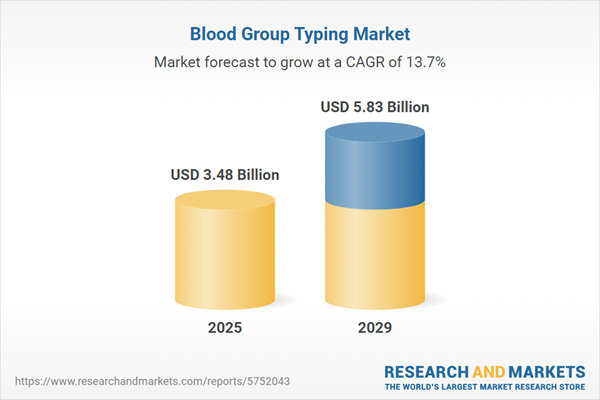

The blood group typing market size has grown rapidly in recent years. It will grow from $3.07 billion in 2024 to $3.48 billion in 2025 at a compound annual growth rate (CAGR) of 13.4%. The growth in the historic period can be attributed to expansion in blood donation drives, aging population, rise in healthcare infrastructure development, rise in clinical trials.

The blood group typing market size is expected to see rapid growth in the next few years. It will grow to $5.83 billion in 2029 at a compound annual growth rate (CAGR) of 13.7%. The growth in the forecast period can be attributed to increasing demand for blood and blood-related products, rising prevalence of chronic diseases, rising road accidents, rise in healthcare spending. Major trends in the forecast period include automation and high-throughput systems, data integration, public health initiatives, technological innovations.

The blood group typing market experienced growth during the historic period, driven by a notable increase in the number of blood donations and transfusions. Various non-profit organizations, government entities, and agencies have been actively promoting the significance of blood donations through awareness campaigns. This surge in blood donations has led to an augmented demand for blood group typing, enabling donors to ascertain their blood type. As reported by the World Health Organization (WHO) in 2022, high-income nations, constituting 16% of the global population, contribute 40% of the 118.5 million worldwide blood donations. Notably, the distribution of blood transfusions varies, with children under five years receiving up to 54% in low-income nations, while those over 60 account for 76% in high-income countries. The upswing in blood donations and transfusions has thus been a significant factor propelling the growth of the blood typing market.

Leading companies in the blood group typing market are focusing on developing innovative products using advanced technologies like next-generation sequencing (NGS) to improve the accuracy and efficiency of blood typing processes. NGS allows for a detailed analysis of genetic variations in blood group antigens, providing more precise and comprehensive blood group typing. For example, in April 2023, Metropolis Healthcare Limited, an India-based healthcare company, introduced the NextGen HLA Typing Test. This test leverages NGS technology to enhance the precision of human leukocyte antigen (HLA) typing for organ transplants, improving compatibility assessments between donors and recipients, which is essential for successful transplant outcomes.

Prominent players in the blood gas and electrolyte analyzer market are directing their efforts toward the development of innovative products, exemplified by the ABO and RhD Solid-Phase Blood Grouping Kit, aimed at enhancing their offerings for existing consumers. This diagnostic instrument utilizes solid-phase technology to detect ABO blood type system A/B antigen and Rh blood group system D antigen in a clean fingerprick blood sample or anticoagulated blood. The ABO and RhD Solid-Phase Blood Grouping Kit, stable at room temperature, serves multiple purposes, including ABO and RhD blood group detection, prenatal testing, and assessing the risk of HDFN and ABO incompatibility. In February 2022, lnTec PRODUCTS, INC., a China-based manufacturer specializing in blood grouping kits and infectious disease diagnostics, launched the Notice-2nd Generation ABO and RhD Solid-Phase Blood Grouping Kit. This second-generation product retains the benefits of its predecessor while introducing additional features, such as improved affordability and redesigned cassettes/strips for faster and easier use. With just one drop of whole blood (15 μl), results can be obtained in 2 minutes, and every cassette or strip now includes both negative and positive internal checks, available in cassette and strip formats.

In March 2023, Werfen, S.A., a Spain-based company operating in blood group typing, hemostasis, and transfusion, completed the acquisition of Immucor Inc. for approximately US$2 billion. This strategic move expanded Werfen's position as a reference business in the specialized diagnostics market and broadened its diagnostic solutions for hospitals and clinical laboratories. The acquisition integrated Immucor Inc., a U.S.-based company specializing in blood group typing, into Werfen's portfolio, strengthening the company's range by adding Transfusion and Transplant product lines to its existing Hemostasis, Acute Care, and Autoimmunity business lines. The acquisition is a testament to Werfen's commitment to enhancing its capabilities and offerings in the blood gas and electrolyte analyzer market.

Major companies operating in the blood group typing market include Grifols S.A., Bio-Rad Laboratories Inc., Immucor Inc., Ortho-Clinical Diagnostics Inc., Quotient Limited, B. Braun Melsungen AG, AXO Science SAS, Agena Bioscience Inc., Merck KGaA, Beckman Coulter Inc., Rapid Labs Ltd., Day Medical SA, Novacyt Group, Chemtrade Logistics Income Fund, DIAGAST SAS, Thermo Fisher Scientific Inc., One Lambda Inc., Tulip Diagnostics (P) Ltd., Guangzhou Wondfo Biotech Co. Ltd., Mesa Laboratories Inc., Hemaxis Inc., ZenTech S.A., Hemogenyx Pharmaceuticals plc, Lifespan Diagnostics LLC, TECOmedical AG, Blood Systems Inc., Japan Blood Products Organization, Medion Diagnostics GmbH, BioMedomics Inc., DiaSorin S.p.A., Grifols Diagnostic Solutions Inc., Hemo bioscience Inc.

North America was the largest region in the blood group typing market in 2024. Asia-Pacific is expected to be the fastest growing region in the forecast period. The regions covered in the blood group typing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa.

Blood group typing is a method employed to determine an individual's blood type, facilitating safe blood donation or transfusion.

Key types of blood group typing include antibody screening, cross-matching tests, ABO tests, antigen typing, and human leukocyte antigen (HLA) typing. Antibody screening tests are conducted in clinical laboratories or blood banks to identify unexpected antibodies, such as alloantibodies, in the serum related to non-ABO blood group antigens. Cross-matching tests are integral to blood compatibility testing before transfusions. HLA typing, a genetic test, identifies variations in immune system proteins, commonly used for matching patients and donors in bone marrow or cord blood transplants. ABO tests categorize blood types into A, B, AB, or O. Antigen tests, utilizing immunoassays, detect specific viral antigens and are employed in the diagnosis of respiratory pathogens like influenza viruses. Products used for blood group typing include instruments, reagents, and kits, employing techniques such as serology tests and molecular tests. Blood group typing finds application in hospital-based laboratories, independent laboratories, and blood banks.

The blood group typing market research report is one of a series of new reports that provides blood group typing market statistics, including blood group typing industry global market size, regional shares, competitors with a blood group typing market share, detailed blood group typing market segments, market trends and opportunities, and any further data you may need to thrive in the blood group typing industry. This blood group typing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The countries covered in the blood group typing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, and USA.

The blood group typing market consists of sale of serology reagents, gel systems, lateral flow rapid technology, and blood group genotyping products. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Blood Group Typing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on blood group typing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for blood group typing? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The blood group typing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Test Type: Antibody Screening; Cross-Matching Tests; ABO Tests; Antigen Typing; HLA Typing2) By Product: Instruments; Reagents And Kits

3) By Techniques: Serology Tests; Molecular Tests

4) By End User: Hospital Based Laboratories; Independent Laboratories And Blood Banks

Subsegments:

1) By Antibody Screening: Indirect Coombs Test; Enzyme-Linked Immunosorbent Assay (ELISA)2) By Cross-Matching Tests: Major Crossmatch; Minor Crossmatch; Electronic Crossmatch

3) By ABO Tests: Forward Typing; Reverse Typing

4) By Antigen Typing: Rh Factor Typing; Kell Typing; Other Blood Group Antigen Typings

5) By HLA Typing: Serological Methods; Molecular Methods (PCR-based)

Key Companies Mentioned: Grifols S.A.; Bio-Rad Laboratories Inc.; Immucor Inc.; Ortho-Clinical Diagnostics Inc.; Quotient Limited

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Blood Group Typing market report include:- Grifols S.A.

- Bio-Rad Laboratories Inc.

- Immucor Inc.

- Ortho-Clinical Diagnostics Inc.

- Quotient Limited

- B. Braun Melsungen AG

- AXO Science SAS

- Agena Bioscience Inc.

- Merck KGaA

- Beckman Coulter Inc.

- Rapid Labs Ltd.

- Day Medical SA

- Novacyt Group

- Chemtrade Logistics Income Fund

- DIAGAST SAS

- Thermo Fisher Scientific Inc.

- One Lambda Inc.

- Tulip Diagnostics (P) Ltd.

- Guangzhou Wondfo Biotech Co. Ltd.

- Mesa Laboratories Inc.

- Hemaxis Inc.

- ZenTech S.A.

- Hemogenyx Pharmaceuticals plc

- Lifespan Diagnostics LLC

- TECOmedical AG

- Blood Systems Inc.

- Japan Blood Products Organization

- Medion Diagnostics GmbH

- BioMedomics Inc.

- DiaSorin S.p.A.

- Grifols Diagnostic Solutions Inc.

- Hemo bioscience Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | January 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.48 Billion |

| Forecasted Market Value ( USD | $ 5.83 Billion |

| Compound Annual Growth Rate | 13.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 33 |