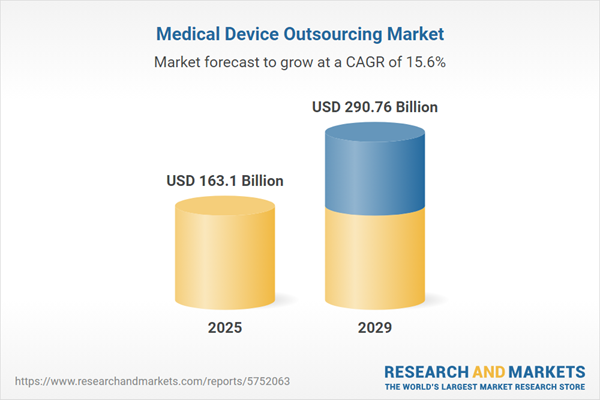

The medical device outsourcing market size is expected to see rapid growth in the next few years. It will grow to $290.76 billion in 2029 at a compound annual growth rate (CAGR) of 15.6%. The growth in the forecast period can be attributed to focus on core competencies, shortened time-to-market demands, cost-efficiency in production, demand for scalability and flexibility, growing complexity of medical devices. Major trends in the forecast period include rise in customization and personalization, focus on risk mitigation and compliance, growing demand for remote monitoring devices, increased emphasis on data security, innovation in wearable medical devices.

The increasing prevalence of chronic diseases is expected to drive the growth of the medical device outsourcing market. Chronic diseases are long-lasting conditions that require ongoing medical attention and can limit daily activities. The rising incidence of chronic diseases is leading to a higher demand for high-quality medical products that can be developed and launched more quickly, thus fueling the expansion of the medical device outsourcing market. For example, according to the UN Chronicle, a digital magazine of the United Nations, the global burden of chronic diseases is projected to reach approximately 56% by 2030. Therefore, the growing prevalence of chronic diseases is anticipated to be a significant driver of growth in the medical device outsourcing market.

The increasing demand for remote patient monitoring (RPM) devices is expected to drive the growth of the medical device outsourcing market in the coming years. Remote patient monitoring devices are technical instruments that collect and transmit health-related information from patients in their homes or other remote locations to healthcare practitioners. These devices rely on medical device outsourcing for the development and production of connected gadgets, sensors, and data analytics, enabling healthcare practitioners to remotely monitor patients' health conditions and enhance care delivery. For example, according to the American Medical Association in September 2022, the percentage of physicians using remote monitoring devices increased to 30% in 2022. Tele-visits were the most preferred digital health tools among physicians, with 57% expressing enthusiasm, followed closely by remote monitoring devices, which garnered approval from 53% of physicians. Therefore, the growing demand for remote patient monitoring devices is a key driver behind the growth of the medical device outsourcing market.

Strategic partnerships and collaborations are increasingly becoming a prominent trend in the medical device outsourcing market. Major companies in the industry are prioritizing partnerships and collaborations as a strategic approach to leading the market. For instance, in July 2023, Medical Device, Inc., a US-based contract manufacturing company of medical devices, acquired NextPhase Medical Devices LLC, a Mexico-based manufacturing company of medical devices. This acquisition resulted in a doubling of NextPhase's size, positioning it as a top-tier global medical device contract manufacturer, with 70% of its revenue derived from the United States. The combined entity, known as the United Group, now operates seven well-capitalized end-to-end production sites across North America, Europe, and North Africa. It boasts a diverse range of manufacturing capabilities and has substantial exposure to international markets.

Major companies in the medical device outsourcing market are focusing on innovative products, such as platforms for creating new medical devices, to better serve their existing consumers. These platforms aim to streamline the process from design to device, enabling businesses to iterate in weeks rather than months and with minimal upfront costs. For example, in March 2023, Science Corporation, a US-based biotechnology company, introduced Science Foundry. Science Foundry is a platform that grants firms access to over 80 of Science's internal products and services, including thin-film electrode technology. This platform is designed to support startups working on ambitious concepts and is expected to attract interest from neurotechnology businesses, as well as other medical technology companies and even quantum computing startups, offering growth opportunities.

In September 2024, Sanner Group, a Germany-based manufacturer of packaging and containers for drugs and medical devices, acquired Gilero LLC for an undisclosed amount. This acquisition allows Sanner to expand its capabilities and global presence, particularly in key biopharma and medtech markets. The move enhances collaboration, strengthens the supply chain, and improves service offerings, ensuring high-quality support throughout the product development process. Gilero LLC is a US-based medical equipment manufacturing company specializing in medical device outsourcing.

Major companies operating in the medical device outsourcing market include Cardinal Health Inc., Flex Ltd., Te Connectivity Ltd., Sanmina Corporation, Celestica Inc., WuXi AppTec Inc., Phillips-Medisize LLC, Intertek Group plc, Plexus Corp, Nipro Medical Corporation, Teleflex Incorporated, Integer Holdings Corporation, Cantel Medical Corp, Sterigenics International LLC, Nortech Systems Incorporated, Toxikon Inc., North American Science Associates Inc, Omnica Corp, NAMSA, Tecomet Inc., Viant Medical.

North America was the largest region in the medical device outsourcing market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the medical device outsourcing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the medical device outsourcing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Medical device outsourcing is a process in which a company contracts out the manufacturing of a medical device to another company, often to leverage specialized expertise or to streamline production processes.

In medical device outsourcing, the main types of products are finished goods, electronics, and raw materials. Finished goods are products that have completed the manufacturing process but have not yet been sold or distributed to consumers. The medical devices are categorized into class I, class II, and class III devices, each with different regulatory requirements and risk levels. Medical device outsourcing services include quality assurance, regulatory affairs services, product design and development, product testing and sterilization, product implementation, product upgrade, product maintenance, and contract manufacturing. These services cater to various applications in the medical industry, including drug delivery, dental care, diabetes management, cardiology, endoscopy, in vitro diagnostics (IVD), ophthalmic devices, diagnostic imaging, orthopedics, and general and plastic surgery.

The medical device outsourcing market research report is one of a series of new reports that provides medical device outsourcing market statistics, including medical device outsourcing industry global market size, regional shares, competitors with a medical device outsourcing market share, detailed medical device outsourcing market segments, market trends and opportunities, and any further data you may need to thrive in the medical device outsourcing industry. This medical device outsourcing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The medical device outsourcing market includes revenues earned by entities by providing services such as design and development. Components and devices manufacturing, process validation and verification, Packaging, regulatory consultation, and full services. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Medical Device Outsourcing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on medical device outsourcing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for medical device outsourcing? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The medical device outsourcing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Finished Goods; Electronics; Raw Materials2) By Device Type: Class I Devices; Class II Devices; Class III Devices

3) By Services: Quality Assurance; Regulatory Affair Services; Product Design Development; Product Testing and Sterilization; Product Implementation; Product Upgrade; Product Maintenance; Contract Manufacturing

4) By Application: Drug Delivery; Dental; Diabetes Care; Cardiology; Other Applications

Subsegments:

1) By Finished Goods: Surgical Instruments; Diagnostic Devices; Therapeutic Devices2) By Electronics: Medical Imaging Components; Wearable Health Technology; Embedded Systems

3) By Raw Materials: Plastics and Polymers; Metals and Alloys; Biomaterials

Key Companies Mentioned: Cardinal Health Inc.; Flex Ltd.; Te Connectivity Ltd.; Sanmina Corporation; Celestica Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Cardinal Health Inc.

- Flex Ltd.

- Te Connectivity Ltd.

- Sanmina Corporation

- Celestica Inc.

- WuXi AppTec Inc.

- Phillips-Medisize LLC

- Intertek Group plc

- Plexus Corp

- Nipro Medical Corporation

- Teleflex Incorporated

- Integer Holdings Corporation

- Cantel Medical Corp

- Sterigenics International LLC

- Nortech Systems Incorporated

- Toxikon Inc.

- North American Science Associates Inc

- Omnica Corp

- NAMSA

- Tecomet Inc.

- Viant Medical

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 163.1 Billion |

| Forecasted Market Value ( USD | $ 290.76 Billion |

| Compound Annual Growth Rate | 15.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |