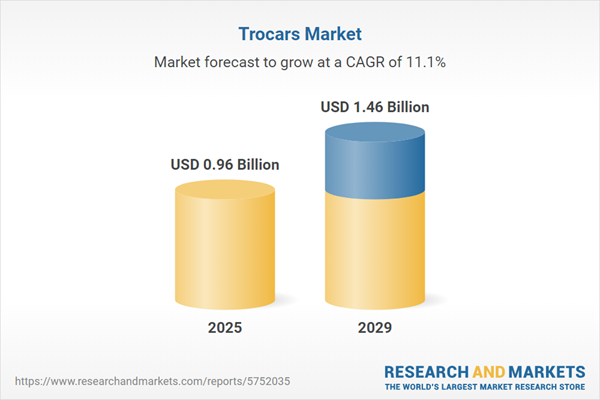

The trocars market size has grown rapidly in recent years. It will grow from $0.86 billion in 2024 to $0.96 billion in 2025 at a compound annual growth rate (CAGR) of 11.2%. The growth in the historic period can be attributed to minimally invasive surgery adoption, rising surgical volumes, safety and infection control, aging population, regulatory compliance.

The trocars market size is expected to see rapid growth in the next few years. It will grow to $1.46 billion in 2029 at a compound annual growth rate (CAGR) of 11.1%. The growth in the forecast period can be attributed to single-incision surgery, robot-assisted surgery, disposable trocars, patient-centered care, healthcare quality metrics. Major trends in the forecast period include robotic-assisted surgery, enhanced visualization, miniaturization of trocars, emerging materials, specialized trocars.

The growing aging population is anticipated to lead to a rise in age-related ailments, thereby contributing to the expansion of the trocars market in the coming years. The elderly population is increasing rapidly worldwide, a trend expected to continue throughout the forecast period. Many routine surgical procedures are progressively being replaced by laparoscopic techniques in older individuals. During laparoscopic surgery, trocars are inserted through the abdomen, resulting in minimal invasion for the patient. For instance, in January 2024, the Population Reference Bureau, a U.S.-based nonprofit organization focused on providing data regarding global population trends, reported that the number of Americans aged 65 and older is projected to grow from 58 million in 2022 to 82 million by 2050, reflecting a 47% increase. Therefore, the rising aging population is driving the growth of the trocars market.

The trocars market is expected to witness further growth due to the increasing adoption of minimally invasive procedures. Minimally invasive techniques involve small incisions, fine instruments, and advanced imaging technology for medical interventions. Trocars play a crucial role in these procedures by enabling surgeons to create small incisions for camera and instrument insertion, thereby reducing tissue damage and promoting quicker recovery. Notably, reports from January 2023 state that approximately 1,875,000 surgical procedures were performed using Vinci Surgical Systems in 2022, reflecting an 18% increase compared to 2021. Developed by Intuitive Surgical Inc., these robotic surgical platforms aid surgeons in minimally invasive procedures, highlighting the growing adoption of advanced technologies in the trocars market.

Technological advancements are shaping the trocars market, with companies investing in improving trocar technology to enhance precision and reduce procedural errors. For example, Dutch Ophthalmic Research Center (DORC) introduced EVA NEXUS in March 2022, incorporating SmartIOP for improved control in cataract surgery and a trocar cannula system called EVA AVETA, featuring a chamfered design for easier insertion and laser-etched shaft for scleral retention.

Major companies in the trocars market are concentrating on developing products like surgical port access systems to gain a competitive advantage. A surgical port access system is a device that facilitates instrument access through small incisions during minimally invasive surgeries. It is frequently utilized in laparoscopic and robotic procedures to reduce recovery times and decrease infection risks. For example, in March 2022, CMR Surgical, a UK-based medical device company, partnered with Surgical Innovations, a UK-based firm that designs and manufactures medical products, to develop the YelloPort Elite 5mm. This new surgical port access system includes a reusable trocar and cannula with a single-use valve, which helps minimize clinical waste and reduce hospital costs compared to traditional single-use ports.

In June 2024, Medtronic plc, a US-based manufacturer of trocars, entered into a partnership with Merit Medical Systems. This collaboration introduces the Kyphon KyphoFlex balloon catheter, designed for precise cavity creation in vertebral augmentation, thereby expanding treatment options for vertebral compression fractures. Through this alliance, Medtronic and Merit Medical aim to drive innovation in spinal health care. Merit Medical Systems is a US-based manufacturer and marketer of proprietary disposable medical devices.

Major companies operating in the trocars market include Johnson & Johnson, B. Braun Melsungen AG, Medtronic plc, Teleflex Incorporated, CooperSurgical Inc., CONMED Corporation, Applied Medical Resources Corporation, LaproSurge Ltd., Purple Surgical Manufacturing Ltd., Unimax Medical Systems Inc., Olympus Corporation, Medline Industries Inc., Stryker Corporation, Grena Ltd., Becton, Dickinson and Company, Maxer Endoscopy GmbH, Microline Surgical Inc., EndoMed Systems GmbH, Seemann Technologies GmbH, Ackermann Instrumente GmbH, Silex Medical LLC, Mediflex Surgical Products, SurgiQuest Inc., MedGyn Products Inc., Reda Instrumente GmbH, Taut Inc., Terumo Corporation.

North America was the largest region in the trocars market in 2024. Europe was the second-largest region the in trocars market. The regions covered in the trocars market analysis report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa. The countries covered in the trocars market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA.

Trocars are surgical devices with sharp points designed to puncture bodily cavities and facilitate intra-abdominal access when used alongside a cannula. These instruments are commonly used in surgeries to introduce various surgical tools into blood vessels and allow the release of gas and fluids from body organs.

Trocars come in different types, including disposable trocars, reposable trocars, reusable trocars, and various accessories. Disposable trocars are intended for single-use, being discarded after one application. They often feature valve designs that facilitate the passage of instrumentation and incorporate safety mechanisms to minimize the risk of visceral injury from the trocar point. Trocars can have different tip designs, such as bladeless trocars, optical trocars, bladed trocars, and blunt trocars, and find applications in various surgical fields, including general surgery, gynecological surgery, urological surgery, bariatric surgery, and others.

The trocars market research report is one of a series of new reports that provides trocars market statistics, including trocars industry global market size, regional shares, competitors with a trocars market share, detailed trocars market segments, market trends and opportunities, and any further data you may need to thrive in the trocars industry. This trocars market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The trocars market consists of sales of Arthroscopic Trocars, Autosuture Trocars, Balloon Trocars, Bladed Trocars, Bladeless, Trocars, Blunt Tip Trocars, and Dilating Tip Trocars. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Trocars Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on trocars market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for trocars? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The trocars market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product: Disposable Trocars; Reposable Trocars; Reusable Trocars; Accessories2) by Tip: Bladeless Trocars; Optical Trocars; Bladed Trocars; Blunt Trocars

3) by Application: General Surgery; Gynecological Surgery; Urological Surgery; Bariatric Surgery; Other Applications

Subsegments:

1) by Disposable Trocars: Single-Use Trocars; Various Sizes and Configurations2) by Reposable Trocars: Trocars Designed For limited Reuse; Specific Designs For Easy Cleaning and Sterilization

3) by Reusable Trocars: High-quality materials For Multiple Uses; Customizable Options For Different Surgical Procedures

4) by Accessories: Sheaths; Cannulas; Blades and Other Complementary Instruments

Key Companies Mentioned: Johnson & Johnson; B. Braun Melsungen AG; Medtronic plc; Teleflex Incorporated; CooperSurgical Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Trocars market report include:- Johnson & Johnson

- B. Braun Melsungen AG

- Medtronic plc

- Teleflex Incorporated

- CooperSurgical Inc.

- CONMED Corporation

- Applied Medical Resources Corporation

- LaproSurge Ltd.

- Purple Surgical Manufacturing Ltd.

- Unimax Medical Systems Inc.

- Olympus Corporation

- Medline Industries Inc.

- Stryker Corporation

- Grena Ltd.

- Becton, Dickinson and Company

- Maxer Endoscopy GmbH

- Microline Surgical Inc.

- EndoMed Systems GmbH

- Seemann Technologies GmbH

- Ackermann Instrumente GmbH

- Silex Medical LLC

- Mediflex Surgical Products

- SurgiQuest Inc.

- MedGyn Products Inc.

- Reda Instrumente GmbH

- Taut Inc.

- Terumo Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 0.96 Billion |

| Forecasted Market Value ( USD | $ 1.46 Billion |

| Compound Annual Growth Rate | 11.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |