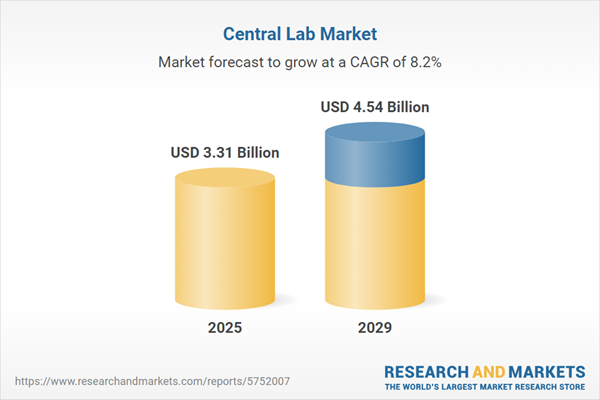

The central lab market size has grown strongly in recent years. It will grow from $3.06 billion in 2024 to $3.31 billion in 2025 at a compound annual growth rate (CAGR) of 8.2%. The growth in the historic period can be attributed to increased clinical trials growth, growth in drug development activities, regulatory compliance, increased healthcare research, growth in diagnostic testing.

The central lab market size is expected to see strong growth in the next few years. It will grow to $4.54 billion in 2029 at a compound annual growth rate (CAGR) of 8.2%. The growth in the forecast period can be attributed to increasing personalized healthcare, increasing biomarker research, increasing demand for telemedicine and remote monitoring, global health challenges, growing demand for precision diagnostics. Major trends in the forecast period include technological advancements, innovative solutions, strategic collaborations.

The increasing number of clinical trials is anticipated to propel the central lab market in the future. A clinical trial is a research study designed to assess the safety and effectiveness of a new treatment, drug, or medical device. Pharmaceutical and biotechnology companies often outsource central labs for the testing, development, and production of new products. For example, in November 2023, the Association of the British Pharmaceutical Industry, a trade association based in the UK, reported a slight increase of 4.3% in the total number of industry-sponsored clinical trials initiated in the UK, rising from 394 trials in 2021 to 411 in 2022. Consequently, the growth in the number of clinical trials is expected to benefit the central lab market.

The surge in chronic diseases is forecasted to contribute to the expansion of the central lab market. Chronic diseases, persistent conditions that can be managed but not cured, lead to a substantial patient pool requiring continuous testing and monitoring. In January 2022, research from the American Cancer Society revealed projections of 609,360 cancer deaths and 1.9 million new cases in the US for 2022. The prevalence of chronic diseases, exemplified by these statistics, propels the demand for central lab services, thereby fostering market growth.

Key players in the central lab market are concentrating on innovations, such as comprehensive diagnostic services for various cancer-related assessments. Comprehensive diagnostic services encompass a broad array of medical tests and evaluations aimed at diagnosing and assessing diverse health conditions. For example, in June 2022, Karkinos Healthcare, an India-based company specializing in innovative solutions for cancer care, unveiled the Advanced Centre for Cancer Diagnostics and Research to transform cancer diagnostics and treatment. This center acts as a central laboratory for global oncology networks, emphasizing molecular and genomic analysis to enhance personalized targeted therapies and anticipate treatment responses. It provides comprehensive diagnostic services, including histopathology and gene sequencing, to facilitate improved early detection and treatment alternatives.

Leading companies in the central lab market are prioritizing innovation, such as green chemistry, to reduce environmental impact. Green chemistry involves designing chemical products and processes that minimize or eliminate the use and production of hazardous substances. For example, in May 2023, PolyPeptide, a biopharmaceutical company based in Switzerland, launched its Innovation Lab as part of its strategic growth efforts. This facility focuses on green chemistry, process and analytical development, and digitalization, aiming to reduce environmental harm. It promotes collaboration between manufacturing sites in Europe, the USA, and India, along with external partners, to enhance product development. This initiative is intended to bolster the company's innovation agenda and maintain its technological leadership.

In August 2023, Frontage Laboratories, Inc., a US-based pharmaceutical manufacturing firm, acquired Nucro-Technics Inc. and Nucro-Technics Holdings, Inc. for an undisclosed amount. This acquisition is intended to enhance Frontage Laboratories' service offerings and capabilities, specifically in drug development, laboratory testing, and preclinical and clinical research services. Nucro-Technics Inc. and Nucro-Technics Holdings, Inc. are Canada-based organizations that provide contract support for the pharmaceutical industry.

Major companies operating in the central lab market include Celerion Inc., Cerba Research, Cirion Biopharma Research Inc., Clinical Reference Laboratory Inc., Eurofins Central Laboratory LLC, Frontage Laboratories Inc., Icon Central Labs, Interlab Central Lab Services, InVitro International, LabConnect LLC, Labcorp Drug Development India Private Limited, Medpace Clinical Research India Private Limited, MLM Medical Labs GmbH, Q2 Solutions Pty Ltd., Sonic Healthcare Limited, Synevo Central Lab, Acm Global Laboratories Private Limited, Altasciences, Barc Lab, BioIVT LLC, ICON plc, Intertek, LabNow LLC, Medidata Solutions, NAMSA LLC, Neoteryx, Northwell Health Labs, PAREXEL International, Pharm-Olam LLC, Pharmaceutical Product Development, PRA Health Sciences, Quest Diagnostics, IQVIA Co., Rho Inc.

A central lab is a facility that offers comprehensive services, consolidating all samples from various clinical locations involved in a trial. This centralized approach ensures uniformity in results and analyses.

The primary services provided by central labs encompass genetic services, biomarker services, microbiology services, anatomic pathology and histology, specimen management and storage, special chemistry services, among others. Genetic services involve identifying and counseling individuals at risk of genetic abnormalities. Test types within this category include human and tumor genetics, clinical chemistry, medical microbiology and cytology, as well as other esoteric tests. These services cater to diverse end-users, including pharmaceutical companies, academic and research institutes, and biotechnology companies.

The central lab market research report is one of a series of new reports that provides central lab market statistics, including central lab industry global market size, regional shares, competitors with a central lab market share, detailed central lab market segments, market trends and opportunities, and any further data you may need to thrive in the central lab industry. This central lab market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

North America was the largest region in the central lab market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the central lab market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa.

The countries covered in the central lab market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA.

The central lab market includes revenues earned by entities by providing services such as specimen management, kit and logistics, and clinical trial data analytics services. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Central Lab Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on central lab market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for central lab? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The central lab market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Service Type: Genetic Services; Biomarker Services; Microbiology Services; Anatomic Pathology or Histology; Specimen Management And Storage; Special Chemistry Services; Other Service Types2) By Test Type: Human And Tumor Genetics; Clinical Chemistry; Medical Microbiology And Cytology; Other Esoteric Tests

3) By End-User: Pharmaceutical Companies; Academic And Research Institutes; Biotechnology Companies

Subsegments:

1) By Genetic Services: DNA Sequencing; Genotyping; Gene Expression Analysis2) By Biomarker Services: Biomarker Discovery; Biomarker Validation; Pharmacodynamic Biomarker Testing

3) By Microbiology Services: Bacterial Identification and Susceptibility Testing; Virology Testing; Mycology and Parasitology Testing

4) By Anatomic Pathology or Histology: Tissue Sample Analysis; Immunohistochemistry (IHC); Slide Preparation and Staining

5) By Specimen Management and Storage: Biorepository Services; Sample Collection and Handling; Long-Term Sample Storage

6) By Special Chemistry Services: Toxicology Testing; Metabolomics; Hormonal Assays

7) By Other Service Types: Hematology Testing; Coagulation Testing; Flow Cytometry Services

Key Companies Mentioned: Celerion Inc.; Cerba Research; Cirion Biopharma Research Inc.; Clinical Reference Laboratory Inc.; Eurofins Central Laboratory LLC

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Central Lab market report include:- Celerion Inc.

- Cerba Research

- Cirion Biopharma Research Inc.

- Clinical Reference Laboratory Inc.

- Eurofins Central Laboratory LLC

- Frontage Laboratories Inc.

- Icon Central Labs

- Interlab Central Lab Services

- InVitro International

- LabConnect LLC

- Labcorp Drug Development India Private Limited

- Medpace Clinical Research India Private Limited

- MLM Medical Labs GmbH

- Q2 Solutions Pty Ltd.

- Sonic Healthcare Limited

- Synevo Central Lab

- Acm Global Laboratories Private Limited

- Altasciences

- Barc Lab

- BioIVT LLC

- ICON plc

- Intertek

- LabNow LLC

- Medidata Solutions

- NAMSA LLC

- Neoteryx

- Northwell Health Labs

- PAREXEL International

- Pharm-Olam LLC

- Pharmaceutical Product Development

- PRA Health Sciences

- Quest Diagnostics

- IQVIA Co.

- Rho Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | January 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.31 Billion |

| Forecasted Market Value ( USD | $ 4.54 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 35 |