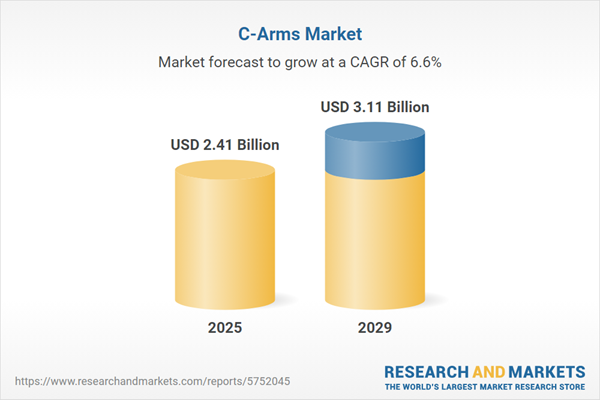

The C-arms market size has grown strongly in recent years. It will grow from $2.28 billion in 2024 to $2.41 billion in 2025 at a compound annual growth rate (CAGR) of 5.4%. The growth in the historic period can be attributed to the rise of minimally invasive surgical procedures, increased utilization of c-arms in trauma centers, a focus on reducing radiation exposure to patients, global healthcare market expansion, and healthcare infrastructure growth.

The C-arms market size is expected to see strong growth in the next few years. It will grow to $3.11 billion in 2029 at a compound annual growth rate (CAGR) of 6.6%. The growth in the forecast period can be attributed toThe increasing adoption of hybrid operating rooms,The use of c-arms in telemedicine and remote consultations, increasing demand for customizable and modular c-arm systems, increased usage of c-arms for medical training and education purposes, and increasing shift towards patient-centric care. Major trends in the forecast period include sustainability and green healthcare, incorporation of ai for image processing, automated measurements, and enhanced diagnosis, integration of robotics with c-arms, technological advancements, and adoption of hybrid operating rooms.

The rising incidence of chronic diseases is anticipated to drive growth in the C-arms market. There has been a notable increase in chronic conditions such as heart diseases, cancer, diabetes, obesity, arthritis, Alzheimer's, and epilepsy. C-arms are utilized for fluoroscopic imaging during surgical and orthopedic procedures. For example, in June 2024, the Australian Institute of Health and Welfare, a government agency in Australia, reported that in 2022, approximately 15.4 million individuals, or 61% of the population, had at least one of the specified chronic health conditions. This prevalence showed considerable variation across different age groups, ranging from 28% among those aged 0-14 to 94% among those aged 85 and older. Consequently, the increasing incidence of chronic diseases is propelling the growth of the C-arms market.

The anticipation of an increased healthcare expenditure is poised to fuel the expansion of the C-arms market. Healthcare expenditure, representing the total financial outlay on healthcare-related goods and services within a healthcare system or economy, is pivotal for supporting the development and accessibility of medical technologies such as C-arms. According to data from the Canadian Institute for Health Information in November 2022, healthcare expenditure rose to 0.8%, reaching $331 billion in 2022 compared to 7.6% in 2021. This upward trend in healthcare spending is a driving force behind the growth of the C-arms market.

A notable trend in the C-arms market is the prevalence of technological developments. Numerous companies are actively engaged in launching new products and introducing innovations to their C-arm platforms. In May 2023, Philips, a Netherlands-based medical equipment company, introduced the Zenition 10 mobile C-arm system, the latest addition to the Zenition series. Tailored to meet the needs of orthopedics, trauma, and various surgical areas, the Zenition 10 offers customizable presets, an uninterruptible power supply, and the flexibility to move seamlessly between operating rooms, showcasing the continuous evolution and advancements in C-arm technology.

Major players in the C-arms market are strategically forming partnerships to enhance market revenues. Collaborations in the realm of C-arms can lead to the development of more advanced and customized medical imaging solutions, ultimately contributing to improved patient care and a better understanding of the practical challenges faced by healthcare professionals. For example, in June 2023, GE HealthCare, a prominent US-based medical technology company, and DePuy Synthes, a leading US-based medical device company, announced a strategic partnership in spine surgery. This collaboration aims to better serve surgeons and address the complex needs of patients by distributing GE Healthcare's OEC 3D Imaging System alongside DePuy Synthes' extensive product portfolio to spine surgeons and patients across the United States.

In July 2022, Canon Medical Systems USA, Inc., a US-based manufacturer of medical equipment, acquired NXC Imaging for an undisclosed sum. This acquisition is intended to bolster its position in the medical imaging market, broaden its product portfolio, and improve its customer outreach. NXC Imaging is a US-based company specializing in medical devices.

Major companies operating in the C-arms market include Koninklijke Philips N.V., Canon Medical Systems Corporation, GE HealthCare Technologies Inc., Eurocolumbus s.r.l., Siemens Healthineers AG, Shimadzu Corporation, DMS Imaging, ATON GmbH, Hologic Inc., Fujifilm Holdings Corporation, OrthoScan Inc., Assing S.p.A, AADCO Medical Inc., Villa Sistemi Medicali Spa, Varian Medical Systems Inc., Toshiba Corp., Omega Medical Imaging Inc., BMI Biomedical International, Ziehm Imaging GmbH, Allengers Medical System Ltd., BPL Medical Technologies, SternMed GmbH, Medtronic plc, Halyard Health Inc., C. R. Bard Inc, Perlong Medical Equipment Co. Ltd., Genoray Co. Ltd.

C-arms, characterized by their distinctive C-shaped design, incorporate radiographic capabilities and are employed for fluoroscopic intraoperative imaging in emergency care, surgical procedures, and orthopedic interventions.

The two main types of C-arms are fixed C-arms and mobile C-arms. Fixed C-arms, large in size, are designed to cater to a broad spectrum of healthcare applications. On the other hand, mobile C-arms are more compact and versatile, suitable for flexible use in different operating rooms within a clinic, catering to various diagnostic imaging and minimally invasive surgical procedures. C-arm detectors, including image intensifiers and flat panel detectors, are applied in diverse medical fields such as cardiology, gastroenterology, neurology, orthopedics, trauma, oncology, and more. C-arms find applications in hospitals, diagnostic centers, specialty clinics, and other healthcare facilities.

The C-arms research report is one of a series of new reports that provides C-arms statistics, including C-arms industry global market size, regional shares, competitors with C-arms share, detailed C-arms segments, market trends and opportunities, and any further data you may need to thrive in the C-arms industry. This C-arms research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

North America was the largest region in the C-arms market in 2024. Asia-Pacific is expected to be the fastest growing market in the C-arms market share. The regions covered in the C-arms market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa.

The countries covered in the C-arms market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA.

The c-arms market consists of sales of mini C-arms, Compact C-arms, full size C-arms, and super C-arms. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

C-Arms Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on c-arms market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for c-arms? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The c-arms market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Fixed C-Arms; Mobile C-Arms2) By Detector: Image Intensifier; Flat Panel Detector

3) By Application: Cardiology; Gastroenterology; Neurology; Orthopedics And Trauma; Oncology; Other Applications

4) By End User: Hospital; Diagnostic Centers; Specialty Clinics; Other End-Users

Subsegments:

1) By Fixed C-Arms: Digital Fixed C-Arms; Analog Fixed C-Arms2) By Mobile C-Arms: Full-Size Mobile C-Arms; Compact Mobile C-Arms; Mini C-Arms

Key Companies Mentioned: Koninklijke Philips N.V.; Canon Medical Systems Corporation; GE HealthCare Technologies Inc.; Eurocolumbus s.r.l.; Siemens Healthineers AG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this C-Arms market report include:- Koninklijke Philips N.V.

- Canon Medical Systems Corporation

- GE HealthCare Technologies Inc.

- Eurocolumbus s.r.l.

- Siemens Healthineers AG

- Shimadzu Corporation

- DMS Imaging

- ATON GmbH

- Hologic Inc.

- Fujifilm Holdings Corporation

- OrthoScan Inc.

- Assing S.p.A

- AADCO Medical Inc.

- Villa Sistemi Medicali Spa

- Varian Medical Systems Inc.

- Toshiba Corp.

- Omega Medical Imaging Inc.

- BMI Biomedical International

- Ziehm Imaging GmbH

- Allengers Medical System Ltd.

- BPL Medical Technologies

- SternMed GmbH

- Medtronic plc

- Halyard Health Inc.

- C. R. Bard Inc

- Perlong Medical Equipment Co. Ltd.

- Genoray Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | January 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.41 Billion |

| Forecasted Market Value ( USD | $ 3.11 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |