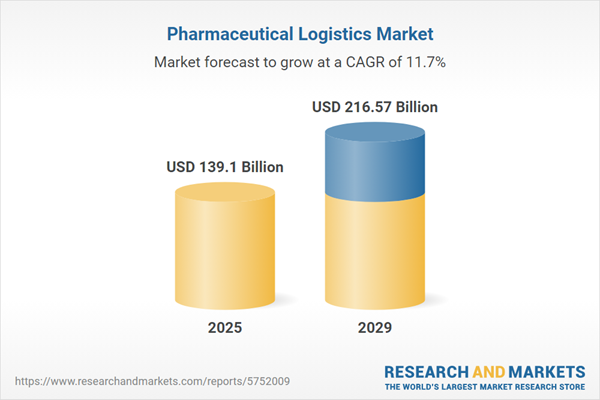

The pharmaceutical logistics market size is expected to see rapid growth in the next few years. It will grow to $216.57 billion in 2029 at a compound annual growth rate (CAGR) of 11.7%. The growth in the forecast period can be attributed to market expansion in developing countries, risk mitigation strategies, supply chain visibility enhancement, healthcare industry expansion, advancements in cold chain logistics. Major trends in the forecast period include focus on security and product integrity, global supply chain network optimization, green logistics initiatives, demand for real-time monitoring, regulatory compliance demands.

The rising demand for pharmaceutical products is anticipated to drive the growth of the pharmaceutical logistics market. Pharmaceutical products refer to any human-use medicines available in finished dosage form and regulated by pharmaceutical legislation. Logistics support pharmaceutical products by managing the procurement, storage, and transportation of resources. For instance, in July 2024, according to the National Center for Biotechnology Information (NCBI), part of the US-based National Library of Medicine (NLM), overall pharmaceutical expenditures in the US reached $722.5 billion in 2023, marking a 13.6% increase compared to 2022. Therefore, the rising demand for pharmaceutical products is driving the expansion of the pharmaceutical logistics market.

Growing healthcare expenditure is expected to further boost the pharmaceutical logistics market. Healthcare expenditure encompasses the total financial resources spent by individuals, organizations, or governments on healthcare-related goods and services within a specified time. Increased spending in healthcare enables advancements in pharmaceutical logistics through investments in modern supply chain technologies, supporting secure and timely medication delivery, and enhancing distribution efficiency. For example, in June 2024, U.S. News & World Report, a US-based media company providing news, consumer advice, rankings, and analysis, reported that healthcare spending in the U.S. was projected to rise by 7.5% in 2023, reaching $4.8 trillion. Consequently, rising healthcare expenditure is driving growth in the pharmaceutical logistics market.

Facility expansion has emerged as a prominent trend in the pharmaceutical logistics market, with manufacturers actively investing in the enlargement of their facilities to cater to the evolving logistics demands within the healthcare sector. A case in point is UPS Healthcare, a US-based provider of healthcare logistics, which, in May 2023, inaugurated an expansive 8,700 square meters facility in West Singapore. Strategically located at Gul Circle, with convenient accessibility to PSA Terminals, the manufacturing cluster at Tuas Biomedical Park, and the upcoming seaport at Tuas, this expanded facility is well-positioned to address the current and future logistics needs of businesses in the rapidly growing healthcare sector of the country. The facility is designed to offer supplementary services, including packaging, labeling, return logistics, and local customs brokerage. Notably, it features state-of-the-art temperature-controlled storage capabilities, accommodating healthcare products within a range spanning from -80 degrees to 25 degrees Celsius. UPS Healthcare's expansion initiative reflects a commitment to providing comprehensive and specialized logistics solutions tailored to meet the stringent requirements of the healthcare industry.

Prominent companies in the pharmaceutical logistics market are actively driving innovation, exemplified by the introduction of healthcare logistics services, to expand their customer bases, boost sales, and augment revenue streams. Healthcare logistics services encompass the strategic planning, execution, and management of the efficient and secure movement of healthcare-related goods, equipment, and information across the supply chain. A notable illustration is UPS Healthcare, a US-based healthcare logistics provider, which unveiled UPS Pickup Point locations in October 2023. The UPS Pickup Point locations represent a pioneering reverse logistics service specifically tailored for health laboratory customers across the UK, Germany, Italy, France, and Spain. This unique offering establishes a comprehensive reverse logistics solution, providing confirmation of collection and real-time visibility for time-sensitive specimens. The service is designed to streamline operations for healthcare companies, reducing the number of collection sites while simultaneously enhancing reliability, control, and the efficient shipment of samples to a central laboratory. UPS Healthcare's innovative healthcare logistics service demonstrates a commitment to meeting the dynamic needs of the industry and improving the overall efficiency of healthcare supply chain operations.

In March 2022, Lineage Logistics LLC, a warehousing and logistics management company headquartered in the United States, successfully acquired MTC Logistics for an undisclosed sum. This strategic acquisition expands Lineage Logistics' portfolio by incorporating four cold storage facilities located along the U.S. East and Gulf Coasts. These facilities encompass a total of 38 million cubic feet of storage space and over 113,000 pallet positions. MTC Logistics, a U.S.-based cold storage facility, specializes in catering to the pharmaceutical logistics market.

Major companies operating in the pharmaceutical logistics market include McKesson Corporation, AmerisourceBergen Corp, Cardinal Health Inc., Deutsche Post AG, FedEx Corp, Kuehne + Nagel International AG, SF Holding Co Ltd., CR Pharmaceutical Group Ltd., DSV Panalpina A/S, Schenker AG, C.H. Robinson Worldwide Inc., Alfresa Holdings Corp, Nippon Express Co Ltd., Air Canada Inc., Kerry Logistics Network Limited, Lineage Logistics Holding LLC., Flexport Inc., Nichirei Logistics Group Inc., Mainfreight Ltd., Americold Logistics LLC., NFI Industries Inc., Agility Public Warehousing Company K.S.C.P., Profarma Distribuidora de Produtos Farmaceuticos S.A., United States Cold Storage Inc., NewCold Advanced Cold Logistics BV, Cloverleaf Cold Storage Co, Kingworld Medicines Group Ltd, CEVA Logistics AG, Kloosterboer Group BV., MEDIPAL HOLDINGS Corp, B.C. Ice & Cold Storage Co.

North America was the largest region in the pharmaceutical logistics market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the pharmaceutical logistics market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the pharmaceutical logistics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Pharmaceutical logistics involves the integration of information flow, material handling, production, packaging, inventory, and chain management for prescription medications. It is a vital part of the healthcare supply chain, concentrating on the storage, handling, and transportation of pharmaceutical products.

The primary types of pharmaceutical logistics are cold chain logistics and non-cold chain logistics. Cold chain logistics involves the technology and processes used for the safe transportation of temperature-sensitive goods along the supply chain. Components in pharmaceutical logistics include storage, transportation, and monitoring elements. Operational procedures encompass picking, storage, retrieval systems, and handling systems. Various transportation methods are utilized, including sea freight, air freight, and overland transport. Pharmaceutical logistics services are applied in different sectors, including biopharma, chemical pharma, and specialty pharma, ensuring the safe and effective distribution of pharmaceutical products.

The pharmaceutical logistics market research report is one of a series of new reports that provides pharmaceutical logistics market statistics, including pharmaceutical logistics industry global market size, regional shares, competitors with a pharmaceutical logistics market share, detailed pharmaceutical logistics market segments, market trends and opportunities, and any further data you may need to thrive in the pharmaceutical logistics industry. This pharmaceutical logistics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The pharmaceutical logistics market includes revenues earned by entities by providing cold chain storage, asset ownership services, and quality management systems. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Pharmaceutical Logistics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on pharmaceutical logistics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for pharmaceutical logistics? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The pharmaceutical logistics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Cold Chain Logistics; Non-Cold Chain Logistics2) By Component: Storage; Transportation; Monitoring Components

3) By Procedure: Picking; Storage; Retrieval Systems; Handling Systems

4) By Transportation: Sea Freight; Air Freight; Overland

5) By Application: Bio Pharma; Chemical Pharma; Specialty Pharma

Subsegments:

1) By Cold Chain Logistics: Refrigerated Transport; Temperature-Controlled Warehousing; Cold Chain Monitoring Systems; Packaging Solutions For Cold Chain2) By Non-Cold Chain Logistics: Standard Transport Services; Ambient Warehousing; General Packaging Solutions; Supply Chain Management Services

Key Companies Mentioned: McKesson Corporation; AmerisourceBergen Corp; Cardinal Health Inc.; Deutsche Post AG; FedEx Corp

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- McKesson Corporation

- AmerisourceBergen Corp

- Cardinal Health Inc.

- Deutsche Post AG

- FedEx Corp

- Kuehne + Nagel International AG

- SF Holding Co Ltd.

- CR Pharmaceutical Group Ltd.

- DSV Panalpina A/S

- Schenker AG

- C.H. Robinson Worldwide Inc.

- Alfresa Holdings Corp

- Nippon Express Co Ltd.

- Air Canada Inc.

- Kerry Logistics Network Limited

- Lineage Logistics Holding LLC.

- Flexport Inc.

- Nichirei Logistics Group Inc.

- Mainfreight Ltd.

- Americold Logistics LLC.

- NFI Industries Inc.

- Agility Public Warehousing Company K.S.C.P.

- Profarma Distribuidora de Produtos Farmaceuticos S.A.

- United States Cold Storage Inc.

- NewCold Advanced Cold Logistics BV

- Cloverleaf Cold Storage Co

- Kingworld Medicines Group Ltd

- CEVA Logistics AG

- Kloosterboer Group BV.

- MEDIPAL HOLDINGS Corp

- B.C. Ice & Cold Storage Co

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 139.1 Billion |

| Forecasted Market Value ( USD | $ 216.57 Billion |

| Compound Annual Growth Rate | 11.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |