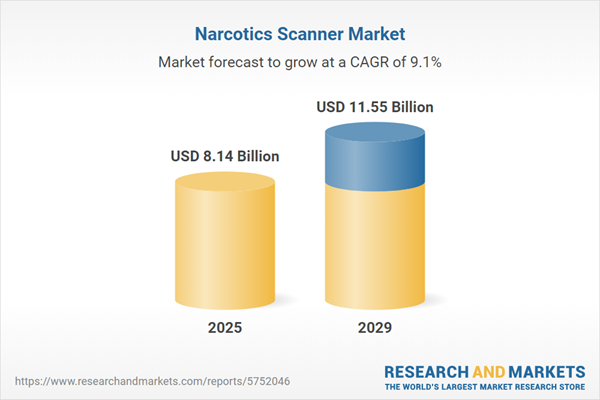

The narcotics scanner market size is expected to see strong growth in the next few years. It will grow to $11.55 billion in 2029 at a compound annual growth rate (CAGR) of 9.1%. The growth in the forecast period can be attributed to public safety investments, rise in illicit drug production, market expansion strategies, adoption of AI and machine learning, stricter border and port security. Major trends in the forecast period include global increase in drug trafficking, regulatory requirements, port security enhancements, demand for non-intrusive inspection, integration of artificial intelligence.

The steady increase in drug users is significantly fueling the growth of the narcotics scanner market. The COVID-19 pandemic led to heightened poverty, unemployment, social pressures, and mental health challenges, all of which have exacerbated addiction among drug users. A narcotics scanner is a security device used to detect drugs and other hazardous substances consumed by drug users. For example, according to the Press Information Bureau, the number of drug users rose to 292 million in 2022, a 20% increase over the past decade. Therefore, the ongoing rise in drug users is expected to drive the growth of the narcotics scanner market.

Increasing healthcare expenditures are expected to boost the growth of the narcotics scanner market. Healthcare expenditure encompasses the total financial resources allocated by individuals, organizations, or governments within a given period toward healthcare-related goods and services. Higher healthcare spending supports research and development in narcotic scanning technologies, fostering the development of more advanced, user-friendly, and efficient drug detection solutions. For instance, in March 2022, according to the Centers for Medicare & Medicaid Services' 2021-2030 National Health Expenditure (NHE) report, national health spending is projected to grow at an average annual rate of 5.1% from 2021 to 2030, reaching nearly $6.8 trillion. Additionally, Medicare spending is expected to increase at an annual rate of 7.2%, while Medicaid spending will grow by 5.6% annually from 2021 to 2030. Thus, rising healthcare expenditures are driving the expansion of the narcotics scanner market.

Technological advancements are influencing the narcotics scanner market significantly. Leading companies in this sector are concentrating on creating innovative technological solutions to enhance their market presence. For example, in 2022, Smiths Detection introduced the IONSCAN 600, an advanced trace detection system capable of simultaneously identifying explosives and narcotics. Its lightweight, portable desktop design makes it ideal for various screening settings, such as airports and law enforcement operations.

Leading companies in the narcotics scanner market are innovating with products like touchless narcotic scanners to reach broader customer bases, boost sales, and increase revenue. A touchless narcotic scanner is a non-invasive drug detection system that allows for discreet screening without physical contact. For example, in April 2022, Bruker, a US-based manufacturer of scientific instruments for molecular and materials research, launched the Fourier 80 CrimeLab, a specialized benchtop FT-NMR solution tailored for forensic narcotics testing. This advanced system features a nuclear magnetic resonance (NMR) Narcotics Profiling module, enabling thorough analysis of seized drug samples. The Fourier 80 CrimeLab offers a user-friendly, automated approach to generating detailed reports on the types and quantities of substances, significantly enhancing the capabilities of forensic laboratories.

In August 2024, Smiths Detection, a UK company and part of Smiths Group, announced an expanded partnership with SeeTrue, a US provider of AI-driven threat detection software. This collaboration represents a significant step forward in aviation security technology, facilitating the successful integration and testing of SeeTrue's technology within Smiths Detection's advanced CT security checkpoint systems. This enhancement not only improves the functionality of Smiths Detection's X-ray screening equipment but also offers customers increased flexibility in selecting detection software, X-ray, and CT machines.

Major companies operating in the narcotics scanner market include Thermo Fisher Scientific Inc., Safran SA, Science Applications International Corporation (SAIC), Elbit Systems Ltd., Smiths Group plc, Bruker Corporation, FLIR Systems Inc., OSI Systems Inc., NUCTECH Company Ltd., Chemring Group plc, Rapiscan Security Products Inc., L-3 Security and Detection Systems Inc., Garrett Electronics Inc., Morpho Detection Inc., Astrophysics Inc., Autoclear LLC, NABCO Systems LLC, CEIA USA Ltd., Aventura Technologies Inc., Detecta Chem Inc., Viken Detection, Kromek Group plc, Scanna MSC Ltd., Argo Security SRL.

North America was the largest region in the narcotics scanner market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the narcotics scanner market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the narcotics scanner market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

A narcotics scanner is a specialized security device designed to counter the threat of drug smuggling. These scanners are employed to safeguard public spaces and national borders by detecting and preventing the unauthorized transportation and usage of narcotics. They play a crucial role in enhancing security measures and curbing the illicit movement of drugs to ensure the safety of various environments.

Narcotics scanners are available in various product types, including handheld scanners, tabletop scanners, and walkthrough scanners. Handheld narcotics scanners are portable analyzers for drug testing, allowing for digital storage, editing, and sharing within a digital network. The technologies employed in narcotics scanners encompass ion mobility spectrum technology, contraband detection equipment, video scope inspection systems, and infrared spectroscopy. These scanners find applications in diverse sectors such as airports, seaports, law enforcement, railway terminals, defense and military, among others.

The narcotics scanner research report is one of a series of new reports that provides narcotics scanner statistics, including narcotics scanner industry global market size, regional shares, competitors with narcotics scanner share, detailed narcotics scanner segments, market trends and opportunities, and any further data you may need to thrive in the narcotics scanner industry. This narcotics scanner research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The narcotics scanner market consists of sales of body scanners, baggage scanners, and freight scanners. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Narcotics Scanner Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on narcotics scanner market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for narcotics scanner? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The narcotics scanner market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Handheld Scanner; Tabletop Scanner; Walkthrough Scanner2) By Technology: Ion Mobility Spectrum Technology; Contraband Detection Equipment; Videoscope Inspection System; Infrared Spectroscopy

3) By End-User: Airport; Sea Port; Railway Terminal; Law Enforcement; Defense and Military; Other End-Users

Subsegments:

1) By Handheld Scanner: Portable Narcotics Detection Devices; Battery-Operated Handheld Scanners2) By Tabletop Scanner: Fixed Narcotics Detection Systems; High-Throughput Tabletop Scanners

3) By Walkthrough Scanner: Walkthrough Detection Systems; Automated Walkthrough Scanners for Security Checkpoints

Key Companies Mentioned: Thermo Fisher Scientific Inc.; Safran SA; Science Applications International Corporation (SAIC); Elbit Systems Ltd.; Smiths Group plc

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Thermo Fisher Scientific Inc.

- Safran SA

- Science Applications International Corporation (SAIC)

- Elbit Systems Ltd.

- Smiths Group plc

- Bruker Corporation

- FLIR Systems Inc.

- OSI Systems Inc.

- NUCTECH Company Ltd.

- Chemring Group plc

- Rapiscan Security Products Inc.

- L-3 Security and Detection Systems Inc.

- Garrett Electronics Inc.

- Morpho Detection Inc.

- Astrophysics Inc.

- Autoclear LLC

- NABCO Systems LLC

- CEIA USA Ltd.

- Aventura Technologies Inc.

- Detecta Chem Inc.

- Viken Detection

- Kromek Group plc

- Scanna MSC Ltd.

- Argo Security SRL.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 8.14 Billion |

| Forecasted Market Value ( USD | $ 11.55 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |