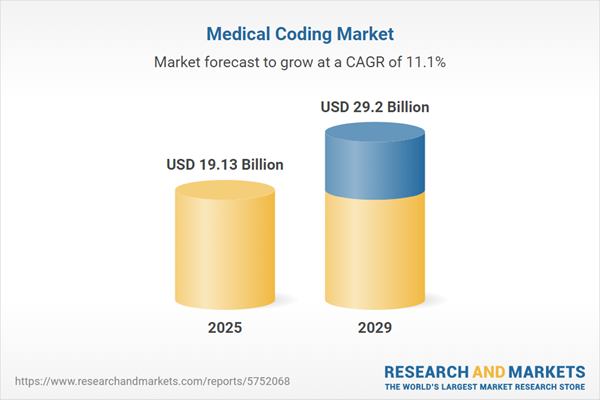

The medical coding market size is expected to see rapid growth in the next few years. It will grow to $29.2 billion in 2029 at a compound annual growth rate (CAGR) of 11.1%. The growth in the forecast period can be attributed to workforce training and development, global healthcare market expansion, regulatory changes and compliance needs, telehealth and remote medicine growth, transition to value-based care models. Major trends in the forecast period include education and training programs, remote work and outsourcing, EHR integration and interoperability, demand for specialty-specific coding, increased emphasis on accuracy and quality.

The increasing necessity for a standardized language in medical documentation is expected to drive the growth of the medical coding market. The healthcare industry generates vast amounts of data that can be challenging to organize manually without standardized labels or names, making it difficult to reference patient histories efficiently. Converting medical records into universal alphanumeric codes facilitates streamlined hospital billing processes, ensuring accurate billing reimbursement and enabling effective tracking of patients' health records for future reference. This growing demand for medical codes that aid in organizing medical data and streamlining processes is expected to reduce inefficiencies associated with manual data recording without universal codes. For example, the International Classification of Diseases (ICD) maintained by the World Health Organization is used globally for reporting and coding data related to human diseases and mortality. Moreover, in October 2022, the American Medical Association (AMA) released the Calendar Year (CY) 2023 Current Procedural Terminology (CPT) code set, which included 102 new codes, 68 removed codes, and modifications to 87 codes. This continuous use and development of universally accepted codes are driving the growth of the medical coding market. In summary, the need for standardized language in medical documentation and the utilization of universally accepted codes are key factors contributing to the expansion of the medical coding market.

The increasing incidence of insurance fraud is expected to drive the growth of the medical coding market in the coming years. Insurance fraud involves intentionally providing misleading or inaccurate information to an insurance company to obtain unlawful benefits or payments. Medical coding plays a crucial role in identifying insurance fraud by ensuring accurate and standardized documentation of healthcare services, which makes it easier to detect discrepancies and irregularities in insurance claims. For example, according to the Association of British Insurers in August 2023, the average insurance fraud case increased by 20% to £15,000 in 2022. Therefore, the rising incidence of insurance fraud is a key factor driving the growth of the medical coding market.

The medical coding market is witnessing increased adoption of artificial intelligence (AI) as a prominent new trend. AI refers to the simulation of human intelligence in machines programmed to think and mimic human actions. This adoption of AI is expected to streamline medical billing workflows, improve the accuracy of medical coding, and enhance overall efficiency. This trend is particularly relevant given the growing volume and complexity of healthcare data. Furthermore, AI in medical coding is anticipated to reduce the need for extensive searches to find appropriate codes for unstructured data, thereby alleviating medical coding fatigue. For example, in November 2022, Maverick Medical AI, an Israel-based autonomous medical coding company, launched its autonomous medical coding platform to meet RadNet's medical coding requirements in the US. This platform aims to optimize revenue cycle management processes, reduce operating expenses, and increase reimbursement for RadNet. Maverick Medical AI's platform integrates medical coding expertise with innovative machine learning and dynamic AI. It autonomously analyzes clinical notes and reports, accurately generating reimbursement codes (ICD-10, CPT) in real-time and making charges accessible to billing systems within seconds.

Major companies in the medical coding market are focusing on innovative technologies such as automated medical coding for inpatient care to better serve their existing consumers. Automated medical coding for inpatient care involves using technologies such as artificial intelligence (AI) and machine learning algorithms to analyze and extract essential data from patient records, clinical notes, and other healthcare documentation. For example, in November 2023, Nym Health, a US-based company specializing in autonomous medical coding, introduced professional (Profee) coding for interactions in skilled care facilities, observation units, and inpatient stays. Given the high volume of inpatient interactions in hospitals and health systems, there is a need for efficient profee coding, especially with a limited number of coders available to manage the demand. Nym's inpatient professional services encompass diagnostic coding, evaluation and management (E/M) coding, bedside operations coding, modifiers, and provider attribution, aiming to streamline the coding process and improve accuracy in medical billing and documentation.

In February 2023, GeBBS Healthcare Solutions, a US-based healthcare company, acquired CPa Medical Billing for an undisclosed amount. This acquisition is designed to enhance GeBBS Healthcare Solutions' service offerings and broaden its presence in the medical billing sector by leveraging CPa Medical Billing’s expertise and resources. CPa Medical Billing is also a US-based healthcare company.

Major companies operating in the medical coding market include 3M Company, Advanced Medical Coding Services, AcerHealth Inc., Aveanna Healthcare LLC, AthenaHealth, AAPC (American Association of Professional Coders), Codemasters Inc., EqualizeRCM Services, Alpha Coding Experts LLC, Accurate Medical Coding LLC, American Medical Billing & Coding Services, Apex Medical Billing & Coding, Associated Medical Billing & Coding, Beacon Healthcare Coding, Billing Advantage LLC, Blue Star Medical Billing & Coding, Brite Medical Coding, Care Medical Coding, Central Billing Services LLC, Certified Medical Billing Specialists, Code 1 LLC, Coding Masters, Complete Medical Coding Solutions, Cypress Medical Coding, Data Plus Services, Dedicated Medical Billing & Coding, Empower Medical Billing & Coding Services, Expert Medical Coding, First Class Medical Billing & Coding, Global Medical Billing & Coding, Greenlight Medical Billing & Coding.

North America was the largest region in the medical coding market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the medical coding market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the medical coding market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Medical coding involves the conversion of health-related information, including diagnoses, treatments, and procedures, into universal medical alphanumeric codes. These codes are used for record-keeping and billing purposes in healthcare.

The components of medical coding include in-house and outsourced coding services. In-house medical coding refers to the process of coding being handled within the organization using coding software. This approach can result in lower costs and more effective management of coding-related issues. Medical coding relies on classification systems such as the International Classification of Diseases (ICD), the Healthcare Common Procedure Coding System (HCPCS), and Current Procedural Terminology (CPT). These coding solutions are used in diagnostic centers and by hospitals and healthcare providers to accurately record diagnoses and procedures for billing and data analysis purposes.

The medical coding market research report is one of a series of new reports that provides medical coding market statistics, including medical coding industry global market size, regional shares, competitors with a medical coding market share, detailed medical coding market segments, market trends and opportunities, and any further data you may need to thrive in the medical coding industry. This medical coding market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The medical coding market includes revenues earned by entities by providing services such as HCC Coding, Offshore coding audit, payer specific coding requirements, and code review services. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Medical Coding Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on medical coding market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for medical coding? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The medical coding market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Component: In-house; Outsourced2) By Classification System: International Classification of Diseases (ICDs); Healthcare Common Procedure Coding System (HCPCS); Current Procedural Terminology (CPT)

3) By End User: Diagnostic Centers; Hospitals & Care Providers

Subsegments:

1) By in-house: Internal Coding Staff; in-house Coding Software Solutions2) By Outsourced: Third-Party Coding Services; Remote Coding Solutions; Hybrid Outsourcing Models

Key Companies Mentioned: 3M Company; Advanced Medical Coding Services; AcerHealth Inc.; Aveanna Healthcare LLC; AthenaHealth

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Medical Coding market report include:- 3M Company

- Advanced Medical Coding Services

- AcerHealth Inc.

- Aveanna Healthcare LLC

- AthenaHealth

- AAPC (American Association of Professional Coders)

- Codemasters Inc.

- EqualizeRCM Services

- Alpha Coding Experts LLC

- Accurate Medical Coding LLC

- American Medical Billing & Coding Services

- Apex Medical Billing & Coding

- Associated Medical Billing & Coding

- Beacon Healthcare Coding

- Billing Advantage LLC

- Blue Star Medical Billing & Coding

- Brite Medical Coding

- Care Medical Coding

- Central Billing Services LLC

- Certified Medical Billing Specialists

- Code 1 LLC

- Coding Masters

- Complete Medical Coding Solutions

- Cypress Medical Coding

- Data Plus Services

- Dedicated Medical Billing & Coding

- Empower Medical Billing & Coding Services

- Expert Medical Coding

- First Class Medical Billing & Coding

- Global Medical Billing & Coding

- Greenlight Medical Billing & Coding

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 19.13 Billion |

| Forecasted Market Value ( USD | $ 29.2 Billion |

| Compound Annual Growth Rate | 11.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 32 |