to predict sepsis, a potentially life-threatening condition that can result in serious complications. This innovative tool enhances early detection by analyzing real-time data, enabling healthcare professionals to respond more quickly and effectively. The integration of AI is intended to support medical staff in their decision-making processes rather than replace them, ultimately leading to improved patient outcomes and reduced healthcare costs.

Major companies in the hospital-acquired infection control market are obtaining regulatory approvals to launch innovative products and technologies aimed at decreasing the incidence of infections within healthcare environments. Regulatory approvals refer to the authorizations granted by government agencies or regulatory bodies that permit a company to market and sell its products or services. For example, in May 2023, Innoviva Specialty Therapeutics, a US-based biopharmaceutical company, received approval for the new treatment Xacduro (sulbactam and durlobactam), which is designed for hospital-acquired bacterial pneumonia (HABP) and ventilator-associated bacterial pneumonia (VABP) caused by specific strains of the Acinetobacter baumannii-calcoaceticus complex. This approval addresses the growing problem of antimicrobial resistance, particularly concerning Acinetobacter species. Xacduro combines sulbactam, which is effective against A. Common side effects may include abnormalities in liver function tests. The drug was granted several designations to expedite its development and review, underscoring its importance in treating severe bacterial infections in healthcare settings.

In August 2024, MicroCare, LLC, a US-based company that develops and manufactures cleaning and disinfecting products for the medical sector, acquired ICT Infection Control Technologies for an undisclosed amount. This acquisition allows MicroCare to enhance its healthcare portfolio by integrating ICT’s specialized infection control solutions into its existing range of cleaning and lubrication products. This strategic move aims to strengthen MicroCare’s position in the rapidly expanding medical infection prevention market, thereby improving the safety and effectiveness of cleaning solutions for healthcare facilities. ICT Infection Control Technologies is a US-based company that focuses on manufacturing infection control chemistries primarily for the dental and medical sectors.

Major companies operating in the hospital-acquired infection control market include Johnson and Johnson, P&G Professional, Honeywell International Inc., MMM Group, 3M Company, Becton Dickinson and Company, Reckitt Benckiser Group plc., Ecolab Inc, Olympus Corporation, Miele Group, Biomerieux SA, Getinge AB, Halyard Health Inc., Ansell Limited, Sotera Health LLC, Contec Inc., Cantel Medical Corp., Belimed AG, Nanosonics Limited, Advanced Sterilization Products Services Inc, Steelco S.P.A, Schülke & Mayr GmbH, Metrex Research LLC, Tristel Solutions Ltd., Whiteley Corporation, PDI Inc., Steris Healthcare PVT Ltd, Matachana Group, Pal International Ltd., Xttrium Laboratories Inc., Zep Inc.

North America was the largest region in the hospital-acquired infection control market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the hospital-acquired infection control market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the hospital-acquired infection control market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Hospital-acquired infections, acquired during hospital care and absent before admission, are managed through hospital-acquired infection control, employing cleaning, sterilization, and disinfection methods to reduce or eliminate transmission. These infections may stem from cross-contamination involving equipment surfaces, patient skin, and healthcare staff. The goal of hospital-acquired infection control is to curb the spread of illnesses.

The primary types of products in hospital-acquired infection control encompass sterilizers, disinfectors, endoscope reprocessors, microbial testing instruments, reagents, consumables, disinfectants, infection prevention and surveillance software, and others. Sterilizers, machines designed to thoroughly cleanse and eliminate bacteria, are employed to kill germs on surfaces or in fluids, preventing disease transmission. Various technologies, including phenotypic and genotypic methods, address diseases such as hospital-acquired pneumonia, bloodstream infections, surgical site infections, gastrointestinal infections, urinary tract infections, and others. Applications range from disease testing to drug-resistance testing, with end users including hospitals, ICUs, ambulatory surgical and diagnostic centers, nursing homes, maternity centers, and others.

The hospital-acquired infection control market research report is one of a series of new reports that provides hospital-acquired infection control market statistics, including hospital-acquired infection control industry global market size, regional shares, competitors with a hospital-acquired infection control market share, detailed hospital-acquired infection control market segments, market trends and opportunities, and any further data you may need to thrive in the hospital-acquired infection control industry. This hospital-acquired infection control market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The hospital-acquired infection control market includes revenues earned by entities by heat sterilization equipment, low temperature sterilization equipment, radiation sterilization equipment, other sterilization equipment, contract sterilization services, sterilization consumables and accessories, disinfectants, and disinfectors equipment. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Hospital-Acquired Infection Control Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on hospital-acquired infection control market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for hospital-acquired infection control? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The hospital-acquired infection control market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Sterilizers; Disinfectors; Endoscope Reprocessors; Microbial Testing Instruments; Consumables; Disinfectants; Infection Prevention and Surveillance Software; Other Products2) By Technology: Phenotypic Methods; Genotypic Methods

3) By Diseases: Hospital Acquired Pneumonia; Bloodstream Infections; Surgical Site Infections; Gastrointestinal Infections; Urinary Tract Infection; Other Diseases

4) By Application: Disease Testing; Drug-Resistance Testing

5) By End User: Hospitals; ICUs; Ambulatory Surgical; Diagnostic Centers; Nursing Homes; Maternity Centers; Other End Users

Subsegments:

1) By Sterilizers: Steam Sterilizers; Ethylene Oxide Sterilizers; Hydrogen Peroxide Sterilizers2) By Disinfectors: Washer Disinfectors; Automated Disinfectors

3) By Endoscope Reprocessors: High-Level Disinfection Reprocessors; Automated Endoscope Reprocessors

4) By Microbial Testing Instruments: Culture Systems; Rapid Microbial Testing Systems

5) By Consumables: Sterilization Wraps; Filters; Personal Protective Equipment (PPE)

6) By Disinfectants: Alcohol-based Disinfectants; Chlorine-based Disinfectants; Quaternary Ammonium Compounds

7) By Infection Prevention and Surveillance Software: Surveillance Software Solutions; Data Management Software

8) By Other Products: Cleaning Equipment; Air Purification Systems

Key Companies Mentioned: Johnson and Johnson; P&G Professional; Honeywell International Inc.; MMM Group; 3M Company

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Johnson and Johnson

- P&G Professional

- Honeywell International Inc.

- MMM Group

- 3M Company

- Becton Dickinson and Company

- Reckitt Benckiser Group plc.

- Ecolab Inc

- Olympus Corporation

- Miele Group

- Biomerieux SA

- Getinge AB

- Halyard Health Inc.

- Ansell Limited

- Sotera Health LLC

- Contec Inc.

- Cantel Medical Corp.

- Belimed AG

- Nanosonics Limited

- Advanced Sterilization Products Services Inc

- Steelco S.P.A

- Schülke & Mayr GmbH

- Metrex Research LLC

- Tristel Solutions Ltd.

- Whiteley Corporation

- PDI Inc.

- Steris Healthcare PVT Ltd

- Matachana Group

- Pal International Ltd.

- Xttrium Laboratories Inc.

- Zep Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 35.86 Billion |

| Forecasted Market Value ( USD | $ 44.42 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |